Justin Sullivan/Getty Images News

Walgreens (NASDAQ:WBA) reports their fiscal Q4 ’22 financial results before the opening bell on Thursday, October 13 ’22, with Street consensus expecting the retail drug store giant to print $0.77 in EPS on $32.1 billion in revenue (per IBES data by Refinitiv) for year-over-year (y.y) declines of -34% and -6% respectively.

Roz Brewer, the current CEO, stepped into a mess when she took over in March, ’21, right in the middle of Covid-19, which in my opinion, I thought Walgreens handled well – at least around Chicago – since I’m a frequent shopper at their stores.

As someone who has modeled WBA since the 1990s, the rise and fall of WBA in the 1990s under Dan Jorndt, and then the peak in the stock in 2015, is as much a story of “creative destruction” in America as it is Stefano Pessina’s bad timing and ill-fated global strategy around the expansion of retail drug stores.

The international retail segment of WBA comprises roughly 12-13% of WBA’s total revenue and operating profit with the lion’s share being the US operations. The problem with the US business is drug reimbursement pressure and continued pressure on the front-end or the retail or “convenience non-scrip” part of the business.

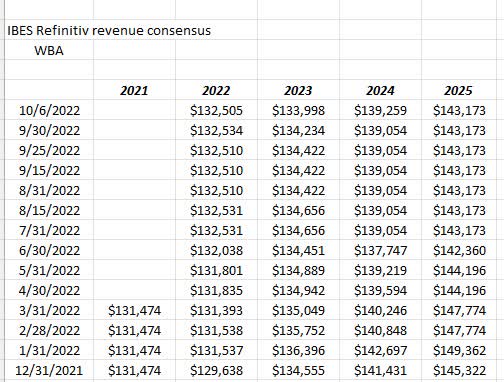

Trend in WBA EPS and revenue estimates:

Trend in WBA’s EPS estimates (IBES data by Refinitiv) WBA revenue revision trend (IBES data by Refinitiv)

What’s positive about the EPS and revenue revision trends is that EPS has stopped falling while Walgreen’s revenue revisions have actually been slightly positive since 12/31/21. It’s less positive to see the revenue revision declines in fiscal 2023 and fiscal ’24 but let’s see what Thursday holds in terms of guidance.

Here’s WBA’s gross and operating margin history over the last 10 years:

| 4-qtr avg | 12 qtr avg | 20 qtr avg | 40 qtr avg | |

| Gross mgn | 21.6% | 21.2% | 21.9% | 24.5% |

| Operating mgn | 4.17% | 4.02% | 4.43% | 4.92% |

Source: WBA valuation spreadsheet

Almost as soon as Stefano took over the CEO position from Jim Skinner, the margins started deteriorating.

Walgreens bread-and-butter for years was TO simply drive traffic into the store through the prescription business, and then drive margin with the front-end convenience items from everything from milk and orange juice to makeup and photo.

That seems to have been lost in the acquisition or joint venture binge that followed with Pessina as CEO, but also the market changed too and Walgreens basic business model and value proposition began to erode at the edges.

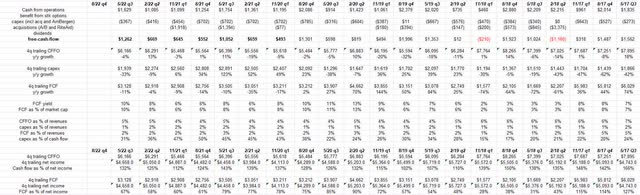

Cash-flow: where the rubber meets the road

WBA cash-flow analysis (valuation s/sheet, earnings reports)

Many readers wind up attracted to “current dividend yield” as a potential catalyst to own a stock, but a broader picture is needed to determine whether you are buying a company that’s temporarily cheap or has longer-term operational issues.

The metrics above show that Walgreens still has moderately healthy cash-flow and free-cash-flow although the trend is a little worrisome.

The following table shows WBA’s free-cash-flow coverage of net income over a longer-time frame and how it’s changed:

| 4-qtr avg | 12-qtr avg | 20-qtr avg | 40-qtr avg | |

| FCF % of net inc | 61% | 72% | 66% | 80% |

Source: valuation spreadsheet

Readers can see with both margins and free-cash-flow coverage of net income that over the last 10 years both have deteriorated and the trend isn’t positive.

Walgreens valuation:

| Valuation metric | Stk at $30 |

| 3-year avg exp EPS gro | 3% |

| 3-year avg exp rev gro | 3% |

| PE ratio | 6x |

| Price-to-book (BV) | 0.85x |

| Price-to-tang book (TBV) | neg TBV |

| Price-to-cash-flow | 4x |

| Price-to-free-cash-flow | 8x |

| Dividend yield | 6.3% |

| Div as % of free-cash-flow | trend above 50% |

| Mstar “fair value” estimate | $48 |

Source: valuation s/sheet and Morningstar

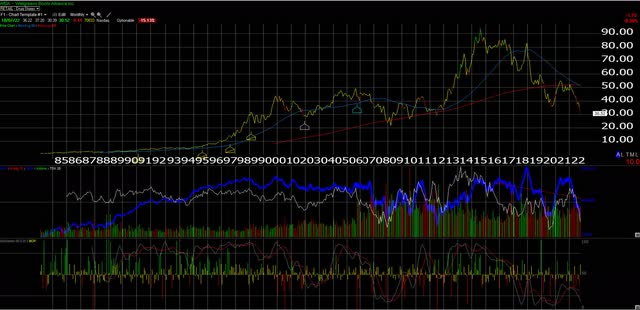

The chart:

WBA monthly chart (Worden telechart)

To keep it simple, this isn’t a good-looking chart. The rejection at $50 per share in early 2022, where the 50 and 200-month moving averages (blue and red line) meet, is not a positive.

The 2012 low was $28.53 which would be a likely (if only temporary) support area.

Summary/Conclusion

Expected fiscal ’23 EPS and revenue growth today is -9% and +1%, but readers can hear what management gives in terms of guidance for fiscal 2023 which began on or around Sept 1 ’22.

The lifeline for any company is cash-flow and Walgreens still looks to have very good cash-flow for the retail drug giant, but it would be helpful to see some growth in the metrics, particularly the income statement and in margins.

As a regular user of Walgreens services and stores, the staff is wonderful, I can get in and out quickly, which is all that I want but it’s also unlikely that the drug reimbursement pressure will change, thus putting more pressure on the front-end of the store to drive margins.

WBA’s recent dividend hike was 1/4 of $0.01, but WBA has repurchased $4 billion in shares in the last two quarters. The total dividend dollars paid have moved up 50% of free-cash-flow. For normal stage growth companies that percentage is typically closer to 33-38%.

Roz Brewer has an uphill battle to turn the giant around. The new initiative can’t be commented on since I just don’t know that much about the new business, but the first thing that struck me when the Health (Village MD?) initiative was announced is that it requires more capex and more brick-and-mortar, although it’s called a “technology-enabled” care model. I liked the nursing-staffed store clinics in the early 2000s and tried to use them wherever possible. Walgreens Health smacks of that old model a little bit with a Tele-Doc difference.

The return to value investing hasn’t helped Walgreens that much in ’22 as this update on WBA alluded to, although the 2022 bear market has hurt everything. The stock was lifted to a hold because of Boots with this update, after the shares were thought to be a sell prior.

Readers attracted to deep value stocks like WBA is trading currently, can take a shot at Walgreens, but I’d use the 2012 dip to $28.53 level as a stop-loss for the position and wait and see what happens. Below that $28.53 price, the 2009 low was around $20.

It’s been a tough 12 years for WBA, with Brexit, Covid-19, and now Ukraine and the price of natural gas greatly pressing on the UK consumer. But the US business is still the straw that stirs the drink.

Walgreens has some positive financial attributes like cash-flow and an AA credit rating that was affirmed in August ’22, not to mention that EPS and revenue estimates look like they are starting to stabilize.

The negatives are obvious in terms of margins and regulatory pressure and front-end pressure.

No positions are owned currently and none likely will be bought prior to earnings this week.

Be the first to comment