Sitthiphong/iStock via Getty Images

“Our sense of history has grown dangerously thin, and our sense of proportion with it.” – Stephen L. Carter

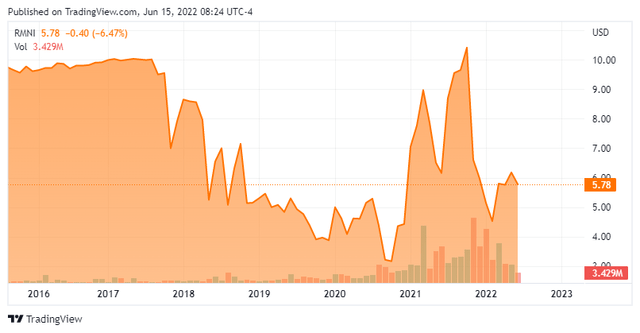

Today, we take our first look at Rimini Street, Inc. (NASDAQ:RMNI). This small-cap tech stock has given its shareholders a wild ride over the past few years. The company recently upped its stock purchase authorization program. A sign the shares are a Buy? We attempt to answer that question via the analysis below.

Company Overview:

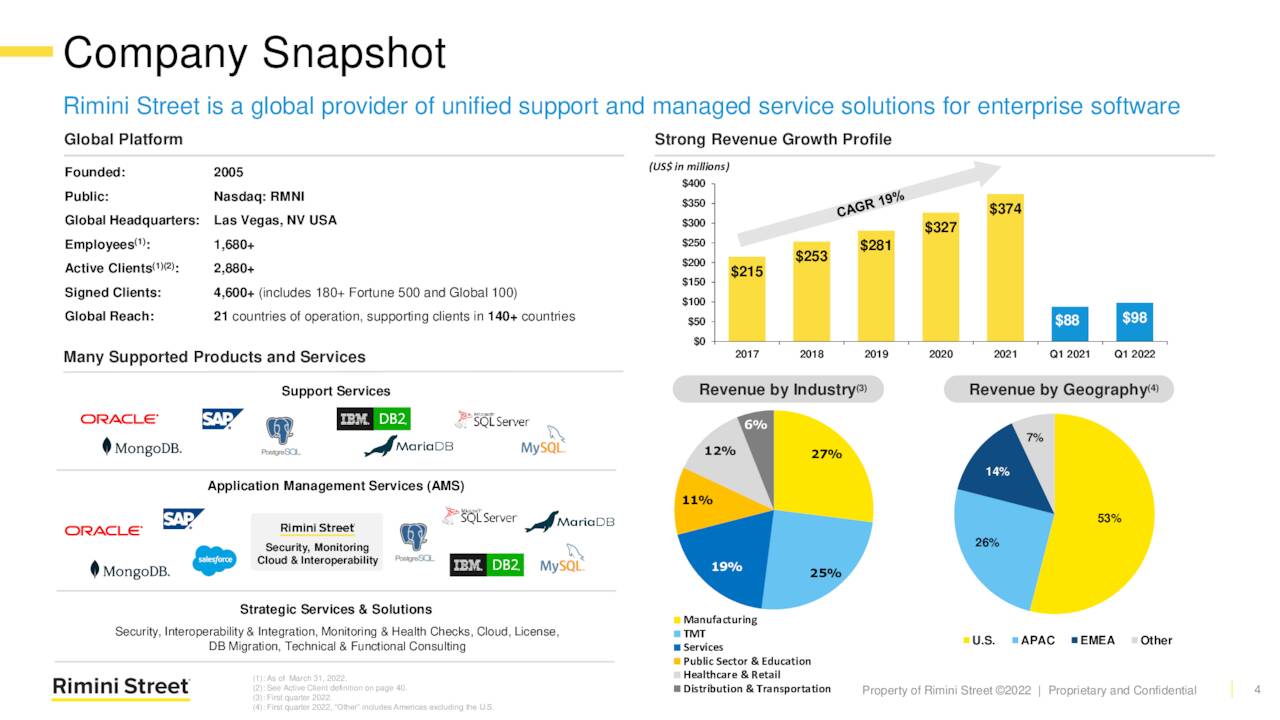

Rimini Street is based in Las Vegas. The company provides enterprise software products, services, and support for various industries and offers software support services for Oracle and SAP enterprise software products. The company gets just over 50% of its revenues from the United States and the rest overseas. The stock sells just south of six bucks a share and has an approximate market capitalization of $520 million.

January Company Presentation

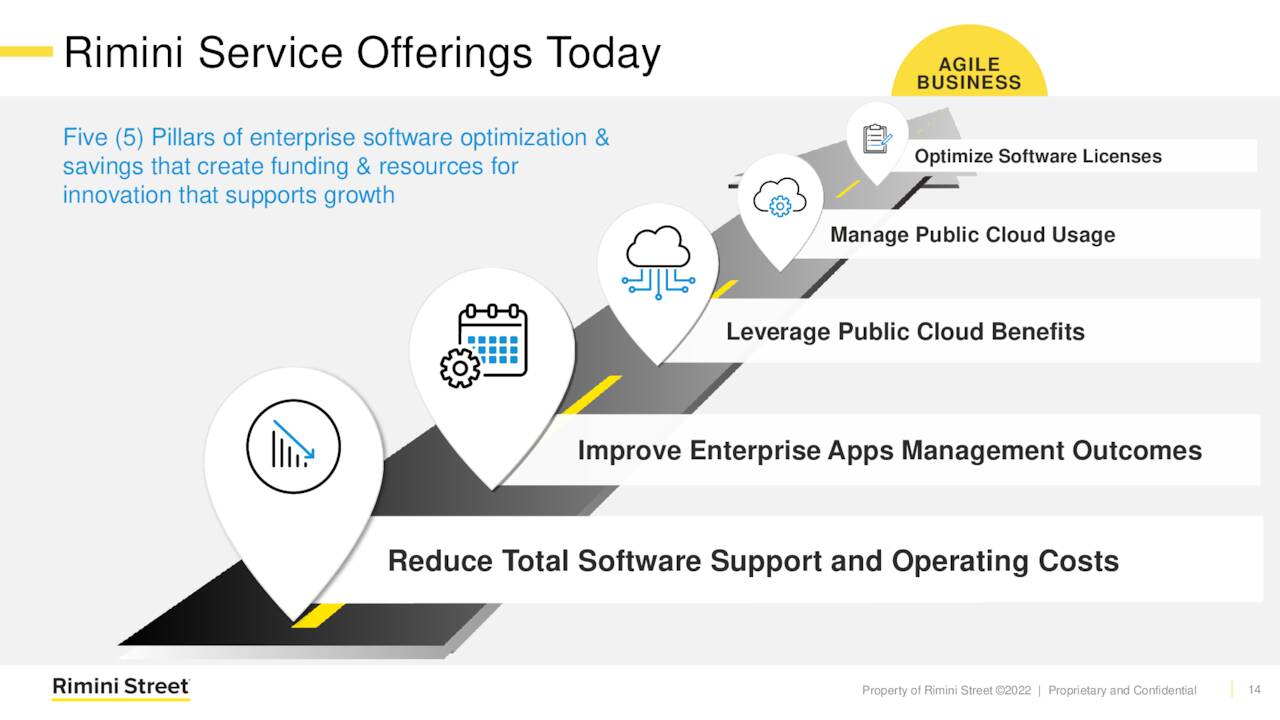

The company’s software and support services help to optimize clients’ enterprise software solutions which drives down costs.

January Company Presentation

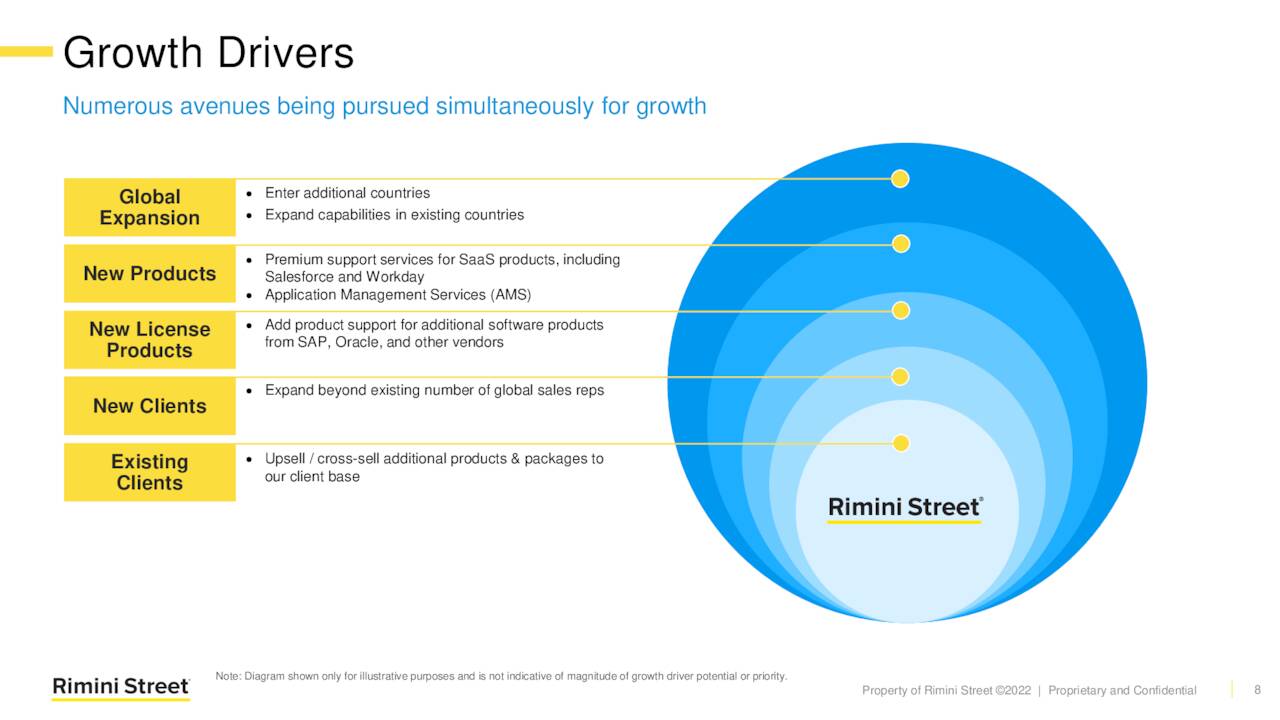

Rimini is targeting a large market and has various avenues of growth it is acting upon.

January Company Presentation

First Quarter Results:

