ClaudineVM/iStock Editorial via Getty Images

Investment Thesis

Covestro AG (OTCPK:CVVTF)(OTCPK:COVTY) is a leading global manufacturer of high-tech polymer materials from Germany. The company’s broad product range addresses diverse industries from automotive, construction, and energy to electronics and healthcare. Covestro has been operating as an independent company from its parent company Bayer (OTCPK:BAYZF) (OTCPK:BAYRY) since 2015.

Since then, the company’s operating performance has been largely encouraging, although it has also become clear over time that Covestro is a very cyclical company. Many investors were caught off guard from early 2018 to mid-2022 when the supposedly strong company saw a massive drop in profits and lost over 75% of its value on its home exchange. After a challenging 2020, management was optimistic that a new growth cycle was ahead. They were able to present a very strong fiscal year in 2021 and the board was also optimistic for 2022.

However, economic and political developments have not left Covestro unscathed. With supply chain issues, inflation, war, high gas prices and recession concerns, it is only understandable that Covestro has not been one of the investors’ favorites lately. Nevertheless, I am convinced that the share price overreacted and now represents a good buying opportunity with a very favorable valuation, a strong dividend, and a compelling vision.

2022 So Far – Much Shadow, Little Light

2021 was a strong year for Covestro. With sales growth of 48.5% and EBITDA growth of 110%, the company made an exemplary recovery from the very weak pandemic year of 2020.

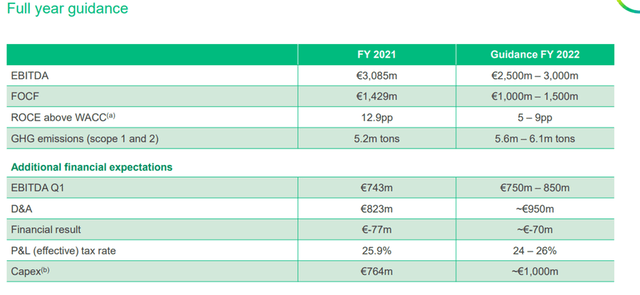

A free cash flow margin of 9% and ROCE of almost 20% were also convincing. However, it was also clear that these figures would hardly be exceeded in 2022 and that consolidation would be the first step. However, the outlook given in March at least signaled a consolidation at a high level, as can be seen below:

In the annual report, the Omicron variant was still listed as the greatest risk in the opportunities and risks report. This shows how much the situation has changed in just a few months. Just two months later, management had to adjust its forecast for EBITDA, operating cash flow and ROCE significantly downward.

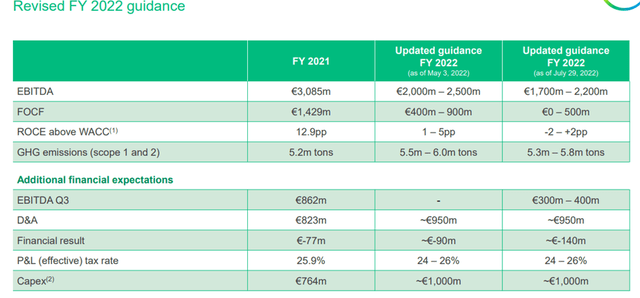

The former lower limits of the range were now the upper limits. On the one hand, this was due to the lockdowns in China and their zero-covid policy and the resulting supply chain issues. On the other hand, rising energy prices due to the war in Ukraine put a clear damper on the outlook for the European economy. However, the situation worsened further, and in July the outlook had to be lowered with the presentation of the half-year report.

The new estimates for operating cash flow and ROCE were particularly negative here, but a 37% drop in EBITDA also read painfully. However, this is understandable given the macroeconomic environment. For example, the GDP estimate for 2022 was still at 3.6% growth in January, while as of September it was reduced to 1.4% with an outlook for a shrinking economy in 2023. Energy prices also played their part, with rising gas prices hitting Covestro and competitors particularly hard.

Fortunately, in September the gas price came back more clearly from its highs and is trading at about the same level as at the time of Covestro’s last forecast. Nevertheless, a price increase of 130% remains compared to June. Due to its high dependence on Russia, Germany in particular is having great difficulty in obtaining gas from other sources and is currently importing at extremely high prices. The German government has also done itself no favors with the planned gas levy.

It is to be hoped that the planned gas price brake will have some effect and that the winter will be survived without blackouts. Although this risk is almost ruled out according to the government, it should nevertheless not be discounted. Because of these problems, the Covestro share has fallen by 50% since the beginning of the year. But what are the reasons why I am still positive about the stock?

