everythingpossible

Investment Summary

We’ve debated at lengths here at HB Insights on how best to allocate towards unprofitable names within US and global healthcare, and note investor sentiment has shifted away from rewarding top-line growth and is now focused on bottom-line fundamentals and more tangible sources of value. With that, there’s plenty to like about in Privia Health Group, Inc. (NASDAQ:NASDAQ:PRVA)’s investment profile.

PRVA fits the mould here with a clean balance sheet and resilient revenue model. It has 80 at-risk contracts in situ that cover ~856,000 attributed lives across its programs – up c.16% from this time last year – and continues to grow turnover and operating income on a sequential basis. Whilst recent share price performance is intriguing, valuations keep us on the sideline for now, as I’ve noted PRVA trades at hefty multiples relative to peers and unjustifiably so. Here I rate PRVA a hold with a $42 price target.

Catalysts to move the needle

To start the month of September, PRVA noted it will team with the non-profit hospital and healthcare provider, OhioHealth, to “form a strategic partnership and launch a medical group for independent providers throughout the state of Ohio”. It’s understood the partnership will expand OhioHealth’s already existing clinically integrated network (“CIN”). OhioHealth’s system spans across 47 counties in Ohio, and comprises 12 hospitals, more than 200 ambulatory facilities, and other exposures to domains like medical equipment, home health and hospice.

Together, the duo will launch a medical group for independent medical providers within the state of Ohio. It is set to be a separate system for Ohio physicians and other providers, whom can choose to remain independent and care for patients across the entire spectrum of payment modes. As a value add to new providers, they obtain access to PRVA’s platform and suite of technologies, helping minimize administrative burden and to perform analysis of data.

Meanwhile, CMS released its proposed 2023 Medicare Physician Fee Schedule rulings in July. Management have said the changes appear positive to PRVA – for the Medicare Shared Savings Program (“MSSP”) in particular [it now serves 11mm patients across 525,000 providers].

PVRA’s Q2 FY22 earnings also provide a number of droplets that wet the beak. Practice collections saw a ~67.5% YoY increase and advanced past $615mm for the quarter. I’ve noted the company has already passed the midway point of its upper-range of guidance here, although, it does not expect any material bifurcation from the trends exhibited in FY21.

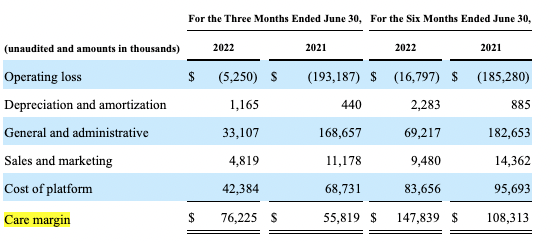

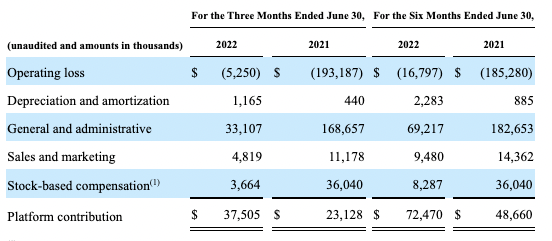

Meanwhile, the “care margin” – the company’s own metric to assess income available for business operations [defined as total revenue minus provider expense] – was $76.2mm for the quarter, up 36% from the same point last year. As the company expands its provider base, I also estimate an uptick in care margin as a result. Similar trends are observed in “platform contribution margin” that is calculated as revenues, less the sum of provider expense plus cost of platform, plus stock based compensation. Reconciliations from GAAP earnings to these two measures are observed in Exhibits 1 and 2.

Exhibit 1. Care margin increased c.36% YoY and continues to display strengths as the provider base widens

I estimate these trends to continue into FY22–FY23.

Data & Image: PRVA 10-Q Q2 FY22; see: Key Metrics and Non-GAAP Financial Measures – care margin, pp.22.

Exhibit 2. Platform contribution margin showing equally as favourable trends

- There is the question of the $3.66mm in stock-based compensation (“SBC”) and whether this should in fact be added back to Operating loss.

- Noted is that SBC narrowed substantially YoY from Q2 FY21.

- Treating SBC as a realized expense [as I prefer to] the platform contribution margin slips to $33.84mm, a negligible impact. In Q2 FY21, however, results are wildly different when doing so.

Data & Image: PRVA 10-Q Q2 FY22; see: Key Metrics and Non-GAAP Financial Measures – platform contribution margin, pp.24.

PRVA Q2 earnings a standout

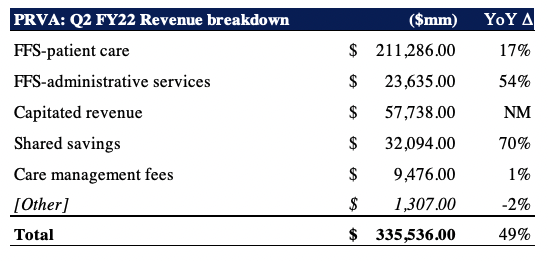

Privia came in with a strong set of numbers last quarter that came in ahead of consensus estimates. Revenue climbed 48.6% YoY to $335.5mm, underscored by a 31% YoY gain in Implemented providers [now at 3,541] and c.16% YoY change in value-based care attributed lives [now 856,000]. It brought this down to a GAAP operating loss of $5.3mm vs. a loss of $193mm the year prior. Meanwhile, the net loss of $10.5mm or $0.10/share for Q2 FY22 included an $18.5mm ($0.16/share) SBC expense [down from $202mm in Q1 FY22].

The strong set of earnings also provides a good insight into what we are buying in PRVA. Exhibit 3 illustrates the YoY change in PRVA’s revenue mix on the second quarter exit. In particular, the 70% YoY gain in shared savings revenue is an attractive takeout from the quarter, and provides unique insights into full-year expectations for the segment.

Exhibit 3. Top-line growth still a standout for PRVA with key revenue drivers clipping double-digit gains in Q2 FY22

Image: HB Insights, Data: HB Insights, PRVA SEC Filings

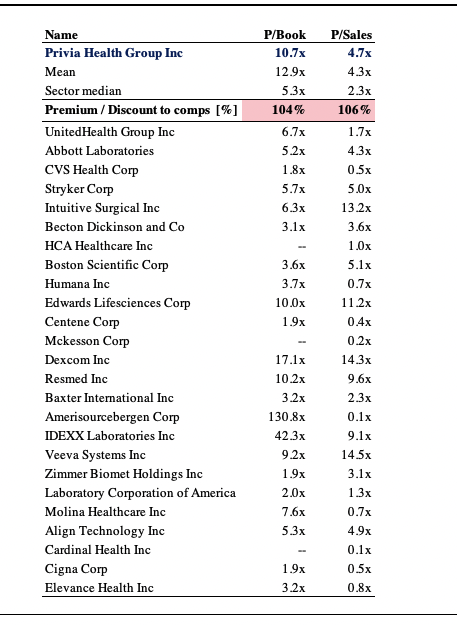

Moreover, we’ve got good clarity of the company’s balance sheet and book value from its financial statements. Goodwill as a percentage of total assets rests at 17% of total assets and is actually down ~160bps YoY, whereas intangibles are light at ~800bps. I’m satisfied with these numbers, as we’ve got a large degree of tangible book value on offer –$281.1mm to be precise. However, this does push shares to trade at ~16x tangible book value, and ~10.7x total book value – large multiples without any profitability.

Valuation and conclusion

Shares look to be richly priced at current multiples and trade at a premium to the GICS Industry peer median, as seen in Exhibit 4. PRVA is priced at 10.7x book value as mentioned, and trades at 4.7x sales, each representing a lack of potential upside when benchmarked to the peer group. Moreover, 10.7x book value looks pricey even on face value. If we were to calculate what we’d theoretically pay on this multiple [at current market cap, shares outstanding and book value], it would be $42.22 – meaning we’d be slightly overpaying at the 10.7x book value. I say we are overpaying secondary to PRVA’s lack of profitability and earnings momentum to justify paying any premium into. As such, valuation is what primarily keeps us on the sidelines in this name right now.

Exhibit 4. Multiples and comps analysis – PRVA priced at a premium to peers

Data: HB Insights, Refinitiv Datastream

Factoring in points raised throughout analysis, PRVA offers compelling value on numerous levels, ranging from its insulated business model to its resilient earnings profile into a weakening economic climate. These are incredibly attractive features that are worthy of potential inclusion into the equity risk budget of portfolios.

However, shares are richly priced at current multiples, and, even when relative to peers, look to be trading at a substantial premium. Valuation therefore is the main tension point in this name for us, and I believe there’s a risk of the stock re-rating to the downside due to its current valuation. I rate PRVA a hold with a $42 price target, and whilst shares finished at $42.74 post-market yesterday, this is a short-term gain in price action that doesn’t nullify or deviate from the whole investment thesis laid out through the entirety of this report. PRVA is a hold.

Be the first to comment