Manuel Velasquez/Getty Images Entertainment

After the market closes on November 3rd, the management team at Warner Bros. Discovery (NASDAQ:WBD) is expected to announce financial results covering the third quarter of its 2022 fiscal year. In recent months, shares of the company have taken a beating, especially relative to the broader market. Concerns over the health of the streaming industry, combined with the company’s own position in that market, have been instrumental in pushing the stock down. But of course, even a business that is not doing all that great can only experience so much downside before it becomes an appealing opportunity. While I’m not yet sold on Warner Bros. Discovery from that perspective, I do think that the picture is getting more appealing for investors. But of course, a lot of what the future holds for the enterprise will be determined by what management reports in the coming days. In preparation for that, I have detailed a couple of items that investors should keep a close eye on, details that will go a long way toward determining the health of the firm as it stands today.

It’s all about subscribers

First and foremost, investors should pay special attention to the health of the streaming operations of Warner Bros. Discovery. This is the true growth area of the enterprise, and its success will likely add more value to the business than any other portion of the firm in the long run. It’s important to note though that the company doesn’t have just one subscription service. At present, management is aiming to merge HBO and HBO Max with Discovery+, but they are still two separate platforms as of this writing.

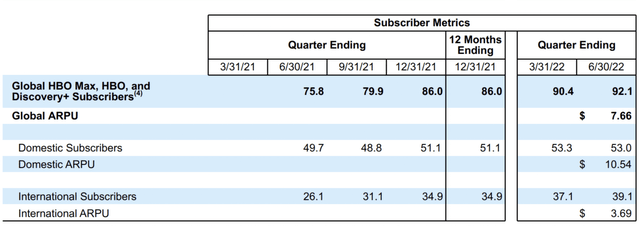

Sticking with that objective though, management has started reporting their subscriber numbers together. For instance, as of the end of the second quarter of this year, the two platforms combined had 92.1 million subscribers globally. This was up from the 90.4 million that the company had just one quarter earlier. And it compared favorably to the 75.8 million paid subscribers reported for the second quarter of 2021. Year over year, the greatest growth that the company will likely see involves its international operations. In the second quarter of last year, the company had 26.1 million international subscribers. This shot up by 49.8% to 39.1 million at the end of the second quarter. Over that same window of time, the number of domestic subscribers grew a more modest 6.6%, rising from 49.7 million to 53 million.

At this point in time, there is considerable uncertainty when it comes to the streaming space. Earlier this year, streaming giant Netflix (NFLX) reported incredibly weak results and even weaker guidance. But at the end of the day, for the past two quarters at least, results have come in better than anticipated. This has created a great deal of worry that other streaming platforms might also suffer. And from the first quarter of this year to the second quarter, Warner Bros. Discovery did post some worrisome results. The number of domestic subscribers at the end of the first quarter was 53.3 million. This number dropped to 53 million in the second quarter. Obviously, investors should also pay attention to the ARPU numbers provided by the company. In the latest quarter, global ARPU came out to $7.66 per month, with domestic ARPU totaling $10.54 and international ARPU coming in at just $3.69. It wouldn’t be surprising to see global ARPU fall sequentially, given that international expansion would likely be greater than domestic expansion.

Content is unbelievably important when it comes to the streaming space. After all, it’s content that not only initially attracts, but also retains customers. I would be negligent in my writing if I didn’t mention that the hottest show being aired by Warner Bros. Discovery at this time is House of the Dragon, the prequel to the once-famous Game of Thrones series. According to one source, the show has averaged around 29 million viewers per episode across all US platforms. While this is a gargantuan number, it’s worth noting that it is below the 32.7 million viewers per episode seen for season seven of Game of Thrones. And it’s also below the 46 million for the final season of said show. Even with these numbers coming up short, the show is an undeniable smash hit. And it’s not unthinkable that its success could have had a positive impact on the company’s overall subscriber numbers. But we will have to wait and see.

Looking beyond this year, management has high hopes for its streaming operations. It would be interesting to see if guidance changes for the global subscriber base. After all, management is forecasting 130 million global subscribers by 2025. Along the way, they hope to achieve global ARPU growth from $8 and higher. In the US, they expect their streaming operations to break even on an EBITDA basis by 2024. And for the global direct-to-consumer segment, the company hopes to be positive EBITDA to the tune of $1 billion or more by 2025.

Debt and cash flows

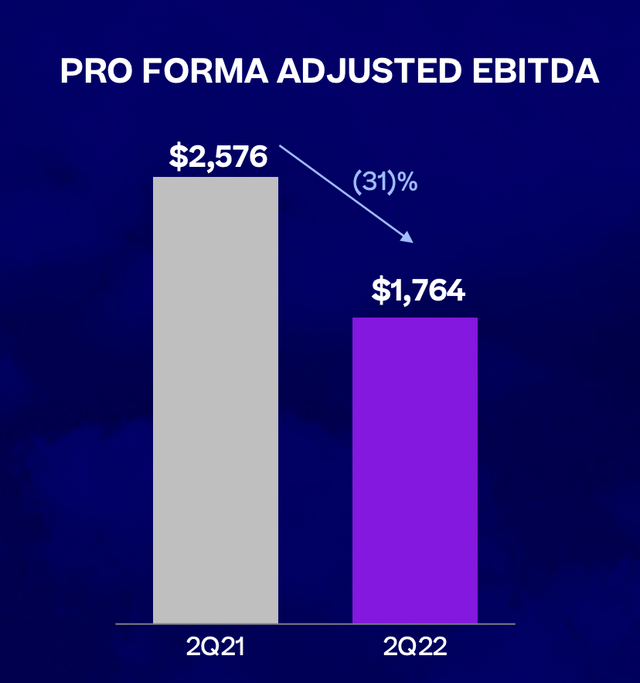

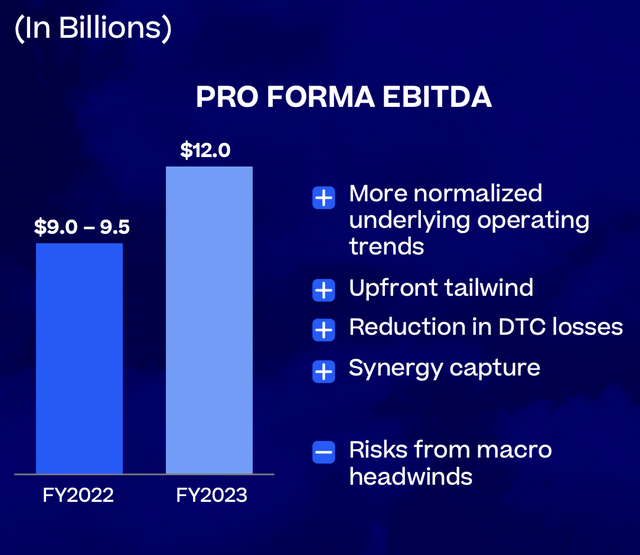

There are also some other factors that investors should look at. As I mentioned already, management is already focused on improving EBITDA when it comes to its streaming operations. But for the company as a whole, there has been some weakness on this front recently. On a pro forma adjusted basis, consolidated EBITDA for the company totaled $1.76 billion in the second quarter of this year. This was down around 31% from the $2.58 billion generated one year earlier. It will be fascinating to see how results reported will impact the company’s guidance for 2022 and 2023. That’s because, for 2022, the company is currently forecasting pro forma EBITDA of between $9 billion and $9.5 billion, with a goal of increasing this to $12 billion next year. Naturally, management is investing heavily in content creation. But this doesn’t mean that the firm is willing to throw out cash for any good reason.

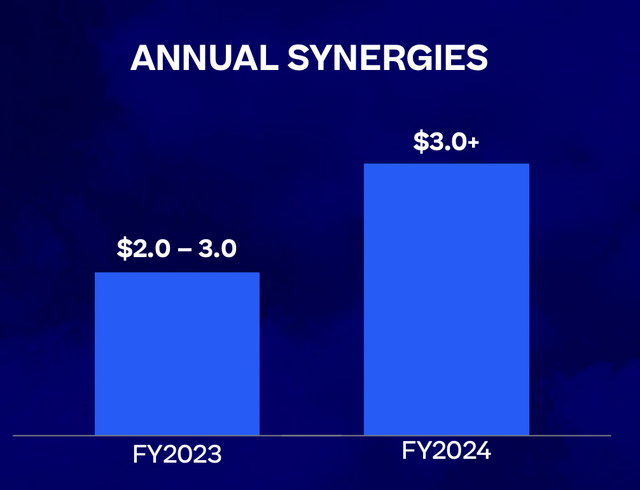

Recently, news broke that the company was planning on taking between $3.2 billion and $4.3 billion in pretax charges, with between $1.3 billion and $1.6 billion of it occurring in the third quarter. Of the total charge, somewhere between $2 billion and $2.5 billion will relate to strategic content programming assessments. In short, the company is going to be laser-focused on which content makes sense to spend money on and which content does not. Although painful in the near term, these decisions will help to shape the picture of the company’s health moving forward. It is not yet known if these maneuvers are included in or separated from the company’s current annual synergies savings plan. In 2023, the firm expects to generate between $2 billion and $3 billion in annual synergies. And in 2024, this number is expected to top $3 billion. In addition to growing its streaming operations, the company should be incredibly focused on reducing its leverage. At the end of the latest quarter, net debt was $49.91 billion. As I highlighted already, the company should generate a great deal of cash flow that it can use to pay debt down if it so desires. But of course, it’s unclear what the picture might look like moving forward. So investors would be wise to keep an eye out on these figures when the company reports.

From a purely valuation perspective, Warner Bros. Discovery is definitely a company that deserves some attention. Taking management guidance for the current fiscal year, I calculated that the company is trading at an EV to EBITDA multiple of 9.9. As you can see in the table below, this is cheaper than two of the four big players involved in streaming that I pointed out. At the same time, it’s also more expensive than two of them.

| Company | EV / EBITDA |

| Warner Bros. Discovery | 9.9 |

| Netflix | 14.5 |

| The Walt Disney Company (DIS) | 31.0 |

| Paramount Global (PARA) | 4.8 |

| Comcast (CMCSA) | 8.5 |

Takeaway

Heading into the third quarter earnings release for the 2022 fiscal year, Warner Bros. Discovery looks to be in an interesting position. Management is continuing to aim for cost reductions while trying to grow the enterprise at the same time. I have no doubt that there is some fat to trim. But the big question is how much. It is important to note that shares in the company do look cheap relative to many other firms. But at the same time, these other players do have advantages that they don’t. For instance, Netflix has far better brand recognition and a larger audience. And The Walt Disney Company and Comcast are both diverse entertainment and communications conglomerates that offer significant stability. So, for investors who want something cheap that is more exposed to the streaming market, Warner Bros. Discovery is definitely looking more appealing than it did previously. But with there being still a great deal of uncertainty about the future, some of this lower price might well be justified.

Be the first to comment