Justin Sullivan

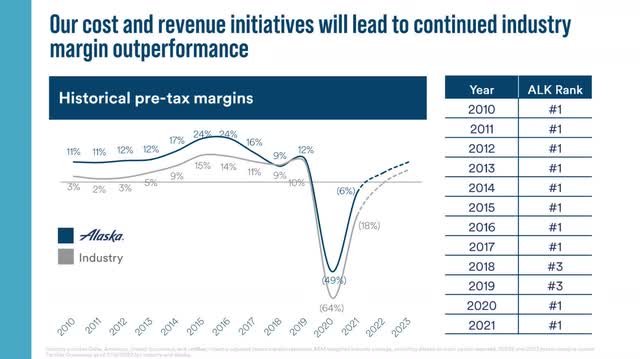

During 2022, Alaska Air (NYSE:ALK) has endured significant cost and operational headwinds. Nevertheless, the fifth-largest U.S. airline has had an extremely successful year. Alaska is on track to post a full-year pre-tax margin between 7% and 9% (see p. 4). That will put it at or near the top of the U.S. airline industry in terms of profitability.

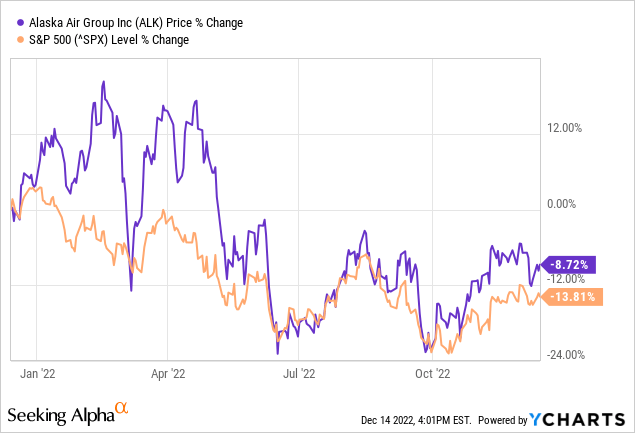

Despite its outperformance in 2022, Alaska Air stock has fallen approximately 9% over the past year, barely beating the S&P 500. However, many of the headwinds the company has faced are starting to abate. That puts Alaska Air stock in great position to crush the market in 2023.

Year in review: excellent demand offsets cost pressures

Entering 2022, Alaska Airlines planned to return to pre-pandemic capacity levels by the summer. For the full year, it expected capacity to increase 2% to 6% compared to 2019, with non-fuel unit costs up 3%-6% over the same period (and just 1%-3% excluding lease return costs).

Unfortunately, a pilot shortage caused mainly by attrition and training delays forced Alaska to repeatedly reduce its capacity plans as the year progressed. The company is on pace to end the year with capacity down 8%-9% relative to 2019.

That sharp and unexpected capacity reduction has severely pressured unit costs. (Alaska executives have noted that last-minute cuts can increase non-fuel unit costs by nearly 1% for every 1% reduction in capacity.) Strong payouts for Alaska’s variable incentive pay program and higher pay under three recently-ratified labor deals are also driving unit costs up. As a result, Alaska Air now expects full-year non-fuel unit costs to climb 19%-20% over 2019 levels.

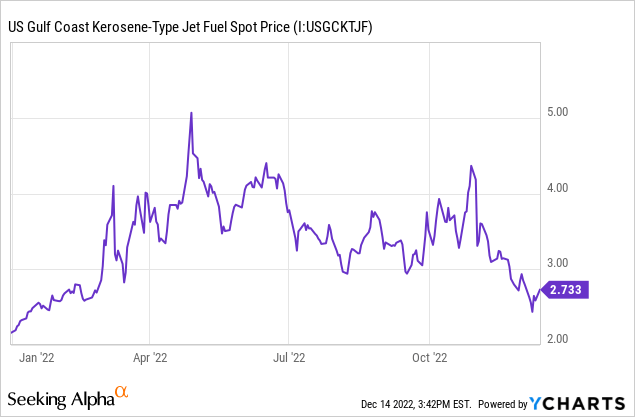

Making matters worse, jet fuel costs soared this year. Gulf Coast jet fuel averaged $2.45/gallon in January but averaged nearly $4/gallon in Q2 before moderating to $3.36/gallon in Q3. For comparison, Gulf Coast jet fuel averaged $1.88/gallon in 2019 and $1.86/gallon in 2021.

In this context, it’s remarkable that Alaska Air posted an adjusted pre-tax margin of 8% for the first nine months of 2022. Red-hot demand combined with industry-wide capacity constraints has enabled the carrier to increase fares to record levels. Loyalty revenue is also surging, thanks in part to the renewal of Alaska’s credit card agreement with Bank of America (BAC).

All told, Alaska’s unit revenue increased 20% compared to 2019 in the first nine months of the year. Furthermore, the company’s Q4 guidance implies a unit revenue gain of approximately 24%.

Efficiency improvements on the way

In the near term, Alaska’s capacity will remain constrained due to the looming retirement of its remaining Airbus (OTCPK:EADSY) A320s next month. That will temporarily reduce its mainline fleet by 7%-8% compared to the 232 jets it operated as of Sept. 30. However, Alaska Air is scheduled to take delivery of 40 new Boeing (BA) 737 MAX jets during 2023, boosting its mainline fleet count to 244 by year-end: modestly above pre-pandemic levels.

As a result, Alaska expects capacity to return to 2019 levels next spring and continue growing in the back half of the year. Assuming it hits those targets, it expects non-fuel unit costs to decline 1% to 3% year over year in 2023, even though the company will be absorbing the full-year impact of its new labor contracts.

Upgauging to larger aircraft will help Alaska reduce unit costs while boosting capacity beyond pre-pandemic levels. The 178-seat Boeing 737-9 accounts for nearly all of Alaska’s scheduled mainline jet deliveries in 2022 and 2023. By contrast, the retiring A320s have 150 seats. The incremental costs associated with the 737-9’s 28 extra seats are fairly minimal.

Alaska Airlines will retire the last of its A320s in January. (Image source: Alaska Airlines.)

Returning to a more stable operating environment will also help Alaska Air manage unit costs. Higher pilot pay rates should stem attrition, and training throughput has improved significantly compared to the first half of this year. This gives Alaska a good shot at achieving its planned 8%-10% capacity growth next year, in contrast to 2022.

Fuel prices are retreating

Equally importantly, airlines are finally starting to get some relief from sky-high fuel costs. As noted above, benchmark Gulf Coast jet fuel averaged nearly $4/gallon in Q2 2022 and $3.36/gallon in Q3. However, oil prices and crack spreads have moderated in recent weeks, bringing the price of Gulf Coast jet fuel down to $2.73/gallon as of Dec. 12.

Obviously, there’s no guarantee that the recent declines will stick. But Alaska currently expects to pay between $3.10 and $3.30 per gallon on average in 2023 (including hedging costs). For comparison, its average economic fuel cost per gallon for 2022 will likely end up around $3.40.

Alaska currently uses approximately 80 gallons of jet fuel for every $1,000 of revenue it generates. This implies that for every 12.5 cent reduction in fuel prices, its pre-tax margin would increase by 1 percentage point (all else equal). Combined with fuel efficiency gains from fleet upgrades and lower non-fuel expenses, unit costs are on track to shift from a severe headwind in 2022 to a meaningful tailwind in 2023.

Demand remains very strong

The improving cost outlook bodes well for stronger profitability next year, as long as unit revenue holds up.

Fortunately, while economic growth is slowing and inflation is crimping consumers’ budgets, the current air travel boom shows no signs of slowing. Airlines continue to benefit from pent-up demand as people make up for missed travel during 2020 and 2021. Meanwhile, Alaska has implemented a slew of initiatives to further boost its revenue, including joining the oneworld airline alliance, increased premium seating, and efforts to grow its loyalty program.

Alaska Airlines also benefits from operating primarily in gate-constrained markets. This supports pricing by limiting competitors’ ability to rapidly increase capacity. That’s particularly important in Seattle, the airline’s primary hub.

Thus, Alaska has a good chance to match or exceed the record high unit revenue it has reported in recent quarters in 2023, despite ramping up capacity growth again. Revenue could grow by around $1 billion next year over the $9.7 billion expected for 2022.

The balance sheet is a big advantage

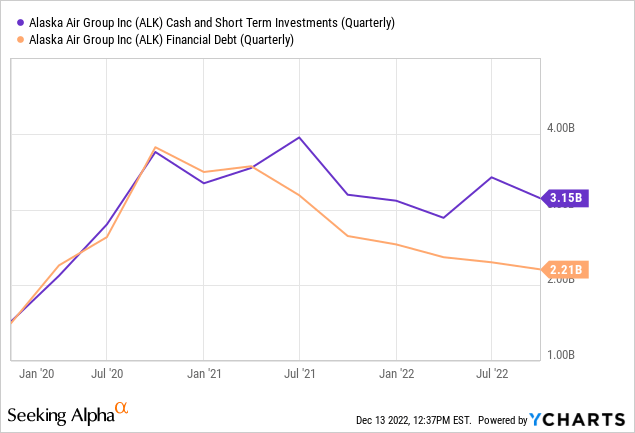

Alaska Air’s pristine balance sheet represents a key advantage over most of its rivals. The company ended the third quarter with over $3.1 billion of cash and investments, compared to just $2.2 billion of debt and $1.7 billion of lease liabilities.

Shareholders benefit in numerous ways from this financial strength. First, rising interest rates will directly boost the bottom line. Interest income on Alaska’s cash and investments is increasing significantly as rates move higher. By contrast, as of Sept. 30, Alaska had just $562 million of variable-rate debt, and $353 million of that was effectively fixed via swaps.

Second, Alaska’s excess cash will allow the company to pay cash for its aircraft deliveries next year, even though free cash flow will almost certainly be negative due to CapEx rising as high as $2 billion. That will allow the airline to aggressively modernize its fleet without issuing new debt when interest rates are high.

Third, with leverage already within its long-term target range, Alaska Air plans to resume share buybacks at a moderate pace in 2023. Shareholder returns will ramp up as CapEx moderates in the following years.

A bargain valuation

The analyst consensus calls for adjusted EPS of $4.99 in 2023. On that basis, Alaska Air stock currently trades for nine times forward earnings. That’s quite cheap considering the strength of Alaska’s balance sheet.

Moreover, these estimates appear stale, having held roughly steady since late October. Jet fuel prices have declined by more than $1/gallon since then. If those declines stick, Alaska Air should improve its profit margin significantly next year.

Indeed, earlier this week, Alaska projected that its adjusted pre-tax margin will improve to between 9% and 12% next year. Assuming revenue growth roughly keeps pace with the carrier’s projected 8%-10% capacity increase, the company would likely generate EPS between $5.50 and $7.50. Alaska Air stock trades for just 7 times the midpoint of that range.

Hitting the high end of that margin target range wouldn’t be as hard as it might seem. Just a year ago, the analyst consensus called for Alaska’s pre-tax margin to reach 13% in 2023.

Furthermore, in the decade before the pandemic, Alaska achieved an adjusted pre-tax margin of at least 11% (see slide 64) in every year but one. Its pre-tax margin peaked at 24% in 2015 and 2016, when fuel prices were especially low. But even in 2014, when Alaska reported an economic fuel cost per gallon of $3.08, adjusted pre-tax margin reached 17%.

Source: Alaska Air 2022 Investor Day Presentation, slide 64.

Margin expansion will likely continue in 2024, all else equal (i.e., assuming a relatively stable macroeconomic backdrop). Alaska will complete its transition back to a single mainline fleet at the end of 2023, unlocking incremental cost savings. It will also cycle past the elevated fleet transition costs it is incurring today. Declining unit costs could enable Alaska Air to boost its adjusted pre-tax margin to 13% or more by 2024.

Assessing the risks

Alaska faces a handful of key risks as it looks to continue expanding revenue and earnings in 2023 and beyond.

First, weakening economic conditions could cause air travel demand to soften, leading to a reversion in average fares. So far, leisure travel demand in particular has remained robust. Consumers have prioritized traveling (in contrast to 2020 and 2021) even as inflation has started to crimp discretionary budgets, supporting record-high airfares. But it’s possible that at some point in 2023, pent-up demand will no longer fully compensate for the weak macro environment.

Second, jet fuel prices (and oil prices) are highly volatile. The current forward curve implies that airlines are due for relief in 2023, but that could change quickly. In the long term, airlines tend to be able to pass fuel costs through to consumers, but rising fuel prices typically have a short-term negative impact on margins.

Third, staffing challenges could persist longer than management expects. Alaska Airlines claims that the hires it has made in 2022 have largely de-risked its 2023 plans. That said, the pace of pilot training needs to accelerate even further to enable Alaska’s planned capacity growth in the second half of next year.

Fourth, aerospace supply chains remain snarled. As a result, Boeing has been struggling to deliver aircraft on time. Alaska Air has built a buffer into its 2023 fleet plan beyond the delays that Boeing currently projects, but if delivery delays worsen, the carrier would have to cut capacity again. That would reduce revenue and also lead to the airline carrying excess costs that could weigh on profitability.

Massive upside in 2023

Despite an unusual 2022, with soaring costs offset by extremely strong revenue growth, Alaska Air remains on track to grow EPS to between $8 and $10 by 2024, as I projected a year ago.

Even if market sentiment towards airlines remains fairly downbeat and shares continue to trade for nine times forward earnings, Alaska Air stock could nearly double to $81 over the next year (assuming 2024 EPS of $9). If investors become more sanguine about Alaska’s ability to maintain low/mid-teens margins going forward, multiple expansion could push the stock into triple-digit territory by the end of 2023. That makes Alaska Air stock a uniquely compelling opportunity today.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment