Leila Melhado/iStock Editorial via Getty Images

Growth stocks and other high multiple sectors of the market have had a rough start to 2022. Higher interest rates, conflict in Ukraine, and other uncertainties have created a market environment that has many investors nervous. That creates opportunity, and for investors looking for exposure to markets outside of the US, MercadoLibre (NASDAQ:MELI) could be an interesting option.

Investment Thesis

MercadoLibre is the dominant ecommerce platform in South America. They have continued to grow at a rapid pace, posting revenue growth well over 50% in each of the last two years. The company has a long growth runway in South America and has the potential to be a dominant player in South American ecommerce. The company is still led by one of its founders, Marcos Galperin. The valuation is rich right now for my taste, but with the growth the company is expected to have in the coming years, the premium valuation can be justified. I won’t be starting a position in MercadoLibre, but the company will be staying on my watchlist of companies that I am looking to start a new position in.

The Business

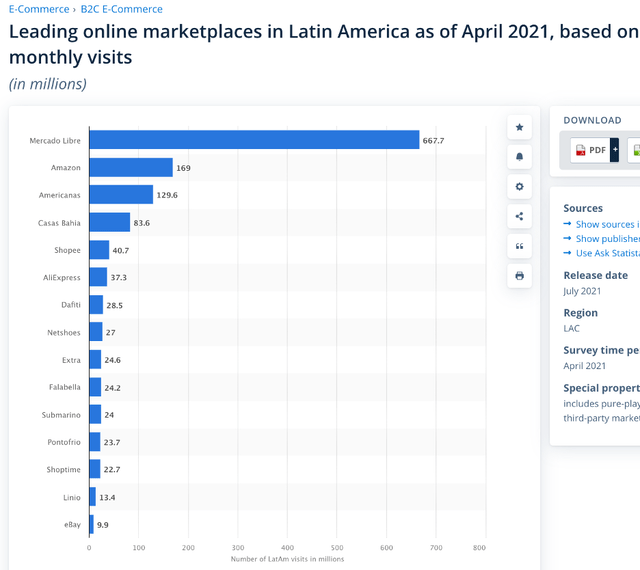

MercadoLibre is a business that I have been watching from the sidelines for a while. The company has a dominant position in business to consumer ecommerce in South America and has a growing fintech segment. In 2021, a little over one third of revenues were generated by the fintech segment, with the rest coming from the ecommerce segment. Below you can see a graph showing the leading online marketplaces in Latin America.

Ecommerce Market Share (statista.com)

While the picture above is from 2021, MercadoLibre still holds its dominant position in South American ecommerce. While MercadoLibre has a presence across several countries, three countries made up over 90% of their revenue in 2021. Brazil (55%), Argentina (22%), and Mexico (17%) are the major markets for the company. If MercadoLibre can become the dominant ecommerce player in those three countries, I would expect them to build out a moat (if they haven’t done so already), and the company could grow significantly over the next decade.

Long Term Potential

Many have made the obvious connection from MercadoLibre to Amazon (AMZN), calling it the “Amazon of South America”. This is obviously an oversimplification, but it makes sense with the way the company is positioned. They don’t have segments comparable to AWS or Prime Video, but the fintech segment is a solid complement to the ecommerce operations. The current valuation might be rich, but with a market cap of $58.5B, investors with a long-term time horizon might consider adding or starting a position here.

Valuation

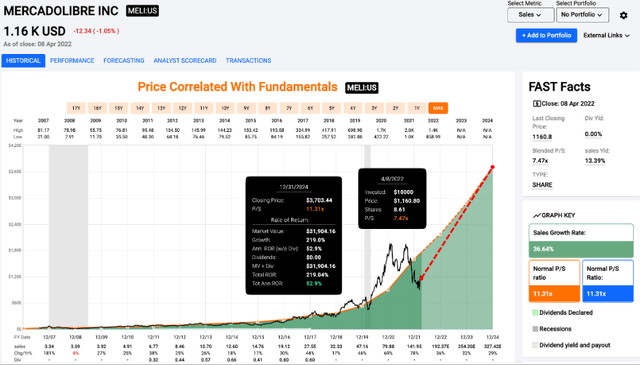

MercadoLibre has been a volatile stock over the last couple years. As you can see, the stock ripped higher after the initial COVID selloff. After a blow-off top near $2,000 per share, the stock has been falling and is down a little over 10% YTD. After a couple years of investing heavily in the business, the company was back to being profitable in 2021. While the blended earnings multiple of 356x isn’t all that helpful, what you can see from the operating earnings graph below is that the company is expected to grow earnings at an explosive rate in the next couple years.

Price/Earnings (fastgraphs.com)

If you get locked in on earnings, you might assume that the company is too rich to buy without a massive selloff. However, the biggest draw for investors in MercadoLibre is the rapid revenue growth. That is why I have included a price to sales graph below. I’m always reluctant to use sales to value a business, but sometimes the revenue and revenue growth is a relevant metric for investors. I typically go for profitable companies that I can buy for less than what they are actually worth, but the revenue growth and long-term potential of MercadoLibre has me interested.

The company has typically traded at 11.3x sales. I’m not here to say what is undervalued or overvalued when it comes to price/sales valuation, but the current price/sales is 7.5x. The company has a history of growing revenues at well over 20% on an annual basis and it appears poised to continue that trend. If you think earnings and sales are going to explode as projected, MercadoLibre is a buy today. However, with the turbulent market environment and volatility of the individual stock, I would be surprised to see a better entry point for new investors in the next couple months. What I will say is that I’m pretty confident that shares will trade at a higher price in 3 or 5 years than today. Part of that is due to the impressive growth, but the founder leadership also plays a role.

Founder Leadership

MercadoLibre is still led by one of its founders, Marcos Galperin. He has been the CEO since the company’s founding in 1999. While founder leadership isn’t a deciding factor when it comes to buying stocks, I do prefer founder leadership, especially for growing tech companies. They typically have a vision of the big picture and have a long-term mindset, and they usually have a good idea of where the company is today and where they are trying to go tomorrow. It might not convince investors one way or another, but all else being equal, founder leadership is definitely a positive factor.

Conclusion

MercadoLibre is a business that has grown into the dominant player in ecommerce in South America. More recently, they have developed a fintech segment that nicely complements the core business operations. However, with their rapid growth and dominant position in the market, the valuation is a little steep for my liking. The stock has always been volatile, and broader market conditions could provide investors interested in starting a position with a better entry point. The balance sheet and founder leadership has me confident in the company’s long-term future, but MercadoLibre will be staying on my watchlist for now.

I will be keeping a close eye on the share price as well as future earnings reports to see if something changes that pushes me to take a long position in the company. If you have held MercadoLibre for years, congratulations. I wouldn’t be a seller at these prices. However, if you are like me and might be interested in starting a long position, I would be patient to see what the next couple months brings. I’m curious to see what happens, but future volatility could provide a great window of opportunity on a rapidly growing business in MercadoLibre that is well positioned in a rapidly growing market.

Be the first to comment