Colleen Michaels/iStock Editorial via Getty Images

If you are familiar with my past articles, you know I am constantly searching for companies I can invest in for the long term (defined as a minimum of several years and maybe even a few decades). And when searching for companies that can remain in my portfolio for several decades, I need to be quite certain the business will be able to perform well over several years and decades.

To perform well over several decades, a company usually needs an economic moat that is protecting its core business from competitors and other companies trying to enter the market. And in a universe of thousands of public-listed companies around the world, it is not so easy to identify these companies. It is easy when a lot of information is available, but it is getting more difficult when trying to find less-covered companies with a wide economic moat. Aside from finding these by coincidence (happens from time to time), we must focus on several different metrics and try to identify businesses that could qualify as wide economic moat companies.

And one company that was identified that way is O’Reilly Automotive, Inc. (NASDAQ:ORLY).

Business Description

When reading the business description, I would not expect the business to have a wide economic moat, as O’Reilly Automotive is an American retailer specializing on automotive aftermarket parts as well as tools, supplies and equipment. And for retailers it is often difficult to establish a wide economic moat as the goods can easily be purchased by a competitor. This is leading to low switching costs, and it is also rather impossible to establish network effects. Retailers are often fighting this by trying to establish a brand name or by creating cost advantages competitors can’t match (but we will get to this).

The company was founded in 1957, and today it is operating almost 5,800 stores in the United States and in Mexico. In fiscal 2021, the business generated $13.3 billion in sales. The company is focusing on DIY customers (responsible for 59% of total sales) as well as professional service provider customers (responsible for 41% of total sales). And aside from an extensive product line the company is offering in its stores, it is also offering several different services like battery diagnostic testing, electrical and module testing, battery recycling or professional paint shop mixing.

