anatoliy_gleb

ICD Will Stay Steady

In 2022, Independence Contract Drilling (NYSE:ICD) will benefit from its repository of pad-optimal super-spec rigs. High reactivation costs for restacked rigs and capital discipline from the operators mean the company will soon see operating margin beneficial. The current momentum in the leading-edge day rate is an indicator of the recovery in the industry. The company is primed to gain from this because its fleet can re-rate at current market day rates by Q4. Its 300 series rig typically commands one of the highest day rates.

However, intense competition and supply chain issues will partially mitigate the operating margin expansion potential. It will make additional investments to reactivate rigs and capital spares to reduce supply risks, which can compound its cash flow problem. The stock is relatively undervalued at this level. So, despite the challenges, investors might want to hold the stock for a decent return in the medium term.

Outlook And Rig Strategy

I covered Independence Contract Drilling’s strategies in my previous article. ICD’s management believes that the energy prices, which have already climbed sharply over the past year, will continue to strengthen in 2022. The run-up will provide the company to benefit from its positioning in the Permian and the Haynesville, where two-thirds of its rigs are oil-centric, and the rest are natural gas-centric. Because of their sizes, these basins can provide economies of scale, translating into better rig margins and more robust free cash flow.

ICD’s ShaleDriller fleet is a pad-optimal super-spec rig. The market dynamics in the super-spec rig suggest high reactivation costs for restacked rigs due to years of underinvestment and capital discipline from the operators. Many contract drillers in the US still do not look to reactivate drilling rigs due to low day rates and unprofitable contractual terms. Demand, on the other hand, is increasing. As a result, the management believes that ICD’s pad-optimal super-spec rigs demand in those basins will increase.

What Changed My Last Call?

I was bullish when I wrote in April, because of the immediate possibility of contract re-pricing and increasing day rate, which would significantly boost the operating margin for its 300 Series rigs marketed supply. I wrote:

“ICD’s management believes that the industry is in the early stages of a upcycle. Therefore, focusing on shorter-term contracts can lead to rapid margin improvement. It also expects to achieve margins exceeding pre-pandemic levels in the near term.”

However, despite the rig count’s upward journey over the past three months, the company is yet to capitalize on the potential. The management still sees the spot rate as the prevailing day rate, which means contracts are typically short-term. Unless the contract period extends and day rates genuinely reflect the underlying market force, there is a possibility that the operating margin and cash flow will not stabilize. On top of that, the looming recessionary fear has contributed to the stock’s relative weakness over the past few months.

I do not see any immediate pressure on the margin because of the upward momentum in the spot rate in the US drilling market. I think the stock will take a couple of quarters to solidify its position. However, for the long term, we might want to wait until Q4 for the company’s contracts to renew at a more lucrative rate for an extended period before the stock reaches its inflection point. However, if the recession does reign in and lead to a slowdown in the energy industry growth, I will be forced to change my opinion again to sell the stock. That risk and uncertainty remain, but hopefully, the central bank will manage to avoid that.

Challenges And Opportunities

The two primary challenges for ICD are intense competition and supply chain issues as the economy recovers from the pandemic. The issue is that even if the leading-edge spot day rates are ~$30,000 for pad-optimal super-spec drilling rigs, high reactivation costs make them untenable. So, we might see even higher day rates and more extended tenor contracts for the contract drillers like ICD in the US. This, however, will take time. Meanwhile, the company’s focus on short-term pad-to-pad contracts can see margin improvement in Q2 and the rest of 2022. Because all of its contracts are due for re-pricing after October, its entire fleet can re-rate at current market day rates by Q4.

In 2022, the company expects to reactivate three additional 300 series rigs, which typically command one of the highest day rates. The company estimates that the reactivation costs for these three rigs can range between $3.5 million-$4.5 million each, which makes a less than one-year payback period.

The Q2 Forecast

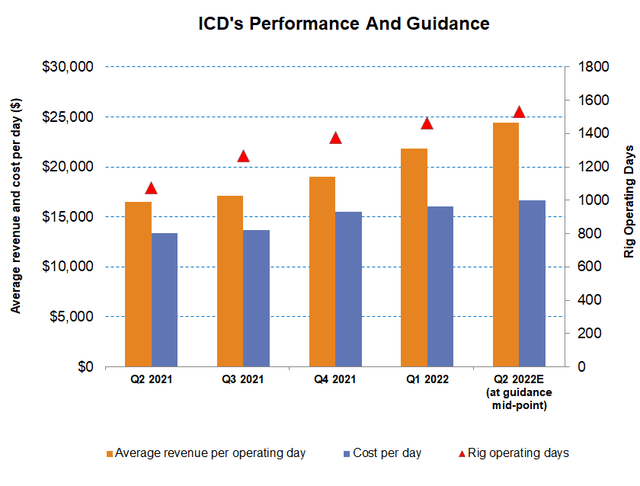

ICD’s Filings and Press Release

In Q2 2022, rig operating days can increase by 5% compared to Q1. On average, revenue per operating day can increase by 12%, exceeding the cost per day, leading to a ~33% rise in average rig margin per operating day in Q2. It expects utilization to remain nearly unchanged in Q2. Also, in Q2, the company expects to operate 16.8 active rigs. I think rig reactivations in a tight labor market can inflate costs more substantially than the company currently expects and hence, can dent its margin expectation.

Analyzing The Q1 Drivers

From Q4 2021 to Q1 2022, the company’s revenue per day increased by 6%, while cost per day increased by 4%. Increased demand for the pad-optimal super-spec rigs and improved market conditions, despite higher labor costs and idle non-operating days, led to a 63% jump in the average rig margin.

However, as of March 31, the company’s drilling backlog declined by 18% compared to a quarter ago. A lower backlog typically represents a high percentage of short-term pad-to-pad contracts. A majority of the current backlog will expire by Q3. So, I think, it will re-rate its entire fleet in Q4 and benefit from the day rate momentum in an improving market.

Cash Flows And Liquidity

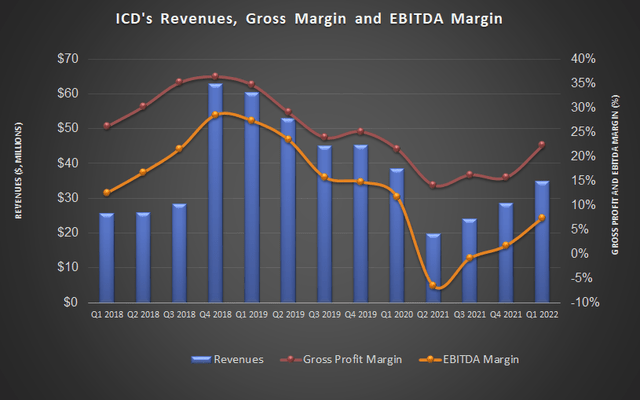

In Q1 2022, ICD’s cash flow from operations (or CFO) remained negative but improved compared to a year ago. Although year-over-year revenues increased significantly during this period, adverse changes in working capital led to a negative CFO. Naturally, free cash flow (or FCF) was also negative in Q1. The expansion of day rates and margins can push the operating cash flow into positive territory in 2022.

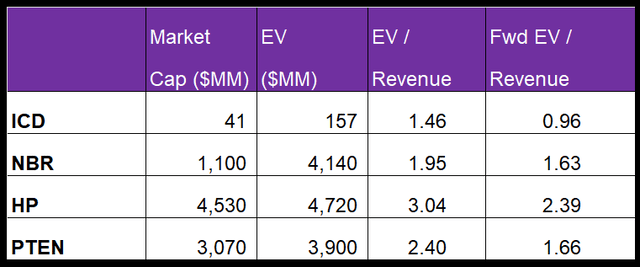

The company has recently increased its FY2022 CapEx budget from $10 million to $24 million. The additional investment will go toward rig reactivations and investments in capital spares to mitigate supply risks and customer requirements. As of March 31, ICD’s debt-to-equity stood at 0.79x, which is lower than the average for peers (NBR, HP, PTEN). Its liquidity stood at $21 million as of that date.

What Does The Relative Valuation Imply?

ICD’s current EV/Revenue multiple (1.5x) to the forward EV/Revenue multiple contraction is steeper than its peers’ (NBR, HP, and PTEN) average fall. This implies higher revenue growth and reflects in a higher EV/Revenue multiple than peers. However, the stock’s EV/Revenue multiple is lower than its peers. So, it is relatively undervalued at the current level.

Target Price And Analyst Rating

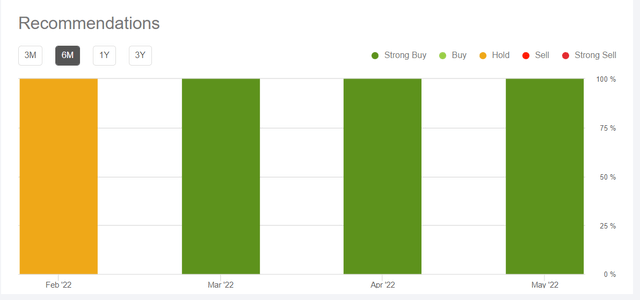

One sell-side analyst rated ICD a “Buy” (“Strong Buy”) while none rated it a “Hold” or “Sell.” The consensus target price is $7.0, which yields ~137% returns at the current price.

What’s The Take On ICD?

In 2022, following the energy price upswing, ICD will benefit from its positioning in the Permian and the Haynesville shales. Its ShaleDriller pad-optimal super-spec rig and 300 series rigs will see revenues rising because of limited availability in the market and high demand. Because all of its contracts are due for re-pricing after October, its entire fleet can re-rate at current market day rates by Q4. many contract drillers are not reactivating the legacy drilling rigs owing to low day rates and unprofitable contractual terms.

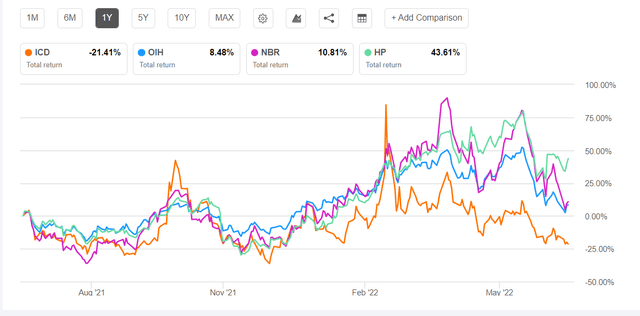

The primary challenges for ICD are intense competition and supply chain issues as the economy recovers from the pandemic. Its drilling backlog declined by 18%. Negative cash flow is another concern. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. With current momentum in the drilling industry in the US, I would suggest investors hold the stock.

Be the first to comment