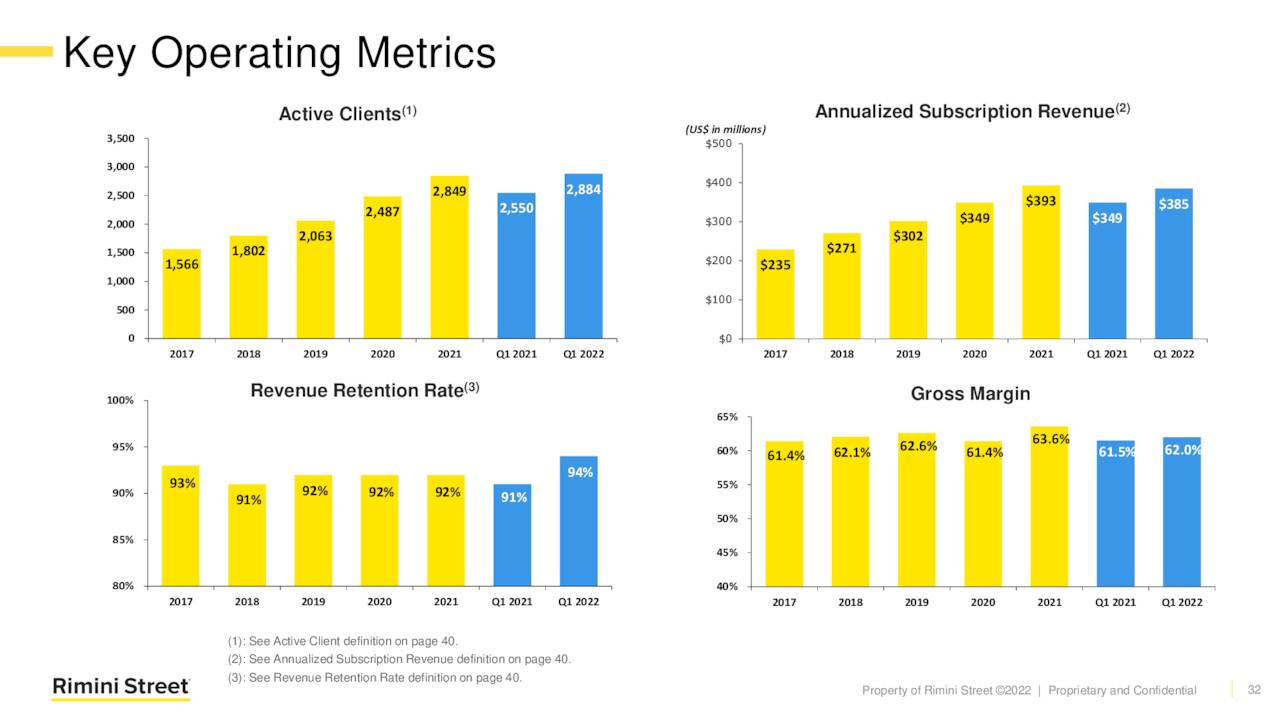

On May 4th, Rimini Street posted first quarter numbers. The company made three cents a share on a GAAP basis as revenues rose more than 11% on a year-over-year basis to nearly $98 million. Revenue growth slightly beat the consensus while the bottom line missed by a penny.

June Company Presentation

The company slightly raised full year sales guidance to a range of $402 million to $411 million. Active clients now total just under 2,900, a 13% increase from a year ago. Gross margins and revenue retention rates rose slightly from 1Q2021.

Analyst Commentary & Balance Sheet:

The company receives scant attention from Wall Street despite an over half a billion dollar market cap. Roth Capital upgraded the stock to a Buy with an $8 price target on January 19th. Alliance Global Partners did the same on March 3rd, even as they lower their price target on the stock to $8.50 from $10.50 previously. That is the only analyst firm commentary that comes up so far in 2022.

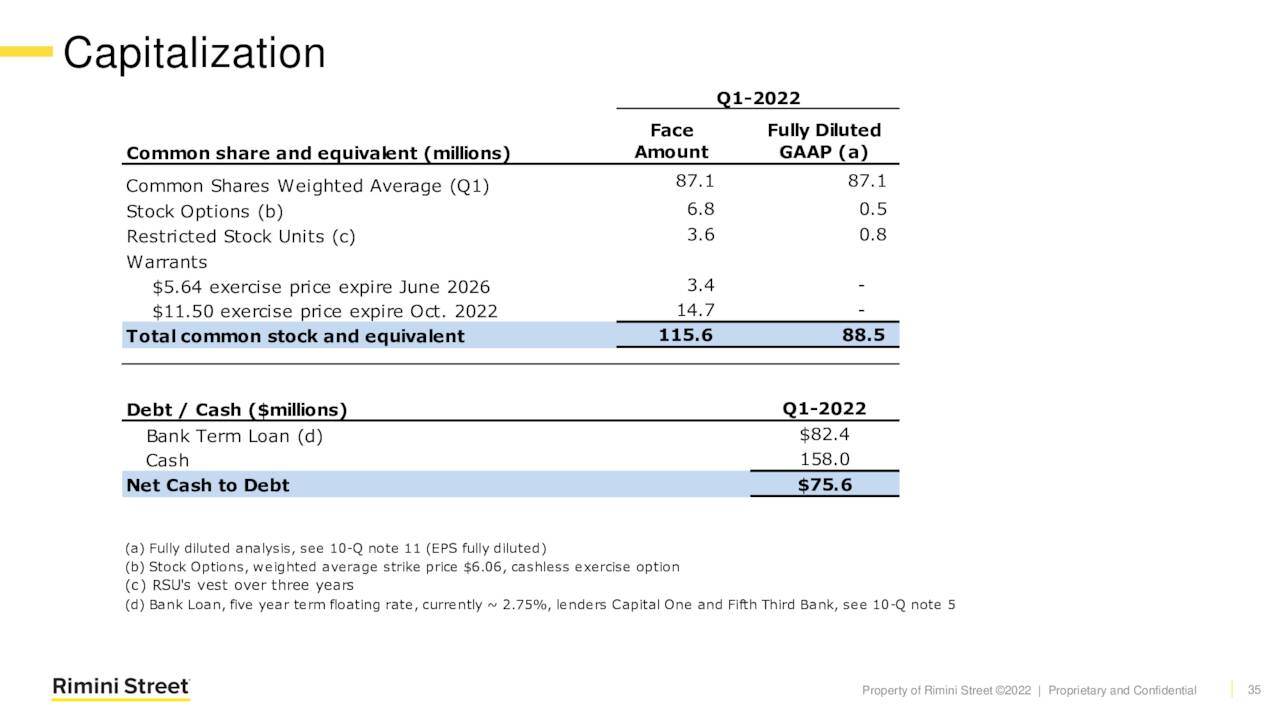

June Company Presentation

The company ended the first quarter with just under $160 million of cash and marketable securities on the balance sheet against just over $80 million of long-term debt. At the beginning of this month, the company increased its stock buyback authorization to $50 million over the next four years from $15 million over two years previously.

Just less than four percent of the outstanding float of RMNI is currently held short. Three insiders have sold just north of $400,000 worth of shares in June so far. Small insider sales have happened frequently in 2022. In December of last year, the company’s CEO sold approximately $9 million of his holdings. The last insider purchase I can find was in September of 2018.

Verdict:

The current analyst consensus has the company roughly a half a buck a share as revenues climb in the high-single digits to some $410 million.

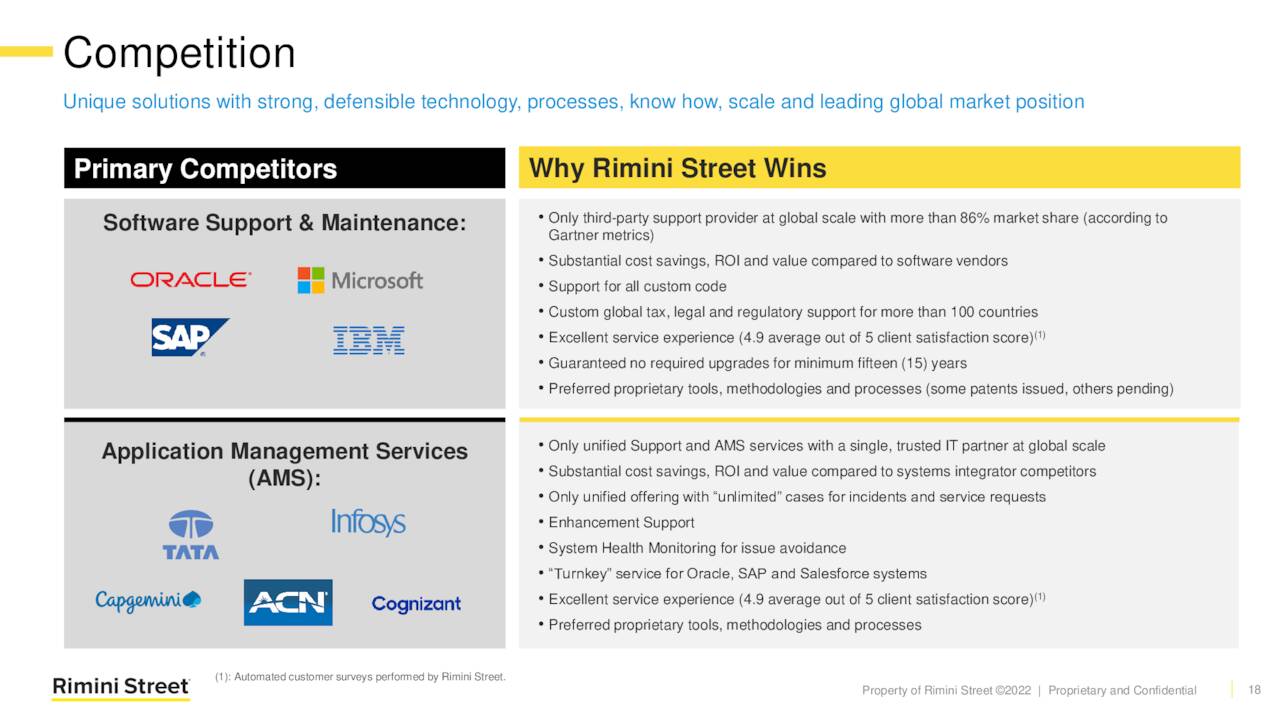

June Company Presentation

The company has many competitors in its space. However, it is a very large and growing market, and management believes its offerings provide broad-based advantages (above). The stock seems reasonably valued at under 12 times forward earnings and 1.3 forward sales. As a way of comparison, much large Cognizant Technology Solutions (CTSH), which is seeing slightly lower sales growth, is valued at approximately 15 times forward earnings and 1.7 times forward revenues.

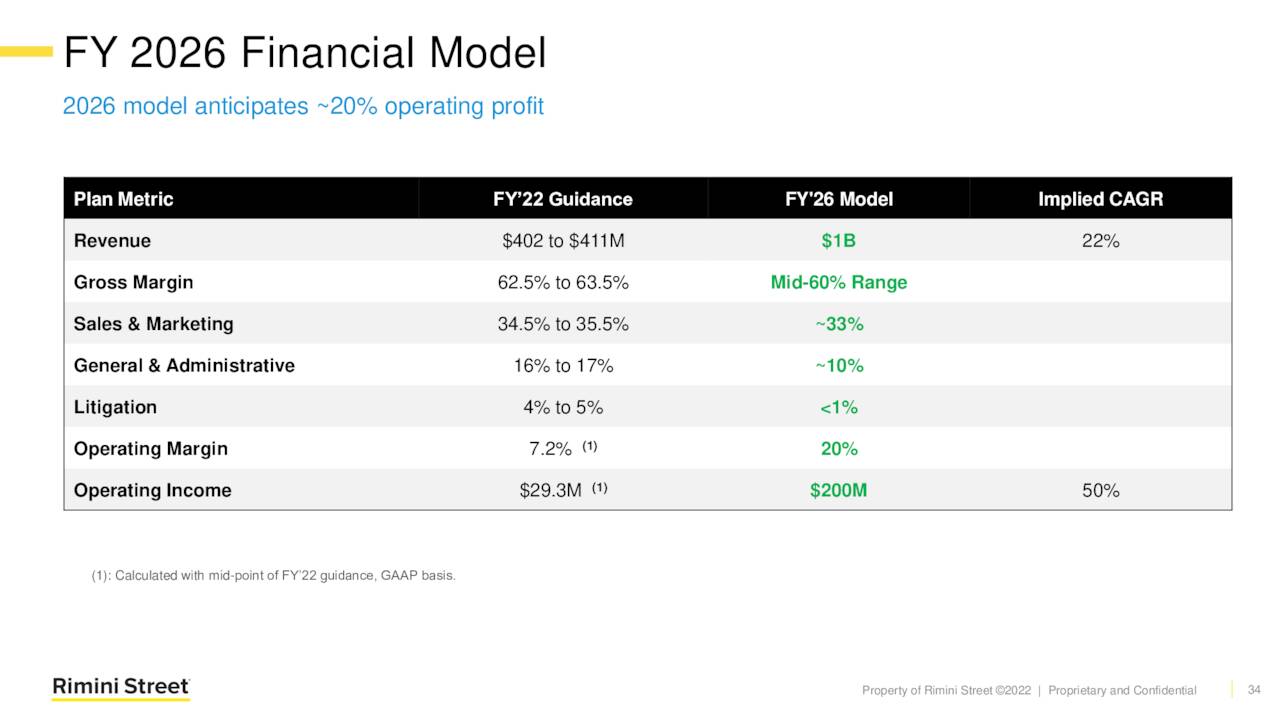

June Company Presentation

The company has a strategic plan to grow annual sales to $1 billion by FY2026 while substantially improving operating margins. The lack of insider purchases is somewhat discouraging, especially when the company just upped its stock buyback program. Large sales by the CEO late last year is a possible red flag, but insider sales can happen for all sorts of reasons (Ex, taxes, diversification). Litigation with Oracle, which has been ongoing for over a decade and is likely heading to another trial in 2023, is another thing to keep an eye on. Given all of this, RMNI is only worthy of a small ‘watch item‘ position for investors wanting more exposure to the tech sector.

“It is myopic to base sweeping change on the narrow experience of a few years.” – Antonin Scalia

Be the first to comment