Impressive Numbers

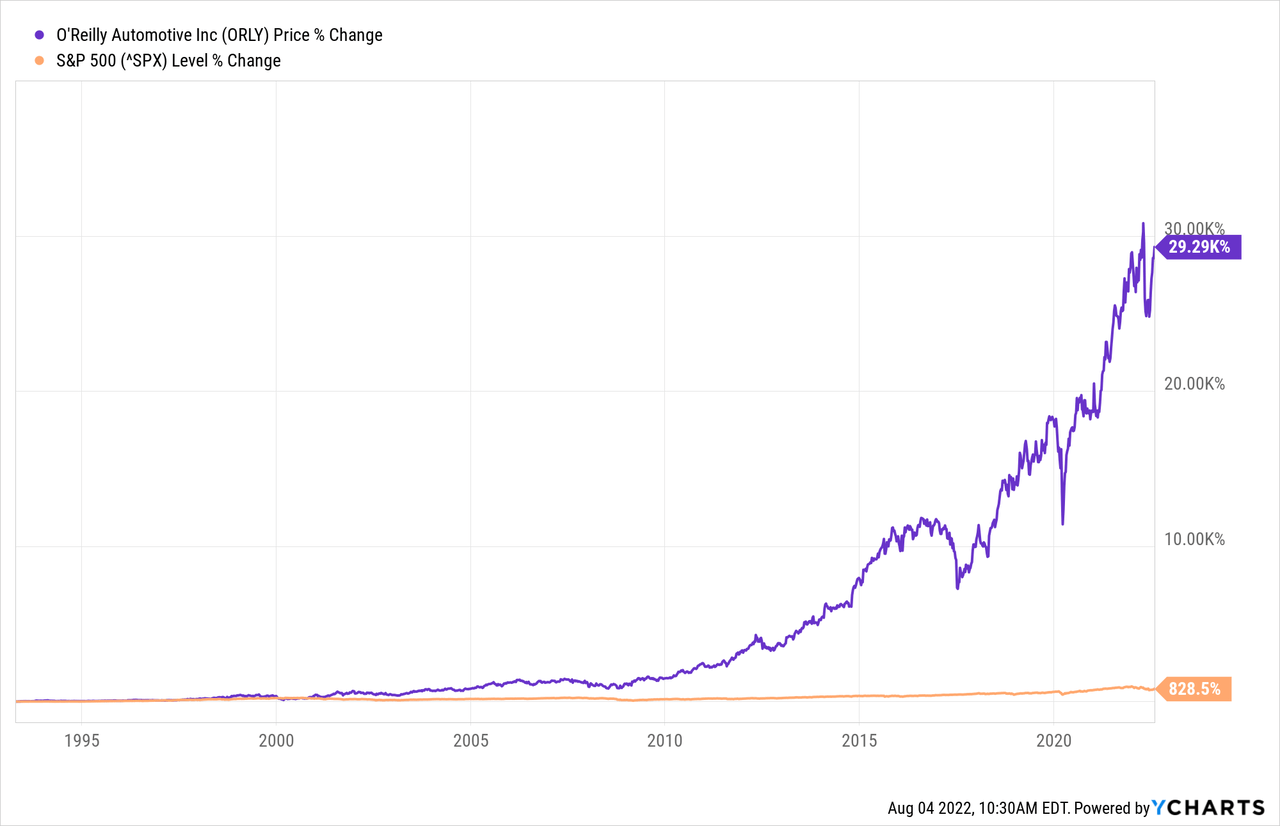

And while the business is probably not the typical business we would expect to have a wide economic moat around, the different numbers are clearly indicating otherwise. We can start by looking at the impressive outperformance of the stock since its IPO 29 years ago. While the S&P 500 (SPY) gained about 830%, O’Reilly gained almost 30,000% in the same timeframe.

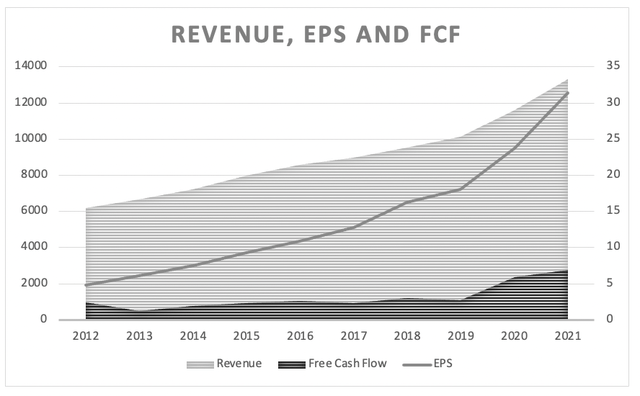

And while this is an impressive outperformance, the stock performance by itself should not be seen as proof for a wide economic moat. However, we can also look at the growth rates in the last ten years and see revenue growing with a CAGR of 8.91% and earnings per share growing even with a CAGR of 23.12%. Free cash flow was also growing with a CAGR of 12.59%.

O’Reilly Automotive: Revenue, EPS and FCF (Author’s work)

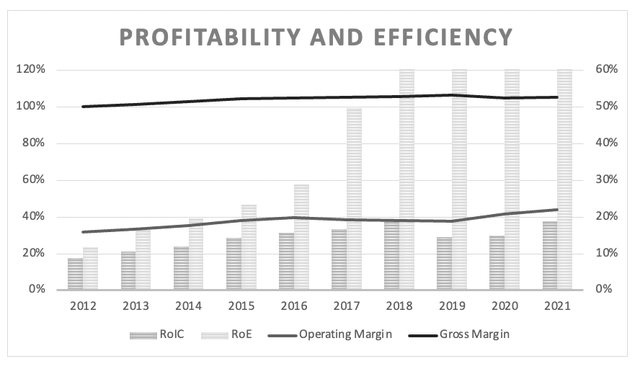

And while growth rates might sometime be misleading a little bit as companies without a wide economic moat can also grow with a high pace for several years (or sometimes even decades), stable margins would be another strong hint for a wide economic moat of O’Reilly Automotive. And when looking at the last ten years, we can see that gross margin as well as operating margin are extremely stable – and this is a strong hint for a wide economic moat around a business.

O’Reilly Automotive: Profitability and efficiency (Author’s work)

And finally, when looking at return on invested capital we can see an RoIC above 17% in every single year with numbers improving over the last decade and the average RoIC being 29.12% in the last ten years.

Economic Moat

I mentioned above that is seems rather unlikely for a specialty retailer to create a wide economic moat around the business. But the numbers indicate that O’Reilly most likely has a wide economic moat around its business and when trying to identify competitive advantages we can mention two different aspects.

First, the economic moat could stem from the brand name and the reputation the company created over the last decades. The brand name makes it easy to identify a company and when consumers need to choose a retail store to purchase equipment for used vehicles, they might choose by name and pick O’Reilly instead of a competitor. The brand name is serving like a short cut in the decision process and might lead to higher revenue for O’Reilly.

Aside from the brand name, an economic moat could also stem from cost advantages – in this case distribution networks which lead to better scale and faster delivery. And the argument is not only made by some analysts, but also the company itself in its own 10-K. Management describes its strategic regional tiered distribution network:

We believe our commitment to a robust, regional, tiered distribution network provides superior replenishment and access to hard-to- find parts and enables us to optimize product availability and inventory levels throughout our store network. Our strategic, regional, tiered distribution network includes DCs and Hub stores. Our inventory management and distribution systems electronically link each of our stores to one or more DCs, which provides for efficient inventory control and management. We currently operate 28 regional DCs, which provide our stores with same-day or overnight access to an average of 158,000 stock keeping units (“SKUs”), many of which are hard-to-find items not typically stocked by other auto parts retailers. To augment our robust distribution network, we operate a total of 375 Hub stores that also provide delivery service and same-day access to an average of 45,000 SKUs from a Hub or 80,000 to 92,000 SKUs from a Super Hub to other stores within the surrounding area. We believe this timely access to a broad range of products is a key competitive advantage in satisfying customer demand and generating repeat business.

The argument is made that especially for technicians at independent car repair shops “time is money” and it is important that the vehicles don’t take up space longer than necessary. And it is especially important for them to get the parts as quick as possible. This enables O’Reilly to charge higher prices as the quicker delivery is much more valuable for technicians trying to finish the job in fewer hours. And therefore, availability of the parts (or at least very quick delivery) is extremely important and could be seen as a competitive advantage for O’Reilly – based on its distribution network.

Recession-Proof?

And while O’Reilly seems to be a great business by the numbers presented above, we also must look at the performance of the business during a recession as it seems like that the United States (and many other countries around the world) will face a severe recession in the foreseeable future (next few quarters). It would not be a great idea to invest in a business negatively affected by a recession right before the risk of a recession being rather high.

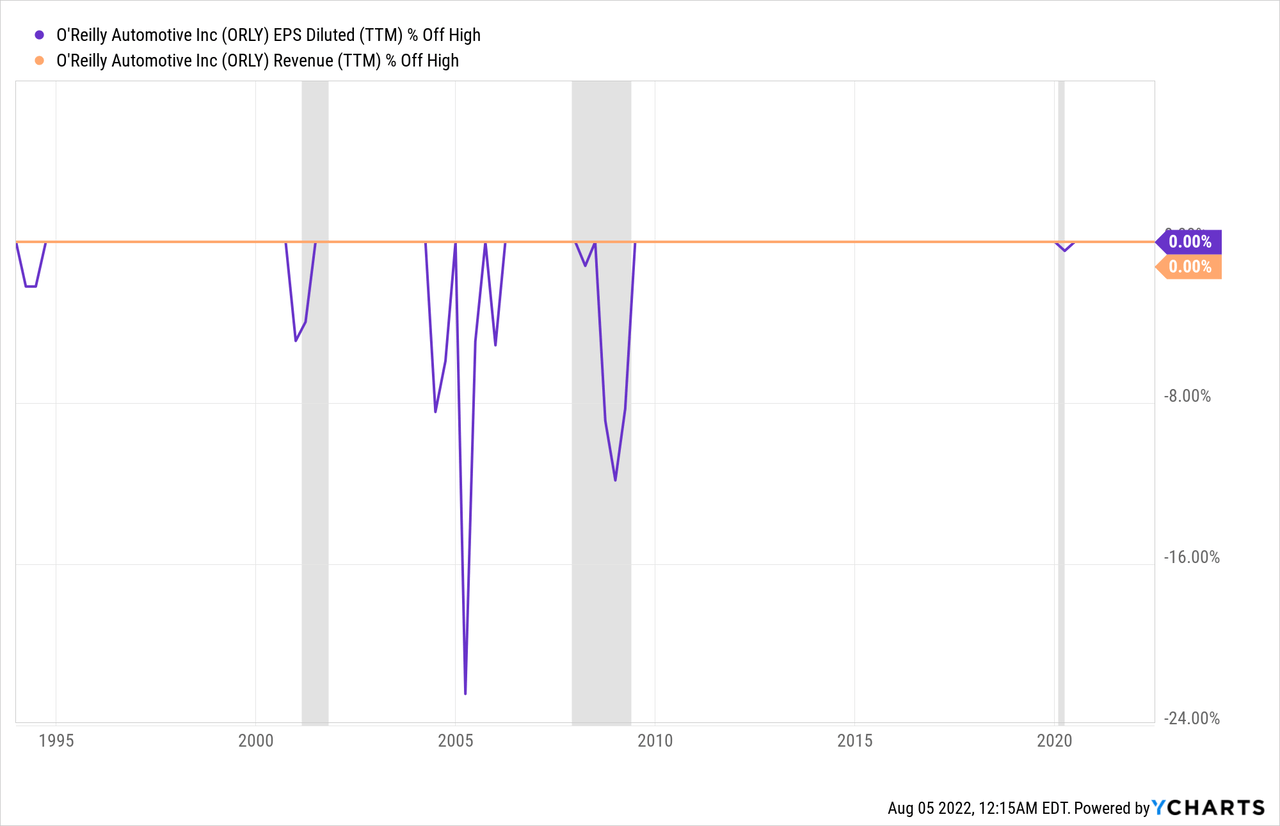

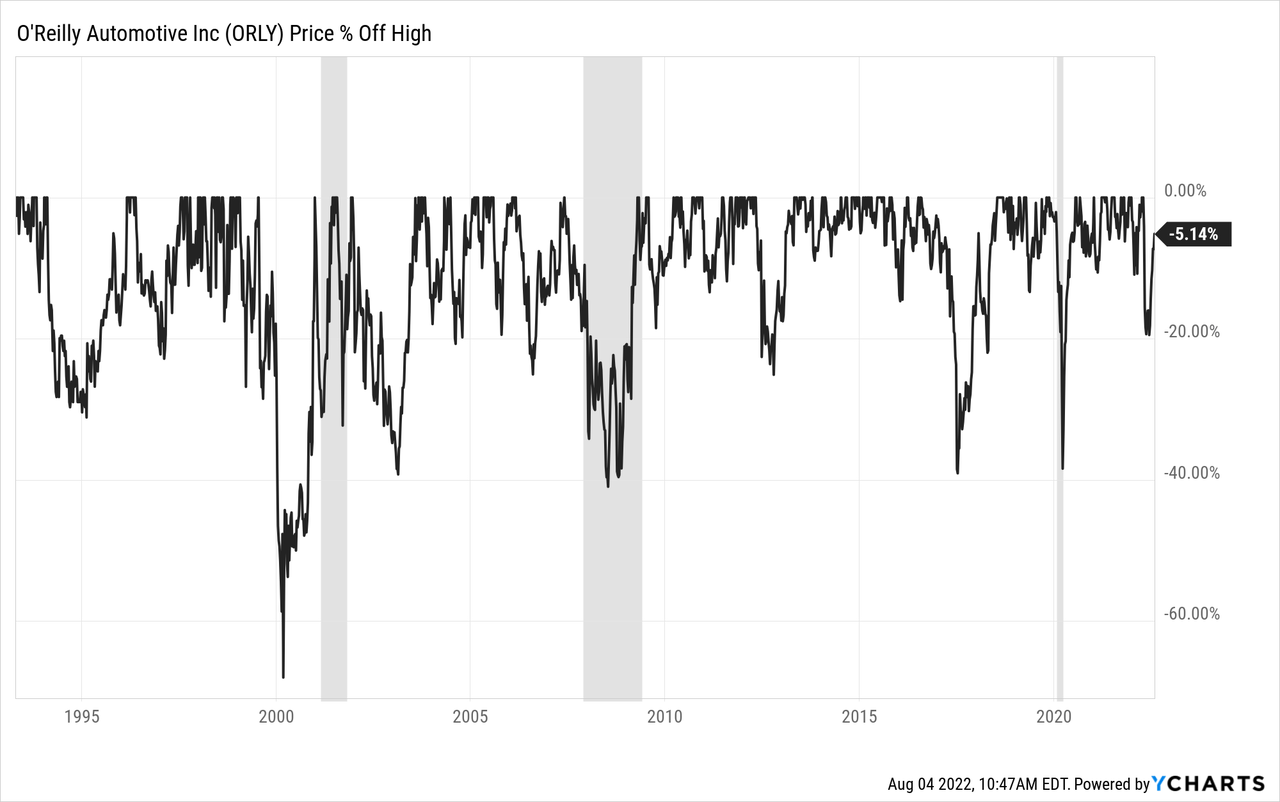

However, when looking at O’Reilly’s revenue in the last three decades, we can’t see any declines at all, and the business could grow in every single recession. Earnings per share however did react to recessions, but declines were rather moderate, and the steepest decline was about 22% (and that was not even during a recession).

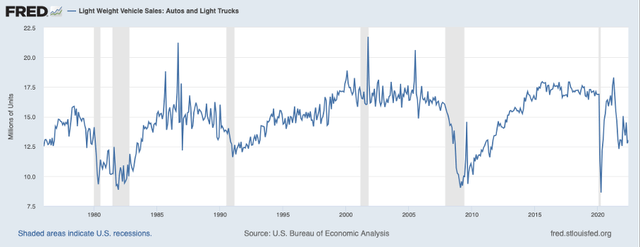

When looking at the stock performance in the past, we can certainly see O’Reilly reacting to a recession and the stock price declining, but declines are not so steep as one might expect. At first, the performance of O’Reilly Automotive during recessions might be surprising. Usually, the automotive industry is hit hard during a recession. When looking at light vehicle sales during past recessions, we see the numbers declining in most cases. The decline was especially steep during the Great Recession and during COVID-19 (but lockdowns and closed stores were probably the main reason in this case).

One possible explanation for O’Reilly’s solid performance during past recessions might actually be the declining sales of new cars. When people don’t buy new cars, they must use their old car longer than planned and might need more tools, parts, and equipment as well as more service for these rather old cars. And O’Reilly might profit from these trends.

A second explanation for O’Reilly’s great performance in the past might be the fact that O’Reilly was a rather small business in its growth phase and therefore able to continue growing during recessions. But with the business getting larger and larger (and more mature) this might not be true in future recessions.

For the next potential recession, we can assume O’Reilly performing quite well again, but I would not count on it as declining earnings per share (and revenue) are certainly a possibility. But it seems like O’Reilly Automotive is able to withstand a recession to a reasonable degree.

Growth

When turning away from the negative side and the question if and how much a potential recession will affect O’Reilly, we can also look at the growth potential of the business in the years and decades to come.

One way to grow for the business is by opening new stores. And opening new stores is certainly a key growth driver for O’Reilly and the company wants “aggressively open new stores” (according to its 10-K). In fiscal 2021, the company opened 168 new stores (165 in the United States and 3 in Mexico). The company claims to be able to operate its stores better in less densely populated areas than competitors and might therefore be able to also open stores in areas where competitors might not be able to operate stores profitable.

