ugurhan

Thesis

If you bought the June dip, congratulations. If you have not, I argue it is very important not to chase this rally. The current macro-economic environment paired with the market’s high valuation (PE > x20) implies one of the most unfavourable risk/reward set-ups for investors that I have seen since the European debt crisis (between 2010 to 2012). That said, I am not alone in this assessment: Michael Burry’s 13F Sec Filing revealed that the ‘Big Short’ investor sold all his positions-even high quality assets such as Alphabet (GOOG), Meta Platforms (META) and Warner Bros. Discovery (WBD). A few weeks ago, Dr. Burry highlighted the returning “silliness” in markets and hinted with a post on Twitter that markets could crash like in early 2000:

Can’t shake that silly pre-Enron, pre-9/11, pre-WorldCom feeling.

Other star investors such as Stanley Druckenmiller, Seth Klarman, and Daniel Loeb also sold a considerable amount of their stock holdings. And Warren Buffett considerably slowed his pace of allocating capital, as compared to the January quarter 2022.

Excessive Risk Taking

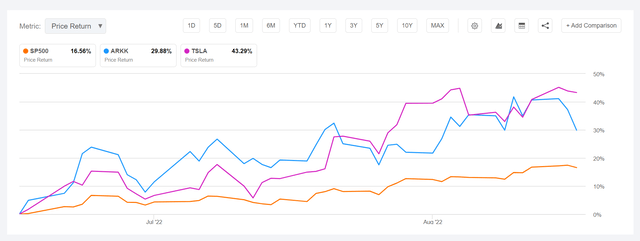

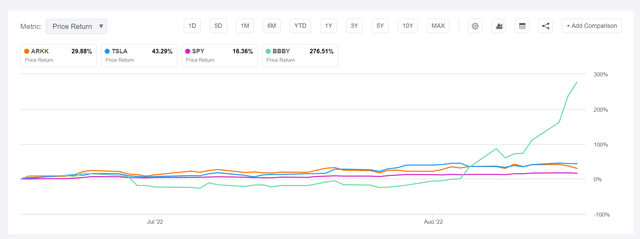

Since the stocks touched lows in mid-July, the S&P 500 index is up by as much as 17%. Notably, this is an annualized performance of more than 200%! But arguably, even such a strong performance fails to reflect the full risk-appetite of the market. Investors should consider that high-beta stocks such as Cathie Wood’s Ark Innovation ETF (ARKK) and Tesla (TSLA) are up by about 35% and 45% respectively.

High short-interest stocks, most notable ‘meme’ stocks performed even better: Bed Bath & Beyond (BBBY) has intermittently gained as much as 500% within less than 5 weeks.

Speculation is also evident in private markets again. Remember the WeWork disaster, which was told by Apple TV ‘WeCrashed‘? The founder Adam Neumann, who was responsible for loosing investors as much as $40 billion dollars, recently announced having received a $350 million investment from Venture Capital firm Andreessen Horowitz-for a very similar idea.

Don’t Ignore Fundamentals

The market is ignoring fundamentals, but I am confident that sophisticated investors and Seeking Alpha readers are one level smarter than “FOMO”-buyers. While I do not necessarily argue for a plus 30% drop, I would like to point out that this macro-backdrop arguably has the potential to provoke a 2008-style equity crash.

Here are four strongly bearish arguments to consider:

First, with oil prices still at >$85/barrel (WTI benchmark) and most commodity prices including copper and steel 100% above their 2019 levels, inflation remains a present danger. Moreover, the new economic stimulus programs that China has recently announced certainly do not help to slow global commodities demand.

Secondly, the FOMC will remain hawkish until ‘substantial and persisting’ progress has been noted in the fight against inflation. Moreover, investors should not forget the planned balance sheet reduction.

Third, geopolitical tensions could provoke further downside re-calibration of risk-sentiment. There is still a war in the Ukraine and the world’s two largest economies, the US and China, are head to head over Taiwan.

Forth and perhaps most notably, the market has not fully priced in the possibility for a material EPS contraction. Multi-billion dollar market cap giants such as Nvidia (NVDA) and Walmart (WMT) have already issued profit warnings. And all FANGS have indicated a slowing macro-environment through material talent recruiting cuts.

Investor Implication

As markets seemingly ignore the bearish macro-economic fundamentals and arguably trades on ‘fear of missing out’, I think investors have an exceptional opportunity to sell into strength and/or bet on a new market drop. Personally, I am buying September 16th SPX 95/85 % Moneyness put spreads for a premium of about 4% vs the notional exposure (implied Volatility reference at approximately 2%). If the SPX closes below the 85% moneyness target, investors gain a 6:1 payoff.

Be the first to comment