TennesseePhotographer/iStock Editorial via Getty Images

Due to changing market conditions, I have found myself becoming a bit more cautious regarding the valuation of particular companies. Firms that might be more exposed to an economic downturn or companies that have rather lofty trading multiples our businesses that I have become more skeptical of in recent months. One company that has made this list is J&J Snack Foods (NASDAQ:JJSF). According to management, this enterprise produces and sells snack foods such as Auntie Anne’s, Superpretzel, Brauhaus, And more. It also distributes frozen beverages. Most recently, the company also acquired Dippin’ Dots in a deal valued at $222 million. Although sales achieved by the company have been improving nicely and some profitability metrics have also increased, the bottom-line results for the company as a whole as of late have been rather mixed. This would be fine if shares were trading at fundamentally attractive levels. But given how pricey the stock is at this moment on an absolute basis and even relative to similar firms, I cannot help but to be a bit bearish on it. So despite seeing the share price rise in recent months, I have decided to keep the ‘sell’ rating I had on the business previously.

Still expensive

Back in September of this year, I wrote an article discussing whether or not it made sense to consider J&J Snack Foods to be a valid investment prospect. At that time, I acknowledged that the company was showing signs of recovery from the COVID-19 pandemic. Even so, financial performance for 2022 on the bottom line had been rather disappointing. I noticed at that time that the firm’s acquisition of Dippin’ Dots could prove to be a solid catalyst for the company. But that on its own was not enough to justify meaningful upside for shareholders. And given how pricey shares were, I felt as though a ‘sell’ rating was appropriate at that time. Since then, the company has defied my expectations. Why all the SP 500 is up 1.7%, shares of the business have dropped by 8.4%.

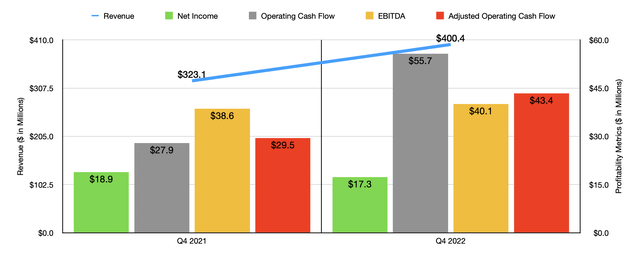

To be clear, this return disparity should not be all that surprising when you look at how the company performed in the latest quarter. This is the final quarter of the company’s 2022 fiscal year, which is the only quarter for which new data is available that was not available when I last wrote about the business. During that time, sales came in at $400.4 million. That’s 23.9% higher than the $323.1 million the company reported the same time last year. $31.5 million worth of this sales increase came from its aforementioned acquisition. But even without that, revenue would have risen by 14.2% year over year. This, management said, was driven by robust organic growth. Under the food service category, sales jumped by 29.2%, benefiting from the fact that, this time last year, fewer companies were fully operational. Its retail operations reported an 11.3% rise in revenue, while the frozen beverage operations grew sales by 18.2%.

You would expect that a rise in revenue would bring with it improved profitability. But the fact of the matter is that profits were somewhat mixed. Net income, for instance, came in at $17.3 million. That’s actually down from the $18.9 million reported the same time last year. Even though the company benefited from an improvement in its gross profit margin from 28.4% to 28.9%, total operating expenses for the company worsened in response to inflationary pressures across distribution and higher administrative costs. Most of the pain seems to have been on the distribution side based on the data that’s available. Despite this rise in costs, other profitability metrics for the company came in rather strong. Operating cash flow, for instance, jumped from $27.9 million in the final quarter of 2021 to $55.7 million the same time this year. If we adjust for changes in working capital, it still would have risen from $29.5 million to $43.4 million. Meanwhile, EBITDA for the business inched up from $38.6 million to $40.1 million.

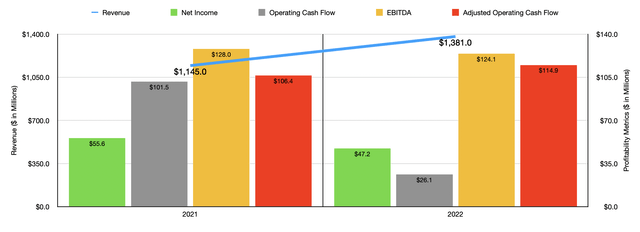

Although the company did see mostly favorable results in the final quarter, results for the entirety of 2022 were not quite as great. Yes, revenue did increase nicely year over year, rising from $1.15 billion to $1.38 billion. But overall net income dropped from $55.6 million to $47.2 million. Despite the strong results achieved in the final quarter of 2022, operating cash flow for the year as a whole actually weakened, plunging from $101.5 million to $26.1 million. To be fair, if we adjust for changes in working capital, it would have risen, climbing from $106.4 million to $114.9 million. But this is offset some by the fact that EBITDA for the enterprise fell from $128 million to $124.1 million.

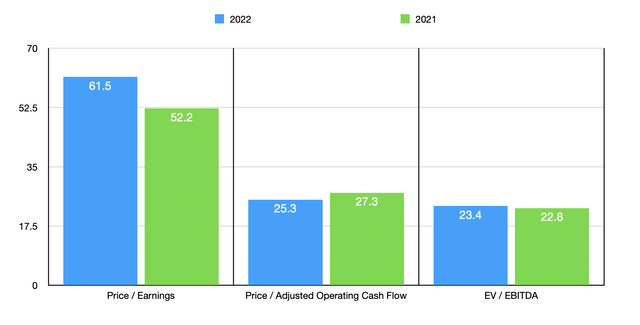

Based on the data we got from 2022, we can see that the company is trading at a price-to-earnings multiple of 61.5. That’s up from the 52.2 reading that we get using data from 2021. The price to operating cash flow multiple does look a bit better than if we were to use data from last year, dropping from 27.3 to 25.3. But if we use the EV to EBITDA approach, the metric would have risen from 22.8 to 23.4. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 10.5 to a high of 127.9. And if we use the EV to EBITDA approach, the range was from 5.9 to 34.9. In both of these cases, four of the five prospects were cheaper than our target. Using the price to operating cash flow approach, meanwhile, would give us a range of between 9 and 34.2. In this case, three of the five companies were cheaper than J&J Snack Foods.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| J&J Snack Foods | 61.5 | 25.3 | 23.4 |

| Cal-Maine Foods (CALM) | 10.5 | 9.0 | 5.9 |

| TreeHouse Foods (THS) | 44.4 | 16.4 | 15.2 |

| The Simply Good Foods Company (SMPL) | 34.9 | 34.2 | 20.3 |

| Utz Brands (UTZ) | 127.9 | 25.8 | 34.9 |

| Flowers Foods (FLO) | 27.9 | 18.9 | 14.9 |

Takeaway

Although I would classify myself as a foodie with something of a sweet tooth, I do think that shares of J&J Snack Foods are a bit pricey at this time. Not only are they lofty relative to similar firms, they are also expensive on an absolute basis. This is true from both an earnings perspective and a cash flow perspective, with the former being particularly problematic. Long term, I have no doubt the company will continue to grow and it could eventually grow into its market value. But because of how pricey shares are right now and how volatile fundamental performance has been over time, I do think that there are better prospects to be had elsewhere.

Be the first to comment