robertsrob/iStock via Getty Images

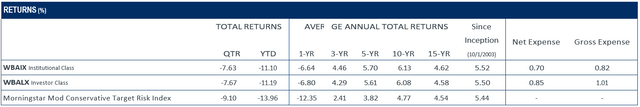

The Balanced Fund’s Institutional Class returned -7.63% for the second quarter compared to -9.10% for the Morningstar Moderately Conservative Target Risk Index. Year-to-date, the Fund’s Institutional Class has returned -11.10% compared to -13.96% for the index.

Over a 10-year period, the Fund’s Institutional Class has returned +6.13% annualized compared to +4.77% for the index. With that longer-term lens, total returns well above inflation have helped our investors retain and build wealth.

It has been a rough six months for stock and bond investors. Stubbornly persistent inflation at 40-year highs is a serious issue. The Federal Reserve has taken increasingly aggressive monetary policy steps to try to tamp it down.

To date, the Fed has raised short-term interest rates three times, in larger increments than they have used in over 20 years. More rate hikes are on the horizon, and investors are concerned that the Fed won’t stop until we have a recession. With this backdrop, prices for stocks and other risk assets continued to decline.

Bond markets also endured another difficult quarter as yields again rose across the maturity spectrum (as yields rise, bond prices fall). Spreads also widened, contributing to steeper declines in investment-grade and high-yield corporate bonds. Here are some quarterly and year-to-date results for context.

|

Q2 2022 | Fixed Income Returns, Bloomberg Indexes as of 06.30.2022 |

||

|

Q2 Return (%) |

YTD Return (%) |

|

|

US Aggregate Bond |

-4.63 |

-10.35 |

|

US Corporate Investment Grade Bond |

-7.16 |

-14.39 |

|

US Corporate High Yield Bond |

-9.78 |

-14.19 |

|

US Treasury: 20+ Year Index |

-12.67 |

-22.29 |

We take the Fund’s capital preservation objective seriously, so we never enjoy reporting negative returns. With few places to hide, losing less (at least for now) has been the more realistic, achievable short-term goal. For the quarter, the Fund’s stocks performed a bit better than the broad indexes. But our real relative edge was in fixed income, where our returns have looked nothing like the table above.

The Fund’s short-maturity collection of bonds has fared much better, posting modest negative returns for both periods. Encouragingly, we can finally reinvest principal and interest cash flows at higher yields.

Berkshire Hathaway (BRK.A, BRK.B), Alphabet (GOOG, GOOGL), and Vulcan Materials (VMC) were the Fund’s largest quarterly detractors. The price declines largely reflected growing recession fears. Investors worried about the outlook for digital advertising (Alphabet), economically sensitive construction aggregates (Vulcan), and a bellwether for the U.S. economy (Berkshire Hathaway).

The story was similar at a raft of other companies whose stocks declined more than 10% during the quarter. While we may see some earnings resets, stocks are forward-looking and no longer reflect “blue sky” outlooks at these prices. The Fund had no positive equity contributors for the quarter.

Markel (MKL) was the Fund’s only positive year-to-date contributor, with a single-digit return. Vulcan Materials, Microsoft (MSFT), and Alphabet were the largest year-to-date equity detractors; however, the Fund’s worst performing first-half investment was the Qurate Retail (QRTEA) 8% preferred shares. The video and digital e-commerce retailer has stumbled with a series of execution missteps, and management’s turnaround plan will take time and investment.

Interest rates are higher, market spreads are wider, and self- inflicted wounds have landed the company in the penalty box — the Qurate preferred deserves to trade at a discount to par.

Still, we think the recent markdown into the $50’s was too extreme. The security trades at a high-teens yield-to-maturity, with discount recapture upside depending on the pace of progress. To be clear, the Qurate preferred is a deeper value investment than our traditional fare, with higher risks and commensurate potential rewards.

During the quarter, we sold the Fund’s AutoZone (AZO) holdings at a substantial profit as the stock traded above our value estimate. Equity analyst Jon Baker made an outstanding buy recommendation back in late 2020, and the stock nearly doubled since then. AutoZone’s management team has done a terrific job, the business is humming, and the stock has clear momentum in this economic and market environment.

While selling a winner with positive trends is not especially comfortable, our discipline drove the decision. To echo AutoZone’s famous jingle, we would gladly “Get in the Zone” again at the right price.

As stocks drifted into bear market territory, we added to a string of existing holdings to maintain the Fund’s equity weighting in the low 40’s. The most notable examples were Analog Devices (ADI), Danaher (DHR), JPMorgan Chase (JPM), Martin Marietta Materials (MLM), Microsoft, and S&P Global (SPGI). As interest rates rose, we gradually increased duration by adding small layers of 3- year to 5-year Treasuries.

We also continued sprinkling in small individual positions in asset- backed debt, with a heavy focus on sponsor quality and structural protection. Our overall fixed income positioning remained quite defensive, with high average credit quality (more than 95% investment-grade) and a duration of less than 2 years. The Fund’s credit exposure is low, so we have abundant capital to deploy if economic conditions deteriorate.

The Fund’s portfolio continues to evolve with market conditions. We own common equity stakes in 29 companies totaling 41.7% of net assets. High-yielding, hybrid securities represent another 2.0% of the Fund. Fixed income holdings include investment-grade corporate bonds (1.3%), securitized debt (12.7%), Treasury securities (35.6%), and cash equivalents (6.7%). We have plenty of capacity to lean into new opportunities as our team uncovers them.

We think the Fund is increasingly well-positioned to provide long-term capital appreciation and capital preservation. The current income outlook also improved with the increase in interest rates. As always, we encourage investors to evaluate the strategy on a total-return basis over longer time horizons.

Top Relative Contributors and Detractors

|

TOP CONTRIBUTORS (%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

There were no securities that provided a positive contribution for this period. |

||||

|

TOP DETRACTORS (%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

Berkshire Hathaway, Inc. |

-22.64 |

2.33 |

-0.58 |

2.1 |

|

Alphabet, Inc. |

-21.68 |

2.01 |

-0.48 |

1.9 |

|

Vulcan Materials Co. |

-22.46 |

1.80 |

-0.44 |

1.7 |

|

Microsoft Corp. |

-16.42 |

2.25 |

-0.37 |

2.3 |

|

Aon plc |

-17.02 |

1.99 |

-0.36 |

2.0 |

Data is for the quarter ending 06/30/2022. Holdings are subject to change and may not be representative of the Fund’s current or future investments. Contributions to performance are based on actual daily holdings. Returns shown are the actual returns for the specified period of the security. Additional securities referenced herein as a percent of the Fund’s net assets as of 06/30/2022: Analog Devices, Inc. 2.0%, AutoZone, Inc. 0.0%, Danaher Corp. 2.1%, JPMorgan Chase & Co. 1.0%, Markel Corp. 1.9%, Martin Marietta Materials, Inc. 1.4%, Qurate Retail, Inc. — Preferred 1.1%, and S&P Global, Inc. 1.3%.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment