tamaya/iStock via Getty Images

Simon Property Group, Inc. (NYSE:SPG) is the largest publicly traded mall owner and boasts some of the finest retail real estate in the world along with one of the strong balance sheets in the real estate investment trust (“REIT”) sector with an A- (stable outlook) credit rating from S&P.

SPG just reported Q2 results. In this article, we will share 3 important takeaways from the Q2 report and also provide our outlook on the stock.

#1. Booming Property Revitalization

For years, the narrative on bricks and mortar real estate – and for malls in particular – has been that they are in terminal decline and that e-commerce will eventually completely dominate retail. With giants like Amazon (AMZN) and Alibaba (BABA) growing rapidly and putting big name retailers like Sears and Toys R Us out of business, it appeared that this narrative was correct. Then COVID-19 hit, and the trend accelerated even faster. In fact, things became so dire that many of SPG’s competitors were either forced into bankruptcy (i.e., CBL and Washington Prime Group), were put into a financially distressed state (i.e., PREIT (PEI) and Macerich (MAC)) or were simply taken private given that their stocks had become so broken (i.e., Taubman Centers by SPG and Brookfield Property Partners by Brookfield Asset Management (BAM)).

While all of that is true, the other irrefutable fact is that after all of that, SPG is still standing tall with a great balance sheet and thriving properties. In so doing, SPG has proven that malls are not dead nor in terminal decline and that bricks and mortar will continue to play a central role in the retail industry for many years to come.

The secret behind this remarkable success story in the midst of the retail carnage has been that SPG – despite having lesser quality properties on average than Taubman, MAC, and Brookfield – had much lower leverage and far more liquidity, enabling it to invest aggressively in revitalizing its properties and respond opportunistically while the sector as a whole plunged into recession during the COVID-19 lockdowns, thereby enabling it to emerge stronger on the other side once things improved. In contrast, most of its peers either sunk or had to unload valuable cargo in one form or another during the macro storm.

This strong state of affairs was clearly evident during the Q2 earnings call, with statements from management like the following:

Our redevelopment pipeline is growing with exciting projects.

Domestic property NOI increased 3.6% year-over-year for the quarter and 5.6% for the first half of the year. Portfolio NOI, which includes our international properties, grew 4.6% for the quarter and 6.7% for the first 6 months.

Occupancy at the end of the second quarter was 93.9%, an increase of 210 basis points…The number of tenant terminations this year has been at record low levels…average base minimum rent increased for the third quarter in a row and was at $54.58.

Mall sales volumes for the second quarter were up 7%. Our reported retailer sales per square foot reached another record in the second quarter at $746 per square foot for the malls and the outlets combined, which was an increase of 26%, $674 for the mills, a 29% increase.

Our occupancy cost at the end of the quarter are the lowest they’ve been in 7 years, 12.1% in Q2 of 2022.

This performance is particularly impressive given that the GDP has shrunk in each of the first two quarters of 2022 and inflationary pressures are weighing on consumer buying power as well as business’ margins. Clearly, SPG has made good use of its balance sheet strength to make opportunistic investments in its real estate portfolio which are reaping these benefits today.

On top of that, SPG remains very well positioned to continue making opportunistic and strategic investments in its business moving forward given that it still has a stunning $8.5 billion of liquidity, good for 13.4% of its current enterprise value.

#2. Compelling Value Proposition

With such a healthy and positively trending real estate portfolio, it is unsurprising that SPG is generating a ton of cash right now:

We generated $1.2 billion in free cash flow in the quarter, which was $200 million higher than the first quarter of this year. And we have generated $2.2 billion for the first 6 months of the year.

They also raised the midpoint of full year guidance as their strong results are giving them increasing confidence in their ability to execute for the remainder of the fiscal year.

Last, but not least, SPG’s opportunistic investments in distressed retailers in years past have generated impressive returns, with several of them now fully returning the initially invested equity via distributions to SPG. As management stated during the earnings call:

Based upon our cash distributions received, we have no cash equity investment in SPARC and JCPenney. And in fact, we have parlayed our SPARC investment into our investment in ABG that is now worth over $1 billion.

As a result of all of these positive developments, SPG is able to return an increasing amount of cash flow to shareholders even after investing aggressively in keeping its assets in top notch shape. On the same day they released Q2 results, SPG also announced a 6.1% sequential (17% year-over-year) dividend increase, leaving them with a 6.2% forward annualized dividend yield relative to the current share price.

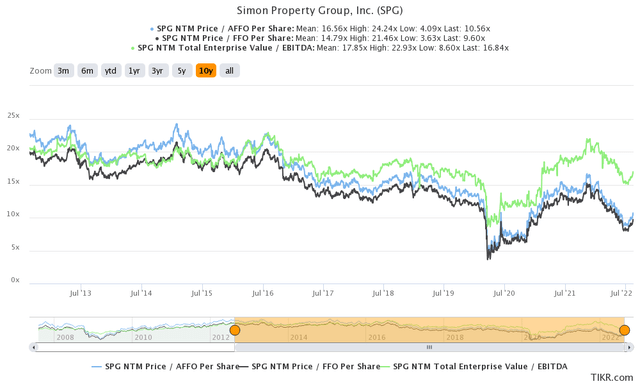

Despite all of this, Mr. Market remains stubbornly negative about SPG’s long-term prospects. It appears he does not buy that there is a future for bricks and mortar retail and even malls in the retail space, despite SPG’s best efforts to prove him wrong. As a result, SPG is trading far below its historical average valuation multiples on a P/FFO, P/AFFO, and EV/EBITDA basis:

Based on these metrics, if SPG can trade level with its 10-year average EV/EBITDA then its stock price should see 10% upside from here. However, when looking at the P/AFFO and P/FFO metrics, SPG has closer to 60% upside potential from current levels. On a P/NAV basis, shares currently appear about 20% undervalued.

Clearly management favors the former theory, as it is repurchasing shares at the moment and plans to continue doing so moving forward. As the CEO stated on the earnings call:

we look at other REITs. We look at other S&P 500 companies. We look at our balance sheet. We look at the fact that we’re a cash flow company that generates cash, return on equity, we make deals like SPARC that gets all our money back, and we have free cash flow. We can’t figure out our value. So the reality is the market — we have refuted e-commerce, taking the malls down. We have still COVID. Our business is strong, growing in the enclosed mall business. In the enclosed mall business is strong, yet we have naysayers out there that don’t believe it, but we believe it. So our stock is cheap, and we’re going to keep buying stock back.

While we certainly understand the argument for the discount and in fact believe it is discounted, we do not subscribe to the view that P/AFFO or P/FFO are standalone effective valuation metrics for this stock. Instead, we favor P/NAV which indicates that the stock does have compelling value proposition, albeit not quite as incredibly cheap as the P/FFO and P/AFFO multiples implies. Nevertheless, given the discount we think buying back stock is still a very prudent use of cash right now.

#3. Management Is Understating Recession Risk

The final major theme that stuck out to us from the earnings call was that management seems quite confident – perhaps even overconfident – of weathering a recession without issues. For example, they said:

Our business and our industry actually tends to outperform during recessionary environments to the extent that we get there and maybe we’re in one, maybe we’re not, I’ll stay out of that political definition primarily because the big ticket items suddenly go toward kind of what we sell at our product…if we do get into a full-blown recession, our cash flow will be positive. It won’t maybe grow as high. We’ll have some exposure on sales, but we do see the big tickets kind of go away and they move toward the items that we sell in our properties.

While we are not going to argue with highly revered CEO David Simon on how a recession will impact his cash flows, what we will point out is simply that in the past two major macroeconomic disruptions – the Great Recession and COVID-19 – SPG slashed its dividend. If SPG were truly as recession resistant as was implied on the earnings call, it stands to reason that its dividend would have withstood those challenging economic periods better than it did.

All that said, we do agree that SPG’s high quality assets and strong balance sheet should enable it to weather a recession better than its peers and that it will likely continue to thrive over the long-term. However, if the recession proves to be as severe and/or prolonged as some economists and business leaders imply it might be, it would not surprise us at all if SPG were to once again cut its dividend.

Investor Takeaway

Overall, it was a very strong quarter for SPG, and the near-term growth profile for the company looks quite promising. It continues to enjoy significant liquidity and its properties are thriving. Meanwhile, its shares trade stubbornly below NAV and at an even greater discount to historical cash flow multiples. As a result, management is prudently allocating capital towards dividends and share buybacks right now with increasing conviction.

While we believe SPG does present compelling value at the moment and rate it a Strong Buy, we would caution investors from expecting it to be worth close to its historical P/AFFO multiple at the moment given the macro uncertainties and its somewhat elevated leverage relative to the past. Furthermore, SPG’s dividend – while growing at the moment – has proven to falter in the face of economic turmoil in the past and may do so again. Investors should keep these factors in mind when deciding whether or not to purchase SPG shares right now.

Be the first to comment