Rasica/iStock via Getty Images

This article was coproduced with Williams Equity Research (‘WER’).

Let’s Get Right To It: Omega Healthcare Q4 Earnings Analysis

Given that most or all the readers of this are familiar with Omega Healthcare Investors’ (NYSE:OHI) basic business model as a triple-net lease REIT focused in the skilled nursing part of healthcare real estate, we’ll skip the history of the firm and get right to it.

Roughly a billion in rent lands in Omega’s mailbox each year. Q4’s $249.5 million in revenue reinforces that general figure well and beat expectations by $12.33 million. It was down 5.3% year-over-year, however, and we care more about cash flow than revenue.

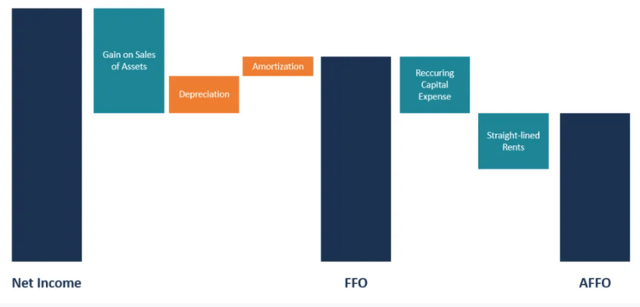

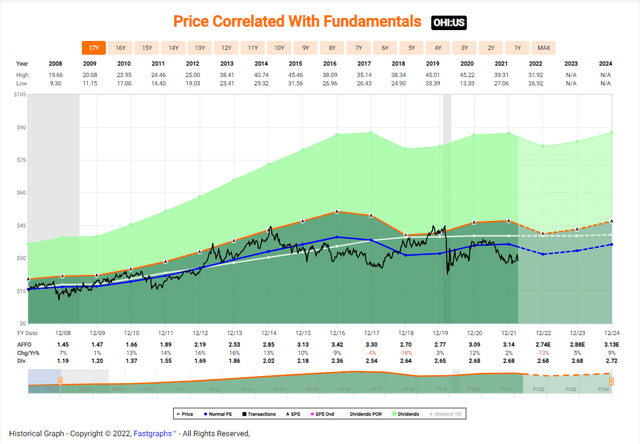

While Funds from Operations (“FFO”) is a good cash flow estimate for many REITs, Funds Available for Distribution (“FAD”) and Adjusted Funds From Operations (“AFFO”) are more precise for measuring dividend paying capacity and true cash flow, respectively.

As explained here, “AFFO deducts the amortization of real estate-related capital expenditures from FFO. But FAD are often derived by deducting nonrecurring (as well as normal and recurring) capex. Some REITs (or investors) who calculate FAD or CAD may also deduct repayments of principal on mortgage loans”.

Omega’s $190.4 million or $0.77 per share in FFO demonstrates healthy margins and $3.08 per share in annualized cash flow generation. The more conservative $178.8 million in FAD indicates Q4’s financial performance supports a $2.89 annual dividend.

There is never a guarantee there won’t be share dilution to degrade these numbers, but Omega authorized a $500 million stock repurchase program in Q1 of this year. That’s 7.2% of the company’s market capitalization as of April 8th’s close and is not insignificant.

Overall, more cash flow metrics were between approximately flat to modestly higher compared to the same period in 2020. AFFO per share in 2021 compared to 2020 was up slightly from $3.23 to $3.31, for example, as was Nareit FFO per share of $2.36 in 2020 versus $2.68 last year.

We’ll go into more detail on the balance sheet later, but there weren’t any material changes throughout the period. Based on this careful analysis of key metrics involving income and cash flow, nothing here rings any alarm bells. So, let’s take a broader look at 2020 versus 2021.

Key Trends in 2021

It’s easy to overlook the nuts and bolts of how REITs function.

Omega, for example, acquired $595 million in properties, spent $319 million acquiring properties, and dedicated $164 million to capital renovation and construction spending in reporting year 2021 alone. That’s against a market capitalization of just under $7 billion.

Omega’s portfolio doesn’t just sit there – it’s actively managed and that’s an important lever for determining if the company’s value and cash flow increases or decreases over time.

After tediously following property acquisition, development, and disposition prices, our conclusion is it has been accretive. For a concrete example, Q4 2021 realized a $161.6 million gain on assets sold.

Referencing the most recent annual report 10-K filing, management notes that $142.5 million in net gains were generated from the sale of 48 facilities. 2020’s 10-K also shows gains, but they were more modest. 2019’s gains on assets sold bested 2020’s by $36.6 million.

Meaningful asset dispositions don’t happen every year, but when they do, it’s a nice boost to total cash flow. For those that didn’t have the joy of studying for the CFA for years, it’s worth remembering that Nareit FFO excludes gains on properties sold.

AFFO doesn’t have a strict definition like FFO does, but it generally results in a lower figure because it deducts the day-to-day operating costs of the portfolio. Since it starts from FFO and only “adds” deductions, AFFO doesn’t include gains on dispositions either.

FAD ends up being extremely similar to AFFO and also excludes gains on properties sold.

Why does this accounting matter?

While we never want to rely on dispositions to fund a dividend, they put money in the same bucket that dividends are paid from. Omega has a good track record of generating 5-15% in additional cash flow from dispositions (relative to AFFO for the same period) that you’ll never see in the distribution coverage ratios, whether it uses FFO, AFFO, or FAD.

That’s key because management has publicly stated that another $400 million or so in dispositions are on the table.

Risk Analysis

Tenant Troubles

As reported in the Q4 earnings report relapsed in February, Omega noted that an operator representing 3.5% of Q4 2021 contractual rent and mortgage interest revenue did not meet its contractual requirements in Q1. Omega has a $1.0 million letter of credit to offset losses, but that will only be material if the tenant is at least able to make most of its payment obligations.

This doesn’t seem wildly optimistic, since the operator asked for a short-term rent deferral rather than simply abandoning ship. That’s on top of issues in Q4 of 2021, which resulted in Omega acquiring two skilled nursing facilities from struggling tenant Guardian Healthcare as part of the negotiation process.

On top of that, tenant Gulf Coast Health Care, which was in Chapter 11 bankruptcy proceedings at the time the last SEC filing was released in February, necessitated $25 million in debtor-in-possession financing from Omega. None of these specific numbers add up to catastrophe or justify a 10x forward earnings multiple, so let’s take a broader view of the portfolio.

The 10-K states that Omega’s annualized yield on its operating leases was approximately 9.8% and that 94% of those leases expired after 2026. It also states:

During the third and fourth quarters of 2020, four of our operators, including Agemo Holdings, LLC (“Agemo”) and Genesis Healthcare, Inc. (“Genesis”), indicated in their financial statements substantial doubt regarding their ability to continue as going concerns.

This list of COVID impacted operators includes Guardian and Gulf Coast as well, the same operators we just discussed.

During the year ended December 31, 2021, Agemo, Gulf Coast Health Care LLC (together with certain affiliates “Gulf Coast”), Guardian Healthcare(”Guardian”) and one other operator either failed to make contractual rent or interest payments for a period or have informed us that they would be unable to pay us rent for the foreseeable future….

….we have placed six operators, inclusive of Gulf Coast, Guardian and the one other non-paying operator noted above, on a cash basis of revenue recognition during 2021 as collection of substantially all contractual lease payments with these six operators was no longer probable.

In total, Omega wrote off $36 million in straight-line rent and $83.4 million in loans involving these operators. This same group represented 6.6% and 7.3% of total revenues in 2021 and 2020, respectively.

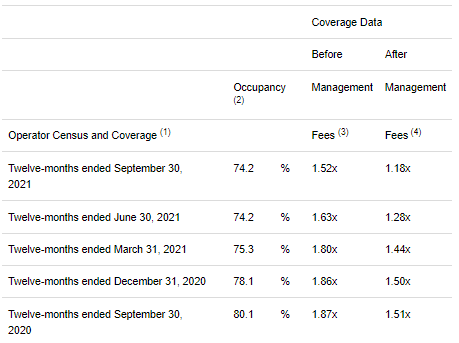

Q4-21 OHI

Note that rent coverage has declined from 1.51x for the 12 months ended September 30, 2020 to only 1.18x as of the twelve months ended September 2021. It’s a much better 1.52x before the management companies fees, but I assume they want to be paid.

Estimating the most current rent EBITDAR rent coverage metric involves a few assumptions, but including recent M&A of some poorly performing properties, an educated guess is that 14% to 18% of tenants by contractual rent currently have EBTIDAR coverage below 1.0x.

Roughly half that has already been written off and is not included in forward earnings projections, but the other half is still on the table. This reconciles with what CEO Pickett stated in the recent conference call:

We’re not past tenants that we’re concerned about. I will tell you that we’ve had additional tenants to express some liquidity concerns over the next couple of quarters. So I think all of our constituents need to be very careful thinking that the restructuring type scenarios are behind us. I’m sure we will have more they might be small. They might be bigger, but it’s — there’s no doubt we’re going to be having these discussions for a few more quarters, just no doubt in my mind.

Kudos for Mr. Pickett’s transparency. Let’s discuss the primary issue driving these tenants’ problems.

Coronavirus Crisis

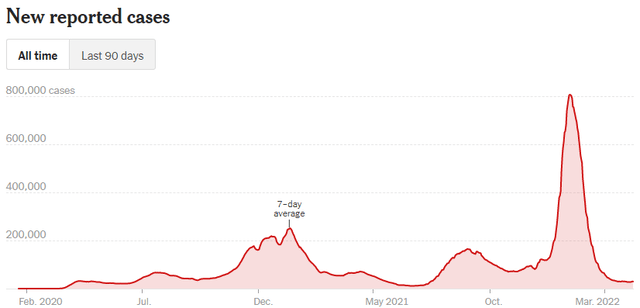

Omega stated that 75.5% of its 944 operating facilities as of January 26, 2022 reported cases of COVID. If that seems high, it’s probably because only 27.7% reported COVID cases as of November of 2021.

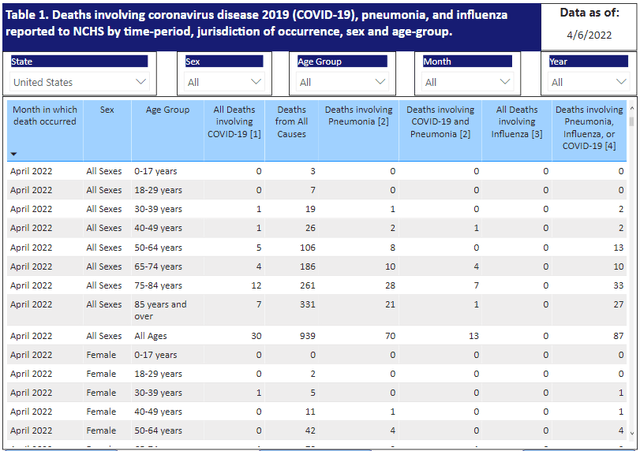

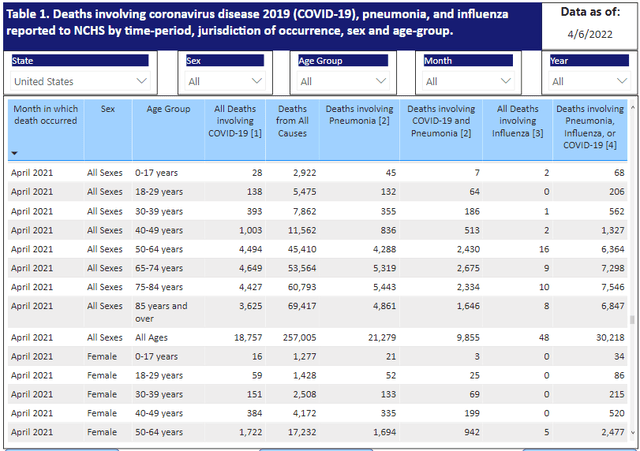

CDC.org

While the current variants of the coronavirus pose minimal lethality risk based on objective statistics from the CDC, as demonstrated by the recording of 11 deaths throughout the entire U.S. in the month of April involving the coronavirus (note this is involving, not caused by) for all people aged 74 years or less, the financial, regulatory, and headline risk is clearly negatively impacting some healthcare facility operators. That said, take a look at April of 2021.

CDC.org

This records roughly 10,000 people aged 74 with deaths involving the coronavirus (there is no explanation provided on what “involving” means on the CDC website). While it’s up to the individual to determine how “bad” that is, it is not subjective that 2022, despite higher case counts in some areas, is nearly two orders of magnitude better than comparable periods in 2021.

This suggests, assuming trends continue, that these operators are likely to see significantly less financial pain and operational complexity related to the coronavirus than they did in previous periods.

Those variables matter because that’s explicitly what Omega stated in its SEC filings as the cause to their financial troubles. The filings specifically mention that PPE costs, staffing issues, testing mandates, and vaccine requirements related to coronavirus regulations and best practices negatively impacted these operators. These requirements are loosening nationwide, and even in areas like California.

Management stated that some skilled nursing facilities are trading hands at 20 times cash flow. How is that possible? It’s the same reason earnings multiples spiked during the Great Recession – the earnings part of the equation shrank dramatically.

This is a good sign, however, as buyers would only pay 20x if they think those assets’ cash flow will improve dramatically in the short to medium-term. There is no guarantee that’ll occur, but it bodes well for Omega that buyers are underwriting a massive recovery in the sector’s cash flow.

Bond Basics

We can also use the debt markets to educate ourselves with yet another perspective on Omega. This is something I rarely, if ever, see equity analysts do, which is a shame because it’s valuable yet straightforward.

On the other hand, it’s good because that’s a competitive advantage for us and our subscribers. In addition, debt investors tend to look through a different lens that equity investors and are less likely to be in denial about a company’s financial situation. This is rational because they have little to no upside if things go great but immense downside if they go poorly.

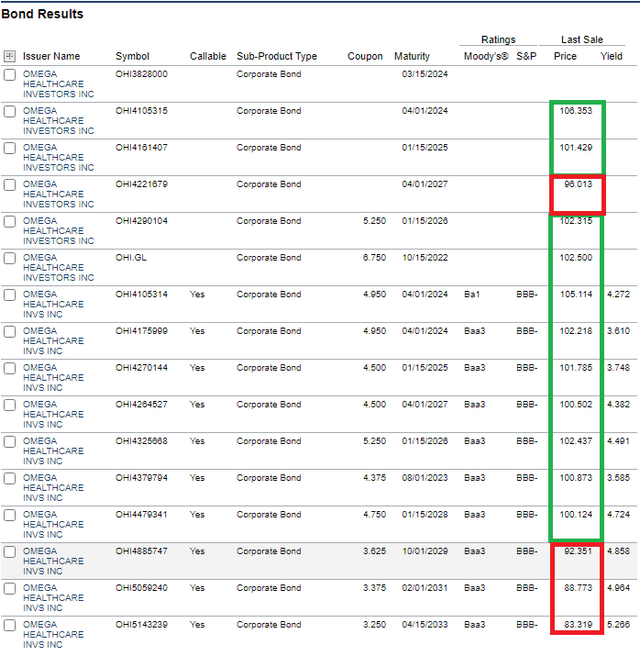

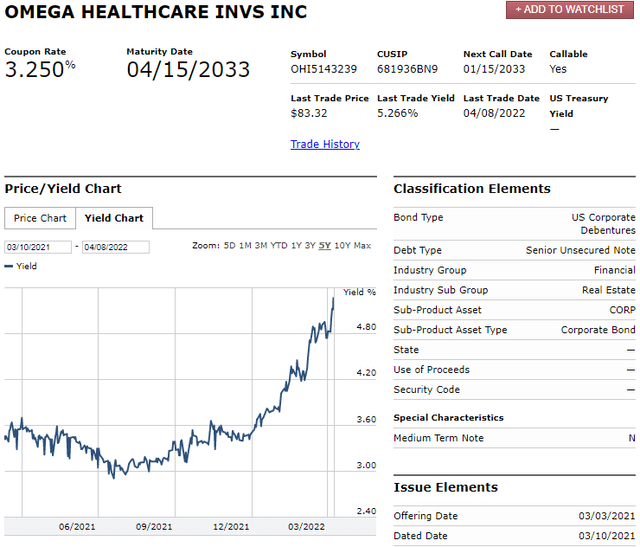

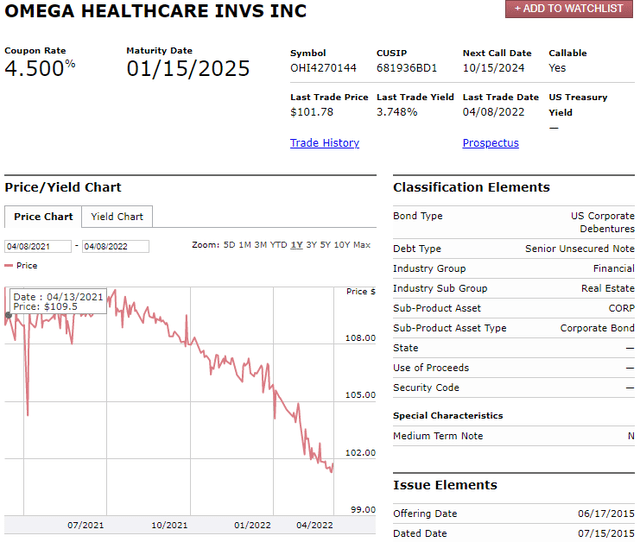

FINRA

This is a complete list of Omega’s outstanding bonds. The ones boxed in green are trading above par and those in red are trading below par value. Every bond maturing between now and 2026 is worth more than when it was issued by Omega.

Of the six issues maturing between 2027 and 2033, three are trading above par and three are not. The largest discounts to par value are associated with the longest dated bonds, which mature in 2029, 2031, and 2033.

What can we conclude regarding this data?

Despite interest rates rising and negative news surrounding some aspects of Omega’s business models, debt investors maintain high confidence in all bonds maturing in less than ~5 years.

That’s significant given many equity investors do not have that same investment time horizon.

At the same time, either concerns about the business model or expected higher rates have caused later-dated Omega bonds to trade at moderate discounts to par. I analyzed the bond prices over time, and it appears to be more timing/interest rate environment related than business related.

FINRA

Notice that Omega managed to lock in 3.250% interest on its 2033 bonds that were issued in March of 2021.

FINRA

These bonds issued in mid-2015 mature in 2025 carry a 4.5% coupon and 3.748% effective yield. In summary, while the rise in anticipated future interest rates has contributed to Omega’s longer dated bonds to trade down, there is no indication that the credit markets have short or medium-term concerns over its financial health and ability to pay its bills. That doesn’t guarantee a downgrade isn’t possible, but there aren’t any indications that’s in the cards for now.

Conclusion and Dividend Discussion

What can we take away from this assessment?

First, Omega’s financial situation, both in terms of cash flow and its liabilities, is quite stable with some metrics even improving over the previous comparable reporting year.

Second, and while it requires a few assumptions, it’s reasonable to conclude that at least half of the revenue and liabilities associated with troubled tenants is already written off and fully priced in.

Third, the bulk of tenant problems were and still are due to coronavirus-related variables resulting in higher costs, staffing shortages, and greater operational complexity/liabilities.

Fourth, the data from government sources shows that the overall coronavirus situation is markedly improved in all material ways.

NYT

Even the New York Times shows case counts near lows, and mortalities have been at lows for quite some time. Although it took a while in some areas, this reality has eventually made its way into less restrictive/burdensome policies for facilities like Omega’s to deal with. We’d expect this to lessen the burden on struggling operators immediately and continue to do so.

Fifth, it is extremely likely that another 3.5% to 7.5% of contractual rent will have to be renegotiated in the next four quarters. Omega’s own CEO said as much in the last quarterly call, though I did some of the math for him.

Sixth, even if all 7.5%, the high end of our estimated loss range, were to disappear, Omega has several million in letters of credit and other instruments to dampen the loss moderately. The REIT would still generate $2.67 in FAD per share versus the current dividend of $2.68, and that excludes gains from dispositions, which are highly likely.

Seventh, depending on one’s assumptions regarding dispositions and other corporate activity, it’s reasonable to assume Omega’s cash flow will decline up to 4% annually in 2022 and 2023 (it might absorb the whole decline in 2022 instead, so be aware of that) before resuming its natural trajectory higher. Dividend coverage is likely to approach 1.0x FAD, and many REIT boards prefer to cut the dividend when distribution gets that close.

Others have no issue over-distributing as long as the financial plan they are working from shows a recovery in the next 1-2 years, as Omega’s likely would. It’s up to the individual to determine if those risks are appropriate for them.

Lastly, while this article was focused almost entirely on risk, let’s not forget a few important facts.

Omega trades at 10x forward earnings and the high end of our estimated rent loss scenario analysis would only push that up to 10.75x. That’s still dirt cheap.

While dividend coverage is likely to approach 1.0x FAD, that’s a ~9.5% fully covered cash flow yield (that’s the distribution adjusted for the payout ratio to normalize differences in payout ratios). That’s significantly higher than the investment grade REIT average of 4% to 7%.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment