Andrii Yalanskyi/iStock via Getty Images

In general parlance, the term duration refers to a time frame, but when it is used in the context of bonds, it means something more. Bond duration is a measure of how sharply the price of a bond will change in response to changes in interest rates. A higher bond duration means a greater level of interest rate risk, and knowing that can help investors decide whether a particular bond is a good investment.

How Bond Duration Works?

To understand how bond duration works, it’s helpful to understand how bonds work. A bond is a loan an investor makes to a corporate or government borrower who must repay the price of the bond along with interest by the bond’s maturity date. All bonds have the following characteristics:

- Issue price: the price at which the bond issuer originally sells a bond.

- Par or face value: how much the bond will be worth at its maturity, and it is the base amount on which a bond’s interest is calculated.

- Coupon rate: the interest rate paid on a bond and it is a percentage of the face value; for example, a bond having a coupon rate of 5% and a face value of $1,000 will pay bondholders $50 every year, or $25 semi-annually.

- Coupon dates: dates on which the bond issuer makes interest payments, most bonds pay interest semi-annually.

- Maturity date: the date on which the bond issuer will pay the bondholder the face value of the bond; for example, the maturity date of a 30-year Treasury bond is 30 years.

- Yield to maturity: the annual return an investor will achieve if they buy a bond and hold it to maturity. Yield to maturity will depend on the purchase price of the bond in the secondary market.

The coupon rate is determined by the bond issuer’s creditworthiness and the time to a bond’s maturity. This is because for bonds having longer maturities, interest rates might rise during the lifetime of the bond, meaning that the investor could have achieved a higher interest rate. Also, if inflation rises during a bond’s lifetime, if the coupon rate isn’t the same as or higher than the inflation rate, the investor is in essence losing money. In 2021, the inflation rate was 7.5%, so investors holding bonds having coupon rates lower than 7.5% actually lost money.

Interest rates are determined by the Federal Funds Rate which is the interest rate that banks charge other banks to lend them money on an overnight basis. The Federal Funds Rate is set by the Federal Reserve, who increases or decreases the rate to respond to changes in the economy. A lower Federal Funds Rate means banks have more money to lend and the economy is stimulated. A higher Federal Funds Rate means banks have less money to lend and the economy is dampened.

When the Federal Reserve raises interest rates, investors look to higher-yielding investments over bonds, and they sell their bonds, often for less than the issue price, lowering their prices. When the Federal Reserve cuts interest rates, investors flock to bonds issued at times when rates were higher, raising their prices.

What Does Duration Mean?

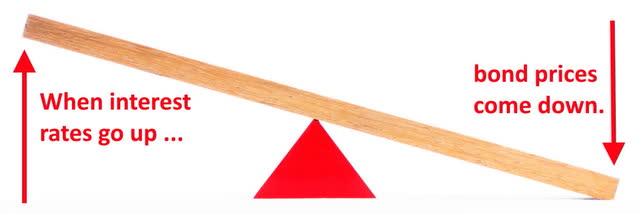

Inverse relationship of bond prices and interest rates (Wendorf)

The price of a bond is inversely proportional to interest rates. That is, when interest rates go up, bond prices go down, and when interest rates go down, bond prices go up. This sensitivity to interest rate changes is called duration.

Before the 1970s, interest rates were fairly stable, however, once interest rates started fluctuating widely, the need for a metric that would help investors assess the effect of interest rate volatility on their fixed-income investments became apparent and the concept of duration was born. Bonds having the longest maturity dates and the lowest coupon rates will have the highest duration, while bonds having shorter maturity dates and higher coupon rates have a lower duration.

How Duration is Calculated

The longer an investor needs to wait for the payment of coupons and the return of principal, the more a bond’s price will drop as interest rates rise, and the higher the bond’s duration will be. In general, for every 1% increase or decrease in interest rates, a bond’s price will change approximately 1% in the opposite direction for every year of duration. For example, if rates were to rise 1%, a bond or bond fund having a five-year average duration would likely lose approximately 5% of its value.

Bond duration is calculated according to several different formulas which we’ll describe below, however, we can get the easiest duration calculation out of the way first. It is for zero-coupon bonds which do not pay a coupon payment, meaning that they pay no interest over the lifetime of the bond. Rather, they are sold for less than their face value and investors receive the full face value when the bond matures. Since there are no coupon payments, the duration of zero-coupon bonds is equal to their time to maturity.

1. Macaulay Duration

Created by Canadian economist Frederick Macaulay, it is a measure of the time required for an investor to be repaid the bond’s price by the bond’s total cash flows. For coupon bonds, the Macaulay Duration, which is measured in years, will always be between 0 and the maturity of the bond. Macaulay Duration is calculated according to this formula:

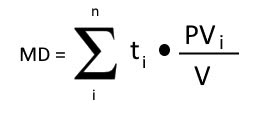

Macaulay Duration formula (Wendorf)

where ti is the time until the cash flow from the bond will be received, PVi is the present value of the cash flow from the bond, and V is the present value of all cash flows from the bond.

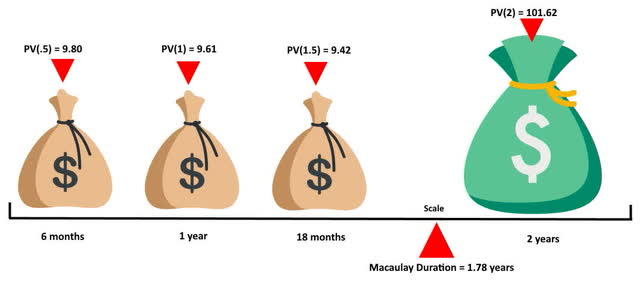

Let’s take a look at the Macaulay Duration for a 2-year bond paying a semi-annual coupon rate of 20% and having a continuously compounded yield of 3.9605%:

Since the Macaulay Duration is a weighted average, the relative weights of each payment appear in the diagram above and the final payment includes both the coupon payment and the final principal repayment. The weight for each period is not the nominal value of the cash flow, but rather the present value of the cash flow.

The Macaulay Duration is the weighted average time it would take to receive cash flows from a bond, and in this case, it is equal to 1.78 years.

2. Modified Duration

While considered as an extension of the Macaulay Duration, which is measured in years, Modified Duration is measured in percentage. It is a measure of the percentage change in the value of a bond for a given change in interest rate. To calculate the Modified Duration of a bond, you need to know its Yield to Maturity which is the total rate of return a bondholder will have earned from a bond once the issuer makes all the interest payments and repays the original principal.

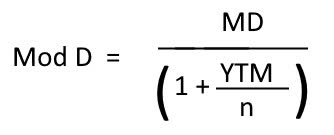

Modified Duration formula (Wendorf)

where YTM is the Yield to Maturity and n is the frequency of compounding.

Modified Duration is considered to be a more precise measure of bond price sensitivity to changes in interest rates than the Macaulay Duration, however, when the yield is continuously compounded, the Macaulay Duration and Modified Duration are equal.

3. Effective Duration

Effective Duration is a measure of the duration of bonds that have embedded options. An embedded option is a component of a bond or other security that provides either the bondholder or the issuer the right to take some action against the other party. Several types of options can be embedded into bonds, creating the following types:

- Callable bond: allows the bond issuer to redeem the bond at a point before it matures.

- Puttable bond: contains an embedded put option that gives the bondholder the right, but not the obligation, to demand early repayment of the principal, with the put option being able to be exercised on one or more specified dates.

- Convertible bond: allows the bondholder to convert the bond into a specified number of shares of common stock in the issuing company or cash of equal value; this makes a convertible bond a hybrid security having both bond-like and equity-like features.

- Extendible bond: contains the embedded option for a bondholder to extend the bond’s maturity date by a number of years; this type of bond can be considered as a combination of a shorter-term bond and a call option to buy a longer-term bond.

- Exchangeable bond: a type of hybrid security comprised of a straight bond and an embedded option to exchange that bond for the stock of a company other than the bond issuer at some future date and under certain conditions.

- Capped floating rate note: allows the issuer to redeem the notes at par value at a predetermined time; callable capped floating rate notes outperform non-callable capped floating rate notes if the reference rate remains below the cap and the note is not called.

More than one type of option may be embedded into a bond so long as they are not mutually exclusive. Securities other than bonds that may have embedded options include senior equity, convertible preferred stock, and exchangeable preferred stock.

Effective Duration takes into account possible fluctuations in the expected cash flows of a bond relative to changes in its Yield to Maturity. The formula for calculating Effective Duration looks a lot less scary if you know that the Greek letter delta, the little triangle, just stands for “change”.

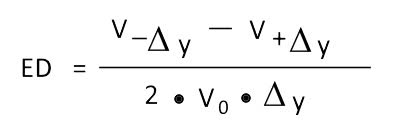

Effective Duration calculation (Wendorf)

where: V–Δy is the bond’s value if its yield falls by y%, V+Δy is the bond’s value if yield increases by y%, V(0) is the present value of all cash flows of the bond, and Δy is the yield change.

4. Dollar Duration

Dollar duration measures the change in the price of a bond for every 100 bps (basis points) of change in interest rates. A basis point is one-hundredth of one percent. On March 16, 2022, the Federal Reserve raised the Federal Funds Rate by 25 basis points, or .025%.

Dollar Duration is calculated as the change in the price of a bond for a unit change in the interest rate measured in basis points. A 1% unit change in the interest rate is 100 basis points.

Calculating Weighted Duration of a Portfolio

Bond portfolio managers must measure the duration of the entire portfolio, and to do that they measure the weighted average of the durations of the individual bonds that comprise the portfolio. The formula for calculating the duration of a portfolio is:

Portfolio Duration calculation (Wendorf)

where wi = the market value of bond i / market value of the portfolio, Di = the duration of bond i, and n = the number of bonds in the portfolio.

Importance of Bond Duration

Duration predicts how sharply the price of a bond will change as a result of changes in interest rates. When interest rates rise, a bond’s price will fall by an amount almost equal to the change in interest rate times the duration of the bond.

For example, for a 10-year Treasury bond having a duration of 9 years, if the interest rate for the 10-year Treasury increases by 1%, the bond’s price will fall by around 9%, and conversely, if the interest rate decreases by 1%, the bond’s price will increase by around 9%. For bond funds, the average duration of all the bonds in the fund conveys to investors how sensitive the fund will be to changes in interest rates.

Duration & Coupon Rate

The lower a bond’s coupon rate, the longer the bond’s duration will be because less payment is received before the maturity date. The higher a bond’s coupon rate, the shorter the bond’s duration will be because more payment is received before the maturity date.

Other Factors That Impact a Bond’s Value

The factors that most affect the price of a bond are:

- Yield: the present value of the bond’s cash flows which are comprised of the bond’s principal plus all the remaining coupons.

- Interest rate: if an investor owns a bond paying 3% interest, if interest rates are below that, the bond is attractive to investors, but if interest rates rise above 3%, the bond is less attractive to investors.

- Rating: the three bond rating agencies, Moody’s, Standard & Poor’s, and Fitch give ratings ranging from AAA, which is the highest rating, all the way to D which is the lowest rating.

- Inflation: because rising inflation erodes purchasing power, when a bond matures, its return on investment is worth less in today’s dollars.

- Risk of default: according to The Balance, over a 32-year period, the default rates of corporate bonds averaged only 1.47%. Investment-grade bonds defaulted at a rate of just 0.10% per year, while below-investment-grade bonds, also known as high-yield bonds, had a default rate of 4.22%.

Bottom Line

Every bond and every bond fund has a duration that can be used to compare individual bonds and bond funds. During times when interest rates are rising, rising durations may point the way toward shorter-duration bonds that have less interest rate risk.

Be the first to comment