Although management is quite confident that it can continue to open stores, the company might at some point start to cannibalize sales of its own retail stores – at least in the United States. Right now, there is about one store per 57,000 residents in the United States and despite other chains – like Starbucks (SBUX) or McDonald’s (MCD) – having a much higher density, I would expect the density already being rather high for a specialty retailer. In my opinion, O’Reilly probably must focus on international expansion in the years to come to continue opening stores with such a high pace or otherwise margins of the new stores might decline.

Of course, O’Reilly can grow its top line not only by opening new stores, but also by increasing sales in already existing stores. Maybe O’Reilly can increase its prices a little more than competitors (to increase the top line) but not aggressive as the switching costs are low and customers might go to a competitor instead (see also section about economic moat).

Aside from opening new stores and increasing same-store sales, O’Reilly can also grow its top line by acquisitions. In its 10-K, O’Reilly also writes that the automotive aftermarket industry is still highly fragmented, and management is expecting the industry to consolidate in the years to come. And O’Reilly will also take part in the consolidation progress by making strategic acquisitions in the years to come which will contribute to top line growth.

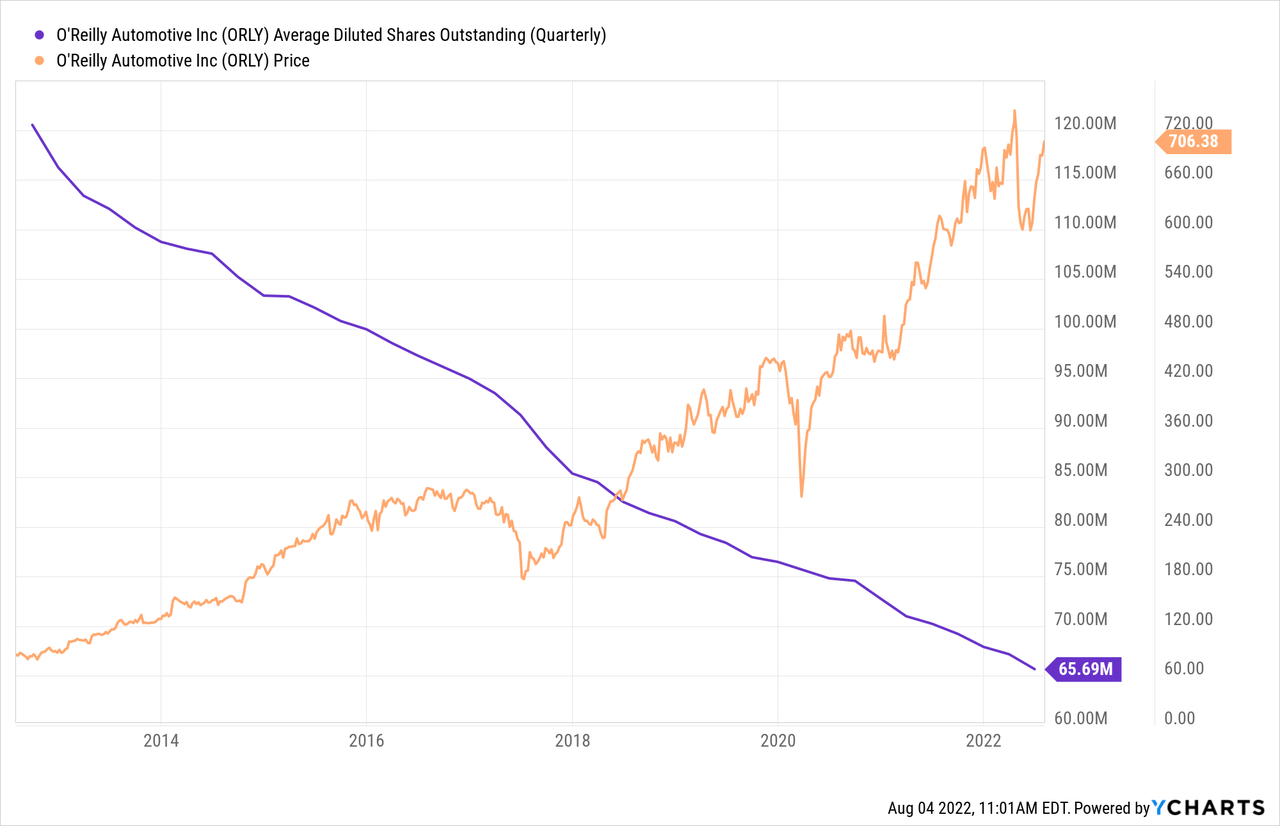

And like every other business, O’Reilly can grow its bottom line not only by growing the top line but also by making its business more efficient (and improving margins) or using share buybacks. And in case of O’Reilly share buybacks contributed a lot to growth in the last ten years. The number of outstanding shares was almost cut in half in the last ten years – reduced from about 120 million ten years ago to about 65 million right now. This is resulting in a CAGR of almost 6% and is part of the explanation why the company could grow earnings per share with such a high pace.

However, it seems unlikely for O’Reilly to continue purchasing shares with a similar pace in the coming years. At current share prices, the company is not generating enough free cash flow to repurchase 6% of its outstanding shares. And when looking at the balance sheet with $254 million in cash and cash equivalents but $4,670 million in long-term debt there is also no net cash position that could be used for repurchasing shares.

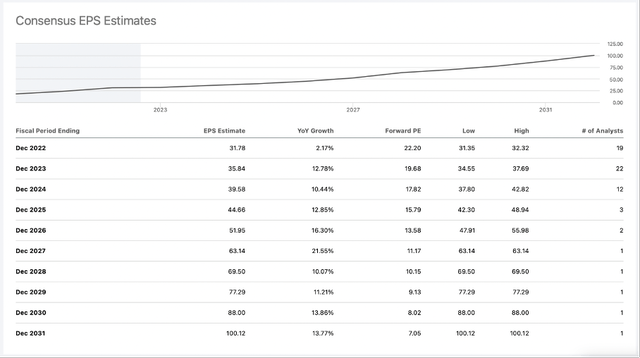

Earnings Estimates for O’Reilly Automotive (Seeking Alpha)

Nevertheless, analysts are quite optimistic for O’Reilly being able to grow in the double-digits in the years until fiscal 2031 and are expecting a CAGR of 12.40% for the next ten years.

Intrinsic Value Calculation

When trying to answer the question if O’Reilly is a good investment right now, we can use a discount cash flow calculation to determine an intrinsic value for the stock. As basis for our calculation, we can take the midpoint of the company’s own free cash flow guidance, which will be around $1.45 billion. To be fairly valued right now, O’Reilly must grow its free cash flow 10% annually for the next ten years followed by 6% growth till perpetuity. When looking at the last two years, free cash flow was much higher than the expected free cash flow for fiscal 2022 and hence we can argue if we should not use a higher free cash flow in the years to come.

On the other hand, we also must consider a potential recession, which might also have a negative effect on free cash flow. Let’s be rather cautious and assume free cash flow will decline 20% in fiscal 2023 due to a potential recession, but in fiscal 2024 the company will reach $2 billion in free cash flow again (in fiscal 2020 and fiscal 2021, the amount was even higher). To be fairly valued, O’Reilly now has to grow 7% annually from fiscal 2025 till the end of the next decade followed by 6% growth till perpetuity.

And although we must assume growth rates slowing down in the years and decades to come, 7% growth seems achievable for O’Reilly considering it is able to grow the top line and use share buybacks to increase the bottom line. Analysts are much more optimistic (see above), and we certainly can make the case for O’Reilly being a bit undervalued right now.

Conclusion

Although O’Reilly Automotive does not look like a wide economic moat business at first look, the company seems to have a competitive advantage and the business is outperforming with an impressive pace for several decades in a row. We can identify O’Reilly as a solid long-term investment and the stock seems to be at least fairly valued (might be even undervalued).

Nevertheless, I would be slightly cautious how wide the economic moat actually is, and I would also not be surprised if growth rates will slow down at some point in the next few years. Due to these uncertainties, I would see the stock rather as a hold right now.

Be the first to comment