2d illustrations and photos/iStock via Getty Images

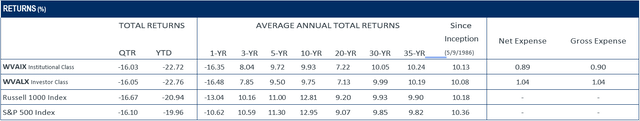

The Value Fund’s Institutional Class returned -16.03% for the second quarter compared to -16.10% for the S&P 500 and -16.67% for the Russell 1000. Year-to-date, the Fund’s Institutional Class has returned -22.72% compared to -19.96% for the S&P 500 and -20.94% for the Russell 1000.

It has been a rough six months for stock investors. Stubbornly persistent inflation at 40-year highs is a serious issue. The Federal Reserve has taken increasingly aggressive monetary policy steps to try to tamp it down. To date, the Fed has raised short-term interest rates three times, in larger increments than they have used in over 20 years. More rate hikes are on the horizon, and investors are concerned that the Fed won’t stop until we have a recession. With this backdrop, prices for stocks and other risk assets continued to decline.

Bear markets are painful, but they are a normal and inevitable part of investing. Lower stock prices, of course, are also the silver lining. From these price levels, things don’t have to go perfectly for our companies, and one certainty is that they won’t. Our long-term confidence stems from the resiliency, adaptability, and durability of our portfolio companies. The Fund’s businesses are geared to survive and eventually thrive through tougher times. We look forward to reporting on their continued progress.

Alphabet (GOOG, GOOGL), Meta Platforms (META), Berkshire Hathaway (BRK.A, BRK.B), Amazon.com (AMZN), and Vulcan Materials (VMC) were the Fund’s largest quarterly detractors. The price declines largely reflected growing recession fears. Investors worried about the outlook for digital advertising (Alphabet and Meta), economically sensitive construction aggregates (Vulcan), and potential overinvestment in capacity (Amazon).

The story was similar at a raft of other companies whose stocks declined more than 10% during the quarter. While we may see some earnings resets, stocks are forward-looking and no longer reflect “blue sky” outlooks at these prices. The Fund had no positive contributors for the quarter.

Not surprisingly, the year-to-date detractors list looks very similar. Meta Platforms faces well-documented headwinds, but we think these are more than reflected in a depressed stock price. Alphabet, Vulcan Materials, and Amazon were material year-to- date detractors after second-quarter price markdowns.

Finally, we think Liberty Broadband (LBRDK) is one of the most discounted stocks we own, despite fears about rising broadband competitive intensity. The Fund’s previously-exited JPMorgan Chase (JPM) position was the only positive contributor year-to-date.

During the quarter, we sold the Fund’s AutoZone (AZO) holdings at a substantial profit as the stock traded above our value estimate. Research Analyst Jon Baker made an outstanding buy recommendation back in late 2020, and the stock has nearly doubled since then. AutoZone’s management team has done a terrific job, the business is humming, and the stock has clear momentum in this economic and market environment.

While selling a winner with positive trends is not especially comfortable, our discipline combined with the wider opportunity set drove the decision. To echo AutoZone’s famous jingle, we would gladly “Get in the Zone” again at the right price.

We added a new position in Adobe (ADBE) as software stocks continued their fall from grace. Adobe is a leading provider of software in three large segments with nice tailwinds. Creative Cloud, a collection of Adobe’s software and applications, serves professionals, communicators, and consumers in the rapidly growing creator economy.

Document Cloud includes the ubiquitous PDF technology, Acrobat and Adobe Sign applications, and other tools to power digital documents. Experience Cloud is a customer experience platform that is a marketing tech leader alongside Salesforce.com (CRM).

Adobe is a “meat and potatoes” software investment with deeply entrenched competitive positions, exceptional margins and free cash flows, and long runways for sustainable, above-average growth. Most importantly, we think this well-managed business trades at a very fair price to a long- term owner.

We added to several Fund positions during the quarter, including Amazon, Analog Devices (ADI), CarMax (KMX), Fidelity National Information Services (FIS), and Meta Platforms. We also trimmed several holdings, including Aon (AON), Berkshire Hathaway, LabCorp, Linde (LIN), and Mastercard (MA). This activity reflected our typical price discipline.

Sales were weighted to stocks with narrower discounts to estimated value, often early in the quarter at higher prices, while buys were weighted to stocks with wider discounts to estimated value. These trades are designed to help seed future potential returns rather than drive immediate results.

The portfolio is focused and well-aligned with our vision for successful large-cap investing. We have concentrated ownership stakes in 27 companies, with the top ten representing 48% of the portfolio. Each position is significant enough to matter, yet none can individually make or break our results.

Our current estimate is that the portfolio trades at a price-to-value in the high 60’s. We believe that most holdings have a chance for healthy gains over a multi-year period. Others are priced for adequate return potential primarily from expected growth in per-share business value.

Top Relative Contributors and Detractors

|

TOP CONTRIBUTORS (%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

There were no securities that provided a positive contribution for this period. |

||||

|

TOP DETRACTORS (%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

Alphabet, Inc. |

-21.68 |

7.41 |

-1.65 |

7.5 |

|

Meta Platforms, Inc. |

-27.78 |

4.20 |

-1.26 |

4.1 |

|

Berkshire Hathaway, Inc. |

-22.54 |

4.34 |

-1.05 |

4.0 |

|

Amazon.com, Inc. |

-34.82 |

2.71 |

-1.00 |

2.7 |

|

Vulcan Materials Co. |

-22.45 |

3.88 |

-0.95 |

3.6 |

Data is for the quarter ending 06/30/2022. Holdings are subject to change and may not be representative of the Fund’s current or future investments. Contributions to performance are based on actual daily holdings. Returns shown are the actual returns for the specified period of the security. Additional securities referenced herein as a percent of the Fund’s net assets as of 06/30/2022: Adobe, Inc. 2.8%, Analog Devices, Inc. 4.2%, Aon plc 2.8%, AutoZone, Inc. 0.0%, CarMax, Inc. 3.5%, Fidelity National Information Services, Inc. 3.9%, JPMorgan Chase & Co. 0.0%, Laboratory Corp. of America Holdings 3.4%, Liberty Broadband Corp. 4.4%, Linde plc 2.6%, Mastercard, Inc. 4.3%, and Salesforce, Inc. 2.7%.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment