piranka

Fifth straight quarter of double-digit profit growth

Wayside Technology Group (NASDAQ:WSTG) reported yet another quarter of excellent financial performance across metrics. Reported revenue was down 9.9% YoY as unfavorable currency hit sales and record revenues from a vendor were included in 2Q21 results. Underlying revenue growth, excluding these one-offs, was close to 10% YoY across the company’s other top 20 partners. Adjusted gross billing was up 2.8% YoY. Gross margin continued to grow with a 380 bps YoY expansion as fewer customers took early pay discounts and the company was able to generate organic growth amongst its top 20 vendors.

Management was able to continue driving operating leverage gains with adjusted EBITDA up 27% YoY. Net income increased by 55.8% YoY with EPS of $0.63 [$0.41 in 2Q21]. Effective margin [adjusted EBITDA as a percentage gross profit] increased to 35.8% from 32.0% in 2Q21. Looking at the most recent results, we are enthused by Wayside’s ability to generate consistent topline growth and drive margin improvement. This has been the fifth consecutive quarter of double-digit profitability growth for Wayside Tech, even in an environment that had been marred by issues related to COVID-19. Net cash per share remains at $6.31 [end June 2022], which is 20% of the current stock price.

On their results conference call, management reiterated that they would continue to focus on their core initiatives, and they see “abundant growth opportunities” to capture in the short to medium-term. Further looking ahead, management will also look to introduce a “multi-year directional outlook for the company” that will lay out their targeted growth and profitability.

13x P/E, 7% FCF yield, $55 price target

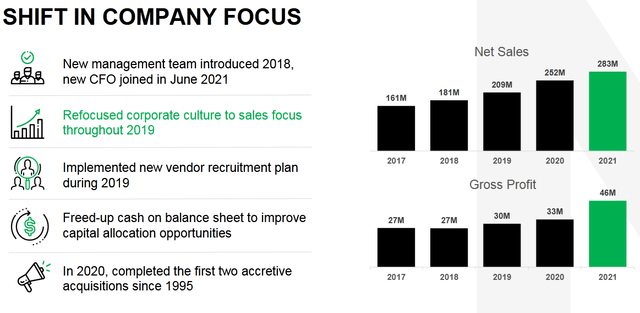

Over the last many quarters, Wayside Technology has demonstrated consistent growth in financials coupled with strong free cash flow generation, a net cash balance sheet and steady dividend payouts. Successful execution of the management’s strategic vision – to focus on marketing, customer management and introducing upcoming vendors – has led to stellar performance. While Wayside Tech has come a long way, we believe it has a solid foundation to continue growing in the medium term. Even though the stock has more than doubled since we recommended it in June 2020, we think there is still significant room for re-rating given the multiples that other tech stocks trade at. We have a target price of $55 for the company which is based on an 18x ex-cash P/E multiple applied to our 2023 estimates. We have further added back net cash per share of $6.85 [as at end 2021] to this to arrive at the $55 price target. Our target price represents a 76% upside potential.

Despite the stock having done well in the last 2 years, in our view the valuations still look compelling and relatively inexpensive. This to us implies that the stock still has a long way to go. On our 2022/2023 estimates, Wayside Tech trades at a P/E of 12.6x/11.5x. On an ex-cash basis this looks even cheaper at 10.1x/8.7x for 2022 and 2023 respectively. Investors should also note that the company is forecasted to generate FCF yield of 6.6% and 7.3% for 2022 and 2023 respectively in our opinion. This, along with 20% net cash to market cap bolsters our confidence that the stock has an attractive risk reward profile. Wayside Tech also offers investors a dividend yield of 2.3%.

Conclusion

Wayside Technology’s stock has had an excellent run in the last 2 years and is up 113% since our initial recommendation on the name. Given its consistently strong financial performance, ability to generate profitable growth and cheap valuations, we believe the stock price still has a considerable runway to appreciate. We value Wayside Tech at a $55 target price, implying a return potential of 76%.

Check out our Subscription Service, Unique Value and Dividends, which helps investors invest in unique “deep value” stocks and interact with us directly.

What investors can expect:

- Weekly Articles on unique under-covered stocks

- High dividends, low P/Es, high FCF, high net cash

- 3-year IS/CF/BS forecasts on most of our stocks

- Provide compelling entry points, many U-shaped charts

- Access to our “actionable, new money buy now” ~25 stock portfolio

- Stocks with multiple clear catalysts to unlock value

- Real-time Earnings Analysis

- Regular Newsletters with insights on our stock portfolio

- 12-year track record servicing some of world’s largest HF/MF

Be the first to comment