Constantinis/E+ via Getty Images

Introduction

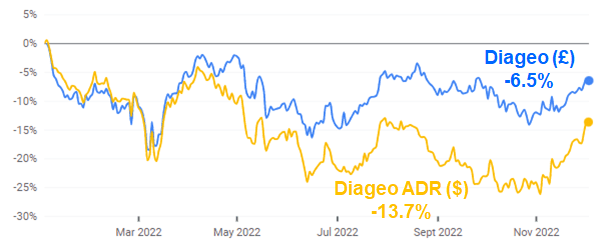

We review our investment case on Diageo PLC (NYSE:DEO) six months after our last review. The price of Diageo’s American Depository Receipts (“ADRs”) has risen nearly 10% since then, but remains 14% lower than at the start of the year:

|

Diageo Share Prices (Year-to-Date)  Source: Google Finance (02-Dec-22). |

In U.K. pounds, Diageo’s share price is down 6.5% year-to-date.

We originally initiated our Buy rating on Diageo in July 2019, and shares have gained 19.5% in U.K. Pounds (including dividends) since then, including 38.9% from the end of 2020.

Diageo continues to be a solid blue-chip growth stock, with management targeting a 6-9% organic EBIT CAGR in FY23-25. While earnings had been volatile in the past, they always recovered strongly, and will likely be more resilient in the next downturn. Consumer demand for Diageo products remains strong globally, even in China. Diageo is structurally well-placed to cope with rising inflation, and the deprecation of the pound is a positive for U.K. shareholders. Shares are at 25.4x FY22 EPS before any currency adjustments, and the Dividend Yield is 2.0%. Our forecasts indicate a total return of 67% (15.8% annualized) by June 2026. Buy.

Diageo Buy Case Recap

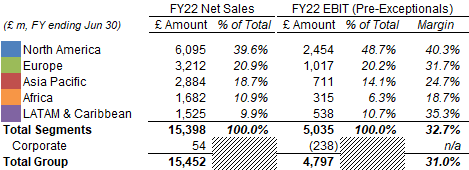

Diageo is the #1 global spirits company by sales. It is broad-based geographically, with North America as its largest region, contributing 48.7% of segmental EBIT in FY22, followed by Europe (20.2%) and Asia Pacific (14.1%):

|

Diageo Net Sales & EBIT by Region (FY22)  Source: Diageo results release (FY22). |

India was approx. 6% of sales in FY22 while China was approx. 5%. Travel Retail and Guinness beer were together 13% of sales in pre-COVID FY19.

Diageo is broad-based in product terms. Its largest spirits category by sales is Scotch (26% of net sales in FY22), followed by Vodka (10%) and Tequila (9%); it also has sizeable sales in International Whiskies, Rum, Gin, and Chinese Baijiu. Beer was 15% of sales. Each category includes a number of strong brands.

|

Diageo Net Sales by Category (FY22)  Source: Diageo annual report (FY22). |

Diageo has exposure to cognac, champagne and wine though its 34% share in the Moët Hennessy joint venture with LVMH (OTCPK:LVMUY). Diageo’s share of the JV’s FY22 after-tax profit was £425m, or 10% of its Profit Before Tax.

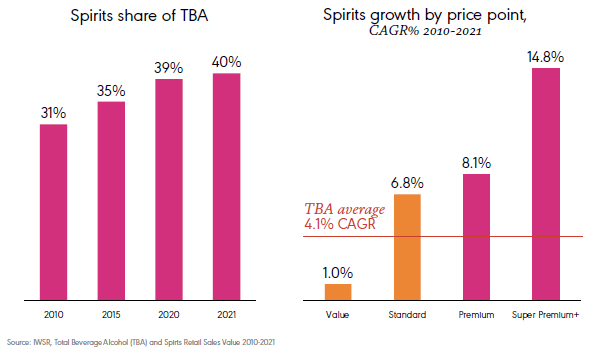

Our investment case on Diageo has been based on the structural volume and value growth in global spirits, and Diageo’s ability to take advantage of this growth:

- The global spirits industry is benefiting from structural increases in the population of drinkers, penetration rates (including share gains from wine and beer) and premiumisation. In 2010-21, total Retail Sales Value of spirits grew at a CAGR of 4.1%, with Premium spirits growing at 8.1% and Super Premium+ spirits growing at 14.8%

|

Global Spirits Retail Sales Value Growth (2010-21)  Source: Diageo results presentation (FY22). NB. TBA = Total Beverage Alcohol, RTD = Ready To Drink. |

- Diageo can grow sales faster than the spirits market thanks to its over-indexation to premium brands (57% of its net sales by FY22), as well as its strong brands, scale, and capabilities in innovation, marketing and distribution

- Diageo can continue to expand its operating margin, from a combination of pricing, positive mix shift, operational leverage and cost efficiencies

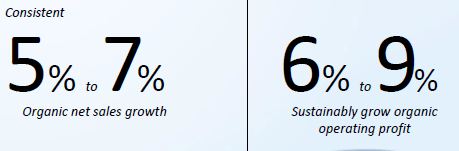

At its November 2021 investor day, Diageo has set out long-term targets to increase its share of the global Total Beverage Alcohol market from 4.0% to 6.0% by 2030. For FY23-25, management is targeting a “consistent” 5-7% organic net sales growth and a “sustainable” 6-9% organic EBIT growth annually:

|

Diageo FY23-25 Targets  Source: Diageo investor day presentation (Nov-21). |

We believe Diageo’s medium-term targets to be achievable, based on its performance in recent years.

Diageo’s Historic Earnings Volatility

We believe the main reason behind Diageo’s share weakness year-to-date is that investors are concerned about an upcoming recession. As CEO Ivan Menezes said on the FY22 earnings call on July 28:

“We do not have and nor do we pretend to have a crystal ball on how consumers are going to behave in the next 6, 12, 18, 24 months. Clearly, the economic pressures are real. The spending power pressures are going to hit and get worse for a few quarters.”

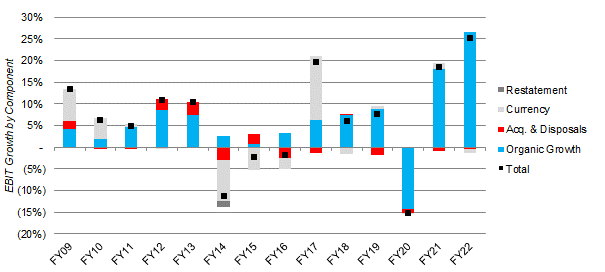

Diageo earnings had been volatile in the past. It fell 14% organically in FY20 due to COVID lockdowns; it grew by 3% or less organically each year in FY14-16 (and fell by up to 11% as reported); It grew just 4% in FY09 and 2% in FY10:

|

Diageo EBIT Growth by Component (FY09-22)  Source: Diageo company filings. NB. EBIT is before exceptional items. |

However, strong recoveries have always followed downturns, with the 18% organic rebound in EBIT in FY21 a particularly striking example. Organic EBIT growth has averaged 6% annually across the entire FY09-22 period, accelerating to average 9% annually across FY17-22.

Moreover, weak EBIT during FY14-16 was, as we described in our initiation article, due to a series of unrelated headwinds, including weakness in Emerging Market currencies, the bursting of a bubble in U.S. vodka sales, new government laws in India (“demonetization” and a ban on the sale of alcohol near highways), and an “anti-corruption” drive in China. Half of these were driven by politics, not economics, and it is unlikely so many of them will coincide over the same period again.

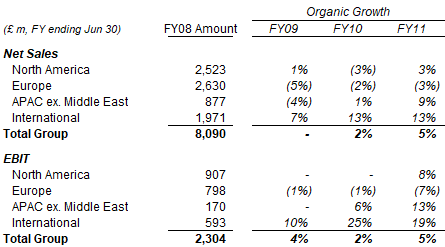

Weak EBIT during FY09-10, in the aftermath of the Global Financial Crisis, likely offers a better precedent for what is likely to happen in a global economic downturn:

|

Diageo Organic Sales & EBIT Growth (FY09-11)  Source: Diageo company filings. |

Diageo’s North American and Europe businesses, together two thirds of group EBIT at the time, experienced two years of zero to negative organic EBIT growth. Thereafter, North America EBIT rebounded by 8% in FY11, but Europe’s EBIT fell 7% as a result of double-digit sales decline in Greece and Iberia as the PIGS (Portugal, Ireland, Greece and Spain) countries in the Eurozone continued to struggle with their sovereign debt and government austerity.

In the event of a global economic downturn, we expect Diageo earnings to be impacted. However, similar to the experience in FY09-11, we believe Diageo would still manage a positive organic EBIT growth, albeit much smaller.

Diageo’s Improved Earnings Resilience

Management believes that the resilience in Diageo’s earnings has improved significantly in the past decade.

One reason is the increasing premiumization in its sales, which means Diageo products are bought by more affluent customers and as an infrequent indulgence, and such customers are less likely to cut back or trade down. As CEO Ivan Menezes explained on the FY22 earnings call:

“The spirits sold in a typical U.S. household is a dollar a day on our spirits category. It’s an infrequent purchase and that also brings a lot of resilience … We tend to skew to a higher-income consumer in the United States, where nearly 60% of our business comes from households that make $80,000 or more”

Another reason is better inventory control. In previous cycles, excessive inventory levels before downturns had often made revenue declines during the actual downturns worse. However, management claims to have improved their inventory management and sales monitoring systems in recent years.

Consumer Demand Remains Strong, Even in China

Thus far consumer demand for Diageo products has remained strong globally, including in China.

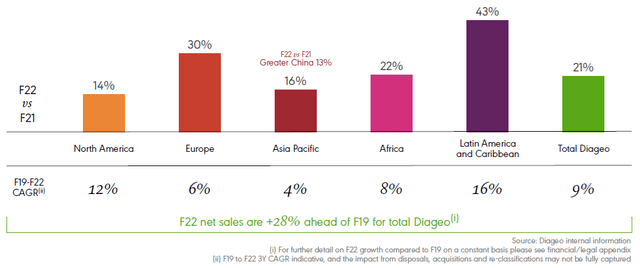

Diageo only reports results every six months, and last reported FY22 results in July. In FY22, every region grew sales organically by double-digits year-on-year, including Greater China growing by 13% year-on-year:

|

Diageo Organic Sales Growth By Region (FY22 vs. Prior Years)  Source: Diageo results presentation (FY22). |

Diageo’s FY22 Net Sales were 28% higher than in FY19 (at constant currency), which represents an acceleration from H1 FY22, when Net Sales were only 25% higher than in FY19.

FY22 year-on-year group organic sales growth was 16% in APAC, also accelerating from 13% in H1 FY22, though Greater China organic sales growth has decelerated to 13% from 18% in H1.

At the time of FY22 results, Diageo had not observed any slowdown in consumer demand:

“Our consumer behaviour so far, and I qualify it by so far because we read this day by day, week by week, to your point on the U.S., we are not seeing either slowdown or down-trading trends just broadly. Obviously, we analyse this at excruciating detail. But at the headline level, we are not seeing it – which doesn’t say won’t come.”

Ivan Menezes, Diageo CEO (FY22 earnings call)

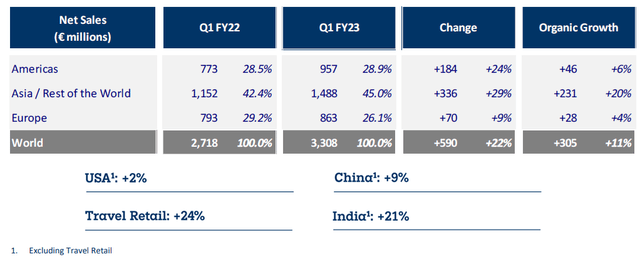

For a more up-to-date view, we turn to Pernod Ricard (OTCPK:PRNDY), Diageo’s closest peer, which reported their Q1 FY23 (July-September) sales on October 20, with group organic sales growth of 11% year-on-year:

|

Pernod Ricard Sales Growth By Region (Q1 FY23 vs. Prior Year)  Source: Pernod Ricard results materials (Q1 FY23). |

Pernod Ricard’s reported organic growth rates understate the strength of demand, due to some one-off factors:

- Europe organic sales growth was reported as 4%, but was in double-digits excluding sales in Russia/Ukraine

- U.S. organic sales growth was reported as 2% based on shipments, but was mid-single-digits based on depletions

- China organic sales growth was similarly 9% as reported but low-double-digits based on depletions

And, even on a reported basis, organic sales growth was strong in India (21%) and Travel Retail (24%).

Pernod Ricard CFO Helene de Tissot provided further details on the Chinese market on the call:

“In China, we are delivering a strong performance across Mid-Autumn Festival and National Day, with our value sell-out that are growing low double digits … quite consistent with the optimism that we mentioned last time we talked 6 weeks ago … this performance is both coming from volume and price, in a context which remains a bit disrupted, but with the off-trade … growing and more than covering a kind of softness in the on-trade … this is a strong performance, particularly given the fact that the environment is still disrupted. As you know, there’s some limited intercity travel, and the on-trade is disrupted, which is probably showing first that consumers are adapting to the environment and that we have built a strong brand in China.”

