ArtistGNDphotography/E+ via Getty Images

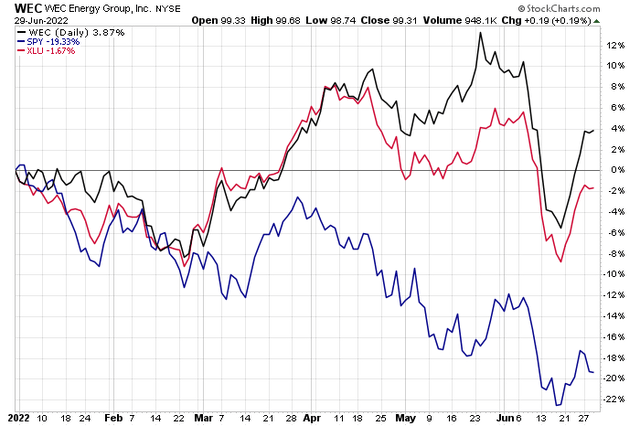

The typically sleepy Utilities sector has been a lively trade in 2022. Through June 29, the Utilities Select SPDR ETF (XLU) is down just 2% (including dividends) while the S&P 500 has plunged 19% – pacing for its worst first-half performance since 1970. Despite a YTD loss, investors have found relative calm in shares of steady utility stocks. One company, WEC Energy Group (NYSE:WEC), has been an alpha generator within a strong sector. It is a double hit of relative strength. WEC is up 3.9% in 2022.

According to BofA, WEC operates as a diversified utility holding company whose wholly-owned subsidiaries provide regulated natural gas and electricity, as well as nonregulated renewable energy. 60% of WEC’s earnings come from its Wisconsin service territory, with Michigan, Minnesota, and Illinois commanding the remainder.

WEC Shares Outperforming XLU & SPY in 2022

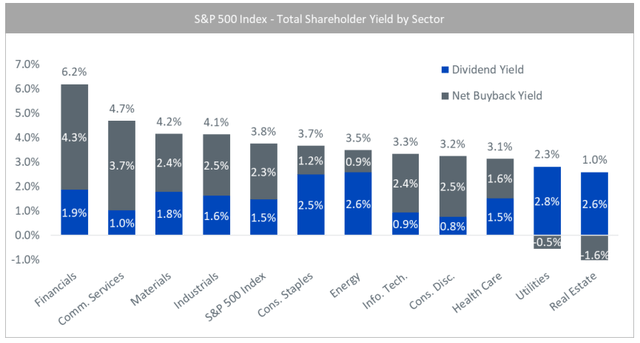

Why are investors flocking to power distributors? Not only do they have mainly domestic operations, buffered from the risks multi-nationals face with currency movements – a sharply higher U.S. dollar this year – and ongoing geopolitical tensions, but utilities stocks also pay big dividends. According to WisdomTree, the Utilities sector pays out a 2.8% dividend yield. But, and here’s the downside when it comes to total shareholder yield, the sector’s net buyback yield is actually negative. That means utility companies have been net sellers of shares, which dilutes current stockholders. This is just something to be mindful of when investing in the sector.

Sector Total Shareholder Yield

WEC Energy sports a 2.9% yield, above the S&P 500’s dividend rate of just 1.6%. Not only have investors been rewarded with a strong price return this year, but they are also getting paid to wait on this rangebound stock.

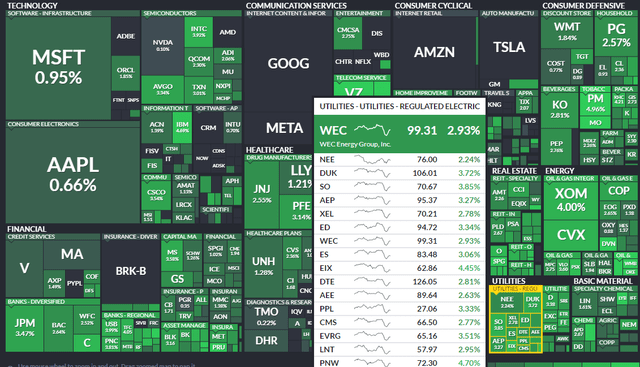

S&P 500 Dividend Yield Heat Map

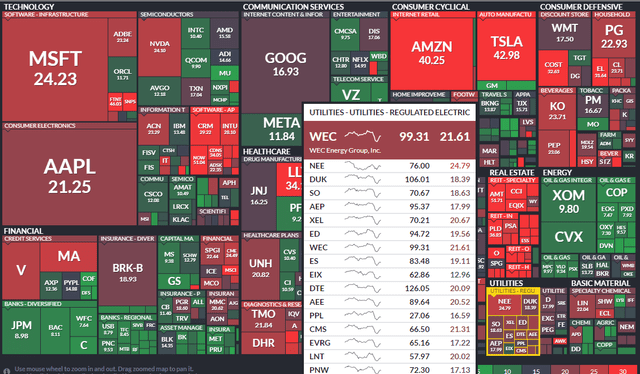

WEC is not a cheap company though. Its forward price-to-earnings multiple is nearly 22x, according to Finviz. For perspective, that’s about what the Information Technology sector trades at right now, according to the latest FactSet Earnings Insights update by John Butters. The firm’s next earnings date is confirmed to take place on Tuesday, August 2, BMO, according to data provider Wall Street Horizon.

S&P 500 Forward P/E Heat Map

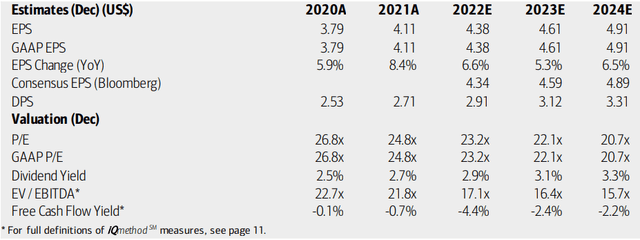

Analysts at Bank of America Global Research estimate that WEC’s profits will grow at a modest rate over the coming years. Consider that inflation is humming along at a high rate at might stay higher than average for a long period. Nominal EPS growth of just 5% to 7% is not particularly impressive. Moreover, WEC generates negative free cash flow and trades at a very high EV/EBITDA multiple.

WEC Earnings, Valuation, Free Cash Flow Forecast

The Technical Take

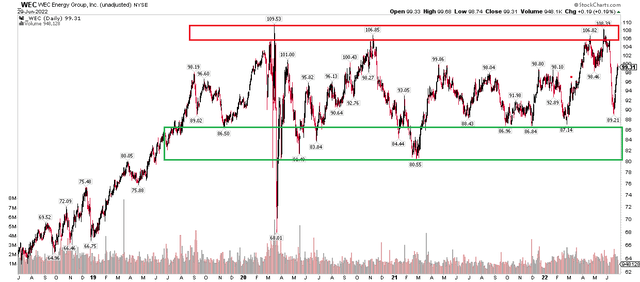

WEC shares have been rangebound for the last three years. That’s a great trait in 2022 given weakness in the broader market. As investors earn a solid dividend, share price appreciation has been scant as there is a defined lower bound and upper resistance area on the chart. I see support in the low-mid-$80s while the $106 to $110 range has been met with selling pressure a few times. Just this month, shares rallied hard back toward $100. A closing price above $110 would help support a bullish technical narrative while a move below $80 would imply bearish price action going forward.

WEC Rangebound, A Major Thrust This Month

The Bottom Line

I expected WEC to trade well this year as volatility persists in the overall market. Insulated from currency and geopolitical risks and with a solid dividend, investors seek safety in this name. Longer-term, its valuation is high and free cash flow is negative, so I would avoid hiding out for a long time in WEC. Keep an eye on how the technical price range breaks for clues on the next trend.

Be the first to comment