pigprox/iStock via Getty Images

Danaher to Spin Off Environmental & Applied Solutions Segment

On Wednesday, the 14th of September, Danaher (NYSE:DHR) announced the following:

Danaher Corporation today announced its intention to separate its Environmental & Applied Solutions segment to create an independent, publicly traded company. The new company will be comprised of Danaher’s Water Quality and Product Identification businesses and will be referred to as “EAS” until it is named at a later date. The transaction is intended to be tax-free to Danaher shareholders and is expected to be completed in the fourth quarter of 2023.

This is the third spin-off for Danaher so let’s take a look at what we can expect from this one and how the past spin-offs performed.

If you want a deeper analysis of the fundamentals of the business, I recommend you check out my previous article on DHR and its competitor Thermo Fisher (TMO) as well.

A Comparison Between Operating Segments

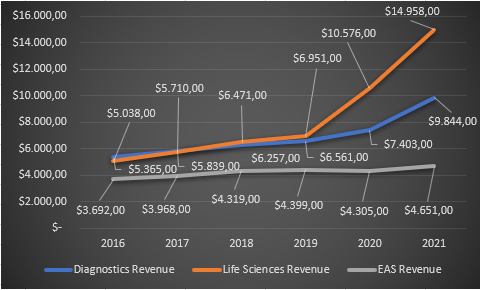

It’s important to understand what motives could be behind a spin-off. Let’s compare the three segments Danaher reports: Diagnostics, Life Sciences and Environmental & Applied Solutions. In the chart below, we can see that Life Sciences was on a steady growth path from 2016-2019 and then saw explosive growth in the last two years due to tailwinds from the pandemic, doubling the size of the business in 2 years. Overall, the segment grew 197% in 6 years. A similar, yet not as extreme story, can be observed for the Diagnostics segment. This segment grew 83% in 6 years. Now if we look at the EAS segment, we can see that growth has been a lot more timid, growing a bit each year with a small decline in 2020. Overall, the segment grew just 26% in 6 years, massively lacking behind the other two segments. This only talks about the top line, maybe EAS is a very profitable business? Let’s take a more detailed look at all the segments.

Danaher segment comparison (Authors model, Data from DHR 10-K)

EAS Overview

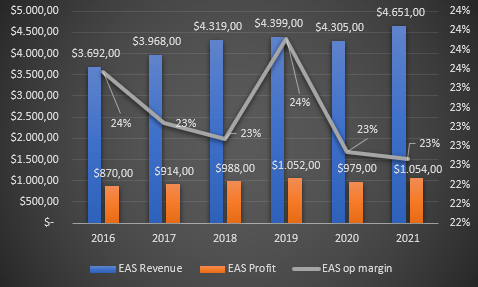

As we can see in the chart below, the EAS business is very steady, staying within the range of 23%-24% operating margin. We did not see any operating leverage over the last 6 years. The business basically hasn’t gone anywhere.

EAS overview (Authors model, Data from Danaher 10-K)

Diagnostics Overview

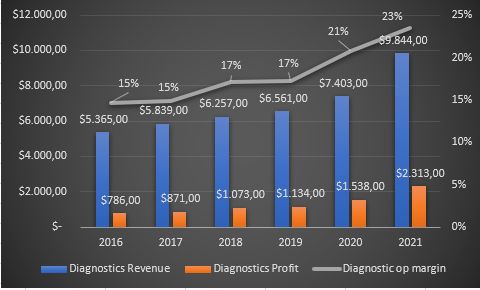

We can see a very different story for the diagnostics segment. Along with strong revenue growth, we also saw a much stronger operating profit growth. We can see clear operating leverage, as the Danaher Business System is used to make the segment more efficient. Operating margins climbed from 15% in 2016 to 23% in 2021! The pandemic clearly had an effect here, but even if we just look from 2016 to 2019 we can see the operating leverage kicking in, growing the operating margin to 17%.

Diagnostics overview (Authors model, Data from DHR 10-K)

Life Sciences Overview

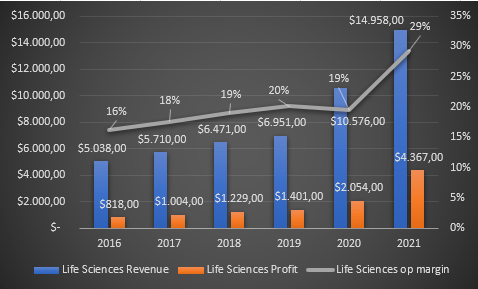

Life Sciences took the trend we saw in Diagnostics to the extreme, growing revenue rapidly, and operating profits exponentially. Operating leverage increased an incredible 1300 basis points in 6 years! We also have to consider that there was a large jump from 19% to 29% operating margin in 2021, in the 5 years before that we saw steady operating leverage.

Danaher gave the following reasons for this explosive margin expansion in its 10-K:

- Higher sales volume, an increased proportion of higher margin product sales, incremental cost savings (Danaher Business Model), foreign currency contributed 500 basis points to the operating margin

- 2020 acquisition-related fair value adjustments of inventory and deferred revenue related to the Cytiva acquisition contributed 440 basis points

- The incremental accretive effect of recently acquired businesses contributed 80 basis points

- Acquisition-related fair value adjustments related to the Aldevron acquisition were a 40 basis points headwind to operating margin

We can see that a lot of the margin expansion was organic, while we also had around half of it from acquisitions. Danaher managed to hold these margins, though, with Q2 2022 Life Sciences margins staying strong at 29.6%.

Life Sciences overview (Authors model, Data from DHR 10-K)

EAS is Danaher’s Weakest Segment

We can conclude that EAS has been the weakest part of the Danaher machine, with the slowest growth and no significant operating leverage kicking in. CEO Blair stated in the press release:

With today’s announcement, Danaher will become a more focused science and technology leader committed to innovation and making a profound impact on human health

I agree with this statement, Danaher should focus on its growing businesses in the medical industry. Danaher also believes that the EAS segment will be able to grow faster as a standalone company, having a “greater opportunity to pursue high-impact and inorganic investments”. Let’s see if this was the case for its prior spin-offs.

How Prior Spin-Offs Performed

Fortive Corp.

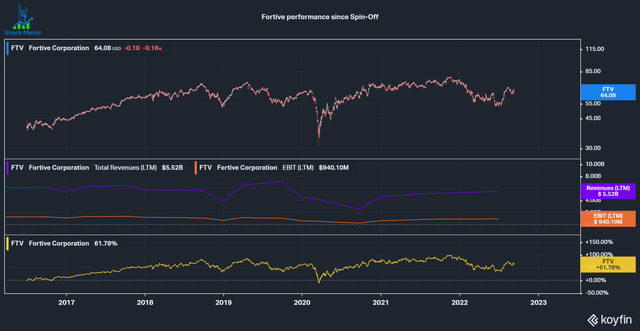

Fortive Corp. (FTV) has been spun-off in 2016 and represented Danaher’s industrial technology segment. We can see that the performance, both from a share price and from a revenue & profit perspective has been very mediocre. Revenue and profits declined 11% and 35% respectively, while the company returned a total return of 61%. Overall, shareholders that sold the spun-off company and bought more Danaher shares performed much better, receiving a total return of 261% in the same period.

Fortive performance since spin-off (Koyfin)

Envista Holdings Corp.

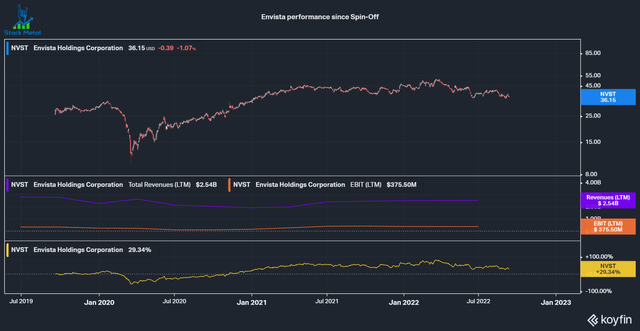

Envista Holdings Corp. (NVST) was spun-off in 2019 and represented Danaher’s Dental business segment. Revenue declined 10% and profits increased 10% since going public while generating a 29% total return for shareholders. Once again, shareholders who sold the Envista Holdings shares after the spin-off would have been better off buying more Danaher shares and receiving a 110% total return in the same timeframe.

Envista performance since spin-off (Koyfin)

Conclusion

Looking at the past performance of the EAS segment and comparing previous spin-offs, I will most likely sell my shares of EAS once the spin-off occurs in Q4 2023. Obviously, it depends on the price the company will be spun off, but unless it is at a bargain price, I’d rather increase my stake in a more concentrated Danaher.

In the short term I still rate Danaher as a buy, together with the news of the spin-off, the company also increased its third-quarter guidance:

Mr. Blair will communicate that Danaher’s third quarter 2022 core revenue growth is expected to be above the Company’s prior guidance range. This increase is driven by higher Cepheid respiratory testing revenue, which is now anticipated to be greater than $500 million for the third quarter 2022 versus the prior expectation of approximately $325 million. The Company continues to expect base business core revenue growth to be in the high single digit range in the third quarter.

Danaher is a high-class company with proven management, a great business model, and a shareholder-friendly culture.

Be the first to comment