behindlens/iStock via Getty Images

In its previous FQ3 earnings call, Lam Research (NASDAQ:LRCX) said it earned an adjusted $7.40 per share, compared to estimates of $7.51 per share and revenue of $4.06B (5.53% Y/Y) that missed by $183.99 million. For the upcoming FQ4 quarter, the company said it expects revenue to be $4.2 billion, an increase of 1.60% over the same period last year.

Lam Research is facing three headwinds that will impact upcoming FQ4 2022 earnings and impact guidance. In this article, I focus on the cause and effect of each of these that will probably be discussed during the earnings call.

Headwind #1 – Supply Chain Disruptions

Lam has had problems with its supply chain over the past several quarters, starting in F1Q 2022. During the earnings call on Oct. 20, 2021, CEO Archer also remarked:

“And so when – we’ve heard so much about chip shortages. Clearly, that hit some of our machines. And it only takes a few of those critical chips to delay us being able to ship what otherwise is a very complex system.”

Archer blamed the weak F2Q 2022 earnings and guidance in the company’s earnings call on January 26, 2022 on the following:

- Effects of COVID-19

- Labor shortages

- Freight and logistics cost escalation, and

- Supply chain constraints

In F3Q 2022 earnings on April 20, 2022, Archer blamed the “miss” on “continued component shortages, along with new challenges that emerged, including COVID-related lockdowns, along with exacerbated an already stressed supply chain situation.”

When will these supply chain issues end? LRCX CFO Doug Bettinger noted during the earnings call:

“We are also deploying incremental R&D resources towards qualifying new supply sources to help improve our supply chain challenges. Incentive compensation expenses that, as you know, are tied to the company’s profitability, were also lower in the quarter.

We had headcount growth primarily in the factory and field organizations to address supply chain constraints.”

So to reiterate, LRCX has had three solid quarters of supply chain problems, increased R&D for new sources, cut incentive compensation, and increased headcount to address these constraints.

But here’s what I didn’t hear LRCX say: “We fired the employee who didn’t keep his finger on the pulse” during the F3Q call, after the third quarter of supply problems.

A quarter earlier, I had remarked in my Jan. 31, 2022, Seeking Alpha article entitled “Lam Research Stock: Not All Its Problems Are Supply Chain Related.“

“But the bottom line is that LRCX was aware of these shortages in the previous quarter, and supply-chain management and above are to blame as investors have suffered. Yet the tone of the earnings call was not to blame executives, but ‘it’s the economy, stupid.'” So I suspect LRCX is now an arm of the federal government.

Importantly, ASML reported in its recent C2Q 2022 earnings call on July 20, 2022, that it too was experiencing “supply chain constraints” that not only impacted Q2 but will impact Q3.

ASML CFO Roger Dassen explained:

“With that I would like to turn to our expectations for the third quarter of 2022. We are experiencing increasing supply chain constraints, which resulted in delayed system starts and requires us to increase the number of fast shipments in Q3 in order to supply our customers with systems in production as quickly as possible.”

My take on the supply issue can be read in my July 21, 2022, Seeking Alpha article entitled “ASML: January Fire Responsible For Big Revenue Pushouts To 2023.”

Bottom Line: ASML reported supply constraints this past quarter and expects them through the next. That suggests LRCX will again report supply chain issues that in the past quarters have impacted EPS and revenue.

Headwind #2 – Consumer Slowdown

There have been countless reports of a slowdown in consumer products, specifically PCs and smartphones, that have impacted recent earnings.

I noted in my July 18, 2022, Seeking Alpha article entitled “Post-Micron Earnings Call: What Samsung’s Pre-Announcement Tells Us,” that:

“Micron’s (MU) stock was pummeled after its June 30, 2022 earnings call because of the weak guidance, and it impacted numerous other semiconductor stocks including Nvidia (NVDA), Advanced Micro Devices (AMD), Intel (INTC), Qualcomm (QCOM), and Marvell Technology (MRVL), all which fell nearly 4% in mid-day trading.”

But I also noted in the article:

TSMC (TSM) Chairman Mark Liu said on March 30, 2022, three months or 90 days before Mehrotra’s call:

“Consumer electronics demand is showing signs of slowing amid geopolitical uncertainties and COVID-related lockdowns in China…the slowdown is emerging in areas “such as smartphones, PCs, and TVs, especially in China, the biggest consumer market.”

Bottom Line: TSMC recognized in Q1 2022 a slowdown in consumer items, and Micron’s earnings and guidance were severely impacted. LRCX sells the same type of equipment to TSMC’s foundry and Micron’s memory fabs.

Most importantly in Micron’s F3Q 2022 earnings call, MU CEO Sanjay Mehrotra remarked:

“Additionally, we are planning for a reduced level of bit supply growth in fiscal 2023 and will use inventory to supply part of the market demand next year. This approach will enable us to reduce wafer fab equipment CapEx for fiscal year 2023 versus our prior plans, and we now expect our fiscal 2023 wafer fab equipment CapEx to decline year-over-year.”

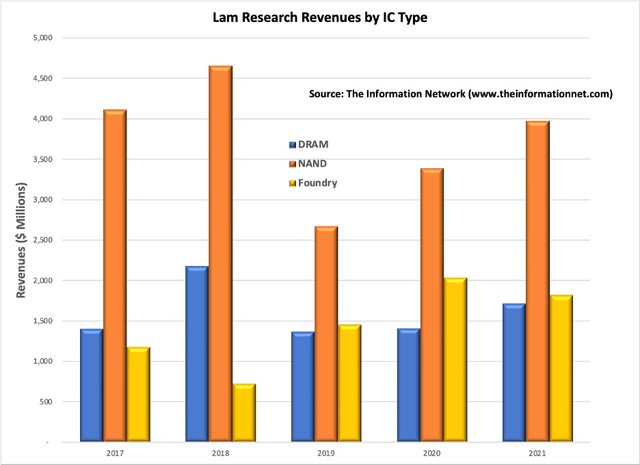

According to our report entitled “Global Semiconductor Equipment: Markets, Market Share, Market Forecast,” most of Lam’s revenues are derived from NAND, as shown in Chart 1.

Chart 1

Headwind #3 – Semiconductor Equipment Meltdown in 2023-2024

In my July 5, 2022, Seeking Alpha article entitled “Assessing My 2021 Call For A Likely Semiconductor Equipment Meltdown In 2023,” I wrote:

On June 24, 2021 I published on Seeking Alpha an article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.” One year later, analysts are just beginning to cut estimates of WFE sales in 2023, nearly a year after to the day after I published my thesis.

For example, UBS analysts in a June 28, 2022, cut earnings estimates and price targets on the group of semiconductor equipment makers, citing lower forecasts for the rest of the year and into 2023.

“We see major producers building inventories in hopes of demand improvement and we expect they will additionally cut CapEx and are already starting to push out tool shipments.”

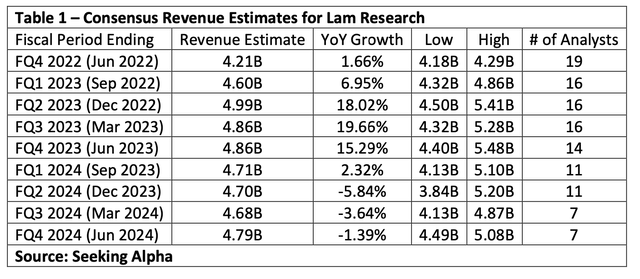

Further confirmation of my thesis can be found on Seeking Alpha‘s site shown in Table 1.

Bottom Line: This is a long-term headwind affecting Lam in 2023. But it will be a severe impact.

Investor Takeaway

Lam Research announces earnings after market close on July 27. The company has three headwinds facing it in the near and long term.

Headwind #1 – Supply Chain Disruptions will strongly impact LRCX this earnings call because the company has tried but not succeeded in completely addressing the problem. ASML’s announcement last week is a nail in the coffin of Lam.

Headwind #2 – Consumer Slowdown be another rationalization for a poor quarter. This has impacted Micron and others, and it will impact LRCX and others in the current earnings call period. As the economy slows and recession takes over, consumers will further cut back on spend.

Headwind #3 – Semiconductor Equipment Meltdown in 2023-2024 is a long-term headwind and will affect LRCX next year. As I noted in Chart 1, Lam’s exposure to foundry, which will be the brunt of the oversupply of chips and meltdown of equipment, is only about 25% of the company’s revenues. This contrasts with competitor Applied Materials (AMAT) which has a significant exposure to foundry, and will be the subject of a future article.

Be the first to comment