RobsonPL/iStock Editorial via Getty Images

Well, we like Intesa Sanpaolo (OTCPK:ISNPY) – especially at this stock price level. Since our initiation of coverage (more than two years), our buy case recap still holds. At that time, we emphasized Intesa’s dominant market position, a strong cost/income ratio and superior capital base requirements.

Looking at the just-released three-month numbers, it is evident how the company is still gaining market share despite a pandemic and an ongoing war is reducing operating costs and is well ahead of the BCE’s capital requirement.

ISP cost/income ratio ISP CET1 ratio

Not a long time ago, we delved deeper into Intesa’s Russian exposure providing some interesting considerations and initiating a new investment in the Italian leading bank.

Q2 Results

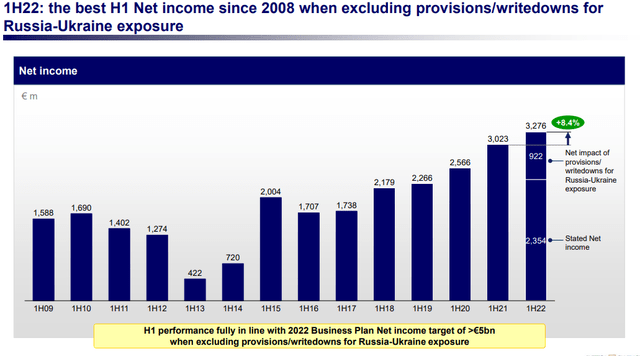

Starting from the bottom line, the bank recorded a net profit of €2.35 billion, after value adjustments of €1.1 billion related to write-offs for Russia and Ukraine. Without the latter amount, the last line of the income statement would have been €3.28 billion a plus + 8.4% compared to €3.02 billion achieved in the first half of 2021. These numbers were positively welcomed by Wall Street analysts.

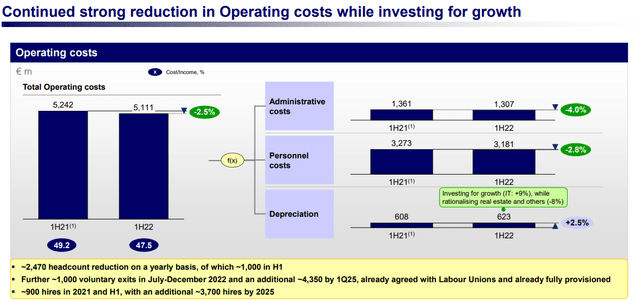

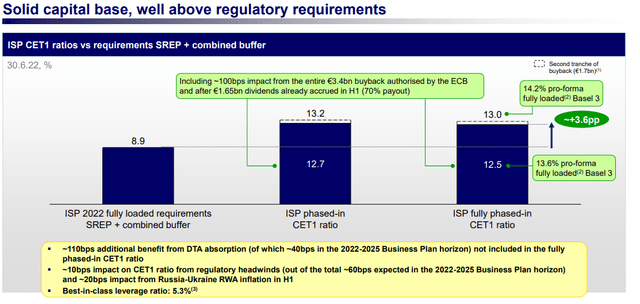

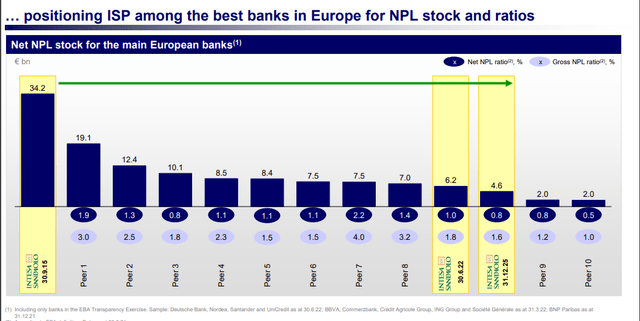

Getting back to the outcomes, Intesa Sanpaolo delivered positive numbers in almost all its operations with net operating income up 0.9% and operating cost down by 2% compared to the first half of 2021. The cost/income ratio now stands at 47.5% one of the best in Europe. Aside from the P&L considerations, we should also note how ISP is better positioned at the NPL level. ISP’s asset quality is by far “better equipped” than its competitors to navigate future turbulences. The capital position is also solid with a Common Equity Tier 1 ratio of 12.5% when fully operational.

Conclusion and Valuation

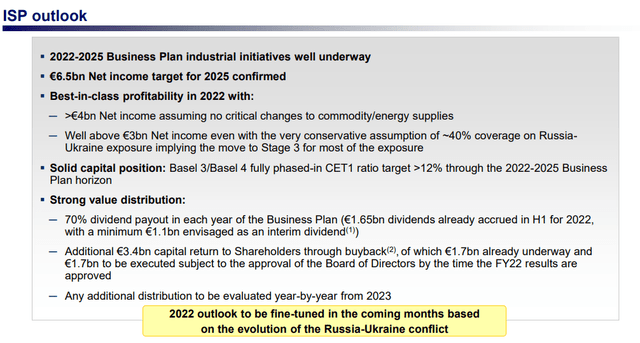

The Italian leading bank reaffirms its 2022 guidance and its 2025 industrial plan. All the objectives have been confirmed and also the net profit target of €6.5 billion by 2025. In Q2, net interest income was above consensus expectation by 7% and Intesa’s profit was higher than estimates. There is a risk of deterioration for the Italian economy, but we are confident that the bank is now ready to tackle a challenging environment. In our previous note, we already adjusted the company’s asset write-offs, so we continue to value Intesa at a price of €2.4 per share based on a ROTE of 13% and a long-term growth rate of 0.5%

The board also announced the distribution of €500 per employee. This was done to contrast inflation pressure and higher energy costs. The total amount of the intervention is estimated at €48 million.

If you are interested, here is our view on the second biggest Italian bank.

Be the first to comment