Andres Victorero

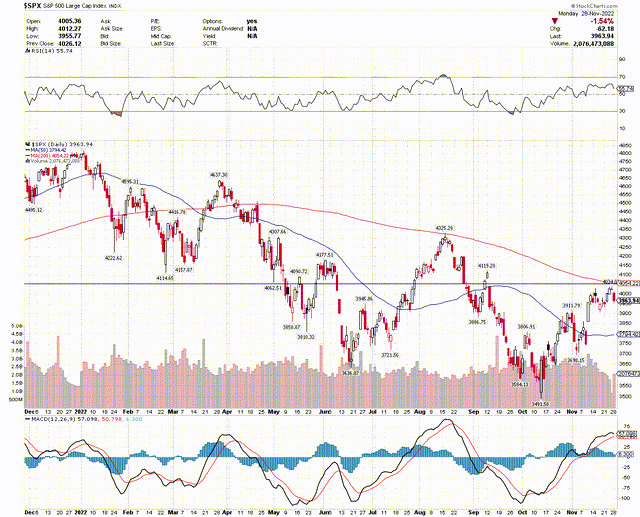

The stock market has had a tremendous two-month run, climbing to what technical analysts view as a significant overhead resistance level where the major market averages failed when previously challenged in August. Investors often look for reasons to sell stocks at this juncture, and protests in China against the government’s zero-Covid policy was the perfect excuse. Yet I view the protests as a positive that may force President Xi’s hand to relax restrictions that have failed to work sooner rather than later. Social stability has always been a top priority for the PRC, and it is clear that the Chinese people have had enough of the current strategy. Any modifications to the zero-Covid policy, including a more aggressive vaccination program, should stimulate global growth and further improve global supply chains, which alleviates inflationary pressures.

Finviz

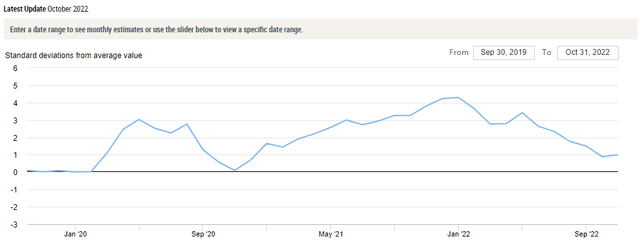

As expected, additional pressure on risk assets came in the form of hawkish rhetoric from the slate of Fed officials scheduled to speak yesterday. Investors should know by now that any meaningful stock price appreciation will be met with unsubstantiated warnings that rates will rise higher than the market anticipates. That is what Fed President James Bullard asserted yesterday, which was followed by Fed President John Williams and Fed Vice Chair Lael Brainard with similar messages. Their sole goal is to keep the inflation-expectation genie in the bottle until the real rate is on a clear path towards the Fed’s target. Still, signs keep mounting that a more rapid deceleration in prices is on the way with the Fed’s Global Supply Chain Pressure Index (GSCPI) declining six consecutive months to a level closer to its historical average.

NY Fed

Combining this development with the rapid fall in commodity prices over the past six months, led by oil, leaves the primary source of inflation coming from services. The primary source of services inflation is shelter, and we know that the housing market is already weakening rapidly with the doubling of mortgage rates. New rental rates are starting to decline in certain parts of the country, as the inventory of new rental units is on track to break records next year. This is why I believe the Fed will end its rate-hike cycle in December, assuming officials see the writing on the wall by January, which shows a confirmed downtrend in all inflation measures.

Finviz

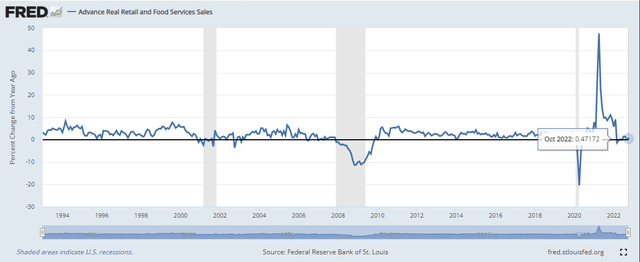

Investors will likely shift their focus from inflation to recession as we start the new year. On that front, I came across another valuable indicator that I plan to add to the ones I discussed yesterday in an effort to monitor the likelihood of an economic contraction next year. The monthly retail sales report is calculated in nominal terms, so we need to subtract the corresponding inflation rate to arrive at real retail sales growth. The recessions in 2001 and 2008 did not start until real retail sales declined more than 1%. The pandemic-induced recession in 2020 was an anomaly. In October 2022, we saw real sales growth of 0.5%.

FRED

Therefore, the coast looks to be clear for now. I think this will serve as a valuable indicator in combination with the Sahm Rule that I discussed in yesterday’s report, especially if the yield curve remains inverted and the PMIs from ISM and S&P Global remain in contractionary territory. Until then, the expansion continues.

The Technical Picture

The S&P 500 started to pullback from its 200-day yesterday, as expected, starting to resolve a very overbought condition for the index on a short-term basis. I expect it will challenge that level and break above it before year end.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment