RobsonPL

Following Crédit Agricole’s (OTCPK:CRARF) ambitious plan for 2025 and the rescue of the three banks of Cesena, Rimini and San Miniato, today we are back to comment on the bank M&A optionality. Looking at the latest plan, we see how the French bank targets the Italian peninsula, making it the second top priority for the future. In numbers, Italy is the second biggest market for the French bank with almost 1000 retail banks and more than 5m clients. Looking at the specifics, Crédit Agricole engages its activities in eleven (out of 20) regions that account for more than 70% of the entire Italian population and 80% of the country’s GDP.

CA Italy second top priority

As we already mentioned in our previous publication, Crédit Agricole has always aimed to expand its strategic reach in Italy and the latest acquisition of CREVAL just confirmed our thesis. More importantly, we can see how the bank did not raise the bar over the next three years and it presented a humble plan with organic and inorganic growth rates with a prudent hypothesis and a conservative cost of risk. So, what’s next?

Banca BMP and Crédit Agricole?

Our internal team believes that a combination is only a matter of time.

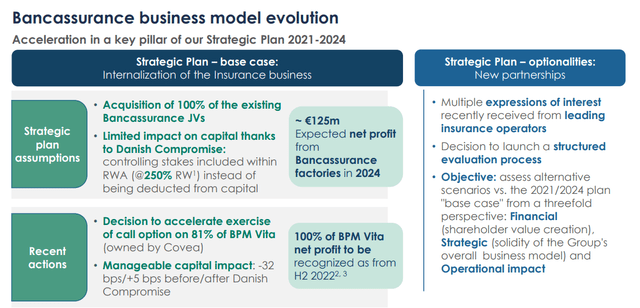

Banca BPM is currently trading below the stock price value on the announcement of its entry. During the presentation, Crédit Agricole management focused on the development of the business in Italy, in particular on how the bank intends to manage its stake in Banco BPM. Credit Agricole, in fact, remained below 10% in Banco BPM (9.2%) and did not request authorization from the ECB to exceed this threshold. However, we should note that Banco BPM’s insurance policies are about to unleash an all-French derby between Credit Agricole and the insurance giant AXA, which has been aiming for years to strengthen its presence in Italy. According to Bloomberg, AXA group values the insurance business at €1.5 billion. During the Ambitious plan presentation, the interest in developing a partnership with Banco BPM on the bancassurance front was reaffirmed. Therefore, at the moment, for Credit Agricole Italia the priority is organic growth in both commercial banking and asset management. Although the statements of Credit Agricole management seem to rule out, at least in the short term, we believe that the speculative appeal remains high and that it can be further strengthened by the definition of the bancassurance strategy, pointing out, among other things, that Banco BPM shares are currently trading at a tangible book value of 0.35x, therefore at a valuation substantially in line with the one preceding the announcement of the entry into the Banco BPM capital.

Bancassurance business model evolution

On the Banco BPM side, the CEO has repeatedly clarified how the most probable scenario remains the business internalization, in line with the strategic plan presented last November. We should note that Unicredit was close to a takeover bid in February which then did not materialize. Following AXA’s interest, Credit Agricole acquired a 9.2% stake in Banco BPM at the beginning of April, with the goal to expand its current strategic relationship with the institute. However, the move could mimic the acquisition of CREVAL, which started with the 5% and commercial partnerships and ended with an acquisition two years later. So, in our view, Banco BPM could become an acquisition target in the future. With the uncertainty about the golden power of the Italian government, we maintain an outperform rating and a target price of €3.60 on the Banco BPM share, and on Credit Agricole, we reaffirm our outperforming rating and a target price of € 13 based on a ROTE at 11%.

Be the first to comment