Maria Vonotna

Broadstone Net Lease, Inc. (NYSE:BNL) is a real estate investment trust (“REIT”) with interests in a large portfolio of primarily single-tenant commercial properties that are net leased on a long-term basis to a highly diversified group of tenants.

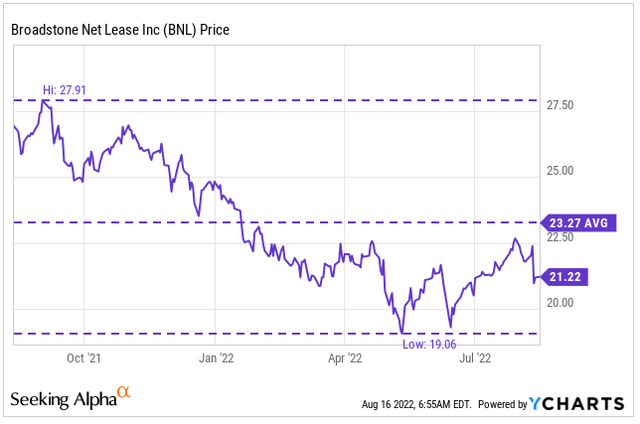

YTD, shares are down about 13%. This is significantly worse than both the broader S&P 500, which is down 10%, and the diversified REIT sector, which is down 2.5%. Recently, however, the stock appears to have settled into a holding pattern in a rangebound position at the lower end of their annual range.

YCharts – BNL’s Recent Share Price History

An investment in BNL at current pricing would provide investors a quarterly dividend that is currently yielding just over 5% and solid diversification at a reasonable valuation.

A fully occupied portfolio with long-range lease terms, however, limits the share-price upside potential. In addition, recent equity raises are likely to weigh on earnings growth in the near-medium term. This will likely neutralize shares in a tight trading band. This would be great for those seeking to minimize their exposure to market volatility but disappointing for those more interested in overall shareholder returns.

The Highly Diversified Portfolio Provides Critical Downside Protection

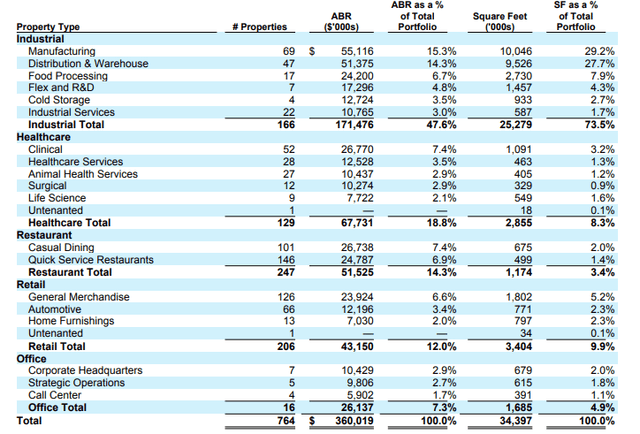

BNL’s portfolio of properties is highly diversified across five distinct property types; Industrial; Healthcare; Restaurant, Retail; and Office. At a collective total of 66% of total ABR, Industrial and Healthcare-related properties account for the largest share of annualized base rents (“ABR”). This balance provides both growth opportunities, with their industrial properties, and downside protection, with their healthcare facilities.

Q2FY22 Investor Supplement – Summary of BNL’s Portfolio by Property Type

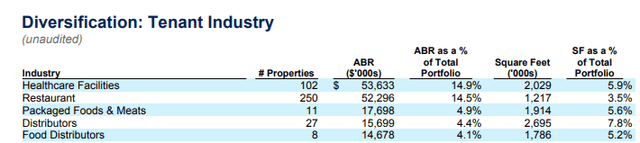

Though the portfolio is weighted more heavily towards industrial buildings, BNL’s industry exposure is heavier on Healthcare and Restaurants, with the two being the only industries to account for over 10% of ABR.

While the Restaurant sector was among the hardest hit during the COVID-19 pandemic, BNL’s tenant base was largely unscathed in terms of their ability to meet their reoccurring rental obligations. With the worst behind them, the industry appears to be enjoying a healthy rebound as consumers continue to shift their spending habits from goods to services.

Q2FY22 Investor Supplement – Partial Summary of BNL’s Portfolio by Industry

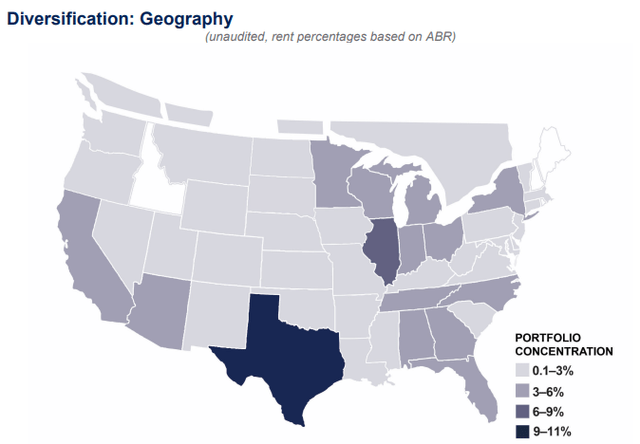

BNL’s portfolio is also geographically dispersed throughout the United States, though they do have a stronger presence around the Sunbelt region of the country, with outsized exposure to the State of Texas. They have also recently expanded into Canada, but the region accounts for just a fraction of ABR at present.

Q2FY22 Investor Supplement – Geographic Concentration of BNL’s Portfolio

Capping off their diversified portfolio is their tenant base, which includes over 200 tenants and brands spread out across 57 industries. At 2% of total ABR, Jack’s Family Restaurants LP, is their largest tenant and the only one to represent 2% or more of ABR.

This high degree of diversification is important, as much of their tenants are middle-market companies lacking investment grade credit ratings. Through Q2FY22, for example, only 16.4% of their tenants were considered investment grade. This would be a concern if BNL’s portfolio lacked multi-tiered diversification.

Near-Perfect Portfolio Metrics Are An Advantage And A Disadvantage

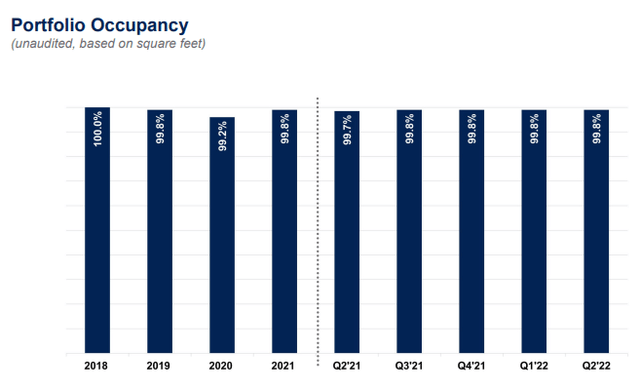

Through Q2FY22, BNL’s portfolio remains at peak occupancy at 99.8%. Even during the height of the COVID-19 pandemic, occupancy never dipped below 99%. More importantly, rent collections have remained at or near 100%. This is a testament to the resiliency of their tenant base, particularly their restaurants.

Q2FY22 Investor Supplement – Summary of Portfolio Occupancy

While full occupancy is certainly a benefit, it does limit upside opportunities to either rental growth or external acquisitions. Regarding rental growth, BNL’s extended lease terms constrain their ability to seize upon mark-to-market opportunities.

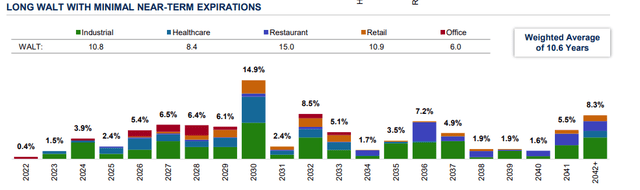

With a weighted average lease term (“WALT”) of 10.6 years, BNL’s rental growth is limited to embedded escalation provisions, which are at most 2.4% for their office properties and 1.8% for restaurants. With renewal spreads significantly higher elsewhere in the industry, the long WALT’s are a disadvantage for BNL, even though they are advertised as a strength due to the defensive edge of locking in predicable and stable cash flows over extended timeframes. In periods where rental rates are steadily growing, however, a shorter duration lease would be more desirable.

Q2FY22 Investor Supplement – Summary of Lease Expirations

External Growth Through Acquisitions Remains Promising

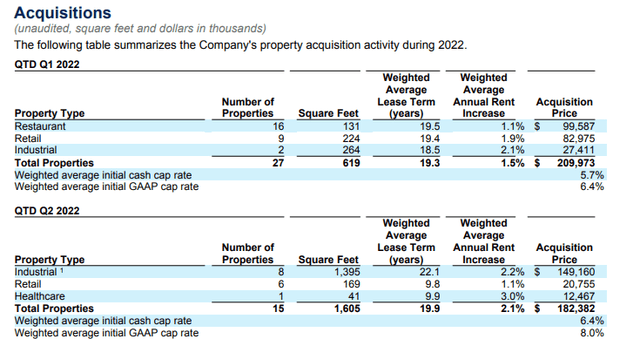

With rental growth limited due to full occupancy and extended WALTs, acquisitions remain critical for future earnings growth. In the current period, BNL acquired 15 properties at a weighted average initial cap rate of 6.4%. This was up 70 basis points (“bps”) from Q1, primarily due to the pivot made to industrial properties during the quarter. In Q1, for example, BNL acquired 16 restaurant properties. But in the current quarter, they acquired 8 industrial properties and no restaurants.

Q2FY22 Investor Supplement – Quarterly Acquisition Summary

Management did note on their call the continued widening of the bid-ask spread in the acquisition environment. This resulted in many participants stepping back due to the uncertainties associated with valuations. In addition, with many smaller buyers locked out of the market due to tightening credit conditions, BNL was well poised to fill the void, anchored by their investment grade balance sheet and consistent ability to close on their deals.

YTD, BNL has engaged in +$544M in acquisitions, which is about 75% of the midpoint of their current acquisition guidance. Given where they stand, management still expects to complete a total of +$700M to +$800M in acquisitions in 2022. This will be accretive to revenues in subsequent periods, but it will be a drag on earnings, at least in the near term due to the manner in which these acquisitions are funded.

The Accelerated Use Of The ATM Program Will Create A Drag On Earnings

A preference of management is the utilization of their at-the-market (“ATM”) common equity offering program. This enables BNL to raise equity to finance their acquisition objectives. With interest rates on the rise, this alternative evidently is preferable to primarily debt financed acquisitions. It does come with a cost, however, of lower adjusted funds from operations (“AFFO”).

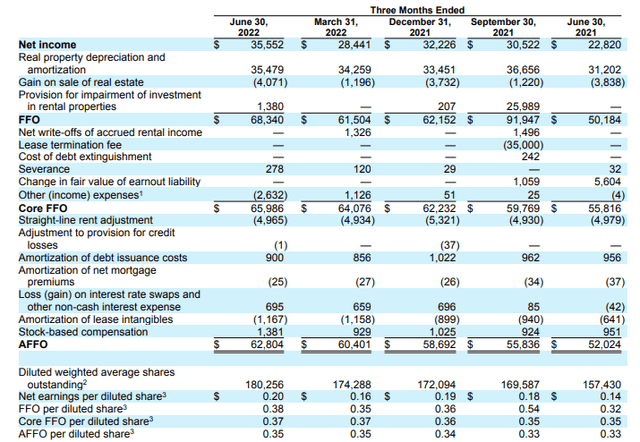

In Q2, for example, AFFO was up 6.1% from the same period last year but flat on a sequential basis. This was largely the result of an accelerated equity raise that resulted in a 3.5% increase in the number of outstanding shares during the current period. And subsequent to quarter-end, BNL engaged in yet another offering.

Q2FY22 Investor Supplement – Comparative Summary of Operating Results

Given the expected impact of these capital raises, full year AFFO guidance was trimmed to $1.38 to $1.40/share, which is $0.02/share lower at the top-end from what was previously affirmed in the prior quarter.

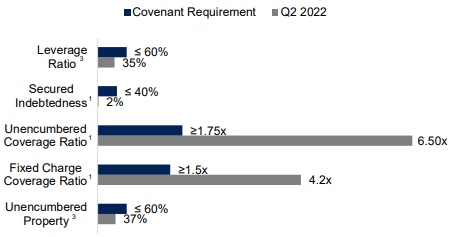

BNL could have alternatively accessed the debt markets without significantly compromising their current financial position. At period end, liquidity stood just shy of +$700M. This is down from previous quarters, but it’s still more than enough to cover their current obligations. They also are well in compliance with all existing covenant requirements, providing them with additional flexibility.

Q2FY22 Investor Supplement – Debt Covenant Compliance Summary

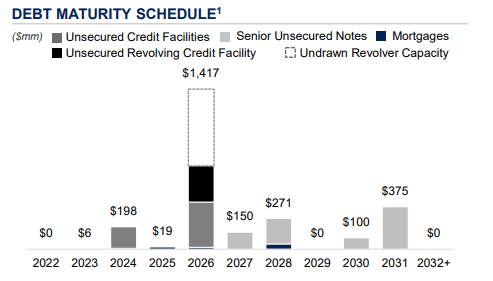

After extending out their debt stack subsequent to period end by executing on two new loans, BNL was left with no significant maturities until 2026. While net debt as a multiple of adjusted EBITDAre has tracked higher to 5.3x, it’s still below management’s top line target of 6x.

Q2FY22 Investor Supplement – Debt Maturity Schedule

At current earnings levels, BNL could have supported a modestly higher level of debt holdings, while remaining within targeted leverage levels. The accelerated use of equity, instead, suggests a near-term top in the stock price.

Growing uncertainty in the acquisition environment, as reflected in current bid-ask spreads, and peak occupancy levels would support the notion that shares have peaked. In this case, it would make sense to accelerate the issuance of stock to capitalize on favorable pricing.

Moving forward, the additional shares will moderate earnings growth and impose a greater burden on their current dividend payouts. While the current quarterly payment of $0.27/share is adequately covered by AFFO, future growth is likely to be inhibited. This may change as they begin to realize the contributions from their acquisitions in later periods, but these benefits are typically on a quarter lag. As such, investors should expect a more tempered outlook in the near-medium term.

Shares Appear To Have Hit A Near-Term Peak

BNL is a quality net lease REIT that is trading at a reasonable valuation of 14.5x forward FFO. Shares are down over 20% over the past year but have settled into a narrower trading range in recent periods. For existing shareholders, some solace can be found in their 5% yielding dividend payout. A full recovery of YTD losses, however, appears unlikely, at least in the near-medium term.

At period end, occupancy was essentially maxed out and collections were 100%. This limits upside that may have been available on weaker portfolio metrics. Extended lease terms with limited near-term expirations further constrains rental growth to annual escalators, which is lower than current mark-to-market opportunities.

Though acquisitions continue to fuel revenue growth, earnings growth has moderated as a result of the increased use of the ATM program. This created a drag on sequential AFFO growth in the current period and is likely to remain a drag moving forward, as already reflected in the trimmed full-year earnings guidance. The accelerated use of the program suggests a near-term peak in the share price.

A highly diversified portfolio with outstanding operating metrics provides an element of predictability and stability to BNL’s cash flows. This will continue to support the quarterly dividend payouts and their current valuation metrics. Upside, however, remains limited in the near-medium term due to the lack of compelling catalysts. As such, a hold on investment would be well warranted.

Be the first to comment