COVID restrictions became more widespread in November after an increase in cases and number of cities affected. However, as of early December, the Chinese government appears to be softening its “Zero COVID” policy, with large parts of key cities like Shanghai and Guangzhou being released from lockdown measures.

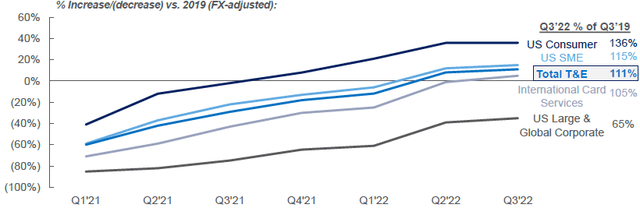

More generally, spending has remained strong among affluent consumers globally, especially in the U.S. As we described in our review of American Express’ (AXP) Q3 2022 results, its Total Travel & Entertainment volume has accelerated throughout 2022 to 111% of 2019 levels by Q3, with U.S. Consumer T&E accelerating to 136%:

|

AXP Travel & Entertainment Volume Indexed to 2019 (ex-Currency)  Source: AXP results presentation (Q3 2022). |

While short-term macro conditions are always hard to predict, and there will inevitably be another downturn at some point, consumer demand remains strong at present and we believe Diageo sales will continue to grow strongly over time.

Diageo Structurally Protected from Inflation

Diageo is structurally well-placed against rising inflation, thanks to its pricing power and natural operational leverage.

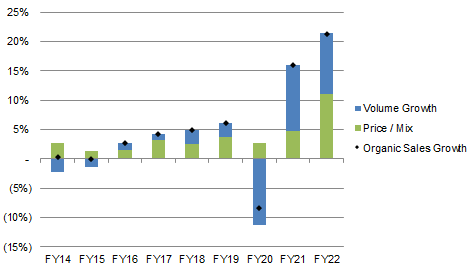

Diageo sales have always benefited from positive price/mix, even in years of volume declines. Price/mix averaged 2.5% in FY14-19, was 2.8% even in COVID-disrupted FY20, and rose to 4.8% in FY21 and 11.1% in FY22 as inflation rose:

|

Diageo Volume, Price/Mix & Sales Growth (FY14-22)  Source: Diageo company filings. |

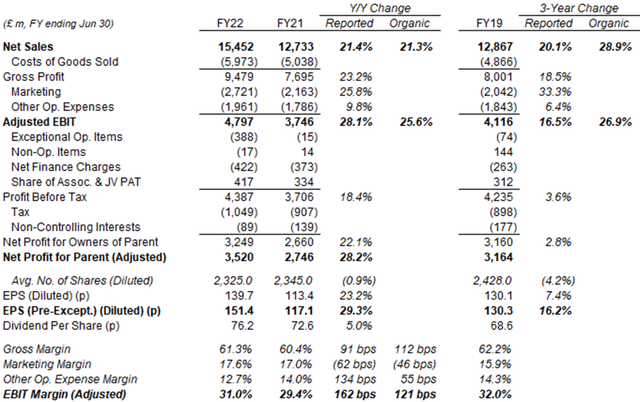

Diageo’s FY22 P&L was an example of how well the company copes with inflation. Gross Margin actually improved by 90 bps year-on-year and, while Marketing Expenses grew 4.4 ppt faster than Net Sales, Other Operating Expenses grew far more slowly, which resulted in Adjusted EBIT growing almost 7 ppt faster than Net Sales:

|

Diageo Profit & Loss (FY22 vs. Prior Years)  Source: Diageo company filings. |

Compared to FY19, Pre-Exceptional EPS was just 16.2% higher, largely due to currency and higher Net Finance Charges. While Diageo finished both FY19 and FY22 with 2.5x Net Deb /EBITDA, FY22 had a higher average debt balance as well as a higher effective interest rate (2.7%, vs. 2.4% in FY19).

Rising interest rates will have only a modest impact on Diageo’s P&L. As of FY22 year-end, 78% of Diageo’s Net Borrowings were fixed rate, compared to 55% at FY19 year-end; 57% of gross borrowings were due after five years.

