Nariman Safarov

Introduction

It is always a pleasure to analyze and write about outstanding and dominant companies like WD-40 (NASDAQ:WDFC). You open the income statement, and you are satisfied with what you find, you move on to the balance sheet, and you are calm and finally, arriving at the cash flow statement you are amazed that you have not found any problems in any of the three documents. I consider it almost useless to talk about the absolute leadership position of WD-40; we all know its products and most will have used them at least once. With decades of history behind it and a brand that could be considered among the strongest in the world, it seems obvious to see exceptional performance at an operational level. The fact is that having all the qualities of this company in mind, the price is certainly not attractive and regardless of how extraordinary a business is, nothing is worth an infinite price.

Business

WD-40’s business model is based on the development and marketing of products used by professionals but also by ordinary people to carry out, for example, maintenance work on vehicles or homes. For more than 40 years they have focused on selling the product that also gives the company its name, WD-40, which can be used for various purposes. In the last two decades they have begun to expand the product offering by attacking the homecare and cleaning products market, through investments in R&D but also acquisitions.

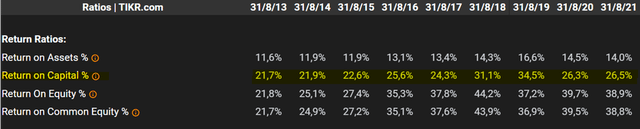

As a business model, you immediately notice a similarity to that of Coca-Cola. To understand the reason for the high profitability of the company, it is useful to underline the fact that WD-40 does not manufacture its products. The production of the products is in fact entrusted to third parties, with some of which have minimum purchase obligations (the quantity of the mandatory purchase is far below the volumes that the company has historically had). As far as production is concerned, WD-40 is directly involved only in producing the concentrate used in WD-40 products (also entrusted to third parties) in some of its factories. The result deriving from this organizational structure is a high return on capital and a relatively low investment in CapEx.

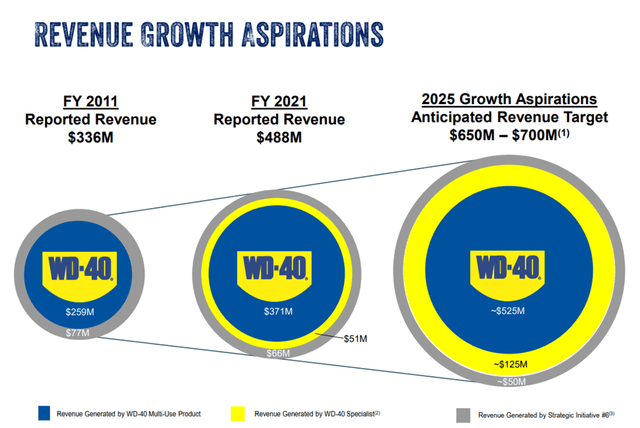

Taking a look at the revenue trend in recent years, we observe that in 2015 the company made approximately $378 million and in 2022 $519 million, a growth of 37% in 7 years, a CAGR of around 4.6% per year (we keep in consideration that only in 2021 turnover grew by 19.5%). Net income had a better performance growing from 2015 by 50% reaching $67.33 million in 2022, to conclude EPS went from $3.04 to $4.90 growing almost 61%, this thanks to the buyback policy of the shares carried out by the company which decreased the basic shares outstanding from 14.58 million to 13.67 million.

In the Annual Report, we can see that the company considers products in the homecare and cleaning segment as “harvest brands”. These products continue to generate positive returns and bring revenue to the company, but over time they are playing an increasingly less relevant role because sales of maintenance products have grown at higher rates. The management’s intention is to focus more on the development of these products. It is the market in which they are most dominant and if they believe they still have a good margin for growth it is smart to concentrate their forces on it.

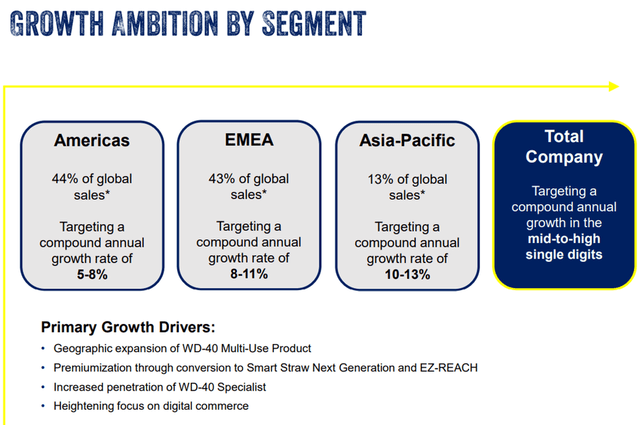

From the image you can understand the aspirations of the management, which in my opinion are very ambitious. They want to replicate the growth in percentage terms they had in 10 years (from 2011 to 2021) in just 4 years, FY22 revenue was $519 million, to reach the $700 million goal, they would therefore lack 34% to be achieved in 3 years. We can also deduce that they want to focus on “WD-40 Specialist” products and more than double their turnover. Based on the past performance of the business, these seem to me to be possible estimates, perhaps even probable ones, but on which I wouldn’t bet much. A very important role in achieving these goals will be played by the Asia-Pacific region, where they aim to grow at a CAGR of 10%-13%.

Valuation

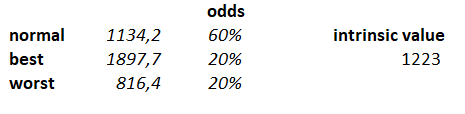

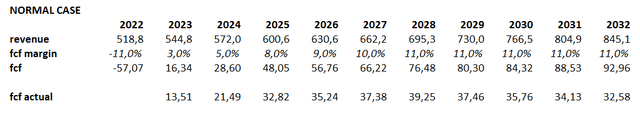

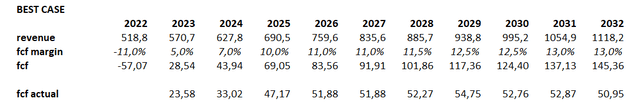

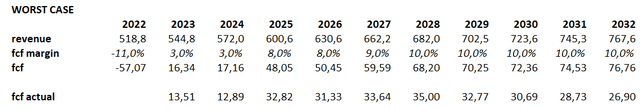

I believe that management’s projections are very optimistic, so I will only take them into account in the best case scenario, in the other two cases I will use growth rates that I believe are more probable and more easily achievable. To calculate the present values, I used a discount rate of 10%.

- Normal case: revenue CAGR 5% until 2032; terminal fcf margin: 11%; terminal fcf multiple: 25

- Best case: revenue CAGR 10% until 2027, 6% until 2032; terminal fcf margin: 13%; terminal fcf multiple: 28

- Worst case: revenue CAGR 5% until 2027, 3% until 2032; terminal fcf margin: 10%; terminal fcf multiple: 20

Giving the Normal case a 60% probability and the other two scenarios 20% we obtain an intrinsic value of $1.54 billion. At the time of writing the article the market cap. of WD-40 is $2.3 billion, very close to the intrinsic value in the best case scenario.

Author’s estimate

In the past 5 years the P/E has even been well above 30 in some periods and the P/FCF has reached even higher levels. The maximum I’ve used is a P/FCF of 28, higher values I believe are very risky to consider for an evaluation. A P/FCF of 28 represents a FCF Yield of around 3.5% and for a solid company with low growth rates I think it is very high, but in the case of WD-40 you obviously pay for the brand and the dominant position that has built over the years.

Risks

The greatest risk lies in the current valuation of the company. As you have seen in the assessment, the margin of error is very low and the growth expectations they have given are very ambitious compared to past performance. Should they reach their goal, the company would appear correctly valued at this moment, always considering fairly high multiples. In the unfortunate event that the 2025 target is not met we could incur a substantial loss, the multiples would most likely go down, and the valuation could be much closer to the average of the three cases, i.e. $1.22 billion a -47% from the current prices.

I consider other operational risks to be very improbable, or not very harmful to the assessment. The brand is strong, the products are popular and have pricing power and will continue to be so in the future. During the lockdown periods in China, they had some problems with suppliers and were unable to fully meet the demand in some markets. Although this is a risk to be taken into consideration, I believe that at the moment the probability of a new zero covid policy is low (but never say never with China).

Conclusion

The conclusions that can be drawn from the analysis of the data that I have shown you are, in my opinion, quite trivial. WD-40 is an extraordinary company, decades of history of market domination and extraordinary returns on capital. The products sold by WD-40 withstand periods of recession very well, do not require large investments in R&D to improve them (they are already excellent) and in the next 30 years (most likely even more) we will continue to use them as we have done in the past. The crux of this thesis is that the market is also aware of the uniqueness of WD-40. This means that the company is absolutely not at a discount and that the returns that can be obtained do not differ much from those that could be obtained by investing in an index.

If you use a discount rate around 6% (with the same estimates I used above) the present value of WD-40 is roughly equal to the current market capitalization. It must be said that the current multiples leave little margin for error to management in terms of growth, a future contraction could in fact erase years of positive performance at an operational level.

I personally wouldn’t invest in WD-40 at these prices. To take the risk of investing in a single company, I demand much higher returns and a margin of safety that in this case I consider completely absent. Is it a company to be shorted? Absolutely not, it’s an exceptional business, and I personally don’t think the risk/reward ratio is advantageous for those who go short. If I were a longtime shareholder, who maybe bought the shares years ago and now, looking at valuations, is in doubt whether to sell or not, I wouldn’t sell. It’s rare to find companies like this, and I think it makes sense to sell the shares of these companies only if a much better investment opportunity is found, and you don’t have the cash to take advantage of it or if the overvaluation is really high. Ultimately, WD-40 is a company that I will follow over the next few years and look forward to an opportunity to invest in.

Be the first to comment