Current Situation

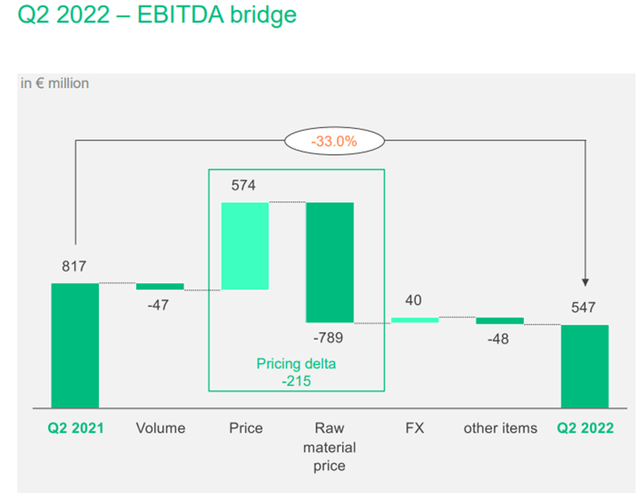

One might think that Covestro’s core business has also suffered badly. However, sales grew even YoY by 18.9% and minimally quarter-over-quarter. Sales volumes have remained roughly stable YoY in the process, while higher prices and the weak euro have driven the growth. Demand is thus stable for Covestro’s products despite the weak market environment. Covestro’s current problem is well illustrated in the following graph:

Compared to the previous year, higher selling prices in the second quarter had a positive effect of €574 million, but the cost of raw materials rose much more sharply to €789 million. The company is currently unable to pass on all costs to customers. It is a problem that many German companies are currently facing, as can be seen from a record-breaking producer price index of 45.8%. Energy prices have been by far the biggest contributor with an increase of almost 140%.

Some Hope In Sight?

It can be seen that the problems are almost all due to external factors, which as an investor I think is better than if bad decisions by management have caused internal problems. I see some light at the end of the tunnel for external problems. For example, prices for major energy sources have come back.

I have already shown the significant 50% drop in gas prices in September above, and oil prices have already been in a corrective movement since June. But German electricity prices also fell sharply in September. While they were still at 65ct/KWh at the end of August, they are now hovering around a level of 30ct/KWh.

This should lead to an overall easing of price pressure and inflation and producer prices at least halting their increases and reporting declines. There are also signs of an easing in supply chains, as can be seen, for example, in average container freight prices, which have fallen by 60% since the start of the year and continue to trend downwards towards 2020 levels.

The reports from the shipping companies also confirm this thesis. Granted, the supply chain issues will continue at least until early 2023, but I think there are increasing signs that the external stress factors for Covestro should ease in the future. Nevertheless, 2022 will no longer be a good year for Covestro, so it is important to look further into the future and analyze the company’s vision.

Segment Analysis

The company reports in the following two segments: Performance Materials and Solutions & Specialties. While Performance Materials represents polyurethane and polycarbonate products and basic chemicals the standard products, Solutions & Specialties include the differentiated polymer products the goods with higher vertical integration and complexity as well as higher innovation.

In Performance Materials, the focus is particularly on the development of supply and demand for the precursors MDI and TDI. Here, the company expects a relatively stronger increase in demand through 2026 than in supply, resulting in high global capacity utilization. The company enjoys a strong competitive position here and the risk of new competitors is considered very low due to very high production entry barriers.

An investor always likes to hear that. In polycarbonates, the company expects strong growth in supply due to investments by competitors, so Covestro plans to shift its business there from standard products to much more differentiated polycarbonate products.

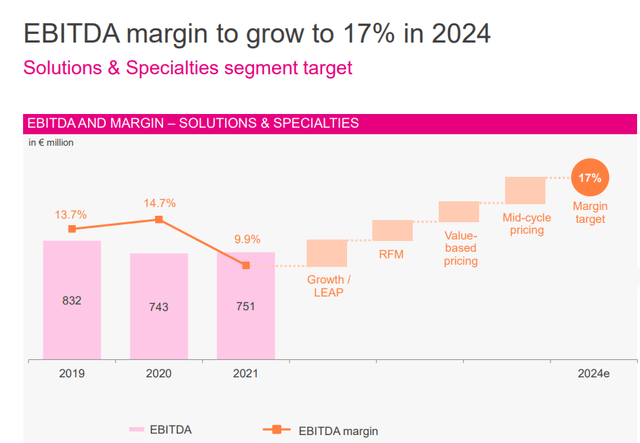

In the Solutions & Specialties segment, the company expects stable annual growth rates of 7% in the largest area of Engineering Plastics, where Covestro is benefiting from trends such as e-mobility, 5G and investments in the healthcare sector. In general, there are some business areas here that are still growing dynamically and also yield good margins due to the high vertical integration. Management is therefore focusing on further investments here to achieve an EBITDA margin of 17% there as early as 2024.

In 2021, this was just 10%, so achieving this target would be associated with a significant increase in profitability. So in the medium term, the company is very well positioned. But what about the long-term vision?

