JHVEPhoto

Making money in the markets in 2022 has been tough. Nearly all major asset classes, from stocks to bonds to precious metals and even many industrial commodities, have produced negative returns YTD.

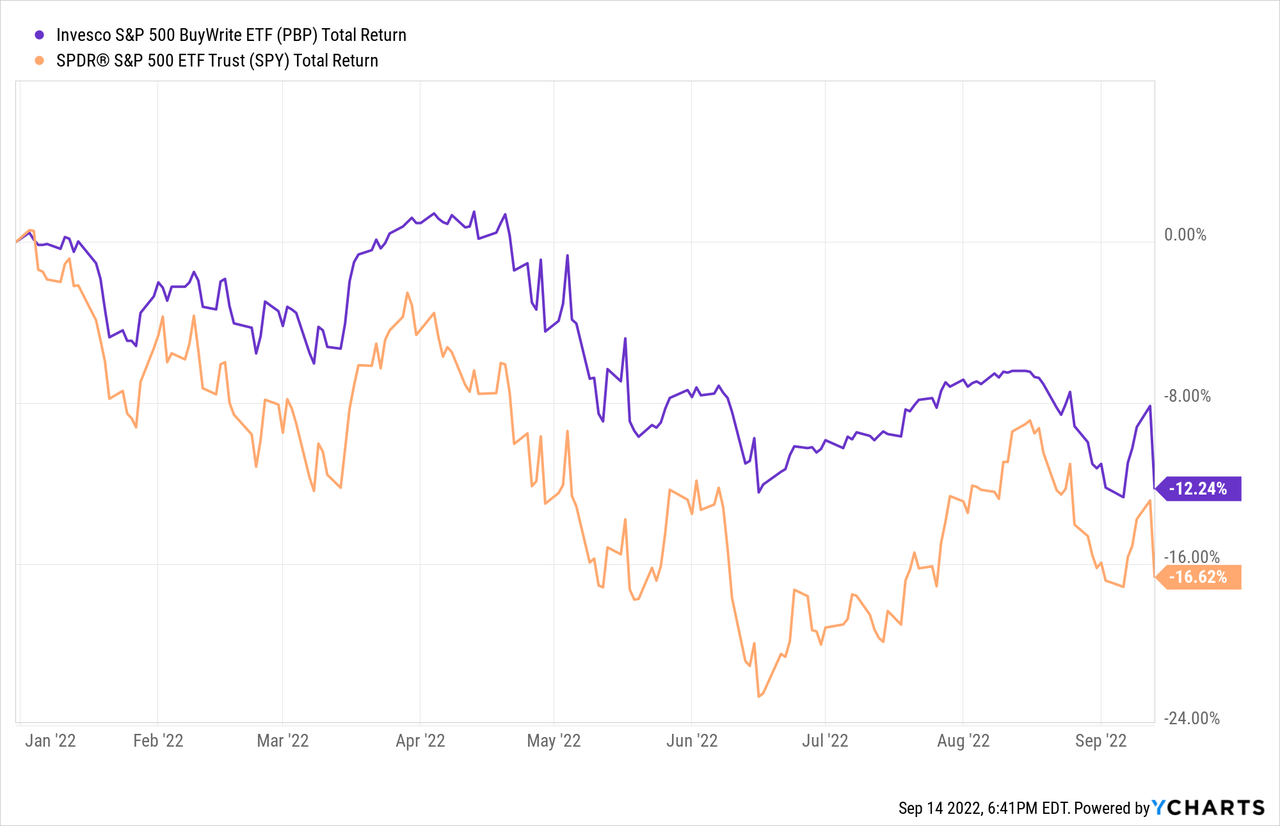

This is when a fund like the Invesco S&P 500 BuyWrite ETF (NYSEARCA:NYSEARCA:PBP) could shine. Since the ETF sells call options on the S&P 500 (SPY), a strategy that tends to do well when the equities market falters, some might have expected the ETF to perform better in 2022. But down 12% for the year (see first chart below), PBP has merely outperformed the broad market by a few percentage points since the start of the year, while still underperforming the benchmark over longer periods of time.

Today, I review why the fund has failed to impress, as I believed would be the case in my most recent article. Whether for growth or income-generation purposes, I still think that PBP is far from a top-pick ETF to own.

What is PBP?

As a refresher, the Invesco S&P 500 BuyWrite ETF is what is commonly referred to as a covered call fund. PBP’s strategy is twofold: (1) to invest 90% or more in the components of the broad stock market index and (2) to hold a short position in several S&P 500 call options — “each with an exercise price at or above the prevailing price level of the S&P 500 index”, as explained by the fund manager. These two pieces combined give the fund its buy-write name.

The benefit of the strategy is that its total returns are not entirely dependent on the performance of the broad market. PBP earns the premium on the options that it sells regardless of stock market movements, plus some of the upside from price appreciation (but not all of it, since the gain opportunity is effectively capped by the short options position) when the market is up.

PBP: lackluster performance

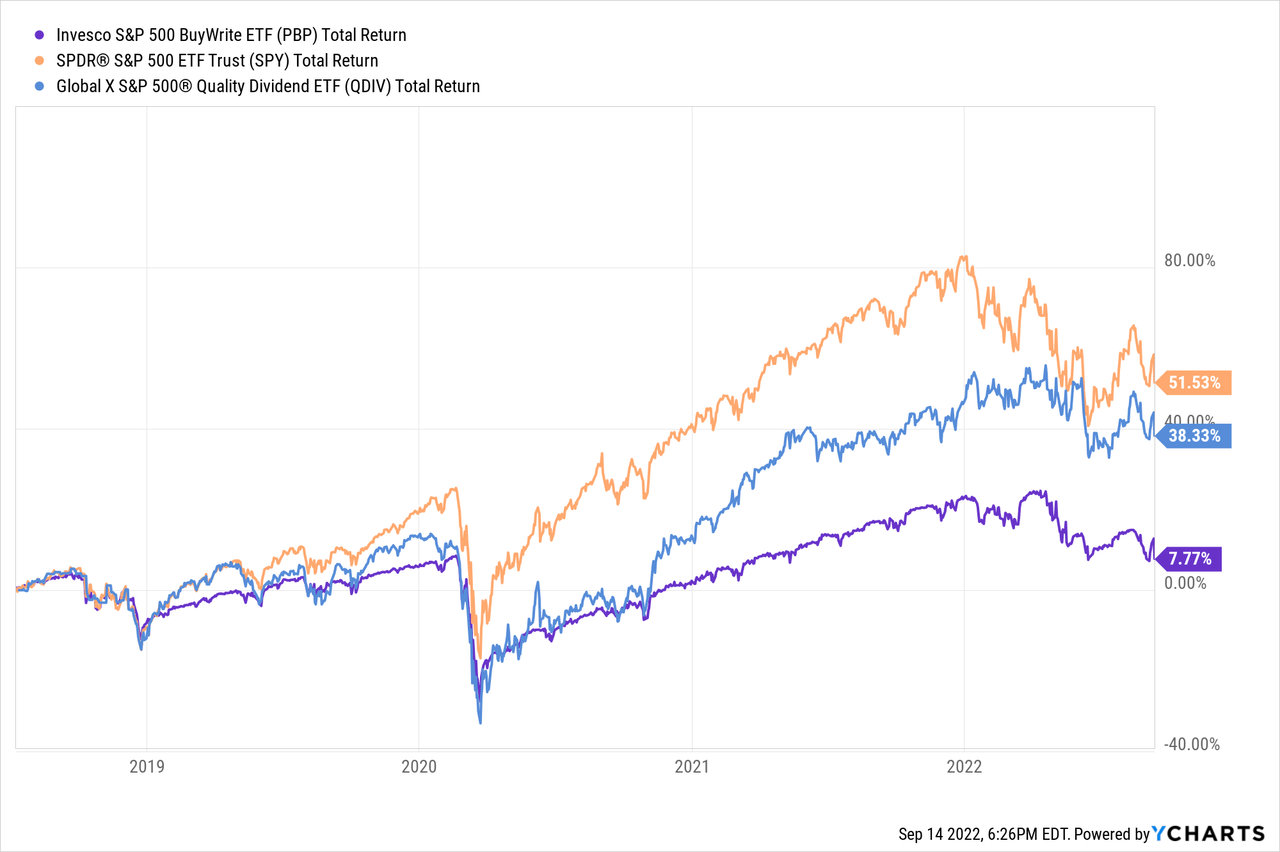

The chart below shows that PBP has produced inferior total returns over the S&P 500 and the quality dividend ETF (QDIV) in the past five years. Notice how the underperformance has been rather consistent, regardless of the market environment:

- PBP failed to keep up with the S&P 500 during the bull period of 2018-2019, before the start of the COVID-19 crisis.

- Once the pandemic hit, PBP corrected about as much as the S&P 500, in Q1 of 2020. The ETF offered little downside protection.

- During the late 2020 and 2021 recovery, PBP was once again left behind.

- In 2022, PBP failed to produce decent returns, even though its losses so far have been slightly tamer than those of the S&P 500.

The problem is that PBP gives up a large chunk of the upside opportunity by selling the calls, which largely defeats the purpose of being invested in stocks. The income earned via option premiums is welcome, but not nearly enough to offset the opportunity cost. At the same time, being long stocks without any downside protection means that PBP is not immune to stock market corrections. That is: not much upside exposure, but plenty of downside risk assumption.

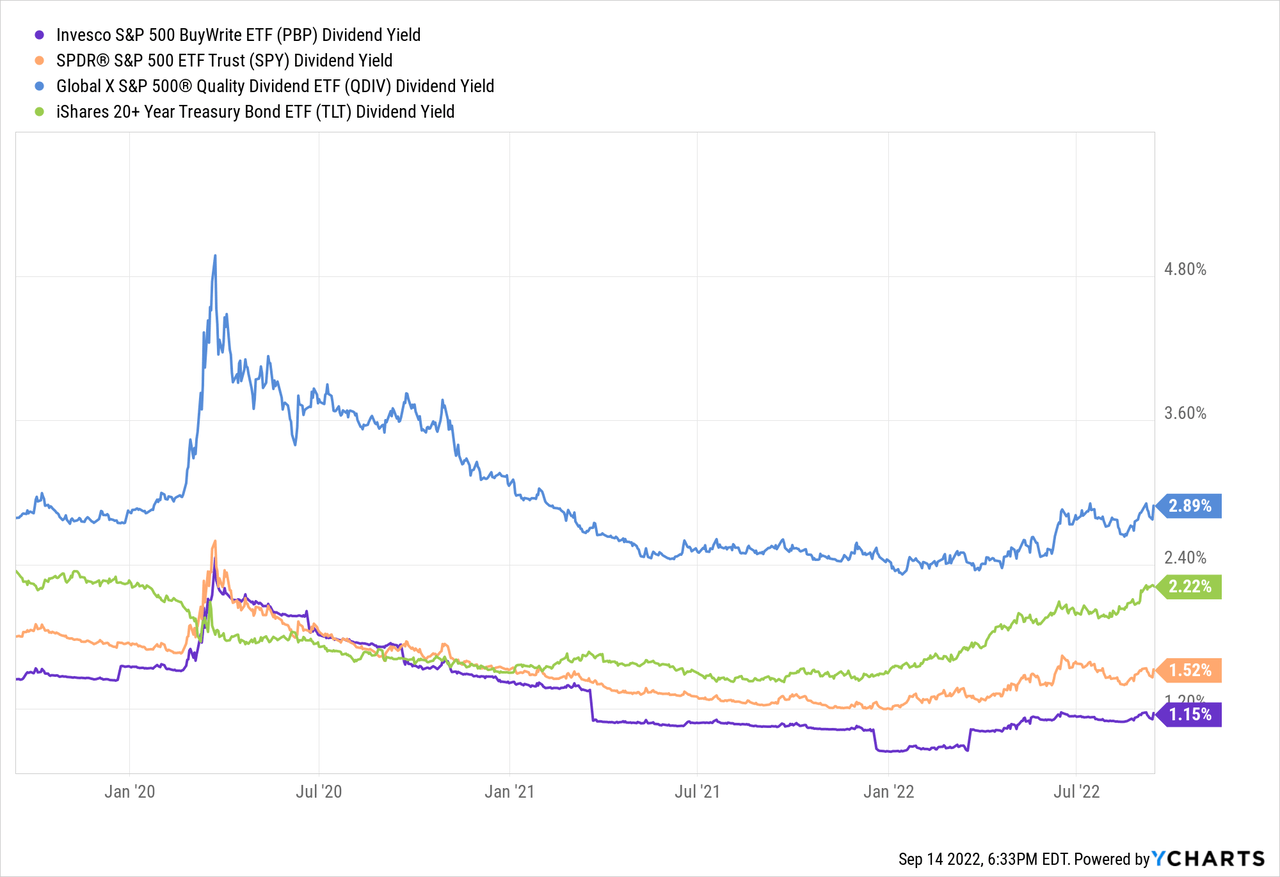

Some could argue that the option-selling piece of the strategy might be compelling for income-seeking investors. But not even this seems to be the case. The chart below shows that PBP has yielded only around 0.8% and 2.4% in the past three years. Currently, the fund’s yield of 1.2% is lower than those of the S&P 500 and QDIV at 1.5% and 2.9%, respectively. Even the 30-year treasury ETF (TLT), whose yield dipped to lows of about 1% during the thick of the COVID-19 downturn, seems to be a more compelling alternative for income seekers.

In summary

Will stocks recover in the back end of 2022? It is generally hard to make market predictions, especially during uncertain periods like this. However, regardless of market direction, I believe that PBP is fundamentally destined to deliver disappointing results, in true “heads you lose, tails you don’t win” fashion. Both growth- and income-biased investors are probably better off looking for opportunities elsewhere.

Be the first to comment