Feverpitched

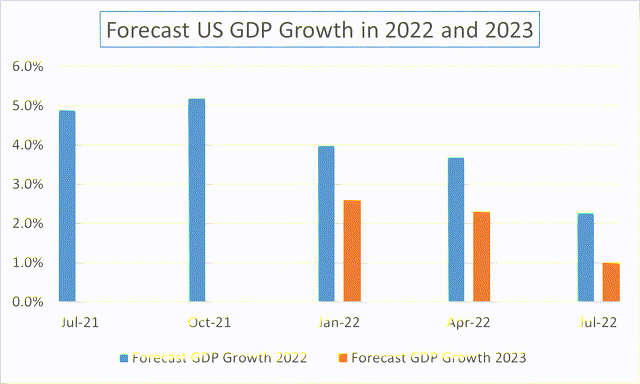

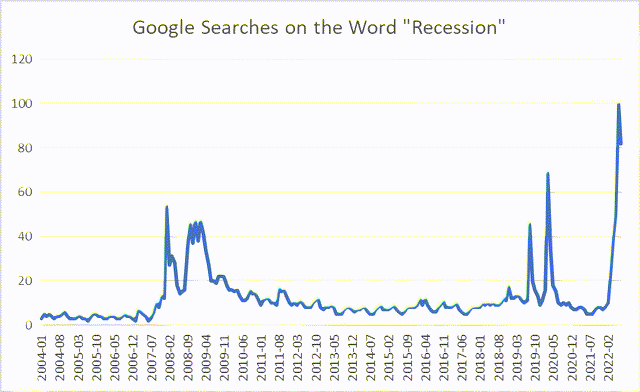

Many American investors are haunted by the ghost of recession. Monthly Google searches of the term “recession” reached all-time highs in June and July. Where’s there’s smoke, there IS fire. Mortgage applications for new purchases are the lowest since the first lockdown in 2020. Consumer and small-business confidence has collapsed. The US economy has contracted in each of the last two quarters and forecasts of GDP growth have been revised down considerably.

However, observations of economic and sentimental variables do not translate readily into profitable trading rules. If it were that easy, everyone would do it. There is a big difference between fear of recession and an actual recession.

Dimensional Fund Advisors reviewed stock market performance during recessions over the last 100 years. Even with the benefit of hindsight, investment lessons remain unclear. While subpar, stock market performance is mixed during periods when economic activity is contracting. The S&P 500 actually appreciated during 8 of the last 16 recessions.

Actual recessions in the US are formally ratified by the National Bureau of Economic Research (NBER). NBER relies on an array of indicators including GDP growth, employment, and other measures of economic health. There is no simple litmus test. The Dallas Fed recently commented:

The two quarters of declining GDP definition is a rule of thumb that does not officially define a recession. The National Bureau of Economic Research (NBER) Business-Cycle Dating Committee, which certifies and dates U.S. business cycles, defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” A range of monthly indicators has been used by the committee to determine the peaks and subsequent troughs in economic activity. The period between the peak and the bottom of a subsequent downturn is called a recession.

There is no fixed rule for weighting these indicators, and it often takes the committee several months or years to determine a business-cycle peak or trough.

The NBER typically announces recessions with a lag as they are continuously reviewing historical data. In the last six recession cycles dating to 1980, they backdated the onset of recession by an average of 7 months! In 5 of 6 cases, the stock market bottom had either passed or was soon at hand.

The lag in the pronouncement of recession confounds simple trading rules. Do investors go to cash when there is a recession announcement? Doesn’t look like a smart idea. The performance of the S&P 500 (SPY) in the 12 months following a pronouncement of a recession by the NBER is actually quite good.

| Recession Announcement Month |

S&P 500 Return over the following 12 months |

| Jun-80 | +12.9% |

| Jan-82 | +35.5% |

| Apr-91 | +10.5% |

| Nov-01 | -16.4% |

| Dec-08 | +26.7% |

| Jun-20 | +41.0% |

| Average | +18.3% |

Of course, today we have a large number of indices that purport to forecast the onset of recession. There are indices of expert opinions, lagged data, and real time data. Many are so new that they lack the track record sufficient to draw meaningful conclusions. But perhaps a larger problem is that there is no consensus. Different measures reveal conflicting forecasts.

Centers of influence are all over the map. There is nothing approaching consensus. The New York Times surveyed a wide range of Wall Street Banks and consultants last month. Here are the rather disparate findings.

Likelihood of Recession

| Not likely | Toss up | Decent Chance | Highly likely |

| Deloitte | Bank of America | JP Morgan Chase | Berenberg |

| Morgan Stanley | S&P Global Ratings | TD Bank | Deutsche Bank |

| Citigroup | Goldman Sachs | Credit Suisse | Wells Fargo |

| HSBC | Fitch Ratings | Oxford Economics | |

| Pantheon Microeconomics |

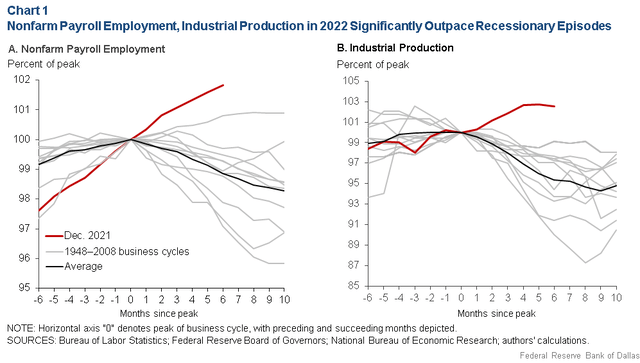

Our own Federal Reserve is perplexed by the data, Just last week, the Dallas Branch opined that employment in the overall economy and output of the industrial sector in 2022 have significantly outperformed what occurred during every previous recession at a similar point.

The public is more skeptical even as it benefits from a buoyant employment marketplace. Sentiment does matter … as consumers drive most of the US economy. Recession is on the mind of those accessing Google searches.

Contradictions abound. The data and the economic experts are divided on the prospects of recession. How can we hope to outguess these experts? And, to what end? Stock market performance during recessions is hardly distinguished from performance during expansions. Certainly, it does not pay to wait until a recession is officially declared. If anything, that is a signal to buy more stocks.

There is one sensible response to recession fears – do NOTHING. Maintain the investment policy that you currently have in place. Adjust it only when your own circumstances change. Don’t rely on the tea leaves proffered by the financial media. Markets are highly efficient and are capable to digesting new information more efficiently than any individual actor.

Be the first to comment