Baloncici

Dear readers,

The issues for Telenor (OTCPK:TELNY) aren’t exactly new. Whenever a conservative, incumbent telecommunications company hinges its growth on emerging markets, even despite its home markets being rock-solid, the share can encounter valuation difficulties when challenges in those emerging markets arise.

Let me show you the reasons why Telenor is down quite a bit – but also why I’m not worried in the least and have taken the chance to really expand my position to its 5% limit, with a very attractive cost basis.

Telenor – Updating due to the sub-110 NOK price

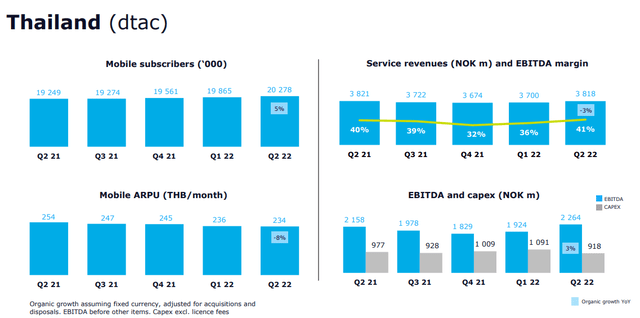

The past few quarters for Telenor have shown a fairly clear picture of the overall ebb and flow of the company’s business. While overall mobile performance was very robust, and the company’s investments are paying off, the company is seeing increased competition in emerging markets – meaning above all Thailand.

This is really the core of the issue we’re seeing, and what other analysts are pointing to as a risk.

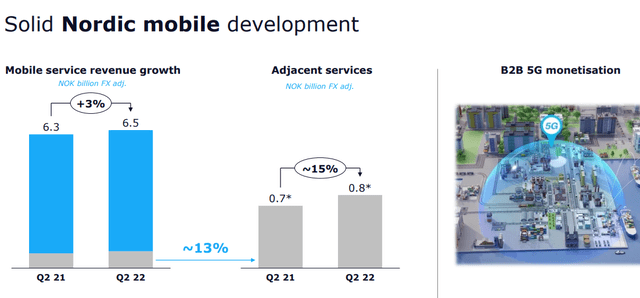

Because mobile service growth and ARPU were really solid – in every home nation (Scandinavia). The company can really do very little “better” in those geographies. Despite the maturities of these markets, the company is really seeing good results here, with around 0.5% organic growth.

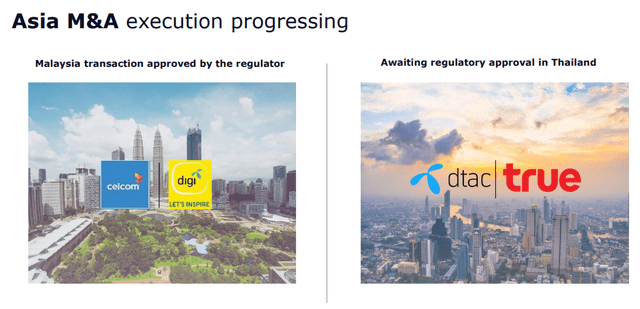

The company also saw some clarity in emerging markets, in the form of a regulatory clearance for a merger in Malaysia.

Copper networks are declining on the home front – but to weigh this up, the company is seeing essentially replacements in the form of mobile growth.

Inflation is an issue. The company is increasing its energy efficiency to offset some of the costs here, along with organizational modernization. But worth mentioning here, above all, is I believe the execution on M&A’s in Asia. These are moving forward, and we can expect more updates on the 3Q22 in about 4-5 weeks.

Stability is, otherwise, the name of the game here. Service revenue growth is good, with EBITDA stable despite several one-offs that drag things down for the quarter. Net income is impaired by a large position in Pakistan, but we still have nearly a billion NOK worth of free cash flow and CapEx below the 4Q21 level of nearly 6B. Leverage remains one of the lowest in the entire industry, close to 2x net debt/EBITDA.

The company’s outlook for 2022 remains solid and stable, expecting low single-digit growth with a CapEx of around 16-17% of sales. This is above the level of Orange (ORAN), which I wrote about recently, but Orange is in a different position.

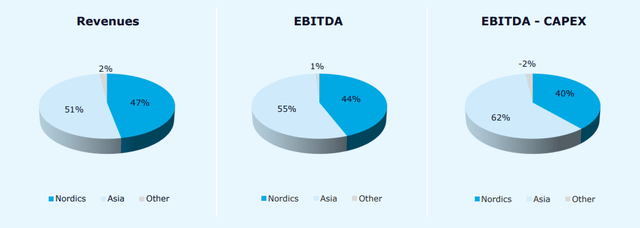

Even if the company has a “home market”, the company’s growth, revenues, and EBITDA tilt heavily towards its growth areas.

The home markets serve as a sort of “safety” for the company’s dividend and its basic business, and once these emerging markets see some of the expected pivot and efficiencies, we have a company that could grow significantly.

It’s not as though emerging market results are bad. Take a look.

Even Malaysia and Bangladesh are showing subscriber, ARPU, and revenue growth. On a group level, service revenue is up 3%, and EBITDA is up 1.2%. Despite this, we see the company declining to levels not seen in a few years. The company has no significant debt maturities in 2022 or 2023 and has low debt regardless. CapEx and other effects, including IFRS 16, have resulted in some ROCE reductions – from around 16% to around 12-13 – but there is potential for improvement here.

The market is missing several things with the company, as I see it. Telenor is one of the best-rated Telcos in the entire market. Why? It’s at an A-rating, and there are no signs that this is changing. Compare this to any of its telco peers in the EU and what they’ve been doing, and the company has kept steadily paying dividends. That’s also why, even after this drop, I’m significantly in the green on my investment.

This is not me saying the company does not have risks. It does – but those risks are inherent to around 40% of its operating revenue and EBITDA, related to the geopolitical instability of its markets. The company had to leave Myanmar, which resulted in a significant loss below around $600 when accounting for the sales price. These geopolitical instabilities and uncertainties are part of what drives the company’s valuation “story” here – with FX because FX losses can really drive things down as well.

In the end, my view is this. I don’t see the same geopolitical risks in Thailand, Bangladesh, Pakistan, and Malaysia that I see in Myanmar. Compared to Myanmar, the other geographies are “more stable” (I hesitate to use “stable” because that’s a bit far).

Still, investors need to consider this as a risk.

However, in the end, we’re looking at a valuation for an A-rated European telco incumbent with attractive home markets – even if there are risks.

Let me show this to you.

Telenor Valuation

Despite the drop in valuation from around 120-125 NOK to a current of around 107 NOK, the company continues to provide a very attractive dividend and valuation case. There is also a difference now from when we look at the company compared to before.

A company like Telenor provides me with a very good yield, throwing off thousands of dollars every year, and also have given me very good capital appreciation. Tele2 (OTCPK:TLTZF) alone is up more than 50% since I invested in it a few years back. Telenor is still up – but not as much. I have, however, been investing more and expanding my position.

I don’t own companies like Tele2 and Telenor for supposed earnings or massive amounts of revenue “growth”. However, at the current valuation, Telenor’s upside from 107 NOK is, based on both growth and reversal. Assuming even a below-GDP growth of 1% in EBITDA and only a 2% terminal growth rate per year, as well as a 1.2% CapEx growth, the company, comes in at an implied EV of well over 250 NOK/share. This may sound ridiculous, as it would imply an over 100% upside, but it’s due to the company’s massively low WACC due to a very low cost of debt (low leverage), and its appealing home areas, which essentially throw off cash like a bond proxy.

The company might be more volatile than your typical telco because of its Asian projects, but the fundamental substance of the company is beyond stable.

Most larger Scandinavian banks, such as DNB (OTCPK:DNBHF), have the company with PTs of at least 145-150 NOK/Share for the native.

Telenor is A-rated but has used its cash to drive for accretive M&As over the past few years. Much of what the company could deliver over the next 5 years is still percolating, and investors should view an investment into Telenor as a mid-term investment at the very least – if not very long-term.

The yield is now over 8% – and it’s well-covered. That puts it on par with Orange, which is amazing to me. The average for these peers around the EU is around 11-12X P/E with a 5.5X EBITDA and a 1.12X book multiple, updated for lower valuations. However, its massive yield and now below-average P/E means that on a comp basis, Telenor is a very buyable business. Due to the company’s home geographies and solid histories, as well as its credit rating, I continue to assign a 5% premium to the public comparisons for Telenor here.

The company’s higher upside is primarily growth-driven, as well as being one of the lower-traded telcos in a collection of low-valued Telcos on the European market.

The search for growth in Asia continues – and coupled with the home market strength, I continue to view the company with a very favorable eye in terms of risk and growth. I’m comfortable assuming an annual revenue growth trend of at least 1-2% per year – this is what forms the basis for my assumptions about Telenor – and is completely in line with current trends.

Telenor ASA has a valuation target range from S&P Global of between 114 NOK and 175 NOK on the high end. Neither of these valuation assumptions takes into account a full success of growth in Asia, which would push the premium up above 230-250 NOK. The 114 NOK is essentially assuming a complete failure in anything but the home market (and the company is currently trading below this level), while the 175 is a balanced approach between growth and legacy. Current averages are 145 NOK per share – and this is also where most current analysts land.

Only one analyst lands even close to the current company share price, and even they say 110 NOK/share. The implied upside to current averages is around 33.1%. My cost basis is improved to below 120 NOK/share at this time.

Asia is making most analysts more cautious than I believe they should be given the cheap price you’re paying for a guaranteed yield in a yield-starved, inflation-driven world, while at the same time getting the potential for growth from Asia.

I’m recognizing the higher amount of risk and lowering my PT by 5 NOK. That puts me at 150 NOK/share.

Even assuming only a post-pandemic reversal followed by single-digit EPS increases for the company, this would be based on normalized 5-year P/E averages resulting in an annual RoR of well over 15% until 2024. Yes, Asia and one-offs turn the company’s net income levels/EPS into a fairly lumpy affair, but once this stock grows, it has the potential to hit that 180 NOK mark, which would deliver growth of well above 25%. This part of the thesis still holds plenty of water, and that’s why my thesis for the company still stands.

Thesis

My thesis for Telenor is as follows:

- I view Telenor as one of the safest telcos in all of Europe, based on its fundamentals and markets. Safer than Orange, and safer than Tele2/Telia. Perhaps Deutsche Telekom (OTCQX:DTEGY) might be as safe, but less than half the current yield.

- Based on this safety and this yield as well as this upside, I’m marking this company as a “BUY” and consider it with a PT of 150 NOK/share.

- I believe the right way to invest in the business is native shares only, not ADR’s. The native share trades on the Oslo Share exchange under symbol TEL.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment