koto_feja

Right now I’m having amnesia and déjà vu at the same time. I think I’ve forgotten this before. ― Steven Wright

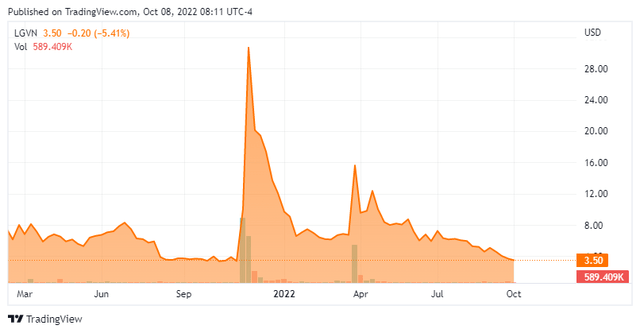

Today, we put Longeveron Inc. (NASDAQ:LGVN) in the spotlight for the first time. As can be seen below the stock has lost over 80% of its value in 2022. The company has an early-stage clinical pipeline targeting several disease areas including Alzheimer’s. What lies ahead for the company is discussed below.

Company Overview:

Longeveron Inc. is a clinical stage biotechnology company developing cellular therapies for chronic aging-related and life-threatening conditions. The company is based an hour south of me in Miami, FL. The stock currently trades around $3.50 a share and sports an approximate market capitalization of $85 million.

September Company Presentation

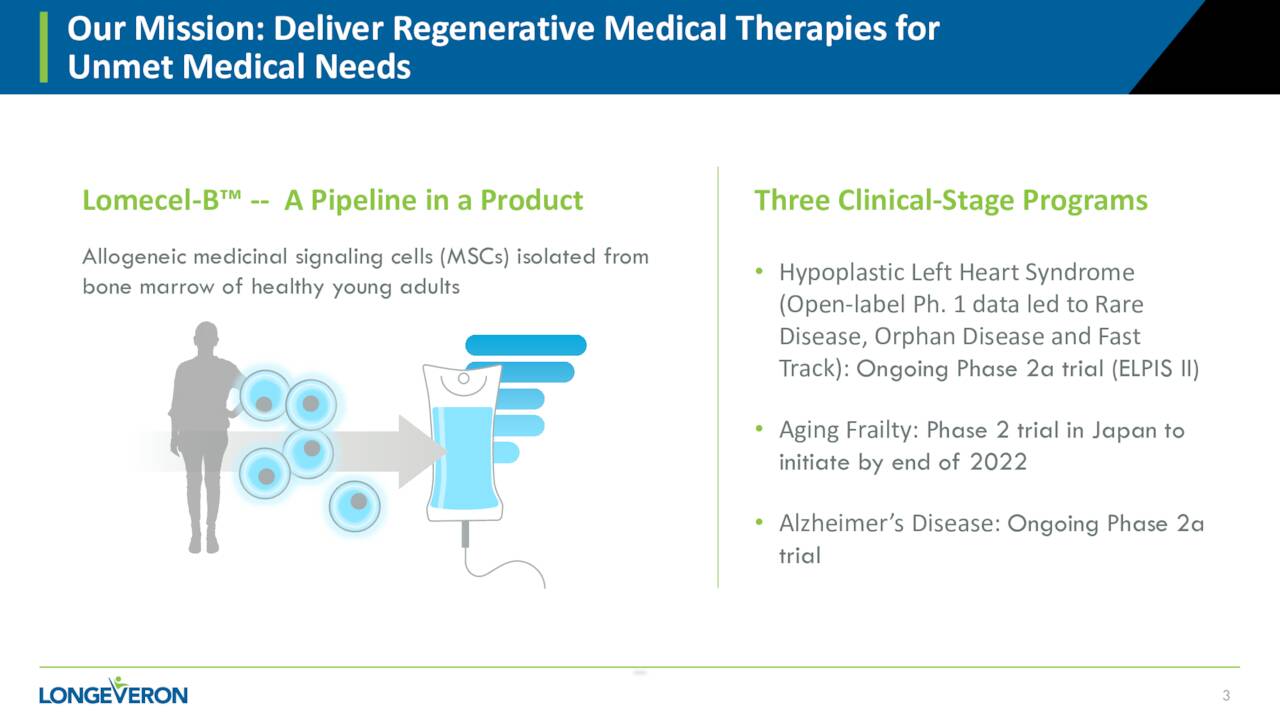

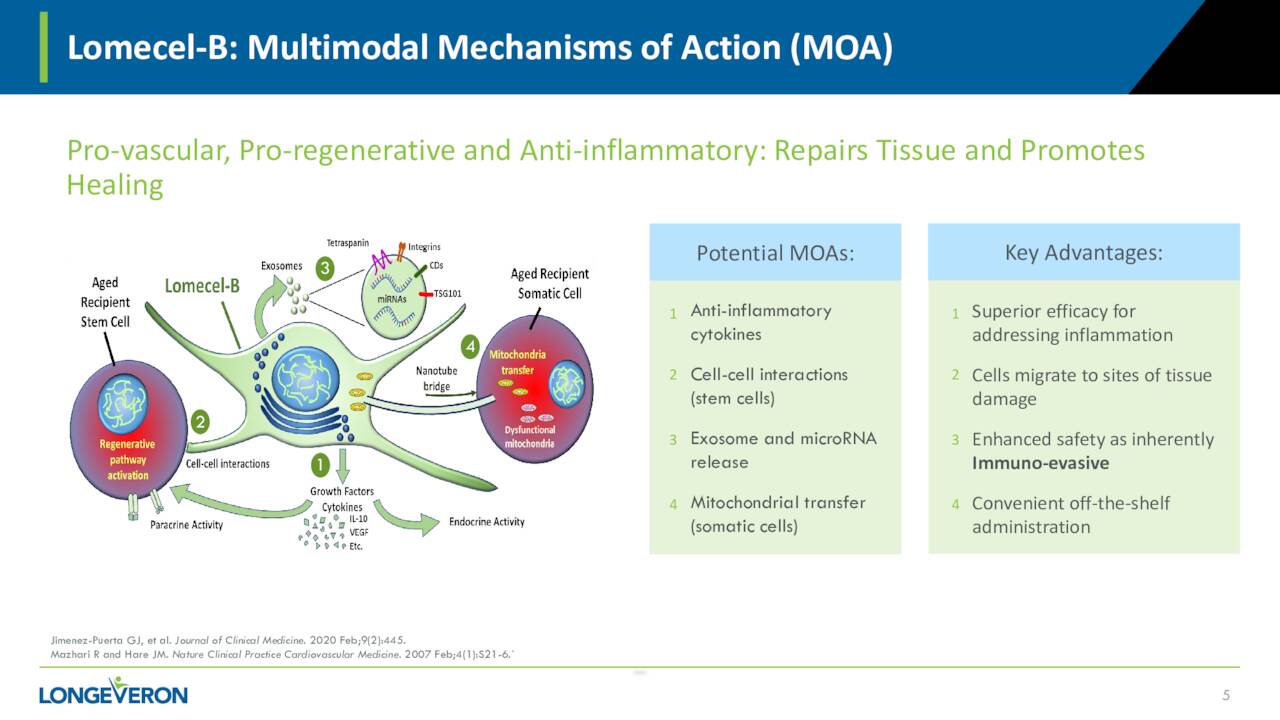

The company primary asset is called Lomecel-B which the company has dubbed a pipeline in a product. The candidate is in early-stage development targeting multiple indications.

September Company Presentation

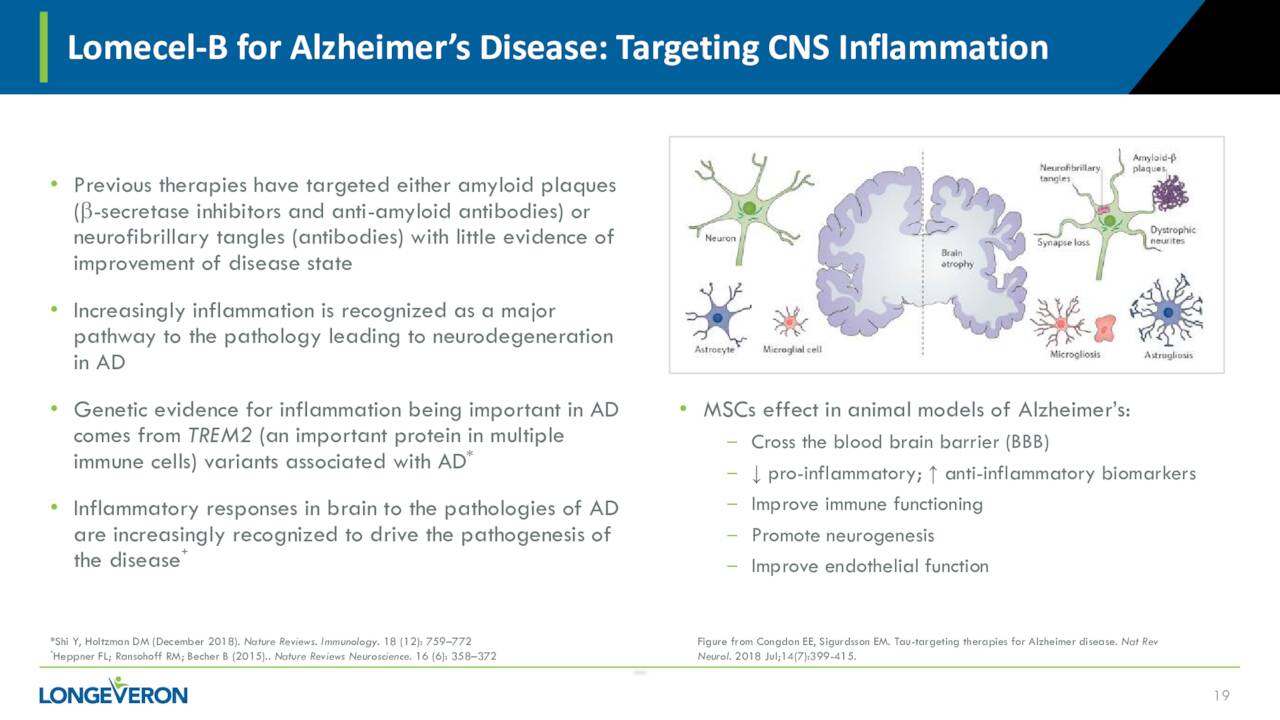

At the beginning of the year, Longeveron initiated a Phase 2a clinical trial of Lomecel-B to evaluate the safety of single and multiple infusions of two different dose levels of Lomecel-B compared to placebo in patients with mild Alzheimer’s Disease. The company’s approach is unique in that Lomecel-B is targeting the CNS inflammation present in the disease and not the amyloid plaque that is the focus of most efforts to treat this horrid disease

September Company Presentation

Enrollment in this 48-patient, 4-arm, parallel design, randomized should be complete by year end. The primary endpoint is safety meaning the occurrence of serious adverse events (SAEs) within the first 30 days after administration of Lomecel-B.

September Company Presentation

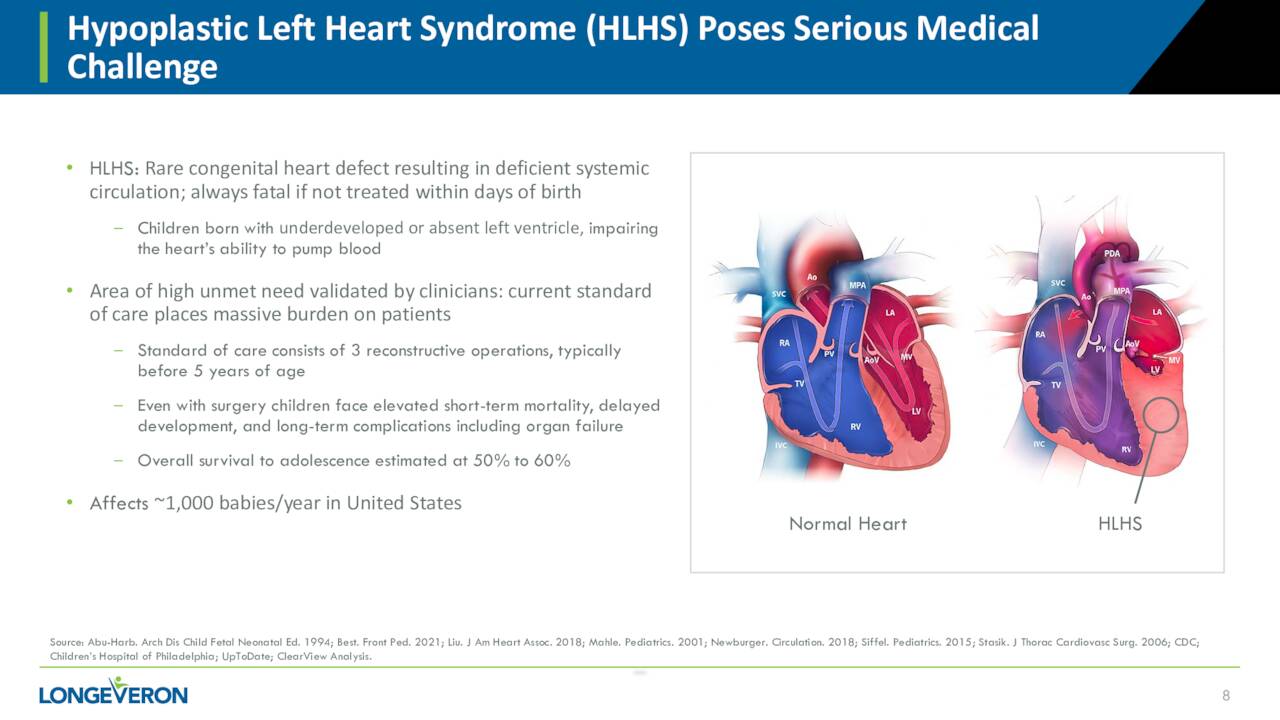

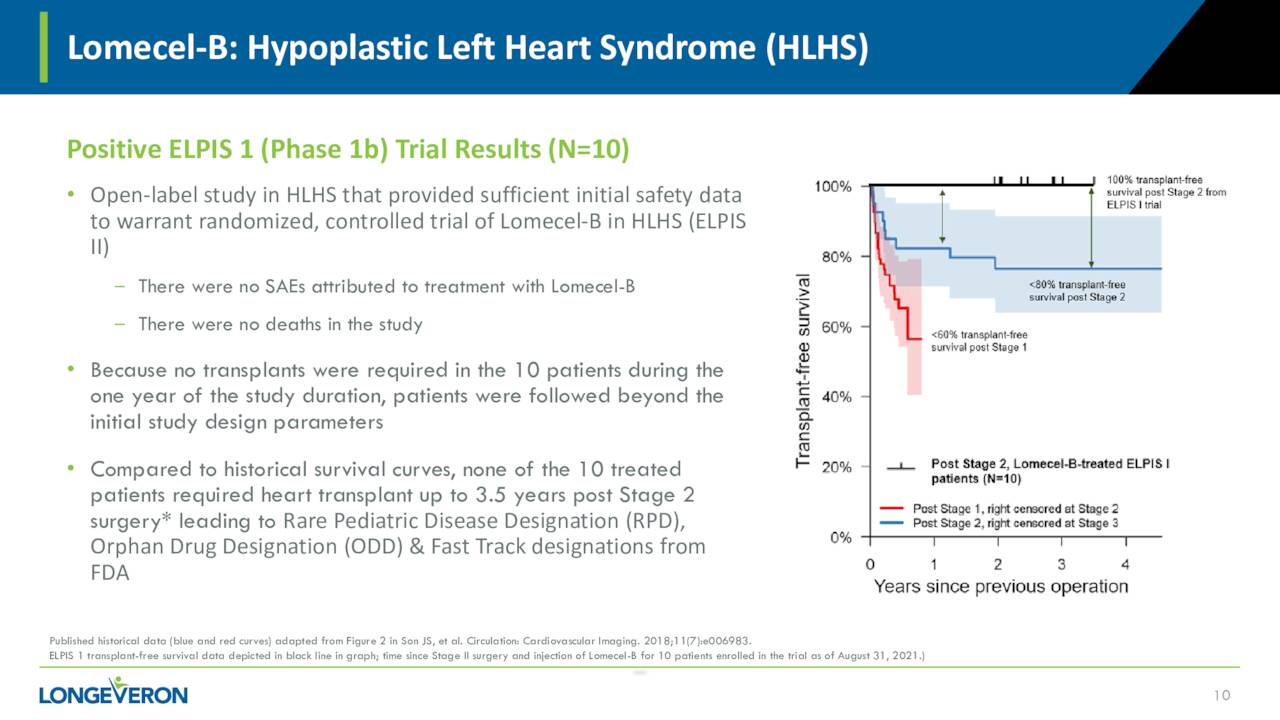

Lomecel-B is also being evaluated to treat a rare affliction called HLHS which stand for Hypoplastic Left Heart Syndrome. The company is currently putting together a Phase 2a clinical study that is intended to evaluate the safety and efficacy of intramyocardial injection of Lomecel-B in infants with HLHS who are undergoing Stage II reconstructive cardiac surgery. The company has activated 12 clinical sites for this trial ‘ELPIS II’ that will consist of 38 patients. Enrollment is ongoing and management will disclose timelines for this trial once the 50% enrollment mark has been met. Lomecel-B for HLHS has received both Rare Pediatric Disease and Orphan Drug Designations from the FDA in late August, it should be noted.

September Company Presentation

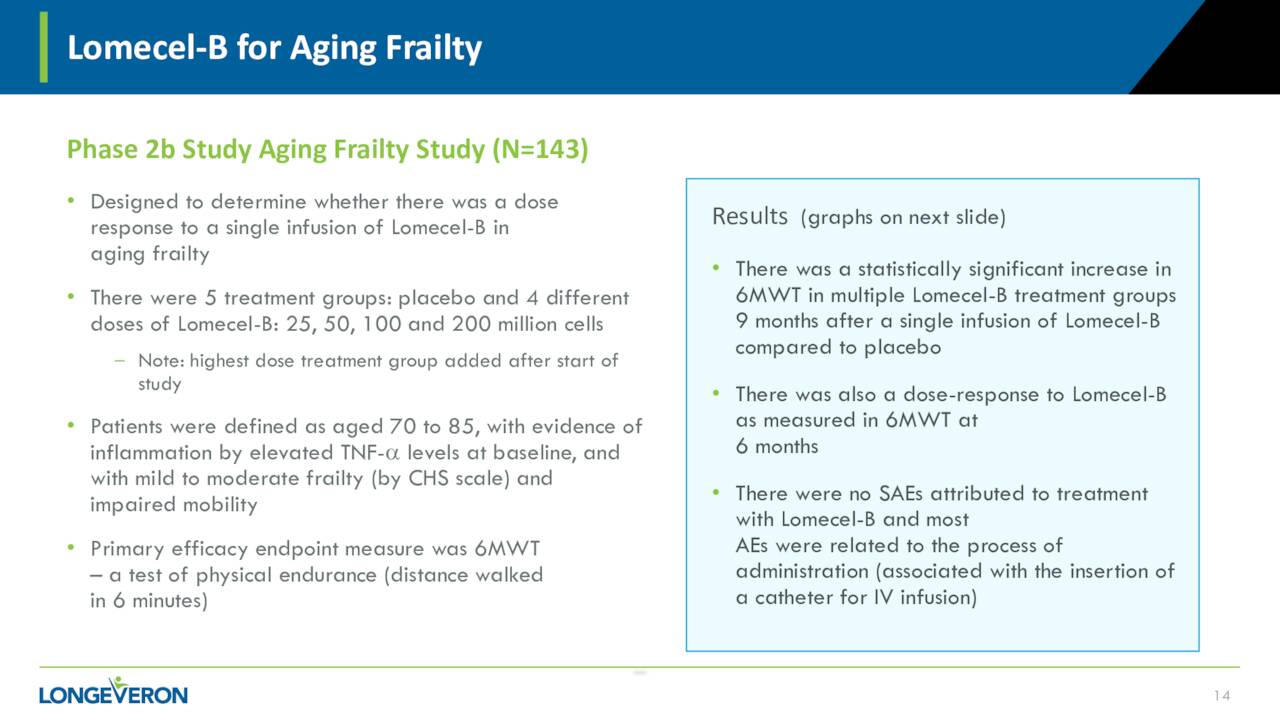

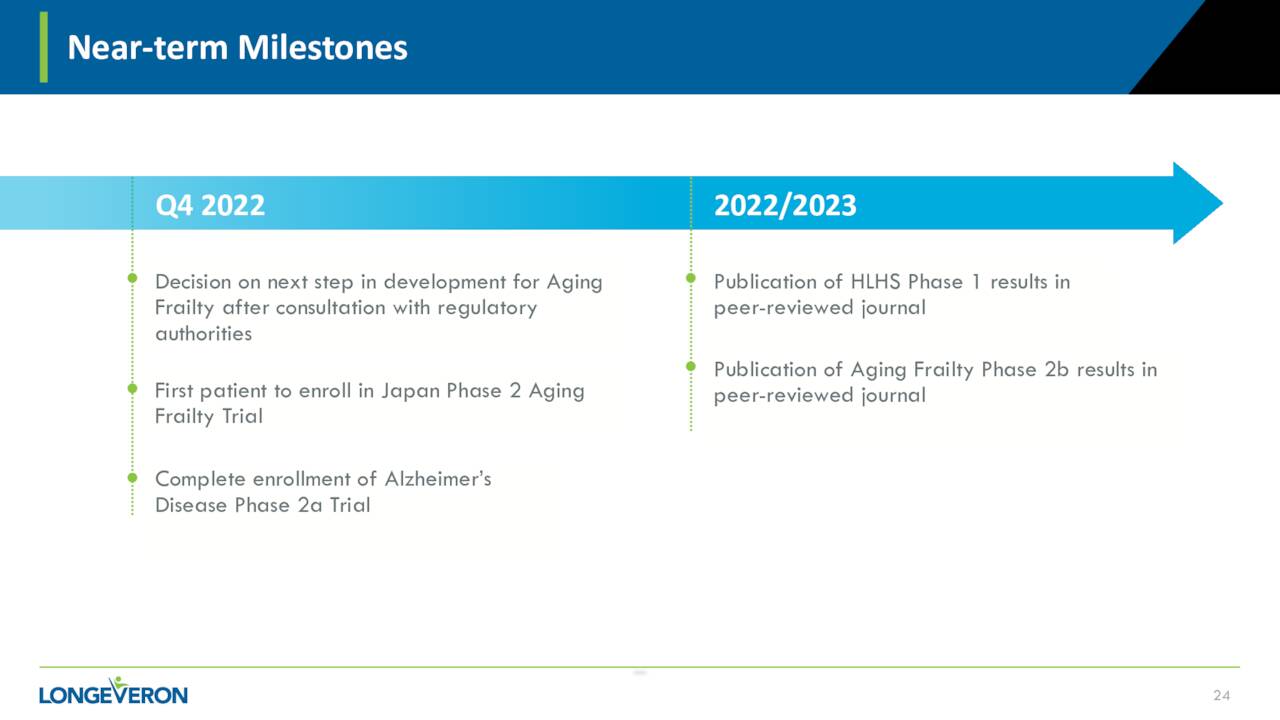

Finally, the design of a planned Phase 2 study evaluating Lomecel-B against Aging Frailty in Japan recently saw the amendment to the proposed design of the study accepted. The company is hoping to enroll the first subject in this study before the end of this year. Results from a Phase 2b trial were encouraging.

September Company Presentation

Analyst Commentary & Verdict:

Only two analyst firms have chimed in on Longeveron so far in 2022. In early January, E F Hutton initiated the shares as a Buy with a $20 price target. In mid-August Maxim Group maintained its own Buy rating with a $14 price target.

Several insiders have sold shares in the company so far this year. So far, aggregate sales total just over $650,000 in 2022. There has been no insider buying in the equity so far this year. Approximately one of every dozen shares outstanding is currently held short. The company ended the second quarter with just over $25 million in cash and marketable securities against no long-term debt. The company posted a net loss of $5.6 million.

Verdict:

There are some things to like about Longeveron. It has several ‘shots on goal‘ and has positive, albeit sparse analyst support. The company is targeting a huge potential indication as well. Unfortunately, the downside far outweighs those positives in this uncertain market. At its current quarterly burn rate, the company is going to have to raise additional capital, most likely in the first half of 2023. Leadership has stated that current funding is ‘sufficient to cover expenses and capital requirements into the first half of 2024‘.

Alzheimer’s is also the black hole of the R&D dollar across the industry, as large biotech firms have sunk tens of billions of dollars of research into this disease area with not much to show for those investments to this point.

September Company Presentation

Finally, any potential commercialization for Longeveron is years and years down the road. Not exactly the kind of risk profile that does well in a bear market. Therefore, I have no investment recommendation around LGVN at this time.

Our memory is a more perfect world than the universe: it gives back life to those who no longer exist. ― Guy de Maupassant

Be the first to comment