KanawatTH

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on July 21st, 2022.

Calamos offers several closed-end fund investments that are worthwhile. They are often associated with convertible bond exposure. Even a fund such as Calamos Global Total Return Fund (NASDAQ:CGO), with a heavier focus on equities, has convertible stock exposure at some level. The fund is more of a hybrid allocation, investing across stocks, bonds, convertibles and just about anything else is on the table.

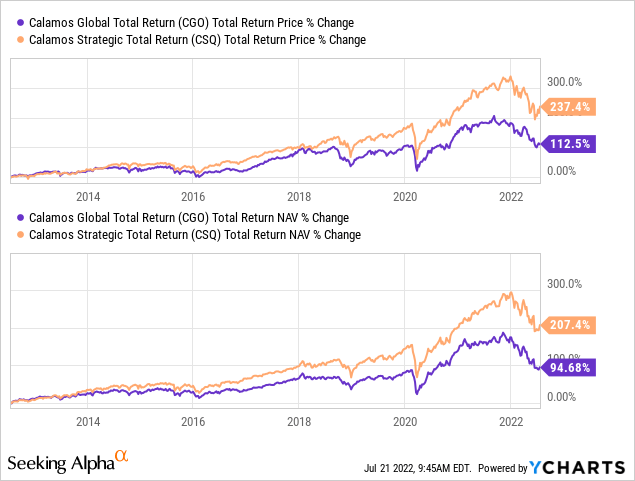

The fund is similar to Calamos Strategic Total Return Fund (CSQ), as I’ve noted previously. However, CGO has a global tilt that sets it apart. We know that over the last decade, U.S. investments have vastly outperformed their global counterparts. This is reflected in the last decade-long performance between these two funds.

YCharts

What makes it a bit more worthwhile at this point is that this trend doesn’t last forever. There are periods when international stocks have outperformed. Based on the cheaper valuations abroad, that shift could happen going forward. Of course, the European turmoil that has been brought about by Russia now would probably need to be resolved.

The Basics

- 1-Year Z-score: 0.25

- Premium: 4.92%

- Distribution Yield: 11.04%

- Expense Ratio: 1.76%

- Leverage: 32.66%

- Managed Assets: $147 million

- Structure: Perpetual

CGO will “seek total return through a combination of capital appreciation and current income.” The way they attempt this is; “by investing in a globally diversified portfolio of equities, convertible securities and high-yield corporate bonds.” Generally, equity positions are the largest allocation of the fund. That’s followed by a material allocation to convertibles and then corporate bond exposure to a lesser degree.

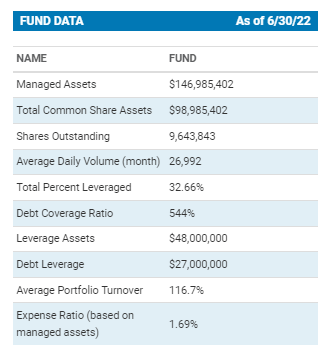

Rapid declines this year have meant that the managed assets have dwindled quickly. Not to mention what havoc that plays on the leverage by really ramping the leverage ratio up considerably. When we covered the fund just in February, the leverage ratio was sitting at less than 34%.

While that figure hasn’t moved today as far as a percentage, that’s because the fund deleveraged its portfolio. It would have otherwise been over 40% at this point. This was a somewhat recent event too. At the end of April 2022, the fund listed $50.5 million in outstanding notes. It now lists that debt leverage is $27 million.

CGO Fund Stats (Calamos)

A smaller fund also leads to a lack of liquidity. A problem I noted the last time we covered the fund when it was at $200 million in AUM.

It also leads to higher expenses, a place that Calamos can’t really afford because they tend to run higher already. There are expenses that are fixed in nature, meaning that as the asset base grows smaller, these take a larger and larger chunk. To be fair, Calamos does run some rather unique funds with exposure into areas that aren’t necessarily as accessible as usual. Convertible bonds are generally going to be private or require a bit more of an understanding to invest in as they are often unrated.

When including the leverage expenses, the expense ratio came to 2.48% in its last semi-annual report. This is only set to rise higher if the fund loses more assets.

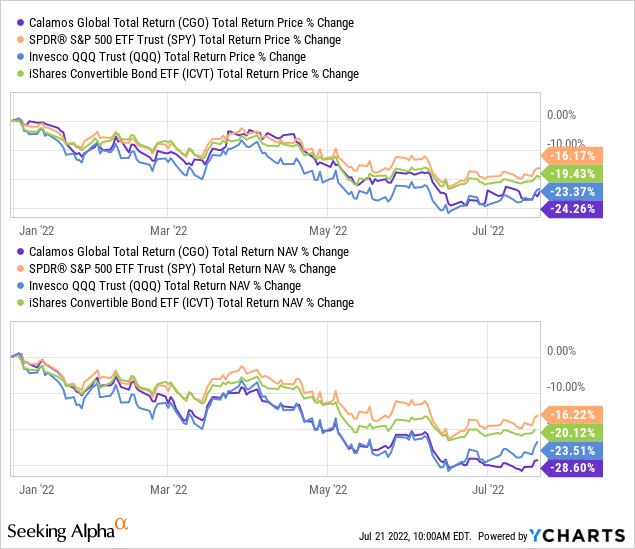

Leverage expenses are also likely to boost the expense ratio of the fund as costs rise due to higher interest rates. They utilize borrowings through both a credit facility and preferred shares.

The credit facility is charged at the Overnight Bank Financing Rate [OBFR] plus 0.80%. The preferred are at various fixed-rate dividends, which means some of the costs will be held steady.

CGO Semi-Annual Report (Calamos)

A lot of the “basics” here cover most of the risks, in my opinion. The lower assets, higher fees, high leverage and the interest rate sensitivity that is presented through that leverage, plus now deleveraging, really should be considered before making an investment in CGO.

Performance – Premium, But Not

Being comfortable with the risks above could lead to a fairly strong outcome going forward in terms of performance. One of the reasons for this is because of how hard the declines have come for the fund. They are geared towards more tech and growth-oriented investments.

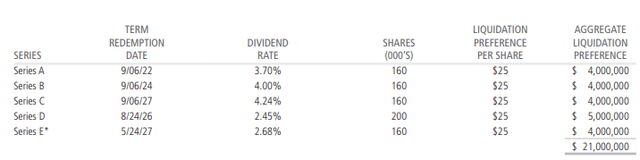

We can compare the YTD performance between a basket of other ETFs for some context. These are not exactly comparable funds, but help illustrate what we are seeing this year. We have included SPDR S&P 500 (SPY), Invesco QQQ (QQQ) and iShares Convertible Bond (ICVT).

YCharts

We see that CGO has performed worse relative to these funds. Even worse than QQQ, which it was tracking quite closely. If we blended these ETFs together, CGO should have come somewhere in the middle. However, the high leverage appears to be what we are seeing play out.

With the strong losses already, the chance for further downside might be more limited than the upside going forward, especially if global stocks can start to gain some relief and momentum.

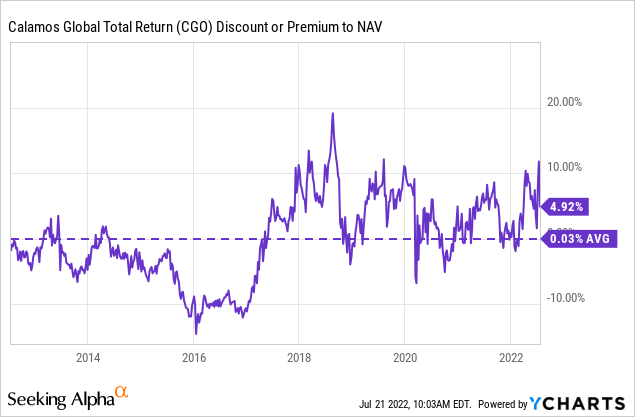

The fund’s premium, while it is elevated, is almost a common characteristic of the fund. The fund was recently at a nearly 12% premium, so at the 4.92%, we’ve pulled back quite a bit. Unfortunately, this premium is coming as a result of the underlying portfolio sinking even further than the fund and the share price holding up relatively better. We want to generally see the opposite of this.

Over the last 5 years, the fund averaged a premium of 4.59% too. This was pushed higher relative to the 5 years before this, though. Over the last decade, the fund has averaged closer to parity with its NAV price. That makes the current premium still a bit higher than we’d want. Combining with the actual declines in the underlying portfolio could still be presenting a mildly attractive entry level.

YCharts

This fund has been really all over the place over the last several years in terms of its premium. This could present an opportunity on its own to exploit these sharp moves by buying closer to parity and then selling at a 5 to 10% premium.

Distribution – Elevated But Concerning

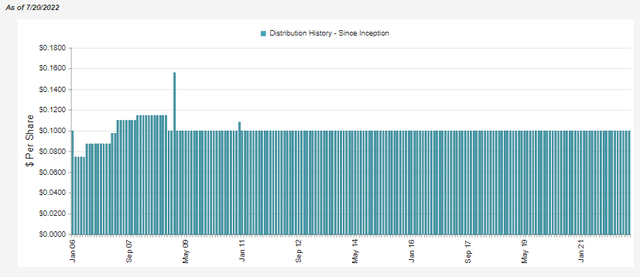

Depending on how you look at this, it could be another risk to consider or a highlight of buying this fund. It really depends on what type of investor you are. The fund has only one cut in its history.

CGO Distribution History (CEFConnect)

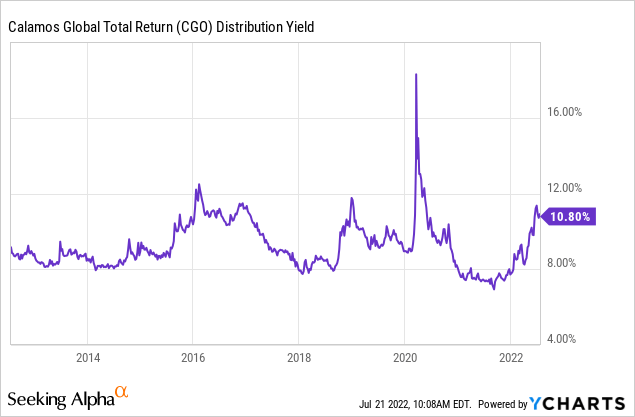

The current distribution rate for the fund comes in at an enticing double-digit level. It’s actually just a bit over 11%, despite what the chart is showing below. Anyway, the chart below still reflects that the fund is paying out near a historically high level.

YCharts

Since it’s at a premium, the fund actually has a distribution rate on NAV of 11.58%. That means that’s what it has to earn to sustain the distribution and keep the fund’s NAV level going forward. That’s an elevated level, which some investors are drawn to – it could help explain some of the premium in the fund. However, that level is concerning, given the current environment.

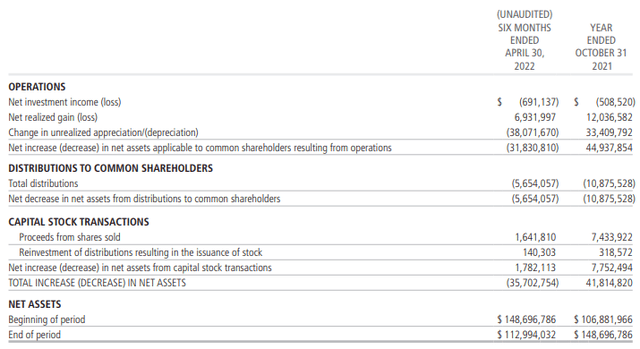

The fund will rely heavily on capital gains to fund its distribution as a fund that invests quite heavily in common stocks. Even convertible bonds hardly pay anything these days as most were issued with low or near 0% rates. In fact, when we look at the net investment income, we see a negative figure. That is for the latest report and for the fiscal year prior.

CGO Semi-Annual Report (Calamos)

Eating into this figure is “(Amortization)/Accretion of investment securities.” That drove the fund’s interest income to negative levels, with the dividends able to offset this to produce around $1 million in total investment income. Of course, TII also then has to go through the total expenses before arriving at the NII. With a total expense of $1.656 million, that’s how we arrive at a negative figure.

Taking the amortization of $723.5K out would leave a sliver of NII for common shareholders. Still, not nearly enough to cover the payout to investors. That’s why even after factoring out the adjustment for amortization, capital gains are important to maintaining the distribution. With deleveraging by a meaningful amount, they are in a tougher situation.

This all leads to the risk that a distribution cut could be implemented. That might rattle some investors and allow the fund to return to a discount. That would take away from any potential positive share price performance going forward, even if the NAV starts rebounding.

For tax purposes, despite not having any positive NII, the fund’s tax character is generally ordinary income. The last two fiscal years show that it was classified 100% as ordinary income for tax purposes. That would suggest that holding the fund in a non-taxable account would be more ideal. In the prior year, more specifically, only a small portion was qualified dividend income, with the remainder being primarily short-term capital gains (identified as ordinary income for tax purposes.)

CGO Portfolio

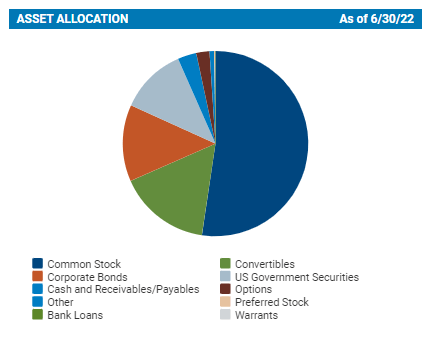

As mentioned above, CGO is invested in just a bit of everything but heaviest in equity positions.

CGO Asset Allocation (Calamos)

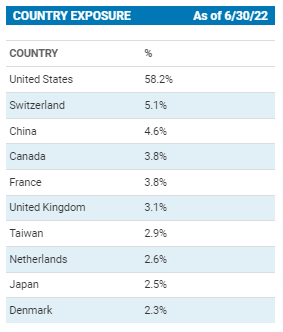

Despite being a global fund, it still has nearly 60% invested in the U.S. It would seem that it was a positive contributor to the overall results of the fund. Had it not had this sleeve, it likely could have performed worse over the years.

With the capacity to add to the global sleeve of its portfolio going forward, the fund could take advantage of the better valuations overseas. That being said, this is an increase from the 51% allocation the fund was carrying previously in U.S. investments.

CGO Country Exposure (Calamos)

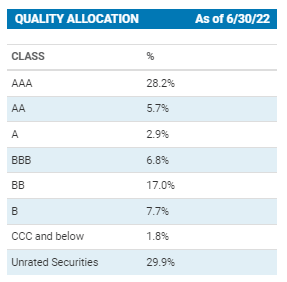

Similar to other funds that carry a sizeable allocation to convertibles, a meaningful portfolio allocation will be rated as “unrated” or below-investment-grade.

CGO Credit Quality (Calamos)

What I find interesting that stands out is the triple A category is quite significant at this time. This appears to be due to a sizeable allocation to U.S. Treasury Notes at this time. An area where the fund isn’t normally so heavily invested. This is likely a temporary holding place until the fund puts this capital to work.

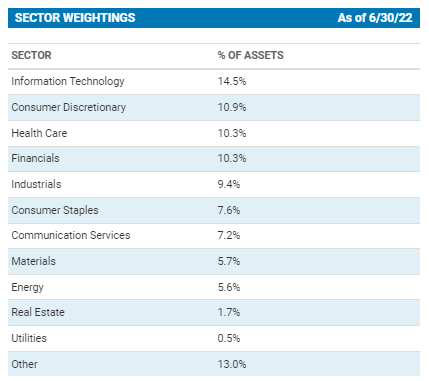

Tech and consumer discretionary remain the largest exposures of the fund. This is a decline from the 18.1% and 17%, respectively, shown in our previous coverage. All this seems to be fairly consistent with the fund making adjustments in the fund.

CGO Sector Weightings (Calamos)

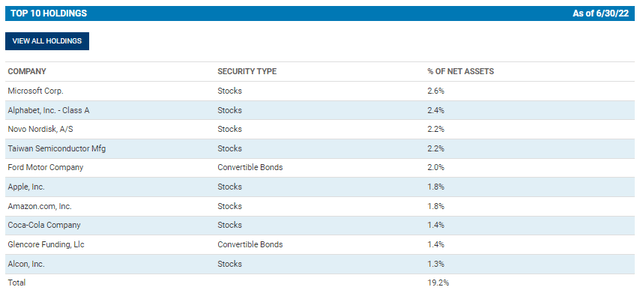

The largest holdings of the fund can be seen below. The total weighting of the top ten has declined from the 24.1% level it was at previously. This would suggest that the fund could be better diversified at this time, at least by a bit. Microsoft (MSFT) as a top position with a 2.6% weighting is reduced from the Taiwan Semiconductor (TSM) position that was 3.8% near the beginning of the year.

Conclusion

CGO appears to be in a tough situation. The underlying portfolio wasn’t working for the fund on a YTD basis. The funds seems to be shifting its portfolio now with a higher allocation to a cash-like position in U.S. Government securities, which I wouldn’t expect to be a long-term position. The fund deleveraged, which likely will hurt the fund going forward. All this being said, I think the bull case can be made that after some steep declines, the fund could look to recover from here.

Of course, that would require the fund to transition its portfolio into some names that will participate in such a recovery going forward. The premium is also sitting at a level consistent with where the fund has often been trading in more recent years. Longer-term, it is still elevated. Due to the risks, I remain rather neutral on the name.

Be the first to comment