The Circular Economy

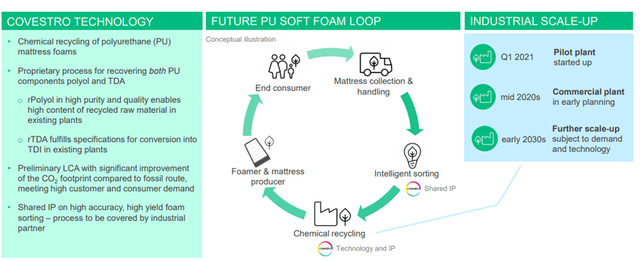

The topic of sustainability has rapidly increased in relevance in recent years, and many companies have made efforts to credibly represent a sustainable image to the outside world. Often this is largely greenwashing, but here has presented an ambitious and credible plan. In the long term, management is pursuing the vision of a circular economy, i.e. a regenerative system in which all resources are used as efficiently as possible, waste is reduced to a minimum and ideally reused at the beginning of the process.

In times of increasing resource scarcity, climate change and environmental pollution, this is a strong and relevant change. It will take a lot of time and capital, but ultimately it should lead to an increase in competitiveness with sustainable production. To realize this vision, management plans to reduce their greenhouse gas emissions by 60% by 2030 and to 0 by 2035.

In addition to the use of renewable energies, production processes should be further optimized to save energy. Harmful steam generation should also become sustainable in the future through renewable energies, as well as biogas and hydrogen solutions. The company’s long-term vision therefore also makes me confident, as following this plan will ultimately lead to competitive advantages.

Valuation

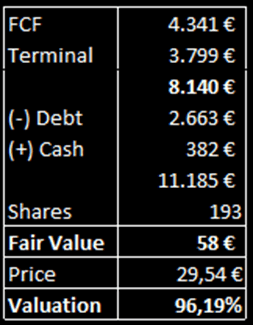

Finally, we need to take a look at the valuation. Covestro is currently valued at 5.6 billion. Subtracting a cash position of 382 million and adding debt of 2.3 billion gives an enterprise value of 7.5 billion.

With TTM sales of 18 billion euros, the EV/sales ratio is 0.41. At first glance, this sounds extremely favorable. In addition, it should be said that Covestro has never been particularly highly valued on a sales basis. 2017 was the only year where the EV/sales were higher than 1, as the market still underestimated the cyclicality of the core business at that time.

Nevertheless, it was much higher in 2020 at 0.94 and in 2021 at 0.75, which means that the current level is historically favorable. EV/EBITDA is 2.4, which was also significantly down from the prior year’s levels of 3.85 and 6.86, respectively. I believe that Covestro should trade at least at an EV/Sales of 0.7 and an EV/EBITDA of 5 after overcoming the external drivers and is currently trading at a massive valuation discount.

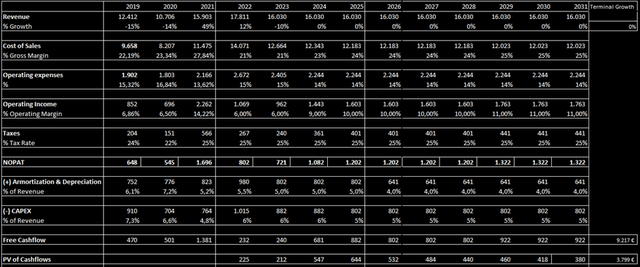

To get a bit more specific, I use the discounted cash flow model for a meaningful assessment of the valuation. For this model, I make the following assumptions, which are extremely conservative based on the current situation.

Sales will fall 10% in 2023 due to the expected recession and falling commodity prices, then stagnate until 2031 to account for a cyclical business.

- Gross margin will improve slightly to 25% over the years after 2023

- Operating expenses will be at 14% of sales

- Tax rate at 25%

- Depreciation at 4-5% of sales

- CAPEX 5-6% of sales

- WACC at 10% (the company says 7% but I add a significant risk premium)

- Terminal growth rate 0%.

This results in the following values:

Author´s calculations Author´s Calculations

Even with these conservative assumptions, the fair value of Covestro is 58€, which would correspond to a share price potential of almost 100%. In my opinion, this prospect is sufficient to compensate for the external risks and make Covestro shares look attractive.

The Bottom Line

This brings me to the conclusion that Covestro has been punished too much in recent months. While things don’t look great for the company for the rest of 2022 and 2023, the core business is showing resilience despite the macroeconomic challenges and in the medium term, this fact should come back to the fore.

Energy prices seem to have seen their temporary highs and supply chains are showing signs of easing. Covestro management has a strong vision for the next few years, which so far is being convincingly advocated. I believe the market reaction is overdone and think Covestro stock is worth buying despite some external factors. Dividend investors should also get their money’s worth with Covestro stock given the lush dividend yield.

Be the first to comment