Gearstd/iStock via Getty Images

Introduction

Following the tragic Russia-Ukraine war in 2022, the operating conditions for the coal industry have never been as strong with these once-hated companies enjoying massive cash windfalls. Despite their bumpy start to the year, this marks a day and night difference from two years ago during 2020 for Peabody Energy (NYSE:BTU) who at the time was fighting for their survival to avoid bankruptcy as they struggled with debt. When looking ahead into 2023, it sees the resulting shackles coming off that have bound their hands from reinstating their shareholder returns. Although, similar to the release of a prisoner, it raises the question of whether they will reoffend once again getting free rein over their capital allocations strategy back from their lenders.

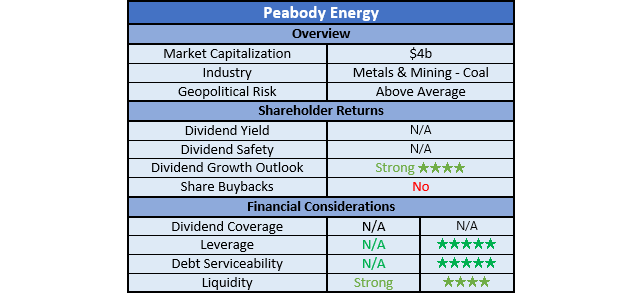

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Author

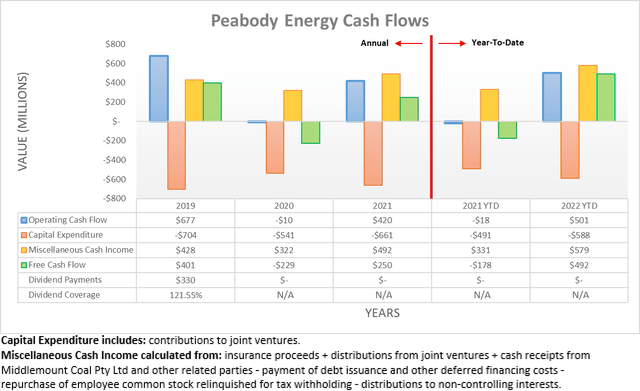

The pain of the last downturn during 2020 is easily visible within their cash flow performance, as their operating cash flow sank to negative $10m, thereby meaning they burnt cash simply running their company, let alone before making any investments. Thankfully, they enjoyed a decent recovery during 2021 that saw their operating cash flow climb back to $420m but alas, even this remained below their previous result of $677m during 2019. Fast forward to the present day and thus far into 2022, they have finally seen their fortunes change on the back of the global energy shortage following the Russia-Ukraine war sending coal prices to never-before-seen levels.

Author

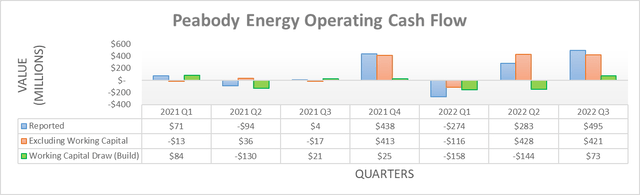

Even though they are now enjoying a massive cash windfall, this was not the case earlier in 2022 during the first quarter when their operating cash flow was negative $274m or negative $116m even if excluding their working capital build. At the time, this very disappointingly saw shareholders missing out on the start of these booming operation conditions due to a variety of issues, both operational and more so, very poorly timed hedges via derivatives.

Whilst disappointing, this is now old news and thankfully, sits in the rearview mirror with the second and third quarters of 2022 both seeing a massive cash windfall. Especially the third quarter with a result of $495m already surpassing the entirety of their result of $420m during full-year 2021, despite being literally one-quarter the length of time. If excluding working capital movements, both the second and third quarters of 2022 saw their underlying results at north of $400m.

When all is said and done, their financial performance will continue fluctuating in tandem with coal prices, which they obviously have no control over. The bigger topic right now is not necessarily their results but rather, the release of the shackles that were placed upon their capital allocation strategy by the hands of their lenders as they found themselves unprepared for the last downturn. The main takeaways to remember for the remainder of the analysis are the severity of downturns they face as well as the inherent volatility of their industry.

Author

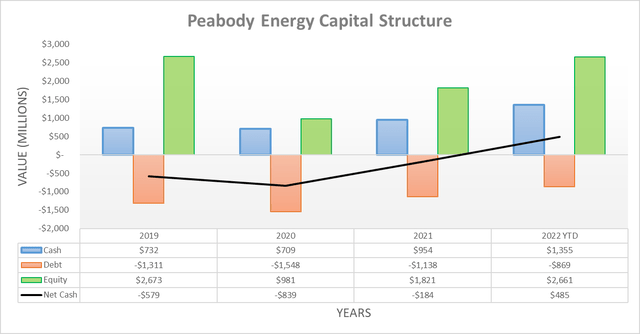

It is amazing to see their transformation since the dark days in late 2020 when they had a near miss with bankruptcy. By the time the year ended, they were levied with $839m of net debt but thanks to the surprisingly strong recovery in coal prices, they now sport a net cash position of $485m. This makes it pointless to assess their leverage or their debt serviceability in detail, as they obviously have zero leverage, nor any issues with interest expenses. Naturally, this would also leave many eagerly awaiting for their shareholder returns to be reinstated, especially after the multi-year wait. Alas, they have not been able to take this path given the various onerous terms within their remaining debt, as per the commentary from management included below.

“As you know, shareholder returns are restricted with our secured debt as well as our surety agreement.“

-Peabody Energy Q3 2022 Conference Call.

Whilst they already sport a net cash position, they still have a further $869m of debt to be repaid that unfortunately, carries various onerous terms that among other things, restrict their ability to reinstate their shareholder returns – and if interested in further details, look here. Thankfully, this is poised to change as they are negotiating with their lenders to shed these shackles on their capital allocation strategy, as per the commentary from management included below.

“We’ve discovered a lot of common ground. We’re certainly aligned on the company’s continued deleveraging efforts, and we are seeking a final reclamation surety agreement to cash collateralize that future reclamation to a reasonable level relative to the actual liability and then remove those restrictions from shareholder returns as well.”

-Peabody Energy Q3 2022 Conference Call (previously linked).

If nothing else, at least going without shareholder returns was not ultimately in vain with their shareholder returns appearing likely to be reinstated during 2023, depending upon the outcome of their negotiations. Whilst not a perfect certainty, the language of management seemingly removes most of the uncertainty regarding whether this will be achieved. Rather in my eyes, the uncertainty and thus big question is now regarding how they will behave when they are once again allowed free rein over their capital allocation strategy. Ultimately, only time will tell but as it stands right now, it seems that all three paths are on the table, as per the commentary from management included below.

“So while we have a great organic portfolio opportunities, we’re also looking to do that side-by-side with shareholder returns and elimination of this debt.”

“…removing those shackles for us, we then can look at different things that aren’t mutually exclusive, whether it’s shareholder returns, organic growth or M&A.”

-Peabody Energy Q3 2022 Conference Call (previously linked).

There is nothing necessarily wrong with management wishing to pursue shareholder returns, organic growth projects and acquisitions, although I am quite concerned about these not being mutually exclusive. This means they are open to pursuing all three of these paths concurrently, which I feel significantly increases the risks of a repeat of the last few years down the track if another downturn were to strike.

The coal industry is capital intensive, which is unavoidable and thus pursuing organic growth projects alongside shareholder returns could easily see debt piled onto their balance sheet, especially if accompanied by acquisitions that anecdotally speaking, are seemingly debt-laden more often than not. Whilst not necessarily problematic in the short-term, it increases the risk they once again find themselves in trouble whenever another downturn strikes, which is almost certain given the booms and busts inherent within their volatile industry.

Even ignoring this risk, there is still uncertainty regarding their shareholder returns, mostly whether they favor share buybacks or dividends. As anyone familiar with my articles will already know, I greatly prefer the latter, especially in the case of companies that are inherently volatile and see medium to long-term threats as the world moves away from thermal coal. Similarly, only time will tell but thankfully in this case, it is only a secondary concern of less importance than their potential to pile on debt once again.

Author

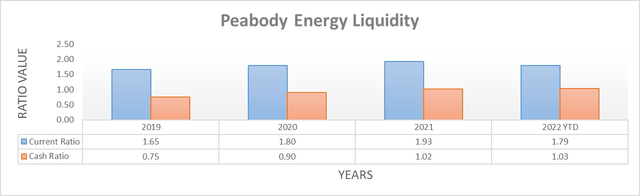

Quite unsurprisingly given their net cash position, their liquidity is strong with a current ratio of 1.79 along with a cash ratio of 1.03. Since they obviously have plenty of cash to clean up their last debt maturities, it removes any risk of bankruptcy in the foreseeable future even if their negotiations with lenders are ultimately unfruitful in removing their onerous terms during 2023.

Although when looking further afield, debt maturities could once again become an issue once their shackles are removed if they spend aggressively on shareholder returns, organic growth projects and acquisitions. Importantly, in the medium to long-term their access to debt markets will continue being negatively impacted by ESG investing that often sees financial institutions limiting their exposure to thermal coal, regardless of the business merit. As a result, if they repeat their previous mistake and find themselves debt-laden amidst another downturn, they will have few financing options and thus once again, could be forced to take onerous and restrictive terms in order to survive.

Conclusion

If not for the booming coal prices of 2022, shareholders would have been waiting much longer for their shackles to be removed but thankfully, this is seemingly coming in 2023. Whilst undoubtedly positive, similar to the release of a prisoner, this nevertheless raises concerns of whether they will reoffend once again as they are allowed free rein over their capital allocation strategy.

It is still too early to tell, although given their commentary about running shareholder returns, organic growth and acquisitions in tandem, I am concerned they may overcommit and thus once again, find themselves on the wrong side of debt markets when another downturn strikes in the future. They are currently enjoying a cash windfall from booming operating conditions but obviously, this can change very quickly, especially as their thermal coal is a fuel of last resort in this age of clean energy and thus I believe that a hold rating is appropriate until more information comes to light.

Notes: Unless specified otherwise, all figures in this article were taken from Peabody Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment