Art Wager/E+ via Getty Images

Investment Thesis

BBX Capital (OTC: OTCQX:BBXIA, OTCPK:BBXIB) is an under-the-radar diversified holding company (no previous articles on Seeking Alpha) trading at a discount to a conservative NAV (~0.93x P/NAV) and ~0.51x of P/BV. Management seems to agree that the stock is cheap and is gobbling up stock in the company via share repurchases/tender offers. It just approved another $15m repurchase plan in January 2022 (~9% of shares outstanding).

Background

BBX Capital is a Florida-based diversified holding company. It was spun-off from Bluegreen Vacations (BVH) on September 30, 2020 and following the spin-off, Bluegreen Vacations ceased to have an ownership in BBX Capital.

BBXIA’s principal holdings are:

- BBX Capital Real Estate (BBXRE): engaged in the acquisition, development, construction, ownership, financing and management of real estate and investments in real estate JVs (multifamily, single-family, and commercial properties mainly located in Florida); also owns 50% equity interest in the Altman Companies, a developer and manager of MF rental apartment communities and anticipates acquiring an additional 40% of Altman in 2023; it also manages legacy assets connected with the company’s sale of BankAtlantic in 2012 (portfolio of loans receivables, real estate properties, and judgments against past borrowers). As part of an effort to diversify its portfolio of real estate developments, BBXRE is evaluating potential investments in warehouse/logistics facilities. It is considering BBXRE has ~$180m of assets as of 12/31/21

- BBX Sweet Holdings: ownership/management of operating businesses in the confectionery industry; (1) IT’SUGAR, specialty candy retailer whose products include bulk candy, candy in giant packaging, and licensed/novelty items (2) Las Olas Confections and Snacks, manufacturer and wholesaler of chocolate/confectionery products and (3) Hoffman’s Chocolates, retailer of gourmet chocolates; ~$144m of assets

- Renin: engaged in the design, manufacture, and distribution of sliding doors, door systems, and home decor products and operates through its HQ in Canada and 3 manufacturing/distribution facilities into the US/Canada. Also sources various products and raw materials from China, Brazil, and other countries. ~$101m of assets

It currently has 12.4m shares of Class A stock and 3.9m shares of class B stock.

BBXIA currently trades at $10 and BBXIB trades at $10.40. Class A stock represents 22% of the total voting power and Class B the remaining 78%. The total market cap is $164.56m.

Insiders collectively own shares of Class A / Class B stock representing ~81% of the total voting power.

Valuation

I would probably value BBXIA on a sum-of-the-parts (SOTP) basis. All data is based on its recent 10-K.

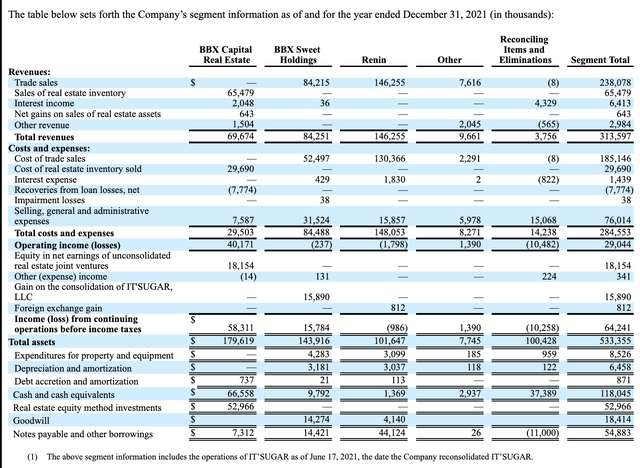

BBXIA 2021 Segment Info (2021 10-K)

BBX Real Estate Segment

- Cash: $66m

- Real Estate: $23m

- Real Estate Investments in JVs: $53m

Estimated Total Assets: 66 + 23 + 53 = $142m (stated Total Assets: $180m)

BBX Sweet

To be honest, I’m not sure how to analyze this segment. It generated $84m worth of sales in 2021 but was unprofitable. BBXIA states there are $144m worth of assets here, but I’m not too sure about that number.

If you look at publicly traded candy companies (Tootsie Roll TR, Hershey HSY), they trade at ~4x sales and ~20x EV/EBITDA. I highly doubt BBX Sweet is worth that much, but it should be worth at least 1x sales, so ~$84m. To put it another way, it’s putting a 20x multiple on the segment if it’s able to obtain a 5% net profit margin ($4.2m net income).

