Oselote

In my last article on the SLV on October 27 I noted that there were signs of a major low for silver prices, and since then the ETF has risen by 20% as silver has rallied back into their previous trading range. The rise in silver prices has occurred alongside the easing of monetary conditions, with declining real bond yields helping drive demand for the metal as a store of value. This upside pressure has more than offset the drag from weakness in the broader commodity complex. Despite the recent gains, and the rising risk of a credit crunch, silver remains cheap from a historical perspective, and I remain long the SLV.

The SLV ETF

The iShares Silver Trust (NYSEARCA:SLV) has tracked the spot price with a median 12-month tracking error of just 0.48%, and should continue to offer investors direct exposure to the metal. With an expense fee of 0.50%, this is far lower than the spreads on buying the physical metal. SLV is the largest and most liquid silver ETF, but has a slightly higher expense ratio relative to others such as the Aberdeen Standard Physical Silver Shares ETF (SIVR). Inflows into the SLV have failed to recover in line with the price of silver, languishing near mid-2020 levels and down 30% from the Reddit-driven spike of February 2021.

Back Into Its Prior Trading Range

The technical picture of the SLV looks highly attractive once again, with the ETF moving back into the trading range where it spent most of the past two years. The recovery of the USD20 level was a key milestone and the next level of resistance comes in at around USD23, where down trendline resistance comes into play. A break above here would suggest a potential large bull flag breakout and allow bulls to focus on a return to the Reddit-inspired silver squeeze which saw SLV spike to just below USD28.

Easing Monetary Conditions Breathe Life Into Precious Metals

Over the past two months long-term interest rate expectations have fallen sharply, and even as inflation expectations have also fallen, real 10-year bond yields have moved lower by around 50bps. This has been enough to reignite demand for precious metals as a store of value, with gold prices moving higher. As is typically the case during rallies in gold prices, silver has outperformed.

Gold Vs 10-Year Inflation-Linked Bond Yield (Bloomberg)

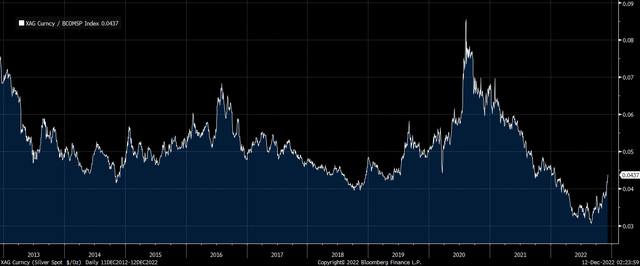

The rise in monetary demand for precious metals has more than offset the impact of lower commodity prices. Since the multi-year low seen on September 1, the ratio of silver prices to the Bloomberg Commodity Complex has risen by 43%.

Ratio Of Silver To Bloomberg Commodity Complex (Bloomberg)

Despite the recent outperformance of silver relative to gold and the commodity complex, the metal remains deeply undervalued based on its long-term correlation with a 50:50 basket of gold and the Bloomberg Commodity Complex. Silver is still 30% below its fair value on this metric, which is the most undervalued it has been at any point over the past 40 years excluding the past year. From a long-term perspective, such a degree of undervaluation implies roughly 10% annual returns over the next decade.

A Credit Crunch Is The Main Risk

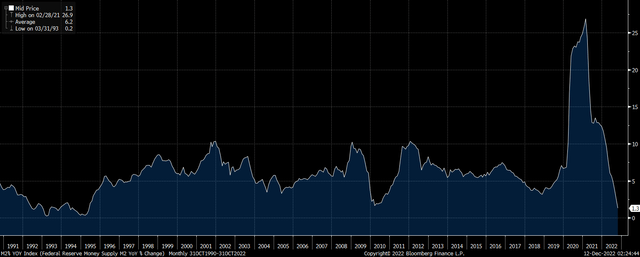

While I believe that we have seen the peak in real bond yields, there is a risk of a deflationary credit crunch that could cause real yields to spike as was the case during 2008 and 2020, which saw silver prices fall sharply. The ongoing collapse in money supply has seriously reduced medium-term inflation potential, and a resumption of asset market weakness could see a self-fulfilling surge in demand for dollar cash. While this is risk to silver prices, such an episode would likely improve the long-term outlook for the metal as the Fed and Treasury would have the flexibility to engage in additional monetary and fiscal stimulus.

M2 Money Supply Growth (Federal Reserve)

Summary

The SLV is a well-placed ETF to benefit from the resumption of the long-term bull market in silver prices. Despite the strong rally off of the recent lows, and its outperformance relative to gold and the commodity complex, silver remains deeply undervalued from a long-term perspective. The main risk comes from a sharp fall in inflation expectations amid the collapse in money supply and a potential rise in global risk aversion. However, any such event would further improve the long-term outlook for the metal as policymakers respond with additional rounds of stimulus.

Be the first to comment