Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Xperi Holding Corporation (NASDAQ:XPER) has announced it is separating its business by spinning off its IP Licensing Business, Adeia, leaving the remaining product business intact. This separation will presumably increase executives’ incentives to produce better operating results in their respective businesses, thereby increasing growth. What is notable, however, is that even prior to the TiVO merger, Xperi demonstrated revenue and FCF growth, although its revenue growth was accompanied by a high degree of volatility. The IP Licensing business is engaged in multiple high-growth fields, such as the Over-the-top (OTT) market. The products business is also poised for growth in various industries as management plans to utilize its AI and machine-learning capabilities to enhance in-cabin comfort and safety for autos, and to improve energy efficiency in consumer electronics. XPER has also been steadily increasing its R&D spending, making future growth more likely. While sustained growth is far from guaranteed, if history is any guide, management is capable of producing it. Of course, the moderate growth of the company’s revenue, both prior and subsequent to the TiVO merger, is not enough to justify an investment. But when one takes into account the company’s valuation, namely that the company is trading at a 7.4x multiple to its LTM levered FCF, and growth prospects, XPER is undervalued.

Background

Xperi Holding Corporation consists of two businesses, a product business and an IP licensing business. The product business “consists primarily of licensing its internally developed audio, digital radio, imaging, edge-based machine learning and multichannel video user experience (UX) solutions.” The categories in which the products business operates are: pay-TV, consumer electronics, connected car features and its media platform ((TiVo)). From 2017 to 2021, the products business has witnessed an approximate tripling of its revenue. However, its operating income has been more variable, as is also the case for the IP licensing segment. However, this variability is not indicative of faux growth because during the same time period the company’s FCF has grown consistently, apart from an outlying 2020 in which FCF spiked to > $400 million.

Products Business Strategic Priorities (Xperi Q2 2022 Presentation)

The IP licensing business (Adeia) contains over 11,000 patents that produce an approximate $375 million in recurring, annual revenue. These patents encompass multichannel video programming distributors (MVPD), the over-the-counter (OTT) market, consumer electronics and semiconductors.

In the four years prior to the TiVO acquisition, XPER had been growing its revenue at 4.2% per annum. Additionally, its FCF had grown by 2.95% per annum in the same time period. However, during this period the company’s R&D expenses increased by $66 million, paving the way for more robust growth in the future. During 2020 the company’s FCF peaked at $420 million and in 2021 reverted to $221 million. From 2020 to 2021 the company’s annual revenue declined from $892 million to $878 million. This trend has since been reversed, as XPER’s LTM revenue is $925 million. In 2021 the company’s R&D expenses rose greater still by $37 million, or by 16.4%.

XPER’s cash on hand is $275 million, and while its current liabilities total $211 million, its net debt is $526 million. For a company producing $220 million in FCF annually, and anticipates top-line growth, the company’s leverage is ostensibly manageable. Being that Xperi’s business is premised on licensing, and that the business is levered, its tangible book value is predictably nonexistent. Namely, negative $222 million. In summary, XPER is a growing business engaged in many high-growth industries, and although its historical growth has not been spectacular, its increasing R&D expenses and presence in the aforementioned high-growth industries, such as the OTT market, show promise for future growth.

Growth Strategies And Prospects

Adeia’s strategic growth priorities are premised around three markets. Management plans to continue penetrating the growing OTT market, which has a prospective 13.87% CAGR according to Mordor Intelligence. It also plans to capture the remaining unlicensed Canadian Pay-TV operators that it does not already service. Additionally, it plans to expand its semiconductor segment by capitalizing on the industry trend toward the use of hybrid bonding for memory and logic chips. As previously mentioned, XPER’s growth in R&D spending suggests that management is making proper preparations to accomplish such a monumental task. The products business’ growth priorities are similarly concrete. Xperi plans to expand profitability in automotive safety and infotainment by addressing current trends in both industries. It also plans to capitalize on growing trends in the advertising-based OTT space. Additionally, Xperi’s presence in Internet Protocol Television (IPTV) is propelled by secular tailwinds which XPER is determined to exploit. IPTV’s CAGR is expected to be 17.89% through 2026 according to Mordor Intelligence. The various secular tailwinds propelling the licensing and products businesses prima facie make the company appear to be a high-growth business. Although historical performance says otherwise, the increase in R&D expense and separation make such an outcome more probable.

Adeia Strategic Growth Priorities (Xperi Q2 2022 Presentation)

The Separation

Adeia and Xperi’s product business are set to separate in Q3 of 2022. Spinning off the licensing business will result in a streamlining of management as executives’ will be further incentivized to perform as their respective segments’ performance will be solely responsible for their compensation. From 2017-2021, the product business averaged $274.3 million in revenue while the IP licensing business generated $243.8 million. Adeia’s average operating income during the same period was $114.7 million and Xperi’s operating income was $20.4 million. While seemingly comparable, it should be noted that both segments’ revenue and operating income was incredibly variable. However, as of 2022, Adeia has recurring annual revenues of $375 million, providing more stability to its historically volatile revenue. Investors who wish to solely own Xperi should be prepared to see less stability in revenue and profitability.

While the separation may accelerate growth in the long-term, it may present a challenge for investors with a short-term time horizon. This is due to the technical overhang present in any spinoff. However, because Xperi is not disposing of a non-essential business, as Adeia it makes up approximately half of all revenue and the majority of the company’s profitability, more investors are actually likely to dispose of the product business as it produces a fraction of Adeia’s profitability. This technical overhang is noteworthy for all investors, and prohibitive for short-term investors.

Valuation

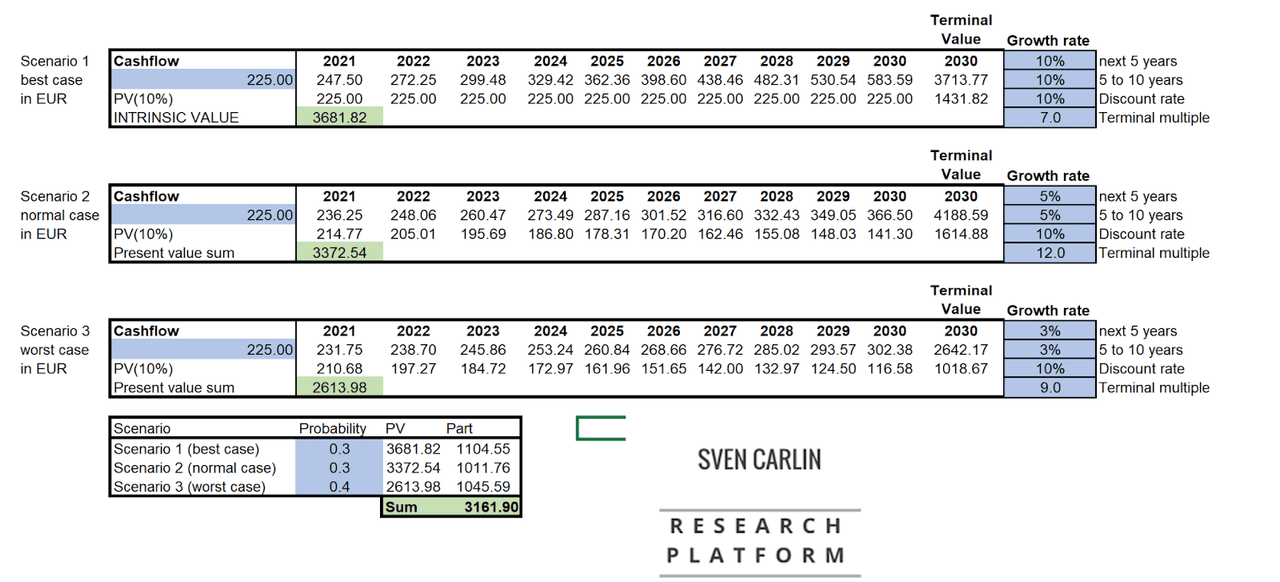

Xperi currently trades at 7.4x LTM levered FCF. For a company with secular tailwinds and historical growth in its business, this valuation is simply unjustified. The difficulty lies not in determining whether the company’s current valuation is justified, but rather in approximating its actual intrinsic value. This is because its historical growth in FCF is only 2.95%, however its future FCF and revenue growth appear to be poised for greater growth. To remedy this, I utilized a three-DCF template, originally from the Sven Carlin Research Platform, consisting of a worst, normal and best-case scenario. I then assigned a probabilized value for XPER. Because I believe a growth rate lower than 3% is incredibly unrealistic, as the company’s respective market CAGRs are so high, my worst-case scenario consisted of a 3% growth rate. To be conservative, even in light of the administrative streamlining that will occur, I assigned normal and best-case growth rates of 5% and 10%, respectively. These growth rates are conservative based upon the assumption that XPER’s growth rates will be well in excess of their historical growth rates because of its higher R&D spending, market CAGRs and administrative streamlining. Given the current rising interest rate-environment, I used a conservative discount rate of 10%. I arrived at a valuation of $3.16 billion, or 90% higher than XPER’s current valuation.

XPER Valuation – in Millions USD (Excel)

Conclusion

In conclusion, Xperi holding corporation has historically grown at a moderate pace in both revenue and FCF. Its licensing and product businesses are set to separate in Q3 of 2022. This is set to increase its previously moderate growth. Furthermore, due to its increased R&D spending and presence in high-market CAGR industries, its growth is set to accelerate well in excess of its former growth rate of 2.95%. Although this growth is likely to buoy both stocks in the long-term, one is likely to suffer underperformance in the short-term when the technical overhang present on both companies, but on Xperi in particular, is taken into account. In spite of this problematic short-term outlook, when conservative estimates of its future growth are taken into account, XPER is undervalued.

Be the first to comment