- Cash: $10m

- Estimated Segment Worth: $84m

Estimated Total Assets: 10 + 84 = $94m (stated Total Assets: $144m)

Renin Segment

Another segment that is hard to value. This segment generated $146m in sales last year but was also unprofitable. Some similar building product companies include Cornerstone Building (CNR) which trades ~0.55x sales and 4-5x EV/EBITDA and Builders FirstSource (BLDR), which trades ~0.76x sales and 5-6x EV/EBITDA. Obviously these are much much better companies than Renin, so I’ll probably give it a ~0.25x sales multiple or ~$37m. BBXIA states Renin has total assets of ~$102m.

- Cash: $1.4m

- Trade inventory (raw materials + paper goods/packing materials + finished goods) of $42m; assume 50% haircut –> $21m

- Estimated Segment Worth: $37m

Estimated Total Assets: 1.4 + 21 + 37 = $59.4m (stated Total Assets: $102m)

Other

The Other segment includes ~$108m of total assets. We know there’s ~$40m in cash and a $50m note receivable from Bluegreen Vacations.

- Cash: $40m

- Note Receivable: $50m

Estimated Total Assets = 40 + 50 = $90m (stated Total Assets: $108m)

P/NAV

- Total Assets: 142 + 94 + 59.4 +90 = $385m

- Total Liabilities: $209m

- NAV = 385 – 209 = $176m

- NAV/share = 176/16.3 = $10.80 (current price: $10)

- P/NAV = 164/176 = 0.93x

Stated P/BV

- Stated Book Value: ~$323m

- Price/Stated Book Value: 164/323 = 0.51x

Risks

- Unprofitable Segments: one risk is that the unprofitable segments (Sweet + Renin) are actually worth negative, meaning that it continually sucks up more cash to keep the operation running without ever turning profit

- Florida Real Estate: another risk is that since BBXIA has a concentration of Florida real estate, it would be detrimental to BBXIA if something were to happen to the Floridian real estate market (but it doesn’t seem like Sunbelt is slowing down anytime soon)

Catalysts

- Tender Offers / Repurchases: BBXIA has been gobbling up its own stock.

- In May 2021, BBX Capital commenced a cash tender offer to purchase up to 4m shares of its Class A stock at a purchase price of $6.75 per share.

- In June 2021, BBX Capital amended the terms of the tender offer to increase the purchase price from $6.75 per share to $8/share and reduce the number of shares sought to be purchased from 4m shares to 3.5m shares.

- In July 2021, BBX Capital purchased 1,402,785 shares of its Class A Common Stock pursuant to the cash tender offer at a purchase price of $8/share for an aggregate purchase price of approximately $11.4m, including fees (~7.5% of total issued and outstanding equity).

- In October 2020, BBX Capital’s approved a share repurchase plan which authorized the repurchase of up to $10m of shares of Class A and Class B Stock.

- In September 2021, they approved an increase in the program from $10m of shares to $20m of shares, and in November 2021, they approved an increase in the program in an amount necessary to repurchase 1,305,416 shares of Class A Common Stock in a private transaction.

- As of December 31, 2021, BBX Capital had purchased 2,425,229 shares of its Class A Common Stock and 14,394 shares of its Class B Common Stock under this program for approximately $22.8m, and there was no remaining availability to purchase shares under the program as of December 31, 2021.

- In January 2022, BBX Capital’s Board of Directors approved a share repurchase program which authorizes the repurchase of shares of BBX Capital’s Class A and Class B Common Stock for a total aggregate purchase price of up to $15m.

- Insiders: they own 36% of Class A and 95% of Class B, effectively controlling 81% of the total voting power

Conclusion

BBXIA is an interesting holding company trading at a discount to a conservative NAV (~0.93x P/NAV) and ~0.51x of P/BV. Management seems to agree that the stock is cheap and is gobbling up stock in the company via share repurchases/tender offers. It just approved another $15m repurchase plan in January 2022 (~9% of shares outstanding). Insiders are also aligned by owning effectively 81% of the company.

Based on the analysis above, I recommend a long position in BBXIA (as long as it continues to trade below NAV and the company is buying back stock)

Be the first to comment