FTiare/iStock via Getty Images

Financials

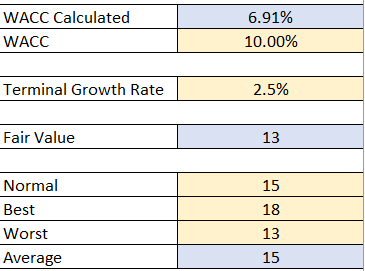

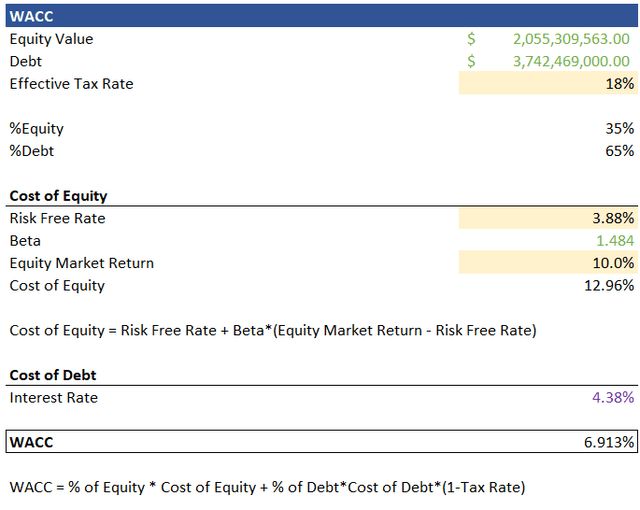

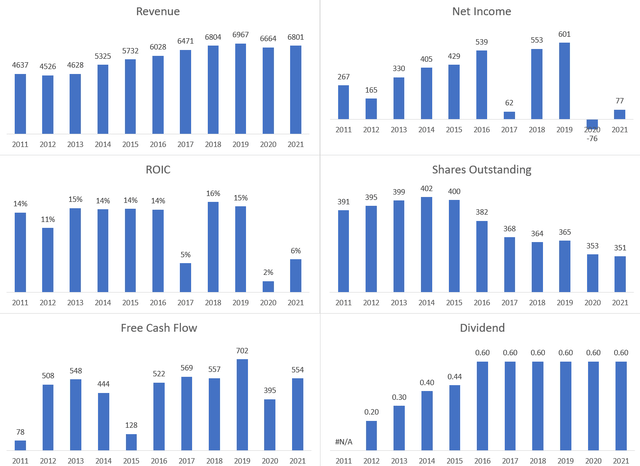

When evaluating Hanesbrands (NYSE:HBI), their financials have struggled the past two years after showing consistent growth in Revenue, Free Cash Flow, and Net Income from 2011-2019. This is largely in part due to inventory issues and supply chain constraints, along with an overall market slowdown. I still think these financials look healthy over the long run for a consumer cyclical company and may provide a buying opportunity before the upswing. Furthermore, they have been consistently buying back shares. There may be backlash on this decision, with short term debt and the dividend dissolving their cash flow. But I believe a stock price under $20 is considered undervalued, shown later in the valuation segment, which means HBI has been buying back undervalued shares in my eyes. Even with the massive headwinds, they still manage to boast positive ROIC over the last two years, with an average of 13% years prior. HBI has a relatively low WACC at 6.91%, which means management has been effectively producing value over the long run. They also have been consistently growing or mainlining a dividend over the years, which leads to the hot topic if they should cut it or not.

Dividend, Debt, Share Repurchases

HBI has been struggling the past two years and begs the question on how they should attack the capital structure. Many investors say cutting the dividend would be the best way, however I’m not in this boat. There is something to be said about a company who never cuts their dividend through thick and thin and makes the shareholders’ returns their number one priority. Besides, cutting the dividend could cause mixed results in the market, where other capital structure plans, such has attacking debt and repurchasing shares is almost a guaranteed value generator. There are a lot of investors in HBI because of their massive dividend yield and cutting it might scare them away, if they aren’t scared away already. I believe HBI should maintain their dividend and attack debt and repurchase shares when excess cash is available as the market cycle trends upwards.

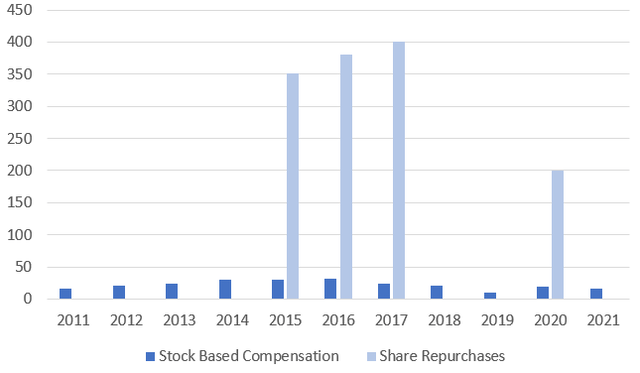

One thing to like about HBI is their share repurchases versus stock-based compensation. During their slow years, they cut back on the stock-based compensation and repurchased shares, putting the investor first. This story combined with the commitment to the dividend, tells me they value shareholder returns.

HBI Compensation Vs Repurchases (Author)

Now let’s be clear, I’m not saying cutting the dividend is a bad idea. I’m just saying I don’t think it’s the best way to attack the capital structure. When a company is down this deep, any decision will create value as the market swings upward. This leads to my next point and why I’m most interested in HBI – Extreme Value.

Valuation

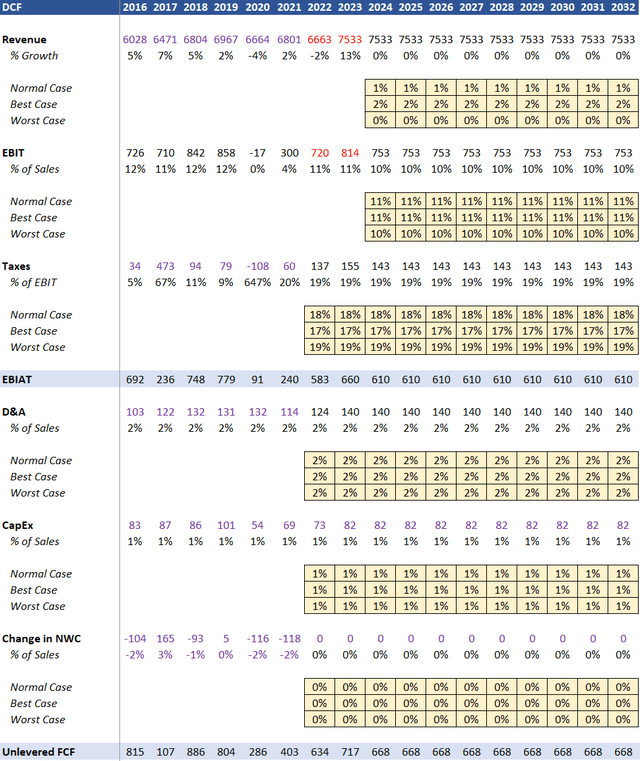

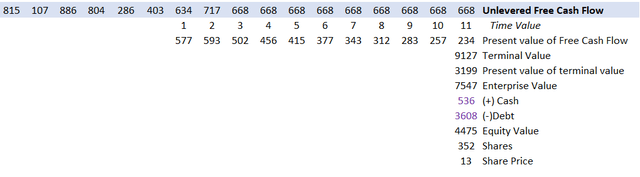

A fair value of $18 per share was calculated by a 10-year Unlevered Discounted Cash Flow (“DCF”) analysis using CAPM with a 2.5% terminal growth rate (“TGR”) and a 10% weighted average cost of capital (“WACC”) discount. Note that HBI’s WACC was actually calculated to be 6.91%, but I decided to discount by 10% to match the market. A worst-case, best-case, and normal-case scenario were averaged to arrive at the fair value. Revenue and EBIT projections were used from average results of (8) analysts for 2022 and (19) analysts for 2023 from Financial Modeling Prep (Red Text). We also took revenue predictions from Seeking Alpha in consideration. Personal projections were used thereafter, with the following conservative assumptions in the tan boxes

HBI Assumptions (Author) HBI Terminal Value (Author) HBI Fair Value (Author) HBI WACC (Author)

Conclusion

HBI is value play first, a cyclical swing second, and a dividend play third. What I mean by this is that I will be adding HBI, because of a low valuation and a long-term outlook. The cyclical swing in the market has provided an excellent opportunity to make 3X the investment. Additionally, their dividend yield is gigantic, and they continue to repurchase shares, providing additional returns. The sentiment is so bad on this, I think that people are overcomplicating the innerwear and outerwear brand we all know and love. HBI should return to the normal levels pre-covid, and I’m here to scoop up extremely undervalued shares, along with some socks and underwear for the holidays.

Be the first to comment