metamorworks/iStock via Getty Images

Introduction

With new standards and requirements being introduced in the ever-evolving ESG landscape, Syntax believes that clarity is of the utmost importance to the growing number of investors that want to invest responsibly. Consequently, we are focused on educating investors on ESG topics and using our proprietary data to provide unparalleled transparency on the ESG characteristics of their portfolios. In our “Breaking Down the Basics” series, we dive into the basics of the most popular topics in ESG investing. Our latest in this series focuses on SDG investing.

The discussions from COP27, held in November 2022 in Egypt, demonstrate that it is more pressing than ever for investors to direct capital to companies aligned with the UN SDGs. Syntax supports this global development and recognizes it is crucial for investors to understand what SDG investing is and is not. With that objective in mind, we will examine the basics of SDG investing, including:

- What are the SDGs?

- Who should consider SDG investing?

What are the SDGs?

The SDGs (Sustainable Development Goals) are a series of 17 goals identified in the United Nation 2030 Agenda for Sustainable Development.1 In addition to 17 top-level goals that target the world’s most pressing development challenges, the goals consist of 169 underlying targets offering further clarity on the stated environmental and societal outcomes of each goal. While these goals were initially intended for governments and world leaders, in recent years they have been embraced by the investment community as an impact investing framework. Note that most consider only 15 of the 17 SDGs to be “investable.” Goals 16 (Peace, justice, and strong institutions) and 17 (Partnership for the goals) fall outside of the scope of private market investments.

In 2018, the United Nations Development Program (UNDP) in collaboration with Sustainable Finance Hub (SFH) launched SDG Impact, an initiative aimed at providing investors and other financial professionals with tools to allocate private capital towards the SDGs. The Sustainable Development Investor (SDI) framework, published shortly thereafter by a consortium of some of the world’s largest pension funds, identified the investability of 15 of the 17 “investable” goals. The SDI framework then mapped the kinds of products and services that were aligned or misaligned to each SDG.

In addition to the 17 top-level goals, the SDGs also include 169 sub-goals or “targets” (though only 54 of which are investable). These are a more specific set of outcomes that together would help to achieve the stated goal. An example is below:

Totabc.org Totabc.org

Who should consider SDG investing?

SDG investing enables investors to measure the environmental and social impact of their investments in a standardized way. The World Business Council on Sustainable Development notes that “the SDGs provide a powerful lens through which the private sector can translate evolving global needs and ambitions into business solutions.”2 Through the SDGs, investors can understand in what ways their portfolios are aligned or misaligned with many of the priority areas that the UN has set for global development by 2030. The UN SDGs were not exclusively designed for impact investing purposes – in fact, they were initially designed for governments and Non-Governmental Organizations (NGOs) – so it is important to translate them thoughtfully for impact investing purposes.

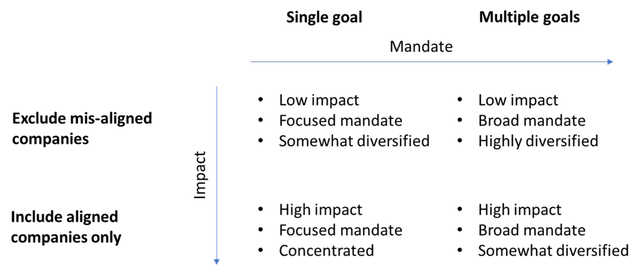

Like all investing, SDG investing should align with the goals and priorities of the asset owner. For some investors, a broad-based portfolio that excludes only the companies that misalign with a single SDG goal may be most appropriate. This portfolio could have limited environmental and social impact, but it will be relatively diversified. On the other end of the spectrum is a portfolio that only includes companies aligned with a single SDG goal. This portfolio would rank high in terms of “impactfulness,” but would be considerably less diversified.

Thea matrix below illustrates different SDG approaches by impact and diversification:

It is also important to note the limitations of SDG investing. The SDGs measure social and environmental impact; but they do not measure the non-financial risk of an investment portfolio, as is the case with many ESG investing frameworks. Unlike ESG investing, SDGs also do not consider any type of financial performance. An SDG framework should be considered alongside other financial and non-financial measures of an investment portfolio. We believe the best approach to SDG investing is a transparent approach that accurately measures SDG alignment alongside other investment factors and criteria.

_________

1 Additional information can be found at: THE 17 GOALS | Sustainable Development

2 Source: World Business Council on Sustainable Development

Original Source: Author

Be the first to comment