AzmanJaka/E+ via Getty Images

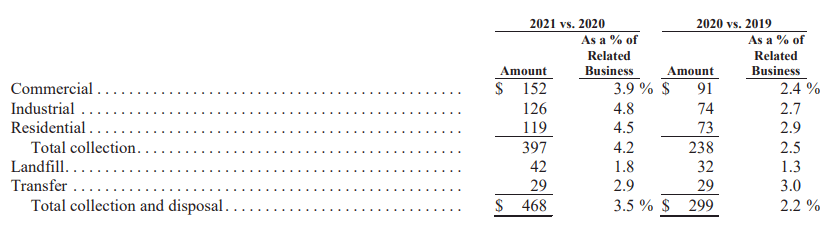

Waste Management (NYSE:WM) reported a strong year in 2021. Revenues rose to USD 17.9 billion in 2021, up 17.8% YoY driven by its acquisition of Advanced Disposal, record high prices for recycling commodities (average market prices for recycling commodities sold by the company were approximately 115% higher in 2021 compared to 2020), strong collection and disposal yield growth (average collection and disposal yields rose to 3.5% in 2021 from 2.2% the previous year), and higher volumes (up 2.8% in 2021 excluding acquisitions and divestitures, on the back of a recovery in business activity after pandemic-induced closures caused a 4.5% decline in volumes in 2020 compared with 2019). Operating profit rose to USD 2.96 billion from USD 2.43 billion in 2020 while operating margins rose to 16.5% from 16% the previous year driven by improving profitability in the company’s recycling business and strong operating results in their collection and disposal business. Although inflationary pressures ate into operating profits, the company’s pricing actions helped mitigate the impact as reflected in strong average yield growth in their collection line of business helping push up overall average yields.

Waste Management 2021 Annual Report

Going forward, Waste Management has multiple positives. In the short term, the impact of further pricing actions is expected to show up in 2022 (due to certain multi-year contracts containing provisions that restricted the company’s ability to increase prices and the timing of those increases) which should help support operating margins in the coming year. Meanwhile, the company’s acquisition of Advanced Disposal is already generating synergies that have exceeded management’s initial expectations (around USD 80 to USD 85 million in 2021), and is on track to achieve USD 150 million in total annual cost and capital savings.

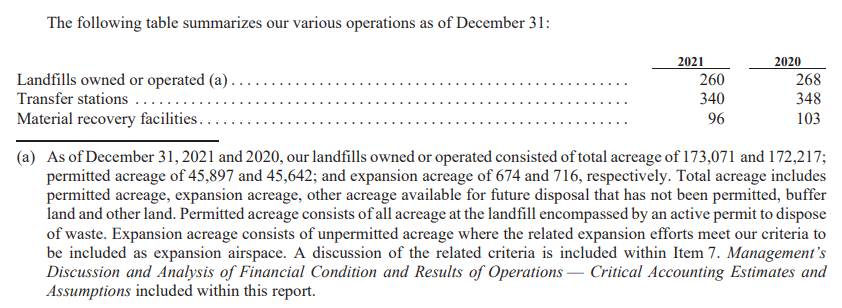

Looking ahead in the longer term, North America’s waste market management market is stable (with single-digit growth rates expected in the coming years). Poised to benefit is Waste Management Inc, the U.S. waste market leader; with a network of about 260 landfills as of 2021, Waste Management Inc has one of the largest networks of landfills throughout the U.S. and Canada.

Waste Management 2021 Annual Report

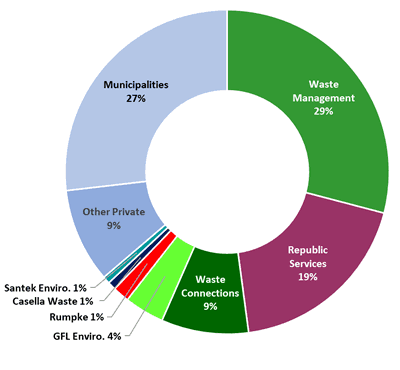

Accounting for about a third of landfill volume managed, Waste Management is far ahead of its closest rivals Republic Services (19% share) (RSG) and Waste Connections (9% share) (WCN). Waste Management gained 2% market share in 2021 from its acquisition of Advanced Disposal in 2020 while GFL Environmental gained 2% to 4% in 2021 as it purchased the divestitures required to complete the Advanced Disposal acquisition. Waste Management’s closest rival Republic Services’ market share remained unchanged in 2020 and 2021. While this could change given ongoing consolidation in the sector, given Waste Management’s considerable lead, the company looks likely to maintain its market leading position in the foreseeable future.

environmentalleader.com

Moreover, steep capital requirements and costs associated with landfill development and ownership, challenges obtaining regulatory permits for hazardous waste landfills as well as costs associated with operating such landfills according to environmental regulations present a major barrier to entry in this space which suggests Waste Management’s dominant position is not likely to be challenged anytime soon.

Continuing investments to drive future growth and profit

Management has announced major investments to boost the company’s renewable energy generation capabilities, recycling capabilities, and reduce labor intensity through investments in automation. Automation can not only insulate the company from labor shortages and wage inflation such as those faced last year but can also potentially yield labor cost savings. Automation technology investments include customer services digitization, and collection automation. The company does not intend to implement any large scale layoffs arising out of the automation of these positions but instead aims to implement these initiatives through the natural attrition cycle which suggests those cost savings could show up in the medium term. Driven by greater automation spending, Waste Management expects to trim as many as 5,000 to 7,000 jobs through attrition in the next four years, most of which will be on the collection side as automated side-load collectors are expected to replace at least 3,000 rear-load trucks.

On the recycling side, Waste Management expects to invest USD 800 million (USD 275 million in 2022 and USD 525 million from 2023 to 2025) on new materials recovery facilities (MRFs) and on accelerating automation upgrades to a number of their single-stream recycling facilities. These upgrades have already helped boost earnings contribution and margins for the company and further investments could increase operational efficiencies and profitability going forward. Management expects this investment to generate incremental EBITDA of approximately USD 180 million by 2026.

The company intends to invest USD 825 million (USD 275 million in 2022 and a further investment of USD 550 million planned in 2023 through 2025) to expand their network of renewable natural gas plants. Management expects this investment to generate incremental EBITDA of more than USD 400 million by 2026. Combined, this amounts to incremental EBITDA of about USD 580 million over the next four years, about a tenth of the company’s 2021 EBITDA of around USD 5 billion.

Financials

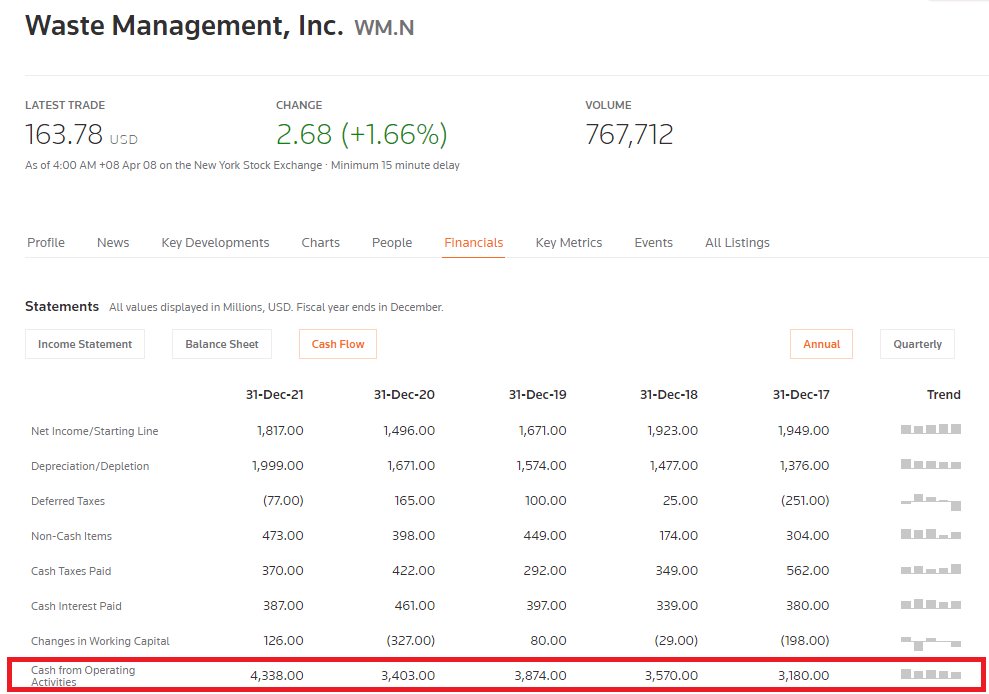

With a long-term debt to equity of 178.2% according to their most recent quarter, Waste Management is quite highly leveraged however a net interest coverage of 7 times indicates the company can comfortably make interest payments and operating cash flows have been on an uptrend.

Reuters

Although M&A activity is high in the industry, Waste Management is exercising discipline, with CEO Jim Fish explaining they would rather grow organically then pay high premiums on acquisitions which suggests the possibility of further big-ticket acquisitions are unlikely which should help maintain its leverage ratio.

In other areas, Waste Management is comparable to peers.

Risks

Zero-landfill waste goals

Landfills are currently the primary waste disposal method in the U.S. Driven by growing environmental concerns, governments and consumers are increasingly setting zero-landfill waste goals and diverting waste to landfill alternatives such as recycling, waste reduction. Naturally this can curb waste volumes thereby affecting revenues, and given that landfills generate the highest operating margins for Waste Management Inc, profitability could be affected as well.

Summary

Waste Management Inc has reported a solid year and prospects are stable. The waste management market is a mature industry with steady long-term growth, and with North American market leader Waste Management’s dominant market position not likely to be challenged in the near future, the company should continue generating consistently solid results. Waste Management is actively investing in automation to help increase operational efficiencies, the results of which should benefit in the coming years (as workforce reduction is expected through attrition rather than large scale layoffs). Although Waste Management is quite highly levered, the company can comfortably make interest payments and operating cash flows have been on an uptrend.

Be the first to comment