Weaker Pound Benefits U.K. Shareholders

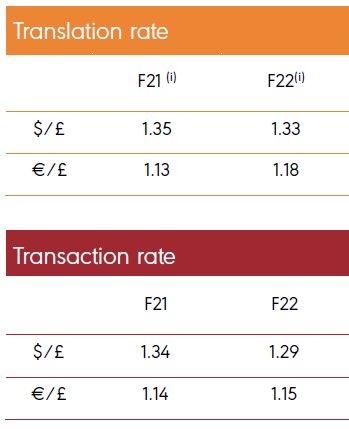

Diageo generates the vast majority of its profits outside the U.K. (with Europe & Turkey in aggregate generating just 20% of total segment EBIT in FY22); these non-U.K. profits become larger in reported figures as sterling weakens.

Among Diageo’s key currencies, the pound has fallen by around 7.5% against the U.S. dollar since FY22, and by about 1% against the euro:

|

Diageo Key Exchange Rates (FY22 vs. Prior Year)  Source: Diageo results presentation (FY22). |

In addition, more of Diageo’s costs than of its revenues are U.K.-based, and 56% of its gross borrowings (£9.21bn out of £16.4bn) were in pounds. The deprecation of the U.K. pound reduce these relative to group revenues.

Diageo Stock Dividend Yield & Valuation

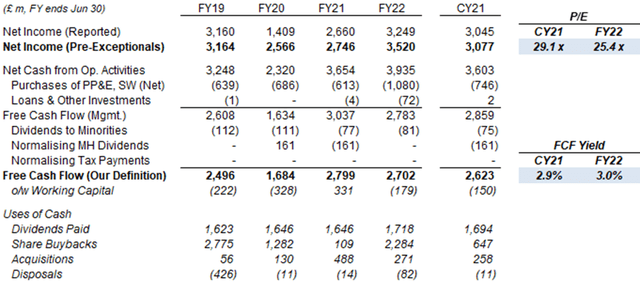

At 3,848.5p, on FY22 figures, Diageo stock is at a 25.4x P/E and a 3.0% FCF Yield:

|

Diageo Earnings, Cashflows & Valuation (FY19-22)  Source: Diageo company filings. NB. FY21 £290m dividends received included £161m for CY19 and £128m for CY20. |

Diageo has a 2.0% Dividend Yield, based on 76.18p of dividends having been declared for FY22. This represented a 5% increase year-on-year.

Diageo has been executing a FY20-23 share repurchase program of £4.5bn. The share count was down 0.9% year-on-year and 4.2% from FY19 as of FY22. The final part of this program began on 1 November 2022, with a non-discretionary agreement with an investment bank to repurchase £0.64bn of Diageo shares by the end of February 2023.

Net Debt/EBITDA at 2.5x at FY22 year-end at the low end of the 2.5-3.0x targeted.

Illustrative Diageo Stock Forecasts

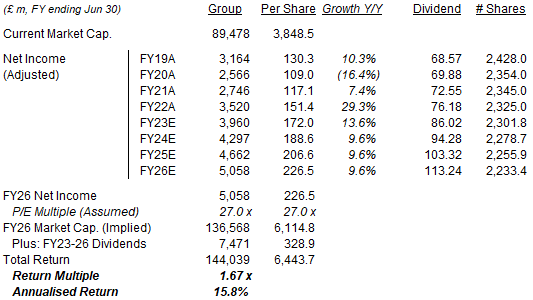

Actual FY22 EPS was 6% higher than our most recent forecast.

We update this, extend our forecasts by one year, and keep most of the assumptions unchanged::

- FY23 Net Income growth to be 12.5% (9.0% growth + 3.5% currency) (unchanged)

- Thereafter, Net Income grows at 8.5% annually (was 6.5%) (unchanged)

- Dividends to be based on a 50% Payout Ratio (unchanged)

- Share count to fall by 1.0% annually (was 1.2%)

- FY26 year-end P/E of 27.0x (unchanged)

Our new FY25 EPS of 206.6p is 5% higher than before (196.5p):

|

Illustrative Diageo Return Forecasts  Source: Librarian Capital estimates. |

With shares at 3,848.5p, we expect an exit price of 6,115p and a total return of 67% (15.8% annualized) by June 2026, in about 3.5 years.

Is Diageo Stock a Buy? Conclusion

We reiterate our Buy rating on Diageo stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment