imaginima

Dear Readers,

When I last wrote about Pinnacle West Capital Corporation (NYSE:PNW), I viewed the company as overvalued. This was due to overall muted earnings by the company. I still own a solid stake in the company – and it continues to go up and down here, with my current stake at about 2% TPV.

We’ve been through why the company is currently trading down. It’s all about the rate case changes and corresponding decline that we’ve seen – though we’ve also seen a fair bit of recovery since then.

Since my last article, the company has basically done a +/- 0% – or very close to it.

Seeking Alpha PNW Article (Seeking Alpha PNW Article)

Let’s look at where things are today.

Pinnacle West – an Update

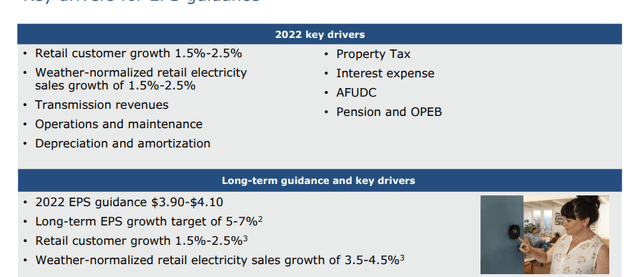

So, as I said in my last article – the fundamentals of pinnacle west haven’t really changed insofar as the company goes. What has changed are the prospects for the rate case. However, despite these issues, the company’s operating geography remains one of the fastest-growing states in the nation, which translates into very strong consumer trends and a continued EPS growth target of 5-7% because of a 1.5-2.5% retail customer growth per year – despite the negative rate case.

The company also remains at BBB+ – the recent rate issues haven’t changed that. And even if all of the expected rate headwinds materialize, the company’s payout ratio and 4.2+% yield at the current price, remain as safe as clear spring water, based on the company’s forecasted 2022-2024E EPS. I do not consider it likely in any way, that the company will be facing any issues that warrant a dividend cut.

My M.O remains to buy this company at a very cheap valuation – which is why I bought some shares when the company dropped well below $70/share not that long ago. That also means though, that the case today isn’t necessarily as positive as we’ve seen in the past.

The rate case issues, as I wrote in my last piece, actually simplify the thesis for PNW. Why? Because it really does cap the potential upside, we can get from this investment for the coming few years. The combination of the company-forecasted required capital investments, combined with PNW’s clear statement that it won’t be tapping equity as a funding source until the end of the next (not this recent) rate case, means that the business needs to fund these costs from operational cash flow and debt either from holding or PNW itself.

The latest results we have are the 2Q22. For this quarter, we’re really starting to see some of the impacts from the rate case – but despite this, the company isn’t really trading down. The EPS is down to $1.45/share, impacted in part by a base rate impact of around a quarter of a dollar or so. Guidance for the year remains at $3.9-$4.1, which more than covers the company dividend, and the EPS growth guidance is very much intact.

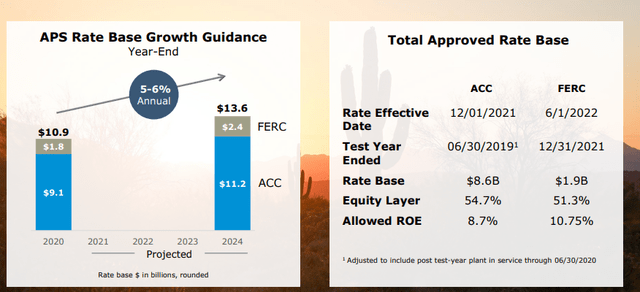

Meanwhile, the company’s current capital deployment plan guides for around $1.5B per year, or $4.7B until 2024E. This is a mix of clean generation, transmission investments, distribution investments (above all), and other investments. This is crucial both in order to harden the distribution infrastructure as well as support Arizona’s population growth.

The latest rate case was a bit of a horror show. The company hopes that the next few rate cases will have a more positive outcome for the company, allowing for a higher RoE.

One of the main worries investors may have until the next rate case is whether the company is going to dilute current shareholders given the investment plans. The company is assuaging fears here and is clear in the communication that there are no plans to issue any equity whatsoever.

Instead, investments will be funded with operational cash flow, APS debt, PNW debt, and equity alternatives, fulfilling the $4.7B in capital requirements.

The rate case also hasn’t impacted the maturity schedule. No significant maturities for the next 2-3 years, with most of the debt after 2028. This company isn’t in any fundamental danger and remains a safe sort of utility investment.

Pinnacle West is a good example of why utilities are indeed stable investments that warrant your money if you’re looking for conservative cash flows. Despite the heavy impact of the rate case, PNW has recovered nicely. PNW’s plan to support its growth, reliability and ESG transition is on track.

A few planned outages will impact the company during 2022. Arizona and PNW usually face only marginal impacts from weather effects, and this was true for 1Q22, which saw only a $1M variance from normal in quarterly impact.

I want forecastability from my utilities, and PNW, despite everything, gives me just that.

So, with little changes in the fundamentals, and the valuation going up and down, let’s see how the company’s forecast has changed.

Pinnacle West Valuation

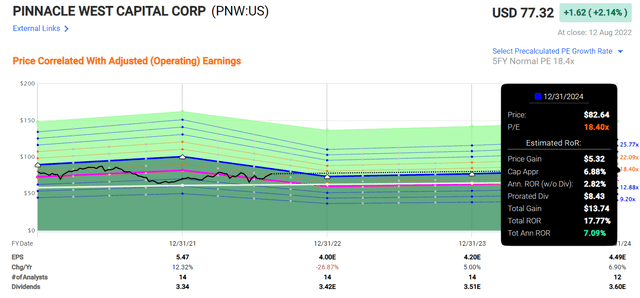

The issue with PNW’s valuation is, unsurprisingly, the impact from the rate case. The current forecast calls for a mid-point sort of EPS forecast of $4/share, which is a 26% YoY EPS decline. This means that we really want to make sure we buy this company cheap.

This is no longer the case at a price of $77.3/share. That’d be a good price, or a decent one, if the company had received a favorable outcome, which the company did not. Beyond 2022, the current forecasts go in-line with the company’s own expectations, making that an EPS growth per year of 5-7% or so.

What this strictly means is, even at a premium upside of 18x P/E, the upside is no higher than 7.5% per year – at most. I wouldn’t go any higher than this. At trough valuation less than 2 months ago, that upside was above 12% per year, which is much more digestible to me. At this valuation…not so much.

In terms of the rate case specifics, 2022 is expected to be the heaviest impact of all. The current forecast lies at the midpoint of the company’s own guidance, with 15 analysts forecasting a $4/share average. Not exactly a positive YoY development.

So you can see why there are now reasons to be far less excited for the company’s prospects. Because what makes utilities such great investments is working clearly against PNW – the forecastability of its earnings and cash flows. I’m at a fairly high degree of certainty that PNW’s earnings won’t be materially better than what’s being forecasted here.

I love investing in utilities – but my current focus based on valuation isn’t PNW, but Finnish Fortum (OTCPK:FOJCF). Still, 2 months ago, my utility of choice was PNW. It’s all about buying these companies at the right valuation – namely, a cheap valuation.

However, some of the advantages of a utility remain here. Take forecast accuracy for one. Historical forecast accuracy with a 10% MoE is 100%. 100%. The company doesn’t beat forecasts, it doesn’t fail them, they’re very clear in what happens. Other utilities are very similar. Yields and dividends are typically very stable.

That means that PNW’s 5% EPS decline until 2024E on an annual basis, as I see it, is more or less etched in stone – or a 5-7% annual increase from a 2022E level, if you prefer. It’s there – and neither we nor the company can do anything about it.

This leaves us with relatively low levels of RoR, even in a relatively positive case. I want 9% or above annualized RoR – as usual.

PNW once again does not give me that potential at this price. I’ve already seen some profits in the investments and realized about 0.4% of it by divesting above $80/share. I have no plans, in this market situation, to divest more. Nor will I be buying more unless the company drops down again.

There are utility investments across the world that yield far more consistent and predictable, higher upsides than does PNW at this time. Enel (OTCPK:ENLAY) is a very good example of such a business. Its upside, based on a current valuation of 14X and an upside to a 15.7X P/E until 2024, yields annualized RoR of 27%, or 85% in total RoR. The yield is similar to PNW, and it shares the company’s BBB+ credit rating.

What’s more, its market cap is almost 7X that of PNW. There is also Fortum, as I mentioned. I invested in the Finnish giant when it was above a 10% yield – and while the company is in a problematic situation, the assets here are absolutely stellar, and the ownership situation is beyond safe (more on that in my Fortum-specific articles).

My point here is, be careful with your utility investments. You can’t buy this too expensively, and you need to be aware of the rate case impacts that are possible in these kinds of investments. What you want here is income stability with the potential of some upside or reversal.

If you can get this, then a utility like PNW is investable.

Here, not so much.

For that reason, I’m sticking with my “HOLD”.

Thesis

My thesis for PNW is as follows:

- There is no easy way for PNW to turn or twist this around. It’s simple math. The simple math of growing demand and need for servicing of infrastructure not being possible at the same RoR/profits without an increase in rate – which the company hasn’t gotten due to the rate decision.

- That’s what I like about quality companies such as this. It usually comes down to simple math. And the simple, current math for PNW is that the future, unfortunately, isn’t as rosy as it once was.

- In the most positive of cases, this is now a 6-7% annualized RoR investment. That’s not high, nor is it the best on the market. Taking the quality and fundamentals into account, I’m shifting to my PT of $70. Based on the price action I’m seeing, this is now a very clear “HOLD”, and I’m considering moving onto my stake to something better.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria, with the fulfilled demands in italic.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic attractive upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment