FilippoBacci/E+ via Getty Images

By Alex Rosen

Summary

LeaderShares Activist Leaders ETF (NYSEARCA:ACTV) is an ETF that focuses on stocks that are subject to a 13D filing. This means that one shareholder holds 5% or more of the company, and is actively seeking to make changes to the company. Typically, a shareholder activist targets companies that have high costs, are mismanaged, or have an opportunity to become profitable if they are taken private.

Strategy

ACTV targets long-term capital growth. According to the prospectus, It “focuses on equity securities that are the target of shareholder activism,” using sophisticated methodologies and frequent trading. The Fund’s Adviser identifies Activist Leader® investors utilizing a proprietary methodology based upon qualitative elements, including research into the effectiveness of activist investors’ achievement of stated objectives and creation of positive shareholder returns in positions that were the subject of a 13D filing by them.

Because the Adviser’s identification of Activist Leaders® investors is based on ongoing research, the list of Activist Leaders® investors may change over time. The fund’s strategy looks to include US equity securities of companies whose market capitalizations are valued at a minimum of $1 billion at inception.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Broad Equity

-

Sub-Segment: Activist Investing

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

The fund has developed a proprietary algorithm that identifies Activist Investors based on 13D filings with the SEC. The list of Activist Leaders will change over time. Therefore, investors should expect a high volume of trading resulting in frequent portfolio turnover. The fund is not designed to be evenly balanced and does occasionally over balance in one sector or industry.

As of December 13, 2022, the top fund holdings (each near 4%) are LivePerson Inc (LPSN), an AI platform, Howard Hughes Corporation (HHC), a real estate development and management company, Seagate Technology Holdings (STX), a data storage company, and Newell Brands Inc (NWL), a manufacturer, marketer and distributor of consumer and commercial products.

Strengths

ACTV seeks to find companies that are being taken in a new direction by investors who have identified companies with high costs, are mismanaged, or with an opportunity of becoming profitable through privatization. Looking for market inefficiencies and exploiting them has been a successful business model since forever. Thankfully, the SEC has made it easier to identify potential shareholder activists through the 13D filing requirement.

Many companies are successes despite themselves. Mismanagement, incompetence, malfeasance, and nepotism, are just a few of the things seen every day in Fortune 500 companies. Even the banking community is not immune to the dangers of incompetence and fraud. Everybody remembers Lehman Brothers, and Enron.

The idea behind activist investing is to take those businesses that are successes in spite of themselves and turn them into money making machines, the belief being that the activist has the resources and know how to make the company better. When it works, it’s great for business.

Weaknesses

Just because someone is rich doesn’t make him a good business person. So often, investors believe they and they alone know how to fix a problem, and then go about doing it. The problem is, just because they were successful in one field, there is no guarantee that it will translate to other businesses or sectors. Follow your dharma, for the path of others is fraught with peril.

ACTV seeks to invest in people who have a track record of being successful in turning businesses around. However, every business is different. There may be very specific reasons companies operate the way they do, and those reasons may not be transparent to outsiders.

ACTV chooses its investments through a proprietary quantitative methodology. As a result it lacks transparency. All that is clear is the stocks must have at least one shareholder who has filled a 13D with the SEC.

Opportunities

When done right, activist investing can be very profitable. Take a failed or failing company with a good concept, make some institutional changes and voila, instant success, or at least a return to profitability. Some examples include Barry Rosenstein convincing Whole Foods to sell itself to Amazon (AMZN), or Daniel Loeb pushing Disney (DIS) to invest in the streaming service Disney+, or Carl Icahn and a myriad of investments.

The point being that sometimes an outsider can see something that those in the company don’t and can really take advantage of it.

On the other hand…

Threats

On the other hand, sometimes you get an investor who has been reading the reviews about himself, and is convinced he can turn anything into gold just by sprinkling his own special brand of pixie dust on a company. He may have had success in some farfetched businesses, but that doesn’t make him suddenly an all-knowing business guru.

Warren Buffett put it best, “Only buy stocks that you understand.”

ACTV is only as good as the methodology upon which the fund is built. If the fund selects activist investors who are in over their heads, or stretched too thin, they can really tank the fund, especially when you consider the fund does not have weight restrictions on holdings.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

It is my long held belief that ETFs that make decisions based on methodologies and algorithms should always be subject to far greater scrutiny then ETFs with a simple straightforward strategy. After all, even the best methodologies are subject to human error.

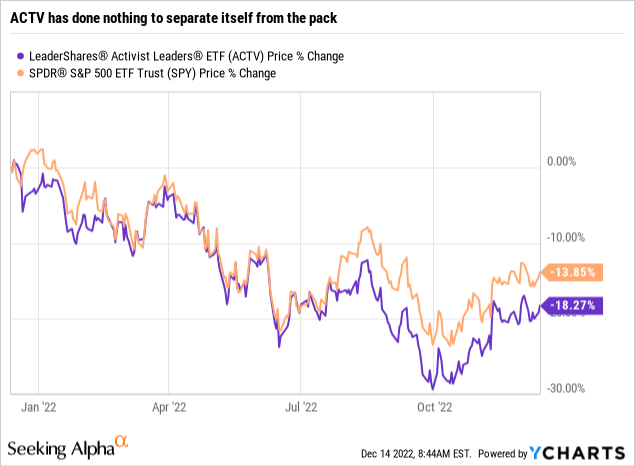

ACTV falls squarely into the methodology category of ETFs and thus has to work really hard to show that it knows what it’s doing. So far, the track record of ACTV would argue otherwise. YTD, the fund is down 16.51%, which is right in line with the broader S&P, but the whole point of the fund is to pick the smartest and brightest investors and bet on them.

ETF Investment Opinion

I like to invest in things I understand. I get the theory behind ACTV, but I would have to do a deep dive into the methodology, and since it is proprietary, that is not an option. As a result, I cannot recommend the fund in good conscience. We rate ACTV a Sell.

Be the first to comment