qunamax/iStock via Getty Images

Above: Too many screens chasing a diminishing number of eyeballs as a percentage of untouched potential viewers in the US market.

The fact of being on the record makes it appear continuous and ubiquitous whereas it is more likely to have been sporadic both in time and place. Besides, persistence of the normal is usually greater than the effect of the disturbance as we know from our own times. – Barbra W. Tuchman, Historian 1912-1989

The massive outpouring of analysis, data, accounting forensics and prognostications about the present and future of Warner Bros. Discovery, Inc. (NASDAQ:WBD) has effectively led many investors to dead ends. There are David Zaslav fans and John Malone believers who see through the current mess as part of a longer-term process that will eventually cross to the promised land of bull scenarios if holders will just be patient.

On the other hand, there are prophets of doom, who see no real solution to the overall broken business model of all streaming. There does not seem to be anyone seeing the forest. There are just too many trees with too many skittering squirrels that bearing watching to really arrive at a new model that can work.

The news flow on WBD has produced a massive echo chamber of examination that in the long view of things as suggested by the Tuchman quote above, will be vastly exaggerated in terms of ultimate outcome. And that outcome will likely reflect a return to the basic premise that entertainment content will continue to be delivered over given pipelines that are the cheapest. And there will roughly be the same ratio of content winners vs. flops as we now experience on the existing verticals.

We make no such pretension here to unveil some mystical, hidden truth of WBD’s business that brings an aha moment. However, we do reiterate our core position: In a miasma like this, the go-to move is to bet on management. To bring some practical depth to our conclusion on the stock, we reached out to four associates and friends, all of whom at one point or another, have spent considerable portions of their careers in the entertainment/TV business.

A broken business model needs more time to reconstruct given the impatience of Mr. Market and a looming recession ahead. All more or less agree with John Malone that patience will be rewarded as management untangles the debt and finds a sensible pathway to profitability.

wswk archives

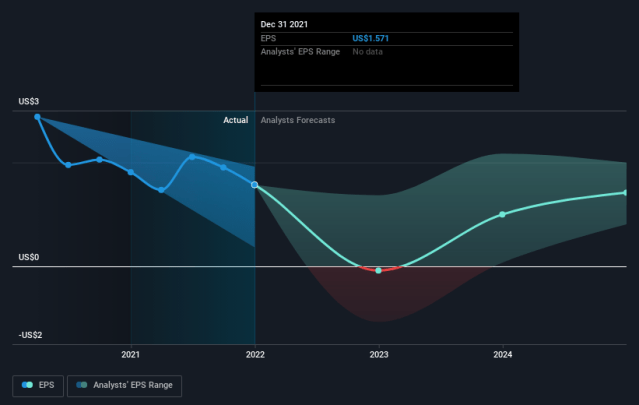

Above: As Malone suggests, there will be an inflection point when the debt load becomes livable and the verticals sorted out to produce EPS gains–but holders need the patience to wait it out.

We realize that there is always a generational coloring to such experiences of executives depending on the timing of entries and exits from the industry. For that reason, our responders range in their career tenures from 10 years, to 18, to 25 and 40.

Because all are still connected either as consultants or content people in the business, they asked for, and I agreed to, talking off the record without attribution. My goal was to learn what they see as informed people who were or are hands on operators in the entertainment/media universe.

The rest of us are part of the peanut gallery, myself included, of observers, analysts, investors and seekers of common sense in what most of us agree is an irrational market disrupted by pricing dilemmas.

My objective was to see if my own explorations of the sector was in any way shared by industry people who had dealt with the problems in the field daily, monthly or periodically as consultants or producers.

My mission here: Contribute context, that’s all. Not much else to find in the masses of WBD reported data IMHO.

WBD archives

Above: One umbrella to shelter all the above may not withstand the test of reasonableness in a growing, but chaotic competitive sector.

What I wanted to avoid was a split screen zoom session with all four that would be the equivalent of those kind of seminar presentations where the experts are seated in a semi- circle around a moderator. What I have found in such formats is that a certain kind of politesse enters the discussion. Guests tend to agree with their co-panelists on key issues to avoid public conflict and then veer a bit off into tepid contrarian expositions. That’s why I conducted my informal chats one on one.

Stipulation: Industry consolidation as a possibility that would shrink the number of sector players, was discussed. Doubtless it represents valid pathway ahead. However, when we raised that issue with an investment banker active in the field, he agreed it was, but that the re-distribution of things like intellectual property rights would be a nightmare to sort out given the existing licensing deals already endemic to the system. “It would be a birthday party for the lawyers,” our banker observed.

Basic premises of my responders

What follows is a consensus of the nine most cogent points all of my responders agreed were the key issues to bear in mind for investors in the space as they relate to the value of WBD. All agreed that for now, Mr. Market seemed to have attained reasonable price discovery with the stock trading ~$10. But they also agreed that the reconstruction process is afoot and the guidance they believe meets the test of investment smarts is to hold on, the cavalry is on the way-not tomorrow, but in time.

All agreed on these prognostications

Not one of the current players in the space will rise to dominate the entire sector with a breakaway share of market. A Balkanized business will prevail so those investors seeking to bet on favorites structured out of the outpouring of data at hand today will be disappointed. WBD is likely to find the ultimate solution to its dilemma by either selling or spinning off some of its verticals. In other words, they see a back to the future kind of ending here. Warner Bros. broken away from Discovery into two far easier to understand companies. One as a producer of content, (WB) steaming and cable customers (D), come one come all.

Discovery+, essentially evolves to what it was before the merger. One unit is only non-scripted content linked to niches the other, (WB) all is scripted content budgeted to fit a streaming pipeline at significantly lower average production costs for the bulk of its content.

The supreme irony: The streamers will all arrive at the exact same model: Subscription prices hammered down to comfortably under $10 a month and the rest entirely given over to ad support models. In other words, streaming TV, will join the back to the future model of becoming defacto broadcast networks all over again.

In other words, the very feature that gave birth to streaming—an alternative to enduring over stuffed ad breaks on broadcast TV consumers came to hate. Viewers proved more amenable to paying a nominal monthly fee, to avoid ads. That is what viewers wanted by signing up. It’s not what they’ll get. Many also wanted freedom from gate-keepers on the four networks, who bombarded them with wokeism. One of our responders suggested that streamers would not control ad time though they would promise no more than x minutes per hour at the outset. The temptation to steadily increase advertising would be too great. Hence, welcome back to the four broadcast network business model.

Consumers know ad time would rise and would pivot to anyone else to an ad free pipeline. Someone somewhere would recognize this and move to a pure, no ad format such as TCM for example and build an audience by poaching ad haters from everyone else at a one- time affordable price.

Attacking huge debt overhang that is the mother’s milk of EBITDA losses is job one. The combined long-term debt of just four leaders: Disney, Netflix, Paramount, and WBD amounts to $130b. The debt service even at their presently manageable interest bases in a sense dooms them to eternal EBITDA hell. They must take a more aggressive set of initiatives to cut costs and increase enough FCF to dramatically reduce debt overhangs. Easier said than done without question but-doable.

Bear in mind, debt has piled up because the business model for all is broken. You can’t overpay for content that has a long line of payback and at the same time, run continuing price deals to poach subscribers. You are defining deviance down.

WBD could spin off HBO as a viable, premium stand -alone product unfettered by bastardizing it with other programming or streaming deals. It should be a single product at a single price period.

Stipulation two: The above are opinions among the knowledgeable, not implied or meant to be gospel.

WBD is in a process that will take far more time than the market has patience for, to untangle the mess handed to it by AT&T (T). That’s what John Malone counsels and it has an internal logic. Whether he espouses that view for his own selfish reasons or genuinely sees nirvana in terms of duration of the transformative process isn’t important. What does ring true to me after my talks with industry operatives is that his guidance makes the most sense of all the pontifications I’ve gone over to date. The key: over time, Zaslav will whittle down debt.

Over time, Zaslav will reign in the insane runaway costs of content that is a long heritage of the entertainment business: overpaying for so-so content because of the cozy relationships with the so-called “creative community”. And if he declares war on wokeness, all to the better. Selling CNN rather than just slimming it would be a great start, all agreed.

But above all, the process needs to be sped up to make a dent in the perception of Mr. Market. At the current pace, the tale being told is $10 a share. No premium is being awarded or appears to be in the cards based on anticipation of big time EBITDA gains for WBD even out of the current cost slashing by Zaslav.

My view now is that we are looking at something like 2+ years to get WBD shipshape all over in terms of debt reduction, the transformation from the vision of a single umbrella company for all its businesses, to a multi-umbrella constellation where value will be returned to shareholders at a much higher level than now.

Conclusion

In my view, two years from now, WBD will look nothing like it does today. Its debt profile will be light years better than it is today. Its offerings to consumers will be well matched in content, in price and sustained, reasonable churn without excessive promotional spend.

Facing recession and inflation for the foreseeable 18 months ahead-at least, the prospects for a short or even intermediate upside on the stock seems to me to have a streak of wishful thinking. But in a steady as she goes, series of moves, there is much greater value to be extracted from WBD’s rich lodes of assets by keeping some and exiting others. The faster Zaslav moves, the sooner Mr. Market’s will approve.

On that basis, a mixture of my own conclusions with those of my informal industry responders. I think we will begin to see real progress by 2Q23 and upside movement through the following 24 months.

If that happens under the astute tutelage of Messers Zaslav and Malone as I have previously suggested, I can see a bull case for WBD moving into the $18.50 to $22 range by mid-year next. If that produces ants in your portfolio pants best bull case-better sell now. Recession related news flow could cause a few dips of the stock into upper to mid- single digits. Know how to fold ’em, know how to hold ’em is the message of the day.

At $10 a share WBD isn’t dead money but more like somnambulant money; kind of Snow White money taking a snooze until the prince comes to the rescue and wakes her up to a wonderful, sunny future. After all, show business is about stories. Every stock in the final analysis is also nothing more than a story. Some are fairy tales, some ring with enduring truths. WBD’s story will be long, but a happy ending looks like a real good bet.

Be the first to comment