DNY59

Transcript

Central to our asset allocation is the end of the Great Moderation – characterized by much tougher trade-offs facing central banks.

In this environment, fighting inflation carries real damages to growth and also through financial disruptions. And this trade-off is not really avoidable, which is why a soft landing is unrealistic.

1) UK at epicenter of growth-inflation trade-off

The UK is one case in point, whereby the fiscal authorities tried to boost growth through unfunded tax cuts and additional spending.

But because the Bank of England recognizes that it needs to bring about a recession in order to bring down inflation, we’re not really expecting more growth but we are expecting more rate hikes.

2) Central banks to overtighten policy

In the near term, we believe this increases the resolve of other central banks to overtighten [policy] in order to stay on top of the inflation narrative. But that carries real damages, and as that damage becomes clear in 2023, we do believe central banks will pause [rate hikes] and not go all the way. And at that point, we will have to live with higher inflation as well.

Tactically, given the very tough rate and growth environment, we’re comfortable with our dialed-down risk-taking. But strategically, as we believe central banks will not go all the way [on rate hikes] and they will pause in 2023, there is a case to be strategically a bit more positive on risk.

________________

We’ve said a period of steady growth and inflation known as the Great Moderation is over – and made this central to our investment views. Central banks face a brutal trade-off in this new regime: either live with inflation or the economic damage needed to tame it quickly. There’s no way around this, or no “soft landing,” in our view. Case in point: the UK’s fiscal splurge. It didn’t push up growth expectations, it only resulted in higher rates. We stick with dialed-down risk.

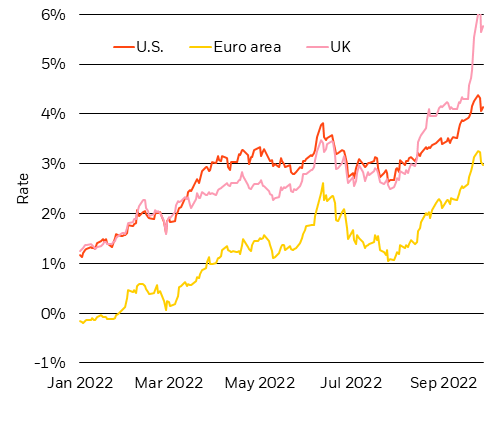

UK rates surge as policy forces clash

Market Pricing Of Future Policy Rates, 2022 (BlackRock Investment Institute, with data from Refinitiv Datastream, October 2022)

Notes: The chart shows the pricing of expected central bank policy rates via forward overnight index swaps. The rate is the one-year OIS rate expected starting one year from now.

The trade-off central banks face in a regime of heightened macro volatility and a world shaped by production constraints came into sharper focus last week. Fiscal authorities in the UK tried to boost growth with unfunded tax cuts and spending increases. Markets shook. Rate expectations for the Bank of England surged above other major central banks (see pink line in chart). Growth expectations did not – the pound plummeted to all-time lows and stocks fell. This all shows how we are in a new regime, where authorities can’t spend to avoid recession. We think getting inflation down quickly would take aggressive rate hikes and recession. Central banks are trying to do whatever it takes to tame inflation, but they haven’t acknowledged what it will take, in our view. We expect them to break growth as a result, but then stop in 2023 once the economic damage is clear.

The macro picture has worsened as a result. We expect recessions in major developed markets (DM). That could be next year in the U.S. but sooner and deeper in the euro area given the energy crunch. Central banks prioritizing the pressure to bring inflation down quickly over the economic implications implies deeper recessions overall, in our view.

Our short-term views

This is why we stick with reduced risk-taking in our tactical investment views. We’re looking for the least bad options. We’re underweight DM equities. Stocks have yet to fully price in recession fears and higher rates, in our view. We think earnings expectations also seem optimistic. An energy crisis further dampens our view of European stocks. Japan is different – still-easy monetary policy keeps us neutral. Valuation remains an important signpost for us to consider getting more positive on stocks. Relatively attractive valuations are also why we prefer credit over stocks. Higher yields and strong balance sheets suggest to us investment-grade credit is better placed than equities to weather recessions.

We’re underweight DM bonds because we think inflation will persist above central bank targets after hiking stops. That said, we see some value in the shorter maturities because of the safety they provide as the closest cash-like investment. Persistent inflation also underpins our overweight on inflation-linked bonds. We’re overweight emerging market (EM) debt. Central banks are well ahead of others in their cycles. EM currencies have also held up fairly well in the risk-off environment. But we remain wary of the currency outlook, as some central banks in EM have paused their tightening as growth deteriorates.

Looking at the long term

Strategic positioning is shaped by our view that central banks will stop hiking next year and not go as far as necessary to get inflation back to target quickly. Recent events reinforce our conviction they will halt rate hikes and live with inflation once confronted with economic damage – either in the form of recession or cracks in financial stability, or both. This will be more favorable to equity than bonds, so we’re overweight DM stocks. We prefer public to private equity. Inflation will persist, so we prefer inflation-linked bonds to nominal bonds. We’re overweight public credit on attractive valuations and income potential.

Our bottom line

We stick with reduced risk-taking, tactically. Heightened macro volatility in a new regime creates stark trade-offs for central banks at risk of overtightening into recessions. Tactically, that means we prefer credit over stocks. Equities remain relatively attractive alongside credit longer term. Persistent inflation keeps us negative on nominal bonds and positive on inflation-linked bonds now and even more so further out into our strategic investment horizon.

Market backdrop

UK gilt yields eased from 14-year highs and the pound clawed back from all-time lows after the surprise government fiscal splurge forced the Bank of England to temporarily buy long-term bonds to stabilize yields. The events illustrate the sharp trade-off policymakers face on higher inflation – and the potential financial dislocations from higher rates. We see risks of central banks overtightening into recessions. U.S. 10-year Treasury yields briefly topped 4% and equities hit fresh lows.

The key release this week is the U.S. jobs report. A rapid pace of job gains has not disguised the fact that the overall level of labor supply remains low compared to pre-Covid – a key production constraint that’s driving inflation higher, in our view. Survey data have softened over the past year. ISM manufacturing data should give more perspective on recession risk.

Be the first to comment