Hispanolistic/E+ via Getty Images

Olo Inc. (NYSE:OLO) is among many other growth stocks that have seen their share price obliterated over the past year, falling as much as 82% from the all-time high. I continue to review growth stocks that are severely impacted by the bear market as there is a potential to find a great deal; I must say that Olo is definitely an interesting company, however, I still find current prices too risky considering some warning signs on the company’s operation. For this reason, I consider the stock for now as a hold and will monitor it closely for the future quarters. Let’s see why I believe this is the case.

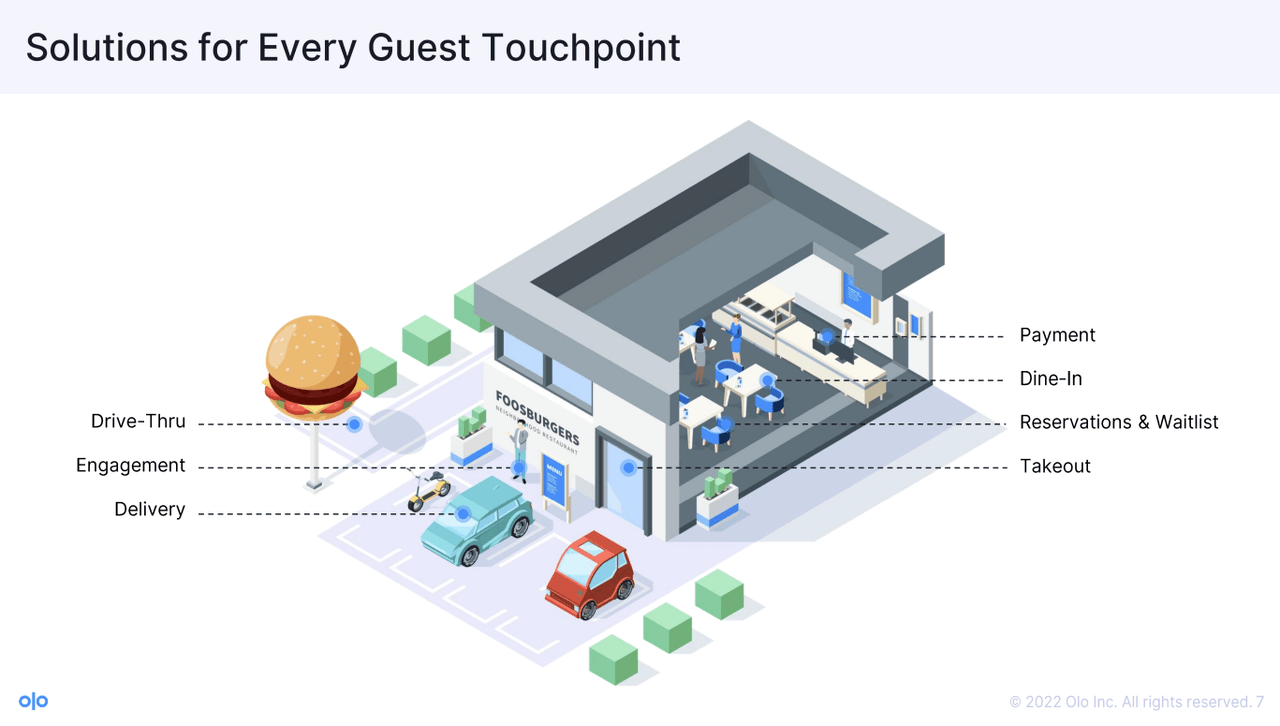

Olo wants to digitize the restaurant industry

Olo Q2 2022 Earnings Report

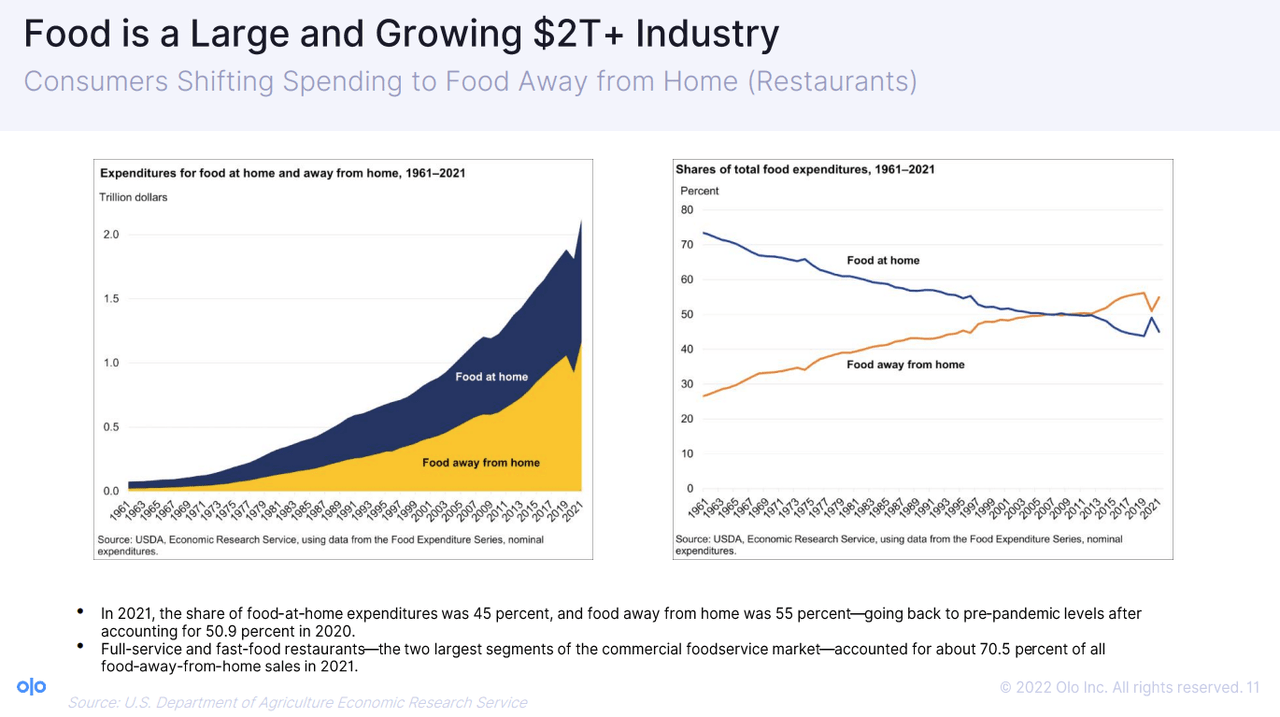

The thesis behind an investment in Olo is that consumers are increasingly eating out instead of cooking at home. Over the decades, the share of expenditures for food at home steadily declined in favour of eating outside of home. In 2021, according to a U.S. Department of Agriculture research note shared by Olo’s management, U.S. consumers dedicated 55% of their budget for food for eating out, almost back at pre-pandemic levels and consistently up during the past 60 years.

Moreover, as per data provided by management only 15% of total restaurant orders are digital. One of the thesis for investing in Olo is that the restaurant industry has been historically one of the more resistant to adopt digital solutions. Restaurants generally rely on legacy systems for their internal needs and at the most delegate to third party delivery operators the digital side of their business. In doing so however they forgo any direct relation with their customers while also renouncing a generous share of the profits. Olo believes there is a potential for disruption and offers restaurants an independent and open Software-as-a-Service platform that allows them to digitally manage orders, delivery and direct engagement with customers by retaining data on their behaviour. Recently it also expanded in the payment ecosystem with Olo Pay, managing the money transactions themselves while retaining a small percentage as fees. The intriguing part of managing transactions is that allows Olo to directly grow together with its customers, as the more they earn the more Olo retains as well: Olo Pay has the potential in my opinion to quickly be very lucrative for the business as we have seen in other similar contexts such as Shopify Pay (SHOP) or Mercado Pago (MELI).

Olo Q2 2022 Earnings Report

Overall, I actually think the thesis behind Olo is very interesting. The restaurant industry does indeed seem ripe for digitalization and there is a good chance Olo will be able to grow in conjunction with the market itself. Having structural tailwinds behind is very important but a company must also operate successfully, and Olo has somewhat stumbled recently. Let’s review the latest quarter.

The market did not like Olo’s second quarter

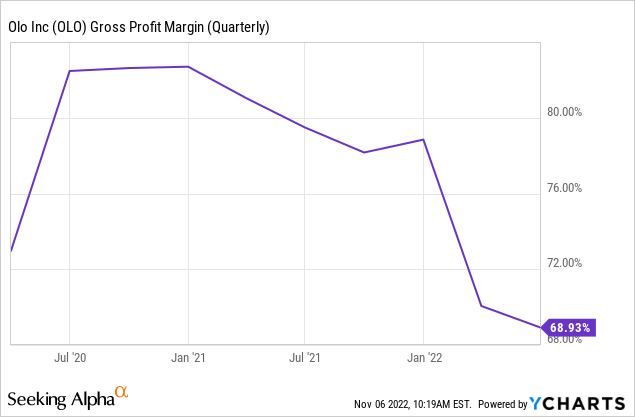

Olo reported earnings for its second quarter 2022 on August 11 and the market definitely was not happy, sending the share price down about 30%. Revenue came in at $45.6 million, up 27% YoY. Gross Margin was severely impacted, dropping from 79.49% to 68.93%, which is also the lowest it has ever been for any quarter for the past two years. Olo exemplifies how the pandemic was not able to structurally change people’s habits and create a new normal, but rather it upended temporarily our lives without structurally changing them. After reaping the benefits of having nearly everyone locked at home unable to order restaurant food if not through digital channels, the business went through a clear normalization path over the past two years. Since reaching 82.70% in the quarter ending in December 2020 (at the height of the pandemic), gross margin consistently declined. Same story with operating margin, which turned very much positive during COVID but rapidly went back to negative after the boost ended, and in the latest quarter came in at negative 25%.

For comparison, Seeking Alpha compiled data shows that the business is quickly reverting back to normalized margins last seen in 2018 and 2019 (65.98% and 69.25% gross margin, respectively).

YCharts

I believe the drop in gross margin needs to be closely monitored as it can be a sign that Olo is finding it hard to attract new customers. Although gross margin was impacted by the acquisition of Wisely and Omnivore, management has confirmed that during the quarter it has increased compensation costs to support new locations coming onto the platform, which has contributed to higher cost of revenue. If gross margin keeps going down it might be an indication that the value offered by Olo to its customers is not as high as management thinks and will obviously impact the future growth.

From a cash management point of view, Olo’s profile always appeared quite better. The company was operating quite thrifty even in the years before COVID, having reported a Free Cash Flow loss of just $4 million in 2018 and a gain of $1 million in 2019. As previously mentioned, 2020 was a hypergrowth year and the supercharged operations generated around 20 million of FCF that year. Interestingly though, while on a GAAP basis operating margin quickly deteriorated already in 2021, in that year the company still managed to generate $14.5 million of FCF. However, in the current fiscal year, Olo could not manage to retain much cash and has basically returned to break-even operation. During the second quarter 2022, the company FCF amounted to negative $0.3 million.

Management’s commentary during the Earnings Call helped paint the picture of a restaurant industry that is experiencing near term headwinds. Costs are going up very rapidly, consumers are wary of discretionary spending and as a result Olo is finding a harder time to increase the customer base and to upsell new modules:

Currently, the industry is facing major challenges brought on by the residual impacts of the COVID-19 pandemic, including structural labor challenges, margin pressure due to inflationary economic conditions, as well as supply chain challenges, and resulting concerns related to a recessionary environment. These industry dynamics have impacted our customers and prospects in two ways. At the brand level, these challenges have resulted in elongated sales cycles, as fewer brand resources have lengthened the decision-making process. And at the operator level, these challenges have resulted in elongated deployment timelines, as many operators are unable to deploy in a timely manner.

Another sour note was the loss of Subway as a customer. Olo was able to add 3,000 new locations over the quarter, which helped to offset the loss of part of Subway locations and maintain the customer base essentially flat quarter over quarter. As a consequence of both the Subway loss and macro uncertainties, management has lowered full year guidance to $183/$184 million in revenue and a non-GAAP operating income of $7.6/$8.4 million.

Overall, the quarter was rather unexpectedly a difficult one. I don’t think anybody was particularly surprised to learn that sales cycles are becoming longer and budgets are tighter now, as we have been hearing the same from so many other companies. The share price movement on the earnings day was severe, but I don’t think that there was anything in particular (other than worrying gross margin decline) that spells trouble for the future of the company. Olo is still operating basically at break-even while having a very safe balance sheet thanks, among other things, to stock-based compensation.

Very high stock-based compensation is impacting shareholders

The difference between GAAP results and the Free Cash Flow is naturally made mostly by Stock Based Compensation. During 2021 the company rewarded its employees by issuing stock valued at $32.7 million, which even increased in the first two quarters of FY2022 as a combined $23.2 million has already been issued. With the stock price down so much since the company’s IPO, the benefit of the additional shares issued over the past 2 years will likely not amount to much, making it particularly hard for Olo to retain its talents. At the same time however, current shareholders are still being diluted at a rather high pace: the first two quarters saw total shares outstanding grow 8-9% YoY, which is generally very high and has definitely contributed to the poor performance of the stock.

In an attempt to keep under control shares dilution, the company has recently announced a $100 million stock buyback program without expiration date. At the moment the stock price is extremely depressed compared to mid-2021 (Olo is currently valued at just $1.29 billion), therefore management could potentially repurchase around 7% of outstanding shares. I find this move interesting: from one point of view, seeing a company buy back stock when things look ugly rather than when the stock price is at all time high is refreshing, as it unlocks a much higher value all else being equal; at the same time, given that Olo is not generating meaningful free cash flow anymore the company would essentially put at use cash from its balance sheet for buy back shares. This suggests to me that management has no other better use for cash for now, which is rather disappointing considering that Olo is supposedly a growth story chasing after a generational shift. Is there really no other good use for cash? It does raise some questions. Nevertheless, the balance sheet remains in great shape at the moment with $460 million in cash and zero debt.

Conclusion

I personally like Olo’s story as I tend to favour companies that are lifted by structural, generational shifts. The restaurant industry’s future seems destined to be much more digital than in the past and Olo might be able to seize a good chunk of the market for itself. Nevertheless, the story is only at the beginning and the stock at the moment seems challenged. I personally don’t like these high levels of stock-based compensation and I am not entirely convinced that deploying $100 million for a share buyback program now is the best way to allocate capital, as I would expect Olo to have more growth-oriented endeavours to fund. I would much rather see the company rely less on SBC as a whole while funding growth initiatives. Moreover, I find worrying the steep drop in gross margin as I believe it might be an alarm bell for the future as explained above. The stock is trading currently at a Price to Sales ratio of 7.5, which in this market is still a premium and as such further adds risks to the picture.

At the moment I believe Olo is a good watchlist stock as I like the story, but I would rather wait and see how the company navigates the tough times ahead; if the stock drops much more in the future it could become interesting quite quickly.

Be the first to comment