Chicago Hosts Annual Auto Show, bZ4X among the exhibits Scott Olson/Getty Images News

Toyota Motor Corp. (NYSE:TM) begins sales of the 2023 bZ4X BEV in the U.S. on April 14, initially in the 14 U.S. states that have passed mandates for zero-emission vehicles. In the fall, Toyota’s new BEV will be available in the remaining states.

Toyota said it expects the new model to compete against such BEVs as the Nissan Ariya, Hyundai Ioniq 5, Volkswagen ID.4 and Kia EV6. Subaru’s new Solterra, developed in conjunction with Toyota, is virtually the same BEV with different exterior styling.

Toyota is planning for about 7,000 bZ4X sales in the first year, which would be equal to about 0.3% of the automaker’s more than 2.33 million vehicles sold in the U.S. in 2021 – a drop in the bucket of total sales. As such, the model isn’t likely to have a discernable effect on revenue or profit. The new model will, however, constitute an important learning exercise for Toyota toward a future in which BEV familiarity among consumers will grow – presumably setting the stage for more significant sales.

Toyota vs. critics

The new BEV also will serve as a rebuttal to environmental and other critics claiming that Toyota isn’t moving fast enough to eradicate fossil-fuel, gas-electric hybrid and plug-in hybrid models from its fleet. Unlike global competitors such as Ford Motor Company (F), General Motors Co. (GM), Volkswagen AG (OTCPK:VWAGY) and Tesla (TSLA), Toyota argues that its hybrids already have averted much CO2 propagation and will avert more in the future. Further Toyota says it intends to respond to consumer demand for BEVs rather than pushing motorists to accept the new and costly zero-emission technology in order to satisfy environmental alarmists.

As I’ve previously stated, I rate Toyota’s strategy to be prudent from a long-term investment standpoint. BEVs definitely are coming to the world of mobility, yet it’s too soon to know when consumers will adopt them as a mainstream technology – or when governments will mandate their adoption.

Like other automakers, Toyota lately has been hamstrung across its product line by parts and materials shortages that have limited vehicle availability. On April 6, the automaker’s U.S. management cut its forecast for U.S. new vehicle sales this year to 15.5 million from 16.5 million. Bob Carter, Toyota’s North American sales chief, blamed the pandemic and the conflict in Ukraine for snarling supply chains and increasing the cost of materials.

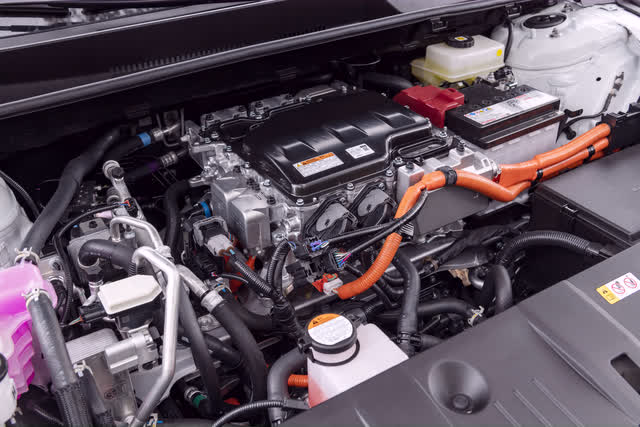

“Look Ma, no engine!” (Just electrical components) (Toyota)

Initially, Toyota will assemble bZ4X at its Motomachi complex in Japan – but the company is investing $1.3 billion to build a battery manufacturing plant near Greensboro, N.C. that is scheduled to begin output in 2025 and presumably will support BEV production in the U.S.

Affluent choice

bZ4X, which goes on sale this week, features an EPA-estimated range rating of up to 252 miles (for XLE front-wheel drive models, based on preliminary testing using EPA’s test procedure standards). The starting manufacturer’s suggested retail price is $42,000. With all options, the new model will sell for a retail price of nearly $49,000. According to the EPA guidelines, an owner can expect to save about $5,000 in fuel over the first five years of ownership, compared to the average new car with an internal combustion engine.

In its press release, Toyota said it “plans to expand to around 70 electrified models globally by 2025. This future lineup will feature 15 dedicated BEVs, including seven carrying the bZ (Beyond Zero) brand moniker. This diverse portfolio of electrified products will help propel Toyota toward its goal of carbon neutrality by 2050. Globally, Toyota has put more than 20 million electrified models on the road – with a CO2 emissions reduction affect equivalent to the CO2 emissions reduction of over 5.5 million BEVs. Over the next nine years, Toyota will invest $70-plus billion in electrified vehicles as a whole with the target to launch 3.5 million BEVs globally in 2030.”

The new BEV will be offered in two grades, XLE and the more expensive Limited edition. Both are available with front-wheel-drive and all-wheel-drive (AWD). Dimensionally, bZ4X is similar to Toyota’s RAV4 SUV, the automaker’s most popular seller in the US. The least expensive RAV4 starts at about $26,500.

bZ4X should appeal primarily to so-called “early adopters” of new technology, relatively affluent consumers who are willing to spend more on a vehicle to experience BEV characteristics, namely the quiet, spirited acceleration of electric drive and the enjoyable handling due to the low center of gravity created by a heavy lithium-ion battery positioned low in the car’s fuselage.

Charging bZ4X can be accomplished with 120V, 240V or DC fast chargers, the time required to charge depending on the voltage, state of battery discharge and temperature conditions. Toyota anticipates that consumers with access to a charger at home or at a workplace are the most likely to consider the new BEV since the number of public chargers remain relatively scarce in some areas. Toyota is pursuing relationships with public charging companies and makers of home systems such as Chargepoint to facilitate installation, which would ease consumers’ migration from fossil fuel to electrification.

Pleasant drive

My short test drive of the bZ4X on the side streets and highways around San Diego felt remarkably quiet, modern and comfortable. Consumers who test drive this model are likely to be favorably impressed. For those seeking basic transportation at an affordable price, this BEV probably won’t be the answer – nor will any other BEV. The cost of batteries is falling but still is high in comparison to internal combustion vehicles.

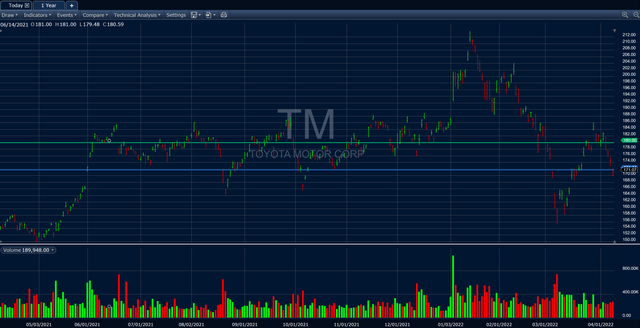

Toyota ADR shares traded in a fairly narrow band from the middle of 2021 through the end of the year. Then the price spurted higher before collapsing in the early part of this year more than 26%. The likely reason for the sharp drop was the mid-January announcement by the company that it would be “difficult” to meet its global vehicle production goal for the fiscal year ended March 31. Until then, Toyota appeared to be weathering supply chain snarls and parts shortages better than its competition.

Toyota ADRs for the past year (Fidelity)

When Toyota ADRs are at or below their technical support level, they’re a good buy. I would rate them as such currently, given their somewhat oversold status as well as because of the company’s long-term strategy to exercise caution in the move to electrification.

Be the first to comment