LNG exports to Europe are driving natural gas prices higher in the United States. alvarez

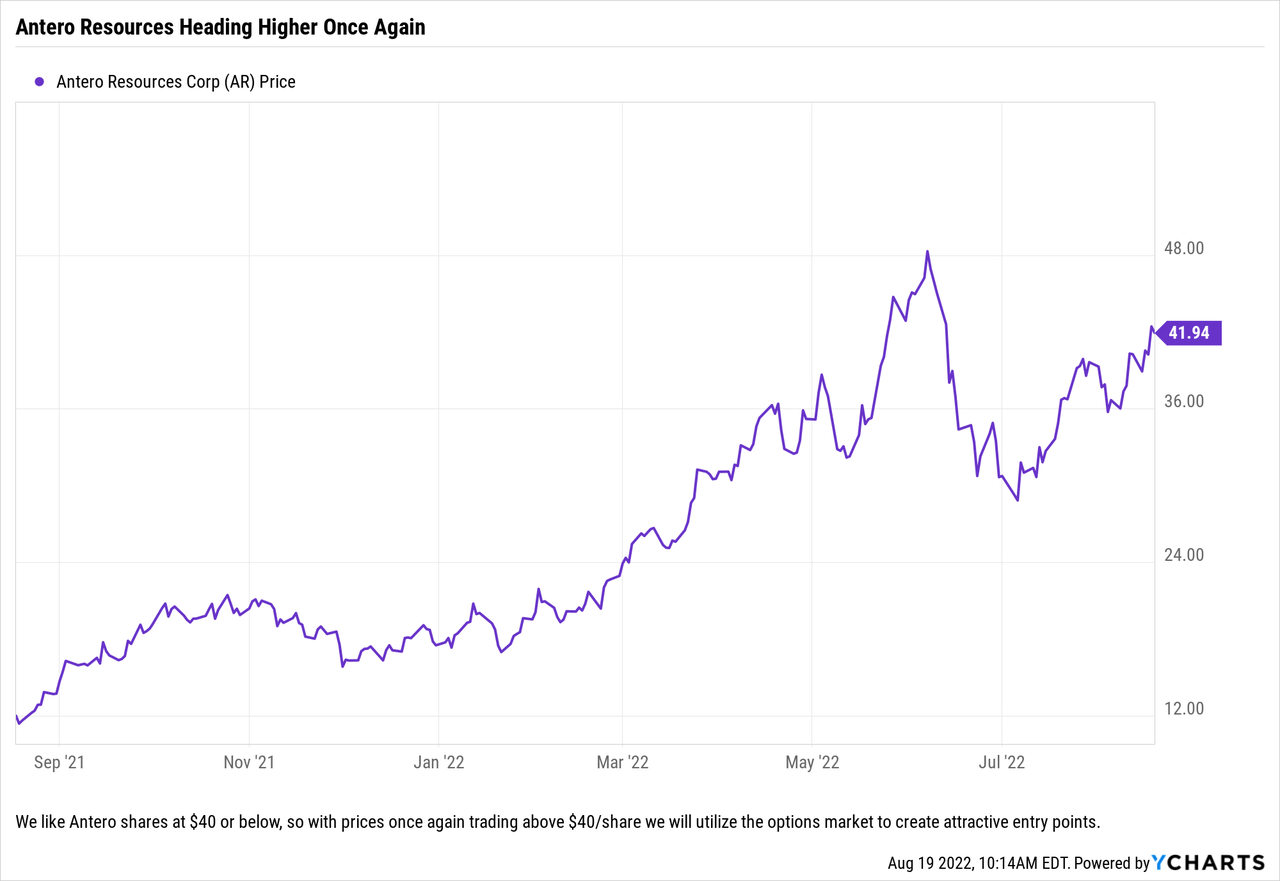

The last time we wrote about Antero Resources (NYSE:AR), the stock was on a tear, setting new 52-week highs that had investors extremely bullish. We constructed a trade using options to create scenarios where we could own shares at $40/share or below, but also having a free insurance policy (via a call option) to cover us in case the shares moved higher. When the dust settled, that trade saw both put contracts having been exercised and shares trading at a steep discount to cost basis. While the volatility was more than we anticipated (really it was the last few days where the price action got pretty nasty), the trades did accomplish the intended goal of helping investors get shares at about 15% below the stock price on the day of publication.

A lot has happened since then, with Antero shares trading down into the low $30/share area, even falling below $30/share and closing in the high $20s on a couple of days. While the stock saw a sharp pullback, management stuck to their plan and continued to plug away – just like they said they would.

Debt Tender

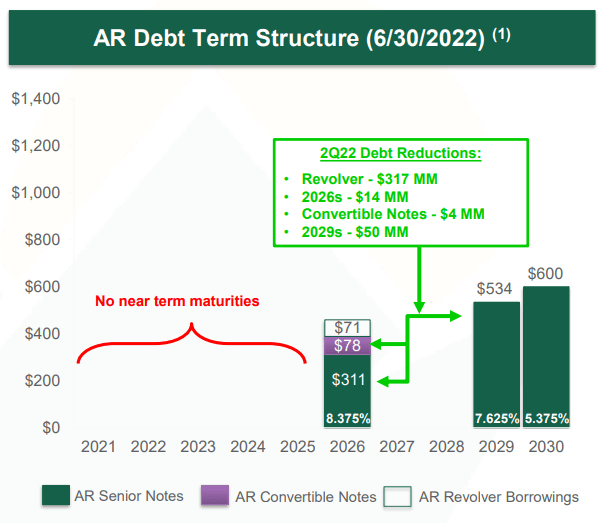

We highlighted the debt maturity schedule in our last article and discussed how taking out the 2026 debt would buy them multiple years until their next maturity and leave the company with no bonds maturing until 2029. An added bonus was that management was going to be able to focus on taking out some of their more expensive debt, which was also some of their shortest maturity debt. Obviously, that makes it cheaper to buy back or call (the debt being shorter maturity) and that is precisely what management did.

Antero announced on August 4th that they would purchase up to $300 million of their bonds via tender. Their focus was on the 8.375% Senior Notes due 2026 but they were also accepting the 7.625% Senior Notes due 2029 (the next maturity that the company has after the 2026 maturity). On August 10th the company announced results for their tender offer for the 2026 bonds, stating that they would repurchase $181,656,000 at par value. This left the company to purchase $118,344,000 of their 7.625% Senior Notes due in 2029, which they announced here.

The below graphic shows Antero’s debt at the end of Q2 (before these most recent debt tenders):

Antero continues to reduce the debt load, and we will not be surprised if they end the year with only 2030 maturities remaining. (Antero Resources Second Quarter Earnings Call Presentation)

Using the cash flow coming in from higher energy prices to reduce debt is going to pay off in the long run, even if energy prices have a healthy decline. Essentially, management is optimizing the debt load and structuring the balance sheet so that the company has a right-sized approach moving forward that should enable them to weather any storm. The tenders will result in annual interest expense savings of just over $24 million per year and leave the company with a very manageable debt schedule; still with no maturities until 2026 and that maturity’s outstanding issuance shrinking with these deleveraging moves.

With where interest rates are today, we suspect that the company will continue to focus on the debt paydown, but might be inclined to draw the line after the 2029s which have a coupon of 7.625%, and then might build the optimized debt load around the 2030s which have a coupon of 5.375% and currently trade more than $1.50 below par. It will all depend upon credit ratings and where the Federal Reserve takes interest rates, but those bonds certainly look like “good debt” to us.

Hedging Program

With the company looking to get the balance sheet optimized while applying a disciplined approach to production growth, management has allowed hedges to roll off as there is less of a need for those guardrails moving forward. The company will have almost no hedges starting in 2023, so the stock will be a true proxy for energy prices moving forward. Some in the market are cheering this, but we think that management has an opportunity to hedge more by using less. With energy prices having doubled in some instances, the company could hedge the same amount of revenue as before by utilizing much less of their production. While some argue that the market wants these E&P plays to be unhedged, it is our opinion that the stock could see a significant boost if management were to hedge 10-20% of production to essentially guarantee stock buybacks, continued balance sheet optimization and a dividend that would be secure for a few years (we should also note that the hedging might also help enhance the company’s credit profile by reducing potential volatility in earnings moving forward).

We have no reason to suspect that management will reverse course and put sizeable hedges back on the books, and we would point out that the management team at Antero has done a really good job of realizing premium prices for production, so they might have a much better idea.

How To Trade

As we have added more energy to our portfolios, we recognize the need to come back to this name once again to help diversify our energy holdings. Antero not only helps one diversify production mix, geographical holdings and leverage within a portfolio, it also gives one the ability to add a lot of exposure to energy prices. That exposure can cut both ways, but in a balanced and properly structured energy portfolio, the downside risk is mitigated from the larger, dividend-paying peers.

With all of this in mind, we still want to focus on owning Antero shares around $40/share, and if a trade can be structured to get the price below $40/share then that is a win in our opinion.

Since we think that Antero could see a slight pullback from current levels, we want to utilize the September 16, 2022 Puts with a $40/share strike price. Selling these puts will generate an option premium of roughly $2/share, or $200 per contract, and provide two benefits. First, if exercised, they will provide an entry point with a cost basis at roughly $38/share, which is 10% lower than today’s price. Secondly, even if they are not exercised, you pocket 5% of profit via the option premium and can use that to buy the stock later. With energy prices trading as they are, we are not sure that Antero shares run into the $50s before their next quarterly results, unless there is a major news item. However, long-term we think that this is a name that investors want to own as there is still significant upside if energy prices do not pull back significantly. Long-term we are not sure if Antero is a takeover play, or a consolidator, but management has created optionality to add shareholder value no matter what the ultimate outcome is.

We remain bullish on this name, and energy in general, but think that investors need to pay attention to entry points due to the volatility that should remain in the market with Putin appearing to be jostling the Europeans around with his energy moves.

Be the first to comment