curraheeshutter

Investment Thesis

SLB (NYSE:SLB) is an oilfield services vendor. Perhaps one of the biggest in the world. Right now, we are in the early stages of a prolonged energy cycle. As such, there’s a considerable amount of investor doubt.

Moreover, given the overall uncertainty in the whole sector, not only are investors unwilling to pay significant multiples for an oilfield service company, but oil companies themselves have no visibility either.

So, if oil companies are unsure of whether or not to invest in a substantial capex cycle, that leaves SLB in a challenging environment. All that being said, I maintain that this uncertainty is already more than priced into the stock.

Could WTI Close 2022 at a Loss?

Being an energy bull, I find it most astonishing to see that WTI is on target to end 2022 lower than it started.

I can’t justify the price action. I give up trying. Instead, I’ve just taken it as a fact. Oil prices go down as well up, and right now, prices are down.

And to be clear, I can also overintellectualize it as well as the next person. Here are a few considerations there’s a global recession, the ongoing SPR release, China’s going to remain closed, seasonality, and anything else you wish to consider.

Are there Reasons to be Bullish on WTI?

Take each one of the above negatives, and it’s likely that 2023 will be the reverse. For example, China is already very slowly starting to reopen. Yet, I would quickly caveat that we don’t know how politically China will succeed as Covid cases continue to rise in China.

Also, the SPR release will at some point finish. Even without replenishing the SPR, the fact that it stops supplying the US market will add further medium-term support, although there are rumors that material volumes ended up being exported outside the US.

And critically, if the global recession doesn’t end up, in actuality, meaningfully reducing crude oil demand, because it turns out that oil demand is less discretionary than many previously assumed, this would also be bullish.

And lastly, and my personal favorite, besides China, there are countries like India, Latin American countries, and other countries in Africa, such as Nigeria, that are desperate to improve their quality of life, through access to cheap and reliable energy. Indeed, as you know, there’s a direct correlation between cheap energy and a quality lifestyle.

And How Does All This Impact SLB?

For its part, SLB very recently had an Investor Day where SLB went to great lengths to reassure investors that it could grow by 15% CAGR over the next 3 years.

And even if that’s a likely outcome over time, in the very near term, as already discussed, WTI prices are all over the place. I personally struggle to believe that with WTI going from $91 to $71 in about 30 days, there are going to be many oil companies substantially increasing their capex projects.

Think of it this way, do CEOs go out and plan, budget, hire, and train, for WTI at $90? Or WTI at $70? Given the amount of inbuilt operating leverage where every $1 move on WTI can often add more than 50 basis points in operating leverage, having stable prices is crucial.

On yet the other hand, I contend that all this uncertainty is already fully factored into SLB’s valuation.

SLB Stock Valuation – 31x 2022 Free Cash Flow

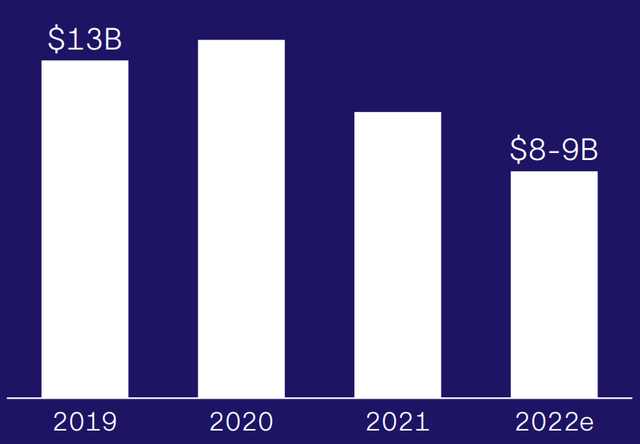

In my previous article, I put a lot more emphasis on SLB’s cash flows, so I won’t repeat this here. What I stated then, and stand by today, is that SLB will probably make around $2.3 billion in free cash flows in 2022.

This is my point. SLB’s momentum right now is strong. And it appears that looking ahead over the next several months, we could expect close to 20% CAGR on the topline. As you know, SLB’s balance sheet is substantially improved, given a couple of good back-to-back years.

Therefore, SLB is growing at somewhere close to 15% over the next several years, with less debt, which will ultimately translate into an increase in buybacks and dividends. Like the increase in its quarterly dividend by 43% y/y to $0.25.

Altogether, long-term investors will benefit from an increase in owner earnings.

The Bottom Line

SLB is at the start of a strong upwards cycle in cash flows. For now, the stock is still very attractive. SLB makes the case, that starting early in 2023, as it does away with deploying as much capital towards debt paydown, it will resume its share repurchase program.

So, there’s a fair amount of growth expected to come down the pipe, plus strong free cash flows, and an increase in a return of capital. A positive picture for SLB, no doubt.

Be the first to comment