Seiya Tabuchi

Introduction

After narrowly avoiding a suspension of their distributions during 2021, Natural Resource Partners (NYSE:NRP) received a lifeline from Eastern Europe in early 2022 due to the otherwise tragic Russian invasion of Ukraine, as my previous article discussed. Whilst the upside for their distributions still appeared limited at the time, they played their hand very well and exceeded my expectations to recently lift their distributions a very impressive two-thirds higher, which now sees their units offering a high 6.90% yield. Despite being very positive, it would still be wise for investors to keep their expectations tempered, as discussed within this follow-up analysis that also reviews their recently released results for the first half of 2022.

Executive Summary & Ratings

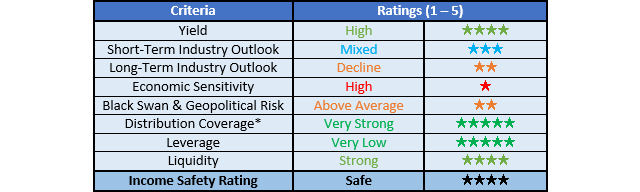

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position

Detailed Analysis

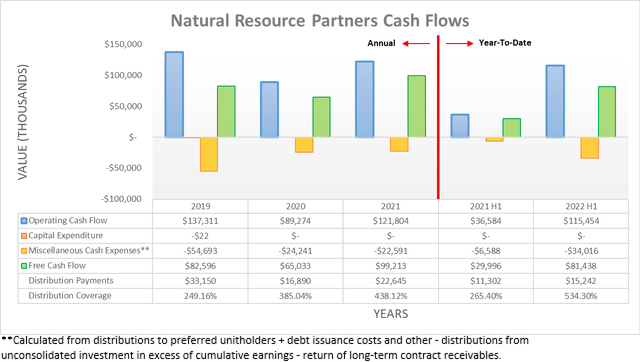

Their cash flow performance that enjoyed a solid recovery during the fourth quarter of 2021 picked up even more momentum during the first half of 2022 as the commodity markets surged ahead following the fallout of the Russian invasion of Ukraine. This lifted their operating cash flow to an extremely strong $115.5m during the first half of 2022, which is a momentous improvement year-on-year versus their previous result of only $36.6m during the first half of 2021. In fact, this was such a large increase that it almost matches their full-year result from 2021 of $121.8m, despite literally being only half the length of time.

Even after funding their $34.6m of miscellaneous cash expenses, which were essentially entirely comprised of preferred distributions, they were still left with $81.4m of free cash flow for the first half of 2022. Since their new quarterly distributions of $0.75 per unit only cost $37.5m per annum given latest their outstanding unit count of 12,505,996, they clearly have scope to lift their distributions higher, especially since even 2020 saw free cash flow of $65m despite the severe downturn. Even though this sounds to be very positive given their existing yield is already a high circa 7%, investors should not lose sight of the medium to long-term.

It is debatable how long these booming operating conditions and thus extremely strong cash flow performance will last but alas, it remains undeniable that commodities are inherently volatile and these booming operating conditions cannot realistically be expected to persist for a prolonged length of time. This dynamic is especially pertinent for thermal coal, which during 2021 comprised slightly more than half of the production from their mineral rights, as per my previously linked article. Even though the global energy shortage effectively provided a lifeline during the first half of 2022, its grim medium to long-term demand outlook persists with a secular decline on the horizon, as it remains a fuel of last resort in a world transitioning to clean energy.

Whilst the short-term sees a mixed outlook given the battle between the global energy shortage and risks of a recession, when looking further into the future, thermal coal still sees a secular decline that will hinder their free cash flow. On the other hand, their metallurgical coal mineral rights production is utilized to make steel and clearly sees a better medium to long-term outlook but is still susceptible to an economic slowdown in the short-term, which is now widely discussed and arguably even expected as the federal reserve hikes interest rates to combat inflation.

It should also be considered that their immense free cash flow comes on the back of literally zero capital expenditure. This is normal for mineral rights partnerships but it does not alter the fact that even forgetting the questionable long-term future for thermal coal, their assets are being depleted each year via production and thus need to be eventually replaced. They have managed to avoid making any sizable investments or acquisitions during the past three years, although one day, this will need to change and as a result, it will hinder their free cash flow and thus no matter the views an investor holds for thermal coal, it would be prudent to keep their distribution expectations tempered.

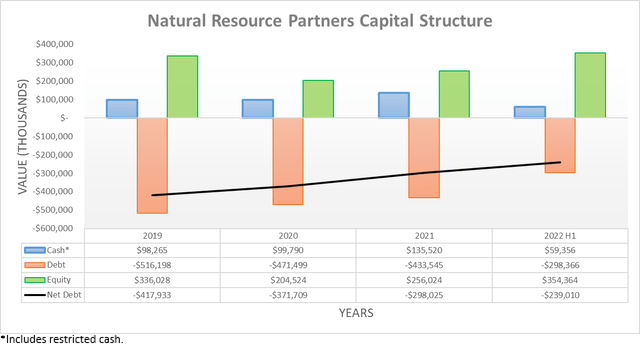

Even after funding preferred distributions on top of their common distributions during the first half of 2022, their massive cash windfall still saw their net debt plummet to $239m and thus $59m or 19.80% lower than where it ended 2021 at $298m. Whilst already an impressive improvement, their total debt saw a far larger decrease of $135.2m, which as subsequently discussed, actually comes as a surprise given their debt maturity profile.

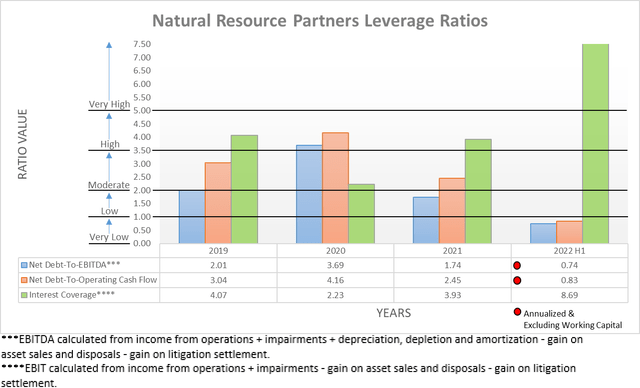

Following their extremely strong financial performance and significantly lower net debt, it was not surprising to see their leverage continue plummeting to new lows that were unimaginable only one year prior. They now enjoy a net debt-to-EBITDA and net debt-to-operating cash flow of 0.74 and 0.83 respectively, which are comfortably below the threshold for the very low territory of 1.00 and obviously mark a significant difference versus their previous respective results of 1.74 and 2.45 at the end of 2021. When looking ahead, their leverage should continue seeing downwards pressure as their net debt trends ever lower, although fluctuations in their financial performance will ultimately determine where it lands.

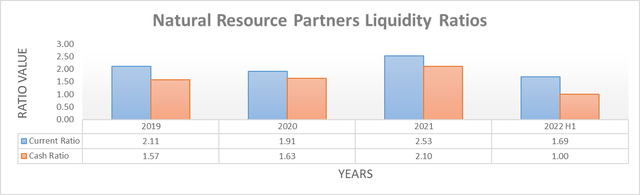

Even though their respective current and cash ratios dipped during the first half of 2022 to 1.69 and 1.00 versus their previous respective results of 2.53 and 2.10 at the end of 2021, their liquidity still remains strong. The decrease largely stems from their cash balance being run down to $59.4m versus its previous level of $135.5m across these same two points in time, as they expedited repaying debt by $135.2m. As hinted at earlier, this far exceeded my expectations when conducting my previous analysis because their debt maturity profile only saw $39.4m during 2022 with the same once again during 2023 and only an even smaller amount of $31m during 2024, as per my previously linked article.

To phrase this situation another way, the first half of 2022 saw them repay slightly more than the next three years of debt maturities. Apart from exceeding my expectations and further supporting their liquidity, more importantly, this also relieves the pressure from their credit facility covenant leverage ratio, which is based upon their total debt, not their net debt. Since they recently increased their quarterly distributions above their former level of $0.45 per unit to $0.75 per unit, its former limit has dropped from 4.00 to now only 3.00, as per my previously linked article. This is particularly low and when conducting the previous analysis, it was expected to deter management from increasing their distributions but thankfully for their unitholders, as they were able to repay debt far ahead of their scheduled maturities, they relieved this issue and thus lifted their distributions higher by two-thirds.

Now that their total debt is far lower, they are less likely to breach this limit even when their operating conditions and thus earnings almost certainly revert lower. In fact, based upon their latest total debt of $298.4m, even if their earnings dropped back to their downturn level of 2020 that saw an adjusted EBITDA of $104.7m, as per their fourth quarter of 2022 results announcement, it would still only see their leverage ratio at 2.85. Since this remains beneath its limit of 3.00, it now means that they face no restrictions inhibiting their ability to increase their distributions, which was echoed recently during their second quarter of 2022 results conference call, as per the commentary from management included below.

“At the current time, our leverage ratios and all of the credit metrics and statistics that we have to satisfy in order to have flexibility with distributions under the preferred documents have been — are being met. So, we don’t have limitations per se on what we can pay out in distributions…”

-Natural Resources Partners Q2 2022 Conference Call.

Conclusion

To their credit, they played their hand very well and exceeded my expectations by repaying debt at a far quicker pace. Whilst this effectively unlocks their ability to lift their distributions higher in the short-term, which they have the free cash flow to support, investors should still not forget about the grim long-term future for thermal coal in the age of clean energy, nor that their immense free cash flow comes on the back of zero capital expenditure. When wrapped together, I still believe that my hold rating is appropriate, especially with their unit price of $43.53 actually down circa 4% since my previous analysis when their unit price was $45.48, which provides further consideration that their unit price will struggle to rally materially higher, despite their outperformance.

Notes: Unless specified otherwise, all figures in this article were taken from Natural Resource Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment