fotograv

Results and guidance wildly below expectations

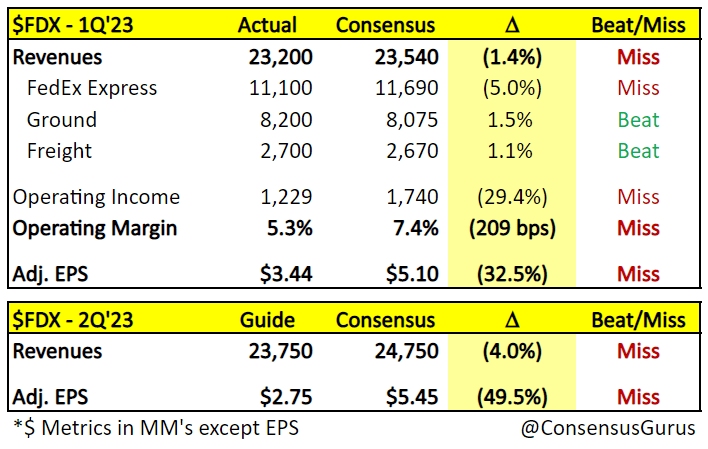

Shares of FedEx (NYSE:FDX) are down more than 20% as the company reported 1QFY23 results that came in wildly below consensus estimates on the bottom line. Revenue of $23.2 billion missed consensus slightly by 1.4% as Express revenue (>50% of total sales with higher fixed cost base) was a 5% miss while Ground and Freight seemed to hold up relatively okay. However, operating margin of 5.3% was more than 2 points below Street estimates and more importantly, adj. EPS of $3.44 was a nerve-wracking 33% miss. Higher fixed costs and volume deceleration both in the US and International markets are to blame, as macro weakness becomes increasingly evident. In addition, management noted slower than expected business from its top two customers Walmart (WMT) and Target (TGT).

For the current quarter, management guided revenue of $23.8 billion and adj. EPS of $2.75, which is almost 50% below consensus. Moreover, FedEx pulled FY23 EPS target (previously $22.5-$24.5) and cut its FY23 Capex target from $6.8 billion to $6.3 billion. As always, analysts are quick to cut their estimates and price targets. For FY23, the Street now expects EPS of $15.5, down 25% vs. previous consensus.

Consensus Guru

FY23 earnings outlook doesn’t look good

Using management’s EPS guidance for the current quarter, earnings are expected to decline by roughly 33% YoY in the first half of FY23. If history was a guide, FedEx showed similar negative earnings trends in past recessions where EPS contracted 19% during the dot-com bubble and over 50% during the Global Financial Crisis. Recently, UPS (UPS) management also highlighted weaker international demand though US may be in a better shape. In the backdrop of a slowing global economic activity and lower e-commerce growth post-pandemic, the days of adding fuel surcharges to address overwhelming demand are likely over.

Going forward, FedEx has laid out a number of cost-cutting initiatives including the following:

- Reduce flights and parking aircraft.

- Cut labor hours and expenses inline with volumes.

- Reduce Sunday operations at certain ground locations.

- Abandon planned network capacity and other projects.

- Close 90 FedEx office locations and slow the pace of hiring.

Given the scale FedEx’s operations, the key macro implication here is that global package demand is slowing and investors don’t have much to look forward to until the current down cycle exhibits some form of stabilization. The shipping business is a game of operating leverage where any decline in volume can easily have a major impact on the bottom line as there’s less revenue and gross profit to be spread across the high fixed costs associated with planes, trucks and delivery stations.

Thoughts on the stock

I do not believe this is the time to be greedy when others are fearful. As FedEx management points to a worsening macroeconomic environment, it’s difficult to spot any meaningful catalyst at least in the near term despite the possibility that a recessionary scenario may have been priced into the stock. More importantly, the current valuation of just below 10x (vs. the long run average of 13x) is unlikely to be a source of optimism given cheaper can always get cheaper in the bear market that we’re in today. Per legendary investor Peter Lynch: wait for things to get better.

Be the first to comment