Nils Jacobi

The Energy Juggernaut

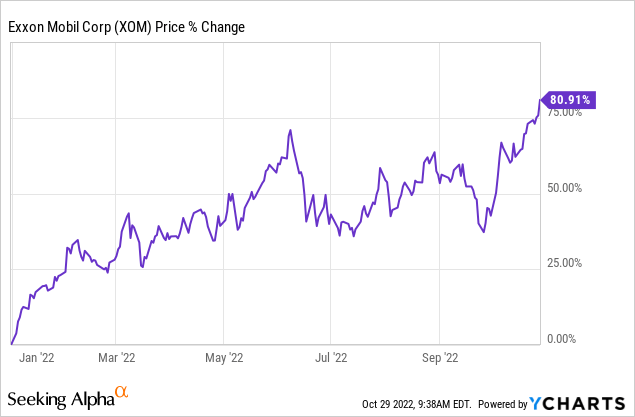

Yes, Exxon Mobil (NYSE:XOM) has done great this year. Yes, XOM is a wonderful company with strong leadership. Yes, XOM is a Dividend Champion.

We’re looking at 80% gains in a year. That’s pretty fantastic for a company in an industry that many said was dead or dying:

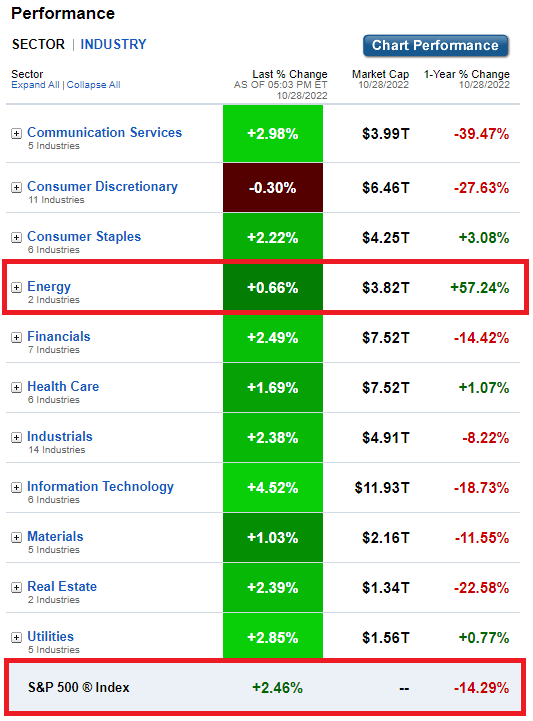

Well, hey, guess what? Oil, at least in 2022, is alive and well. Plus, it’s not like other sectors are kicking butt this year. Far from it.

Energy vs. S&P 500 and Sector Performance (Fidelity)

But you already know this! I’m just giving energy investors, myself included, a chance for a nice little victory lap.

While I do still like plenty of growth stocks (properly diversified and also properly sized), my real love is dividend growth investing. I am enamored with Dividend Champions, but also Dividend Kings. To be clear:

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

We’ve now set the table. You know that I’m happy with XOM. But, like me, let’s say you’re not a dyed in the wool “Buy and Hold Forever” investor. Instead, let’s assume you’re more of a value investor, or more accurately, you’re a dividend growth investor (or perhaps an income investor).

All of that said, this article isn’t about buying XOM. This article isn’t about holding XOM, either. To be clear, right now, I rate XOM a strong Hold, given the macro environment, but I’m not sure it’s a Buy.

This article is about possibly selling some XOM. I wouldn’t think of telling you to sell all your XOM. Yet, now might be a time to start “taking profits” as they say, and moving your winnings. That’s what this article is about, OK?

Where to Put Your Winnings

I’m starting by assuming you’re thinking about trimming your XOM but you’re not sure where to put that cash, per the discussion above.

I’m going to tell all you more conservative investors that maybe you should take another peek at the Dividend Kings. Let’s see which stocks can potentially offer an offload point.

While not perfect, I think Sure Dividend does a great job service for us right here: 2022 Dividend Kings List. You can do what I did, and you can download their Dividend Kings Excel Spreadsheet. Then you can sift and sort, and look for what might make sense. Or, you can follow my logic here, and keep it really simple. That’s my approach.

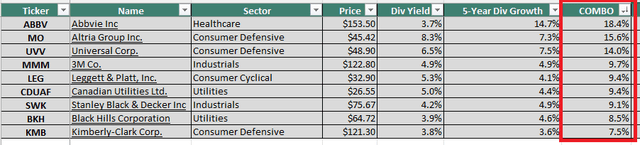

Right now, XOM is paying $3.64 per year in dividend, good for a yield of 3.3% give or take little. And, my back-of-napkin numbers tell me that XOM’s dividend growth rate over five years is about 3.2% and over 10 years, it’s about 3.7%. Like I often say, we don’t need perfection here:

“You don’t need to know a man’s weight to know that he’s fat.” ~ Benjamin Graham

In any case, with a sort of “Chowder Rule” way of thinking here, XOM provides a potential total return via dividends of 3.3% + 3.2% with the five year dividend growth rate, and 3.3% + 3.7% with the 10 year dividend growth rate. Adding it up, we’re looking at 6.5% and 7%, respectively, for the total income returns expected here.

We largely ignore price gains in this analysis. But, this approach works fairly well for value investors, because low yields are often caused by price appreciation, and high yields are caused by problems, and price declines. That means yield is a type of flare: Maybe now these companies are on sale.

We can wave our hands, and go this way and that, but this is rational way to think about dividend income in the medium and long run. We’re not following this religiously. It’s merely a way to filter out and filter in, getting us down to those Dividend Kings that “beat” XOM right now.

Here’s the moment you’ve been looking for:

Dividend Kings With Better “Chowder Numbers” Than XOM (Sure Dividend and Author)

For fast reference and easy clicks to the pages:

- AbbVie (ABBV)

- Altria (MO)

- Universal Corp. (UVV)

- 3M Co. (MMM)

- Leggett & Platt (LEG)

- Canadian Utilities (OTCPK:CDUAF)

- Stanley Black & Decker (SWK)

- Black Hills Corporation (BKH)

- Kimberly-Clark (KMB)

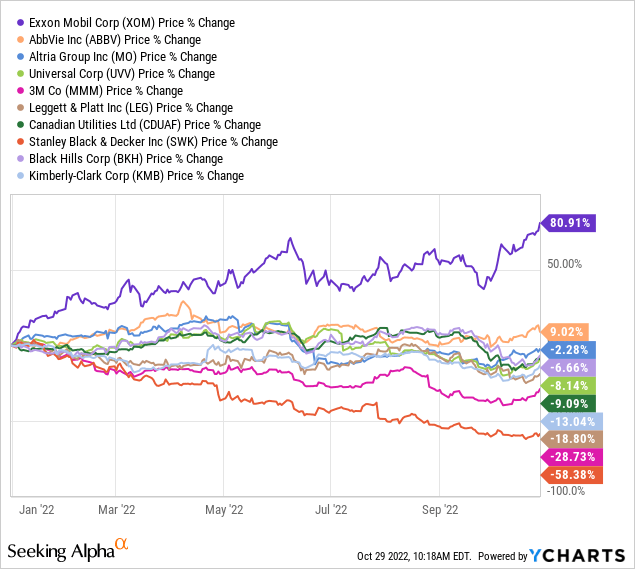

And, because I just know you’re curious:

“Sell XOM, Are You Crazy?”

Come on, I don’t have a crystal ball. I have no idea if XOM will go higher. I have a feeling it will, but why deal with emotions and the gut, when there’s history, and data? (We can look through rearview mirror and windshield.)

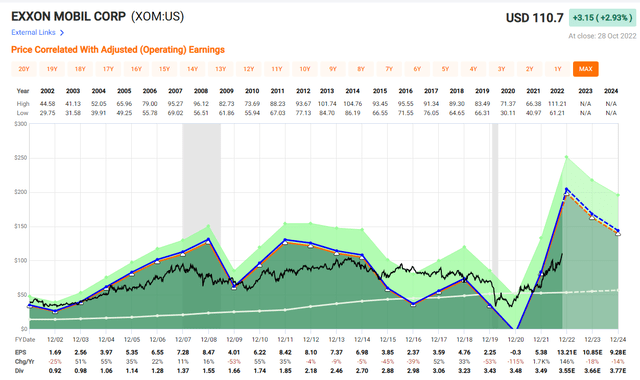

Let’s pivot a little. It’s important. Sometimes, you have to call a spade a spade, which in this case is simple: XOM is a highly cyclical business. Let’s meet XOM’s three friendly trends: Lumpy, Bumpy and Choppy.

Lumpy, Bumpy, Choppy (Price Action, Cash Flow and Earnings) (FAST Graphs)

Again, I’m not saying XOM is a Sell. I rate XOM as a Hold. Instead, I’m saying that maybe you’re holding on to a ton of profits and there’s a chance XOM could swing the other way. Why not at least consider companies with a higher starting yield and higher five-year (and 10-year!) dividend growth?

Also, need I remind anyone that in 2020, XOM was crushed? Prices were absurdly low. There were problems, issues, and so much pain. Oil is dead. Forever. Gone Baby Gone. Might we say the same thing about some Dividend Kings right now? ABBV, MO, LEG, SWK… I’m looking at you.

I shall be even more precise. From the Dividend Kings list, I’m always interested in ABBV and MO. I’ve added a bit of SWK this year. LEG and KMB are attracting my eyes.

Wrap Up

So, in effect, I’m saying two big things in this article for you. First, maybe XOM will go higher – even much higher – but, well, maybe it won’t. We’ve made a lot of money this year. Maybe, just maybe, a trim could make some sense, but definitely not a sellout. That’d be crazy, I think. Second, if you’re thinking about a little (or big) XOM trim, why not look at the strongest of the strong, in terms of dividend history, current starting yield, and five-year and 10-year growth rates.

I also get this: Some people will hold on to XOM with their cold, dead hands. “Hey man, that’s cool, you go ahead and do that.” – But seriously, I respect that, I really do. But, there is this other nifty thing that’s rather powerful too: regression to the mean, especially in highly cyclical industries. Hint: Energy, especially oil and gas, got it? For those philosophically minded, trees don’t grow to the sky.

Very importantly, and to club the baby seal’s head, consider how sad and angry you were in 2020 when XOM took a fall. Sure, we all say that it doesn’t matter, and look at me now, ma. Those dividends kept me warm and dry in the dead of winter.

But, perhaps we need to think about making hay while the sun is shining. Reap what you’ve sown. Friends, there are options available. Scroll back up, take a look.

Follow me if you like this article. Leave comments if you feel strongly, either way. And above all, peace and love to you, and your family. Prost!

Be the first to comment