Mindful Media

During uncertain times, it can pay off immensely to buy into companies that are going to be stable moving forward. The most stable companies are often those that have a sizable market share in a space that should experience robust demand almost irrespective of what the broader economy goes through. In truth, there aren’t that many industries or companies that fit this description. But in my opinion, one space that does is the waste management space. And what better company to consider buying in this market than industry leader Waste Management (NYSE:WM). Although not the cheapest stock on the planet, the company has a good degree of stability, and the long-term outlook for the enterprise should be promising. Due to these factors, I feel as though the enterprise makes for a soft ‘buy’ at this time, reflecting my belief that shares should outperform the broader market by a small but measurable amount over the long haul.

Trash pays

As the company’s name suggests, Waste Management focuses on providing services dedicated to getting rid of and even recycling waste. As of the end of its 2021 fiscal year, the company owned or operated 260 landfill sites, making it the largest network of landfills throughout the US and Canada. In addition to these assets, the company also manages no fewer than 340 transfer stations that work to consolidate, compact, and transport waste as efficiently and economically as possible. Through some of its operations, the firm also utilizes waste to create energy, namely by recovering the gas produced naturally from the waste decomposition method and using that gas in generators to make electricity. Its operations also include recycling activities throughout the US and Canada, with the end result being the production of cardboard, paper, glass, plastic, metal, and more.

On the renewable energy side of things, it’s worth noting that the company had, at the end of 2021, four facilities that produce around 3.2 million MMBtu of RNG (renewable natural gas) per annum. This has been pointed to as a major growth opportunity for the firm, with the enterprise adding another such facility throughout 2022. At present, this portion of the enterprise accounts for less than 2% of the company’s revenue. But in time, management hopes that this number will grow significantly. They are spending around $275 million on renewable energy projects this year alone, with an incremental $550 million in planned expenditures between 2023 and 2025. By 2026, the company hopes these investments to result in $400 million of run-rate EBITDA per year. If this comes to fruition, it would mean that the company will have added another 17 projects totaling 21 million MMBtu per year by 2026.

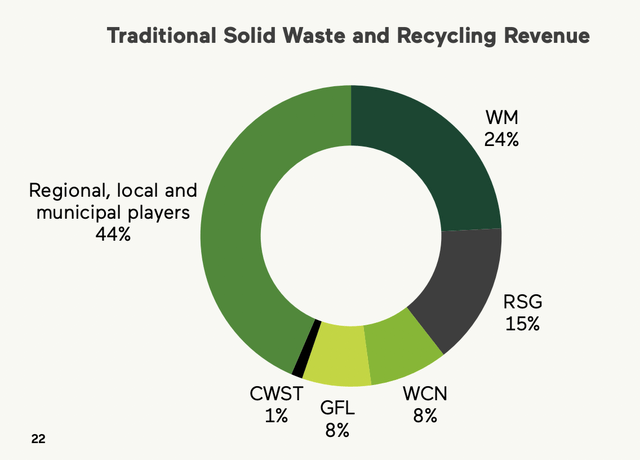

The reason why management seems to be dedicated to this kind of activity is because it already has a very large stake in the traditional solid waste and recycling market. In the markets in which it operates, it claims a 24% share of total revenue. The next largest competitor stands at only 15% by comparison. This does not mean that the company will not be focused on growing this portion of the enterprise further. In fact, this year alone, the company plans to spend between $300 million and $400 million on acquisitions, almost certainly dedicated to the regional, local, and municipal players that collectively make up 44% of industry sales. This is on top of the 88 acquisitions that the company has made over the past five years that have collectively added $560 million to its top line.

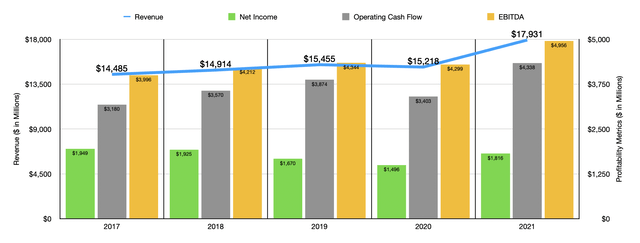

Thanks to the investments that management has made, combined with steady growth over the years, the firm has achieved consistent revenue expansion from year to year. Back in 2017, the company generated sales of $14.49 billion. By 2021, this number had jumped to $17.93 billion. The year-over-year increase between 2020 and 2021 was an impressive 17.8%, with $1.03 billion associated with acquisitions, while $1.25 billion involved higher pricing charged to customers. Increased volume, meanwhile, made up $435 million of its sales increase.

On the bottom line, the picture has been a bit volatile. Between 2017 and 2021, net income for the company has remained mostly in a fairly narrow range of between $1.50 billion and $1.95 billion. Last year, profits were $1.82 billion. Although this may be disappointing to some investors, other profitability metrics have generally fared well over time. Operating cash flow, for instance, increased from $3.18 billion in 2017 to $4.34 billion last year. Meanwhile, EBITDA for the company expanded from $4 billion to $4.96 billion.

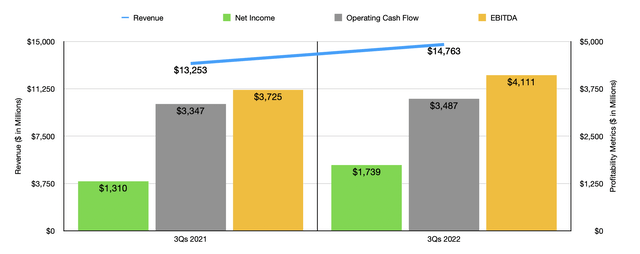

Growth for the company has continued into the current fiscal year. In the first nine months of 2022, sales came in at $14.76 billion. That represents an increase of 11.4% over the $13.25 billion the company generated the same time last year. Other metrics have also followed suit. Net income, for instance, jumped from $1.31 billion to $1.74 billion. Operating cash flow rose from $3.35 billion to $3.49 billion. And over that same window of time, we also saw EBITDA expand from $3.73 billion to $4.11 billion.

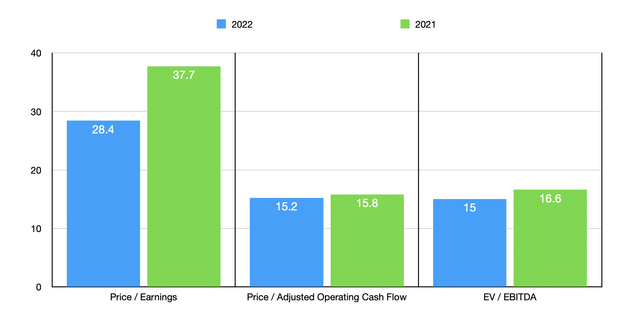

Clearly, the picture for the company is looking up. Unfortunately, we don’t really know what to expect from the financial picture in the near term. But if we annualize results experienced so far, we should anticipate net income of $2.41 billion, adjusted operating cash flow of $4.52 billion, and EBITDA of roughly $5.47 billion. Based on these numbers, the company is trading at a forward price to earnings multiple of 28.4, at a forward price to operating cash flow multiple of 15.2, and at a forward EV to EBITDA multiple of 15. By comparison, if we were to use the data from 2021, these multiples would be somewhat higher at 37.7, 15.8, and 16.6, respectively. As I often do in my articles, I decided to compare the business to a couple of similar firms. In this particular case, I compared it to Republic Services (RSG) and Waste Connections (WCN), its two largest rivals. As you can see in the table below, Republic Services does seem to be trading at a slight discount to Waste Management from a cash flow perspective. By comparison, Waste Connections is considerably pricier. But considering that its smaller size permits it to grow more rapidly (at least in theory), this pricing may not be out of the range of rationality.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Waste Management | 28.4 | 15.2 | 15.0 |

| Republic Services | 29.3 | 14.0 | 14.1 |

| Waste Connections | 43.4 | 18.2 | 19.1 |

Takeaway

Based on all the data provided, I will say that I am impressed by the size and quality of the operation that is Waste Management. No, this is not the kind of company that will achieve rapid growth for its investors. But the firm should continue to grow steadily over time, especially as long as this renewable energy opportunity exists. Shares are not exactly in the value territory. But they don’t seem unreasonable for an industry leader with such robust cash flows. Because of this, I feel as though a soft ‘buy’ rating makes sense for Waste Management at this time.

Be the first to comment